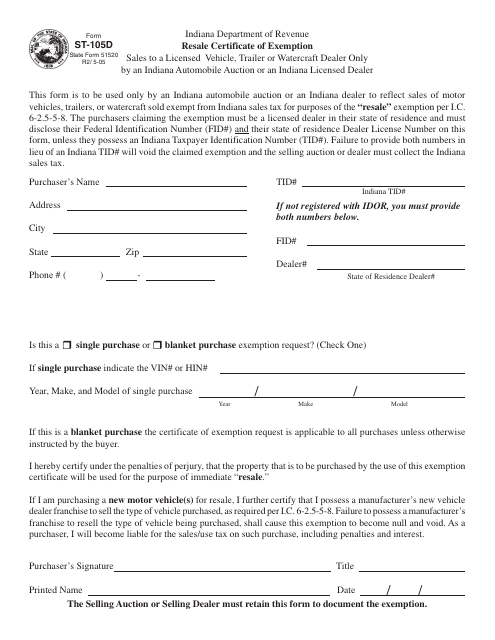

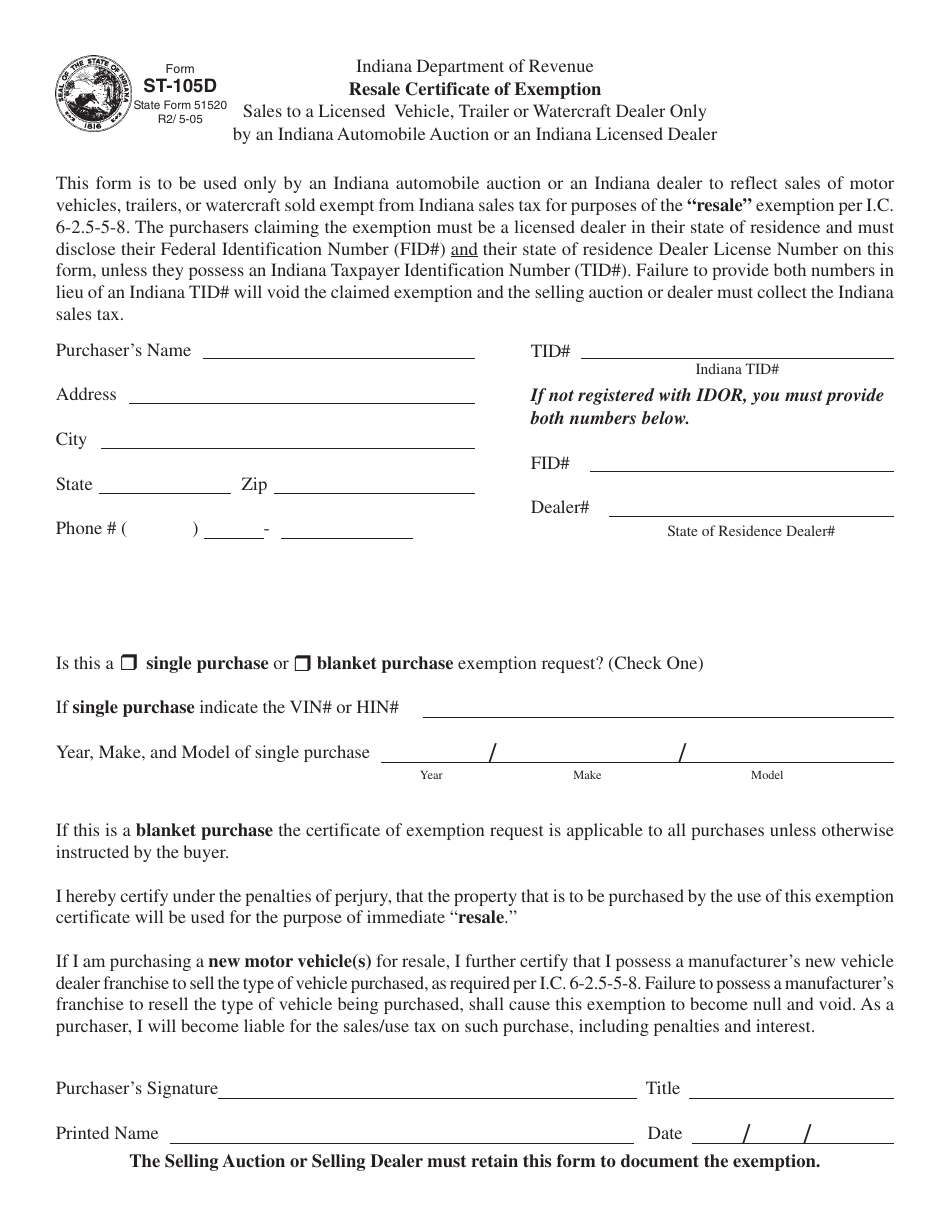

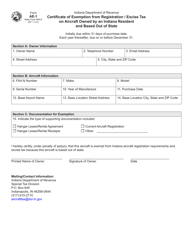

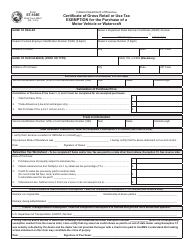

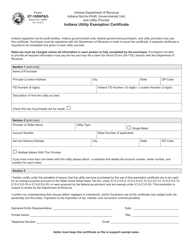

Form ST-105d Resale Certificate of Exemption - Indiana

What Is Form ST-105d?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

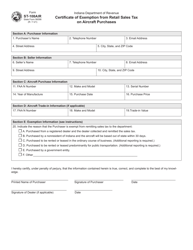

Q: What is the Form ST-105d?

A: The Form ST-105d is a Resale Certificate of Exemption specific to Indiana.

Q: What is the purpose of Form ST-105d?

A: The purpose of Form ST-105d is to certify that the buyer intends to resell the purchased goods and is therefore exempt from paying sales tax.

Q: Who can use Form ST-105d?

A: Form ST-105d can be used by individuals, businesses, and organizations that are registered to collect and remit sales tax in Indiana.

Q: What information is required on Form ST-105d?

A: Form ST-105d requires information such as the buyer's name, address, and Indiana Sales Tax ID number, as well as details about the purchased goods.

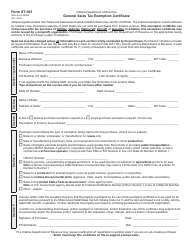

Q: How long is Form ST-105d valid?

A: Form ST-105d is valid for one year from the date of issuance, unless the certificate is revoked or canceled by the Indiana Department of Revenue.

Q: What happens if Form ST-105d is not provided?

A: If Form ST-105d is not provided to the seller, the buyer may be responsible for paying sales tax on the purchased goods.

Q: Are there any penalties for providing false information on Form ST-105d?

A: Yes, providing false information on Form ST-105d can result in penalties, including fines and potential criminal charges.

Q: Can Form ST-105d be used for services?

A: No, Form ST-105d is specifically for the purchase of tangible goods that are intended for resale. It does not apply to services.

Form Details:

- Released on May 1, 2005;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form ST-105d by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.