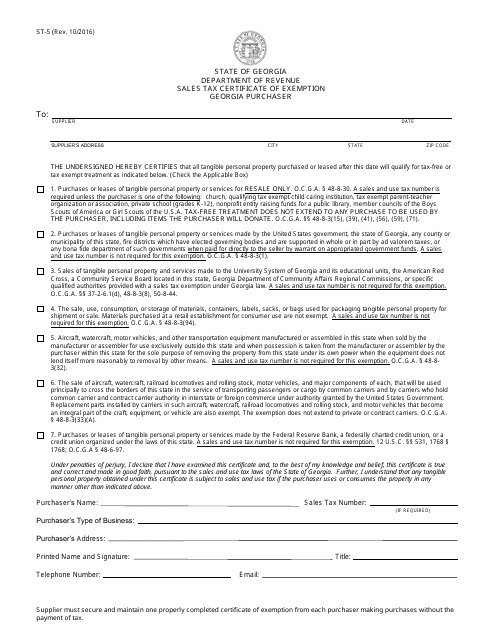

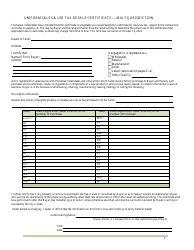

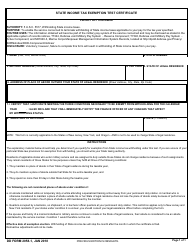

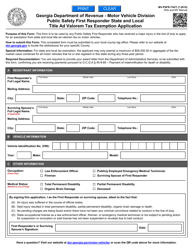

Form ST-5 Sales Tax Certificate of Exemption Georgia Purchaser - Georgia (United States)

What Is an ST-5 Form (Georgia)?

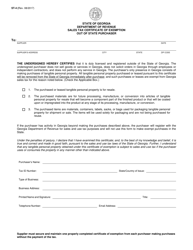

Form ST-5, Sales Tax Certificate of Exemption Georgia Purchaser , is a legal document needed to gain tax exemption for the purpose of resale in the state of Georgia. If you purchase products from a supplier to resell them later, you can avoid paying sales tax when buying those products. To do so, you need to present the Sales Tax Certificate of Exemption to the merchant from whom you are buying the merchandise to be resold. Do that to show you are certified to buy goods without paying tax because you will be charging your own customers the sales tax for the items.

Alternate Name:

- Sales Tax Certificate of Exemption.

This form was released by the Georgia Department of Revenue . The latest version of the form was issued on October 1, 2016 , with all previous editions obsolete. A fillable ST-5 Form is available for download below.

Georgia ST-5 Form Instructions

Provide the following details when completing a Sales Tax Certificate of Exemption:

-

Name the supplier and write down the supplier's address. Write down the actual date of signing the form.

-

Check the appropriate box to indicate the tangible personal property purchased or leased. The certificate allows the purchaser to avoid paying additional taxes for certain types of tangible personal property and services:

- Property or services for resale only. Provide the sales and use tax number unless you represent a church, child caring institution, parent-teacher association, private school, entity raising funds for a public library, or member council of the Boys Scouts or Girl Scouts;

- Property or services acquired by the federal or state government and paid for by the warrant on appropriated government funds;

- Property and services made for the educational system of Georgia, the Red Cross, and other organizations specifically listed in the form;

- Materials, labels, sacks, containers, and bags used to package tangible personal property for sale or shipment;

- Various types of transportation and transportation equipment assembled or manufactured in Georgia that will be used exclusively outside the state;

- Various types of transportation and their major components that will be used to transport passengers or cargo crossing the borders of the state. The exemption does not extend to contract or private carriers. You need to enter a sales tax number if you purchase merchandise that falls into this category;

- Property or services bought or leased by the Federal Reserve Bank, federal or state credit unions;

-

Your name, type of business, and address. Sign the form, write down your full name and title, and leave contact information so that the supplier will be able to get in touch with you. By signing the papers, you certify the property or services described in the form will qualify for tax-free or tax-exempt treatment.

The supplier is responsible for verifying the information contained in the form, paying close attention to the sales tax number stated, and maintaining one fully completed certificate received from the purchaser who buys merchandise without paying taxes.