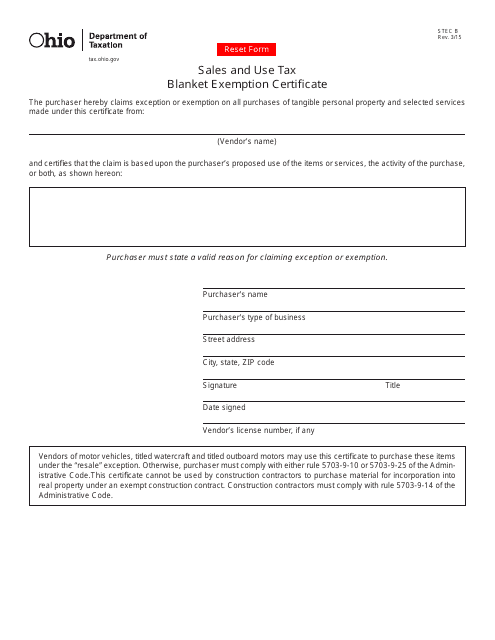

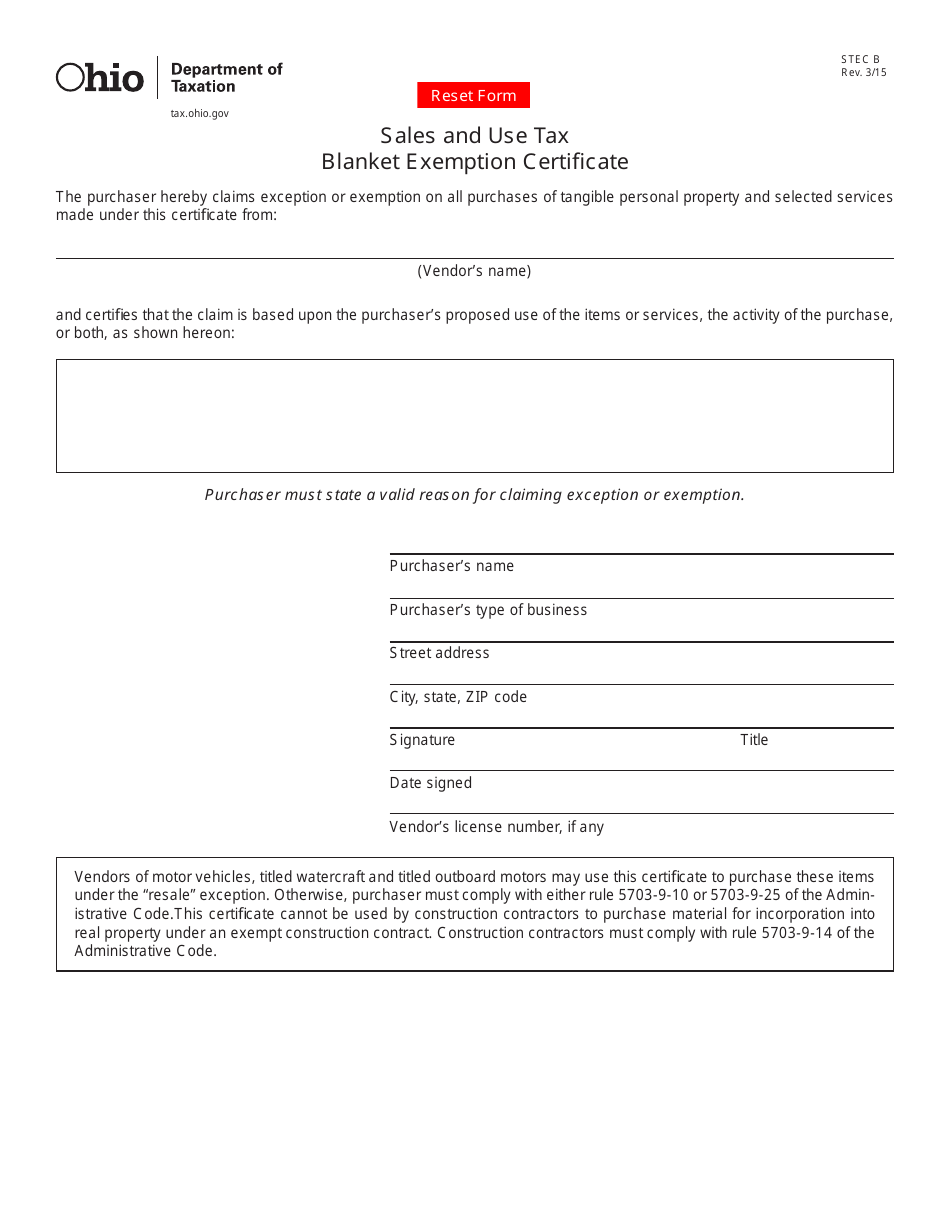

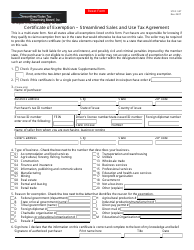

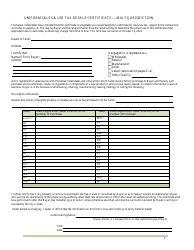

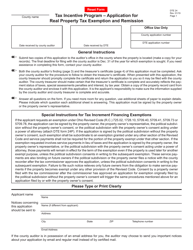

Form STEC B Sales and Use Tax Blanket Exemption Certificate - Ohio

What Is Form STEC B?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the STEC B Sales and Use Tax Blanket Exemption Certificate?

A: The STEC B Sales and Use Tax Blanket Exemption Certificate is a form used in Ohio to claim exemption from sales and use taxes.

Q: Who can use the STEC B Sales and Use Tax Blanket Exemption Certificate?

A: Any individual or entity purchasing items for resale or for use in a business or other exempt purpose in Ohio can use the STEC B form.

Q: How do I fill out the STEC B Sales and Use Tax Blanket Exemption Certificate?

A: You need to provide your name, address, and Ohio vendor's license number, indicate the reason for the exemption, and sign the form.

Q: Do I need to submit the STEC B form for every transaction?

A: No, the form can be completed once and provided to vendors to exempt future purchases, unless the vendor requests a new form.

Form Details:

- Released on March 1, 2015;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form STEC B by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.