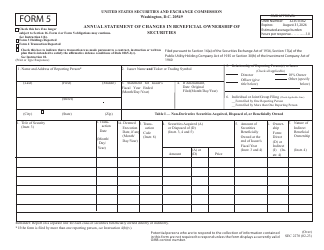

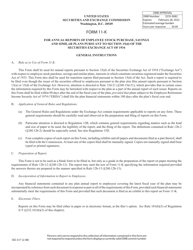

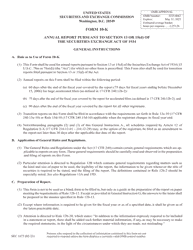

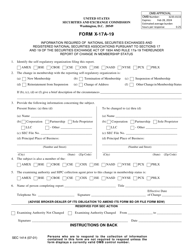

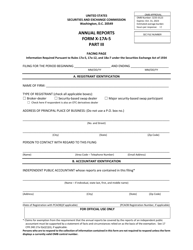

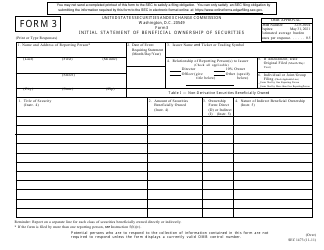

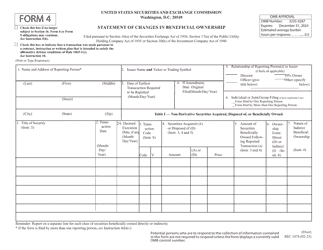

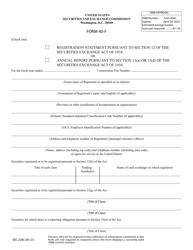

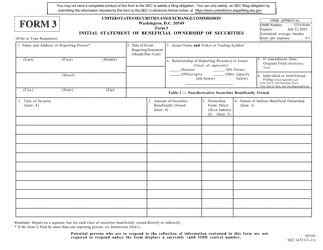

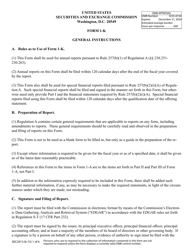

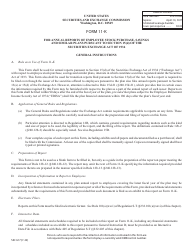

Instructions for SEC Form 2270, 5 Annual Statement of Beneficial Ownership of Securities

This document contains official instructions for SEC Form 2270 , and SEC Form 5 . Both forms are released and collected by the U.S. Securities and Exchange Commission. An up-to-date fillable SEC Form 2270 (5) is available for download through this link.

FAQ

Q: What is SEC Form 2270?

A: SEC Form 2270 is the Annual Statement of Beneficial Ownership of Securities.

Q: Who needs to file SEC Form 2270?

A: Individuals or entities who are beneficial owners of securities need to file SEC Form 2270.

Q: What is the purpose of filing SEC Form 2270?

A: The purpose of filing SEC Form 2270 is to disclose the beneficial ownership of securities.

Q: How often is SEC Form 2270 filed?

A: SEC Form 2270 is filed annually.

Q: Are there any filing fees for SEC Form 2270?

A: No, there are no filing fees for SEC Form 2270.

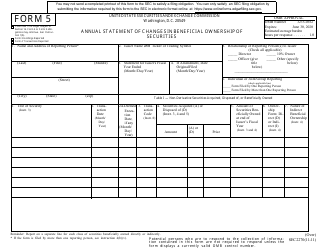

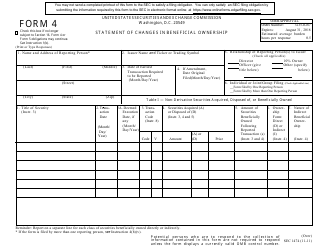

Q: What information is required on SEC Form 2270?

A: SEC Form 2270 requires information such as the name of the reporting person, the type of security, and the number of shares owned.

Q: What happens if I fail to file SEC Form 2270?

A: Failure to file SEC Form 2270 can result in penalties or legal consequences.

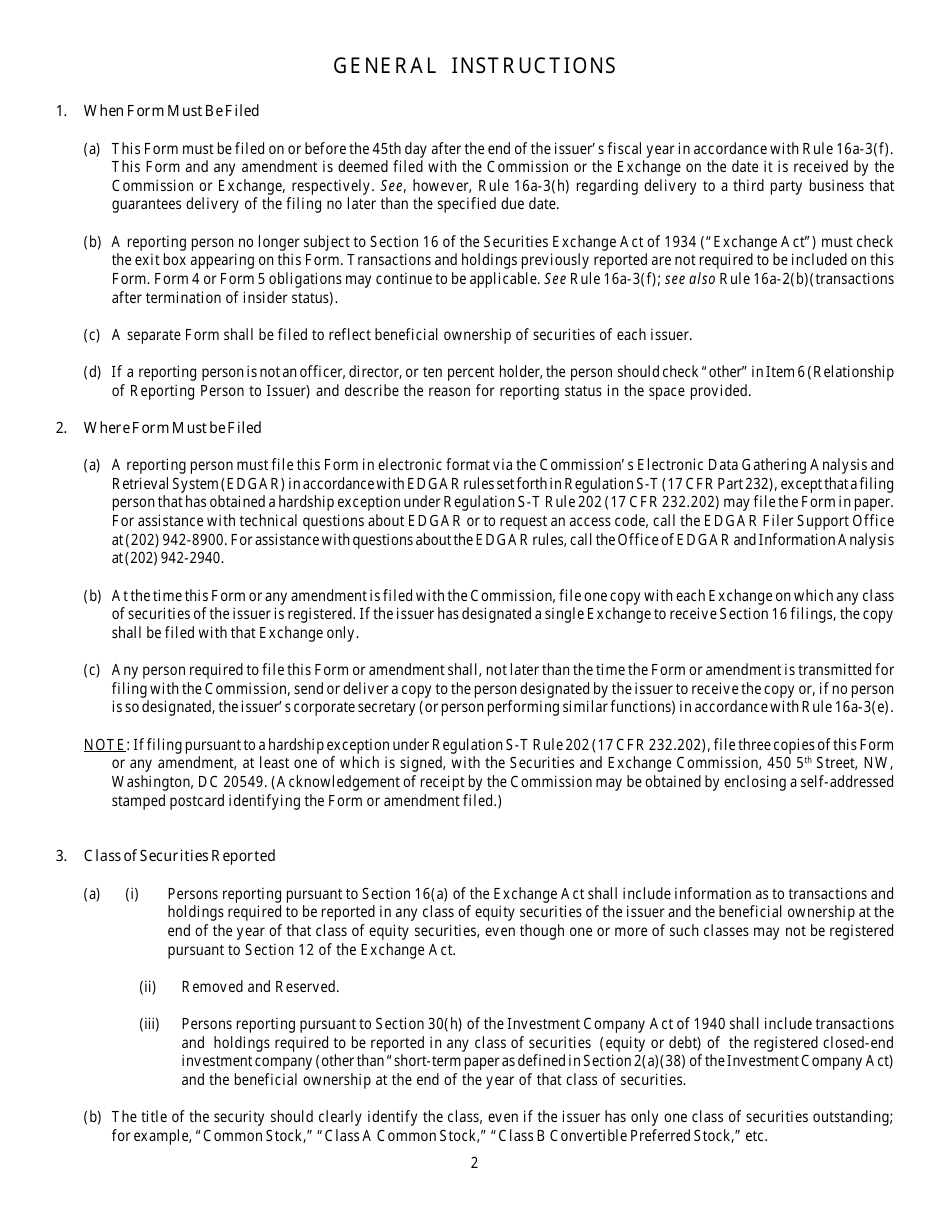

Q: Can I file SEC Form 2270 electronically?

A: Yes, SEC Form 2270 can be filed electronically.

Q: Is SEC Form 2270 required for all types of securities?

A: No, SEC Form 2270 is not required for all types of securities. There are certain exemptions and exclusions.

Instruction Details:

- This 7-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the U.S. Securities and Exchange Commission.