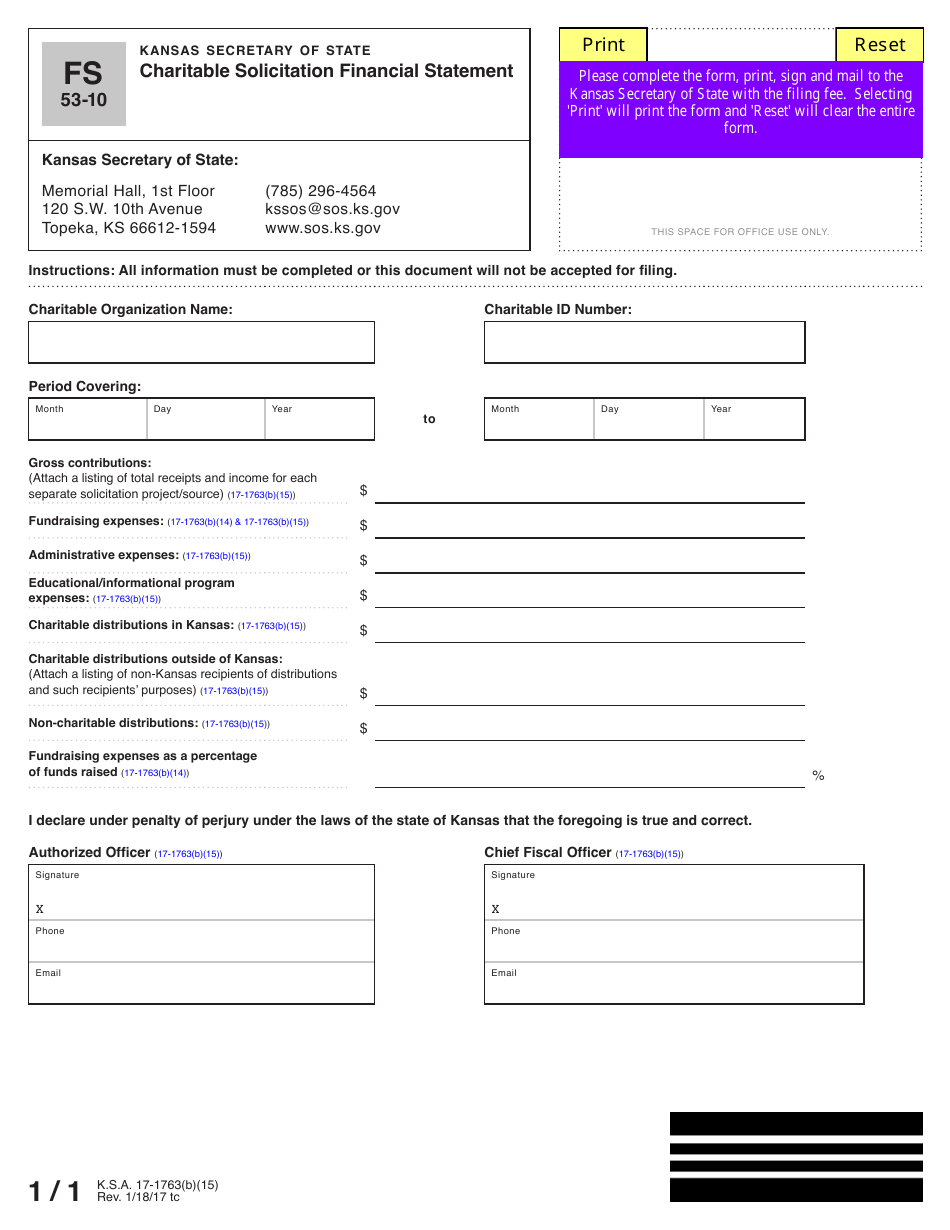

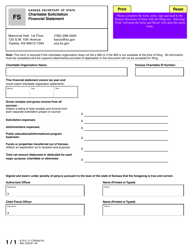

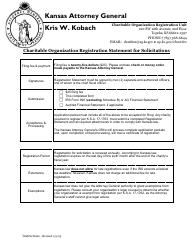

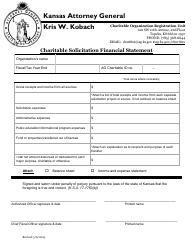

Form FS53-10 Charitable Solicitation Financial Statement - Kansas

What Is Form FS53-10?

This is a legal form that was released by the Kansas Secretary of State - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FS53-10?

A: Form FS53-10 is a Charitable Solicitation Financial Statement.

Q: What is the purpose of Form FS53-10?

A: The purpose of Form FS53-10 is to provide financial information about charitable solicitations in Kansas.

Q: Who needs to file Form FS53-10?

A: Charitable organizations that solicit funds in Kansas need to file Form FS53-10.

Q: When is Form FS53-10 due?

A: Form FS53-10 is due within 90 days after the close of the organization's fiscal year.

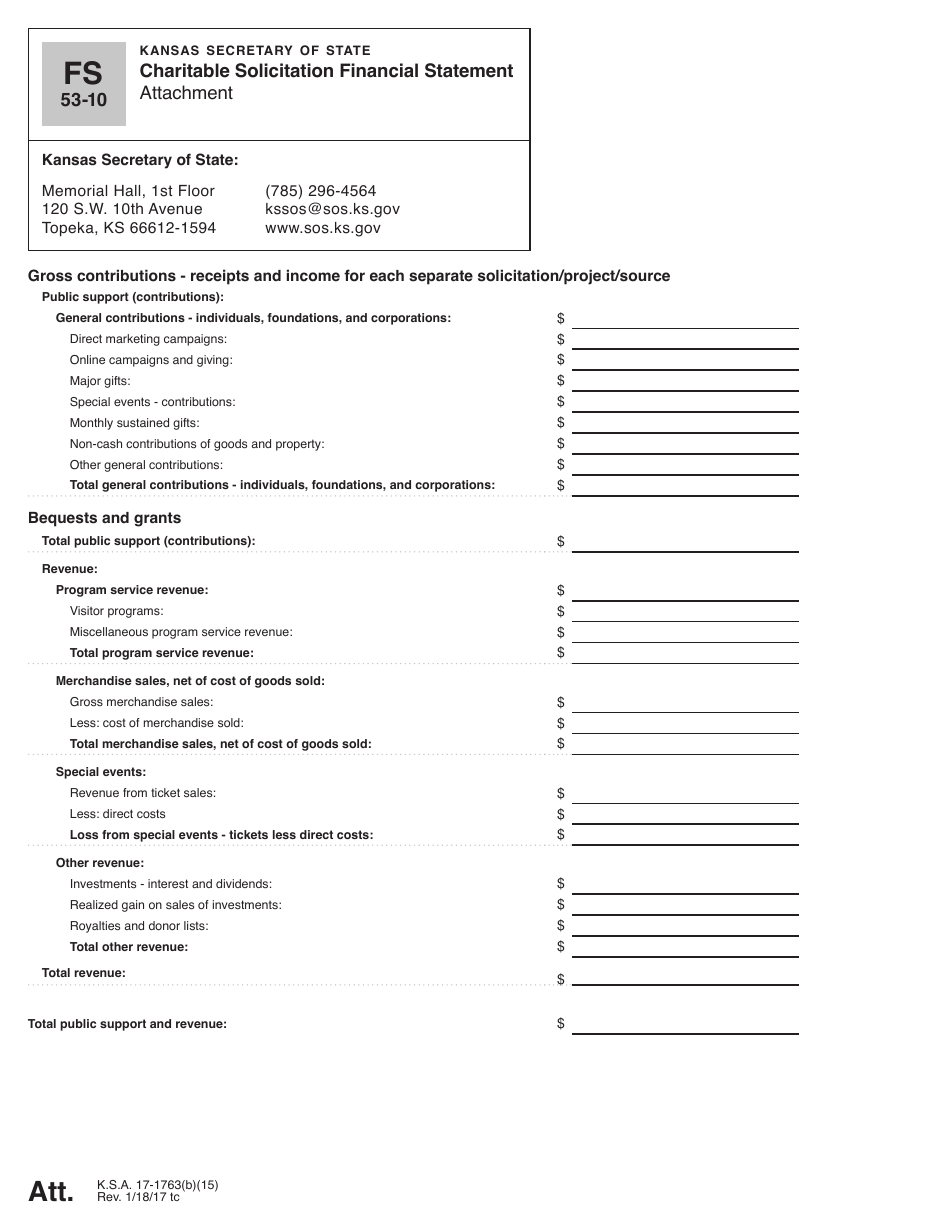

Q: What information is required on Form FS53-10?

A: Form FS53-10 requires information about the organization's revenue, expenses, program services, fundraising activities, and more.

Q: Are there any fees associated with filing Form FS53-10?

A: Yes, there is a filing fee associated with Form FS53-10. The fee amount depends on the organization's gross revenue.

Q: What are the consequences of not filing Form FS53-10?

A: Failure to file Form FS53-10 can result in penalties, including the revocation of the organization's registration to solicit funds in Kansas.

Q: Can Form FS53-10 be filed electronically?

A: Yes, Form FS53-10 can be filed electronically.

Q: Can I request an extension to file Form FS53-10?

A: Yes, organizations can request an extension to file Form FS53-10, but the extension must be requested before the original due date.

Form Details:

- Released on January 18, 2017;

- The latest edition provided by the Kansas Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FS53-10 by clicking the link below or browse more documents and templates provided by the Kansas Secretary of State.