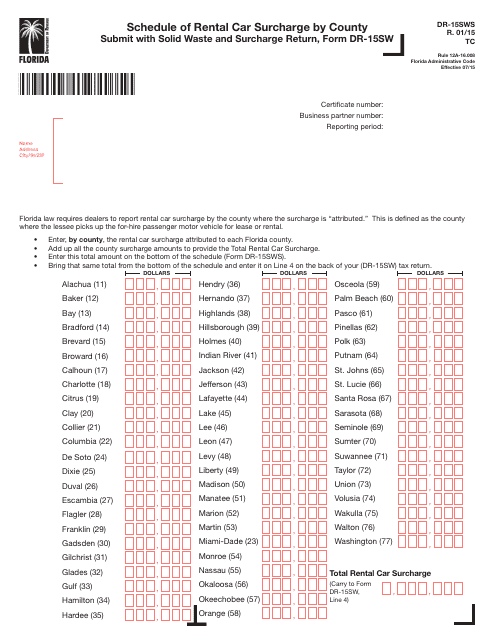

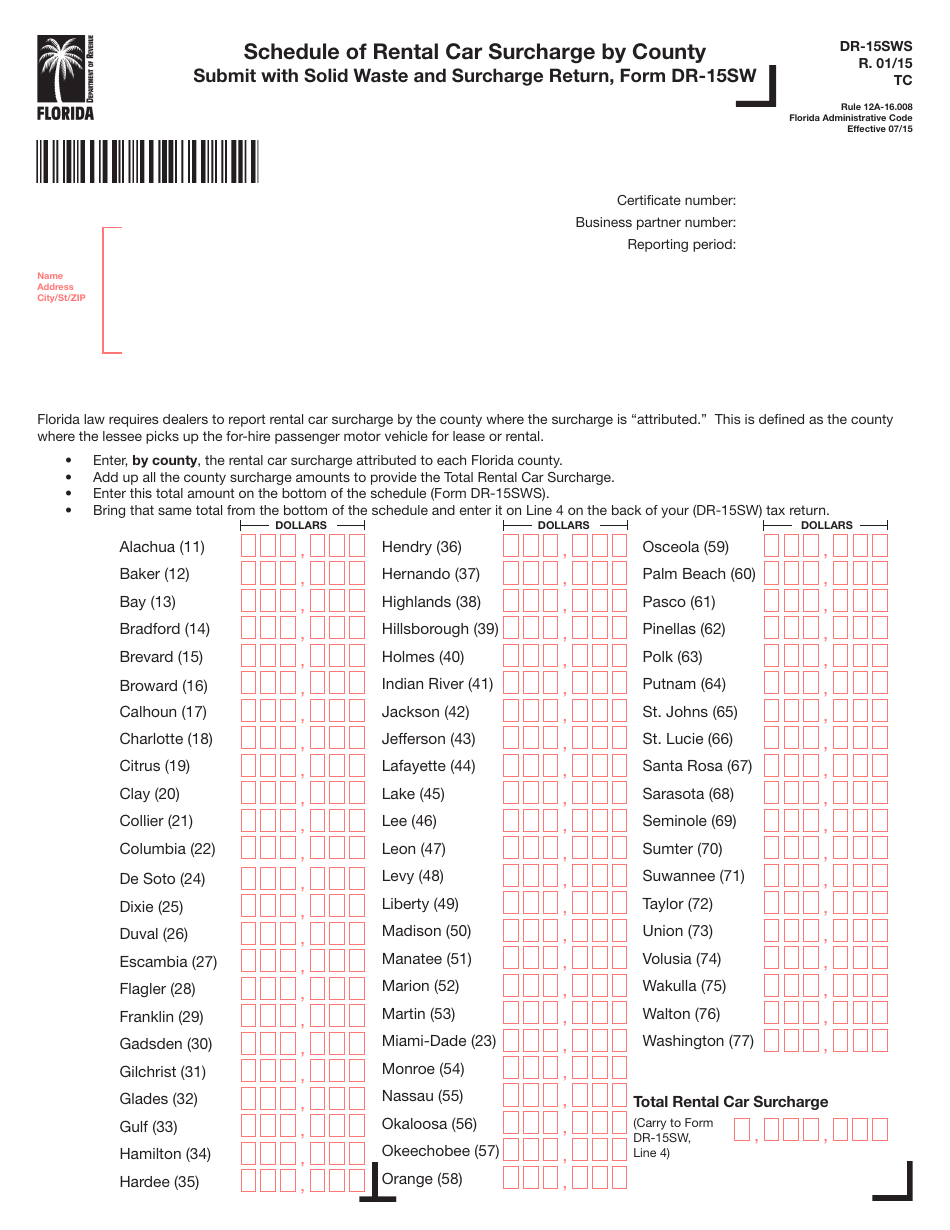

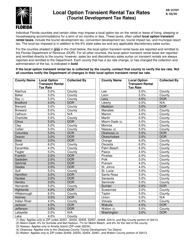

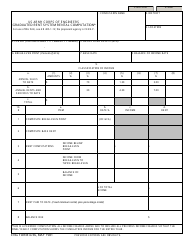

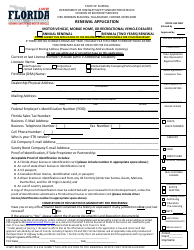

Form DR-15sws Schedule of Rental Car Surcharge by County - Florida

What Is Form DR-15sws?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR-15sws?

A: Form DR-15sws is a Schedule of Rental Car Surcharge by County in Florida.

Q: What is the purpose of Form DR-15sws?

A: The purpose of Form DR-15sws is to report and remit rental car surcharges by county in Florida.

Q: Who needs to fill out Form DR-15sws?

A: Businesses or individuals that rent out cars in Florida and collect surcharges from their customers need to fill out Form DR-15sws.

Q: What information is required on Form DR-15sws?

A: Form DR-15sws requires information such as the rental car company's name, county of surcharge, surcharge amount collected, and total surcharge remitted for each county.

Q: When is the deadline to file Form DR-15sws?

A: Form DR-15sws must be filed on a quarterly basis, with the due date falling on the last day of the month following the end of each quarter.

Q: Is there a penalty for late filing of Form DR-15sws?

A: Yes, there may be penalties for late filing of Form DR-15sws, so it is important to submit it by the deadline.

Q: Are there any exemptions or deductions available for rental car surcharges?

A: No, there are no specific exemptions or deductions available for rental car surcharges in Florida.

Form Details:

- Released on January 1, 2015;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DR-15sws by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.