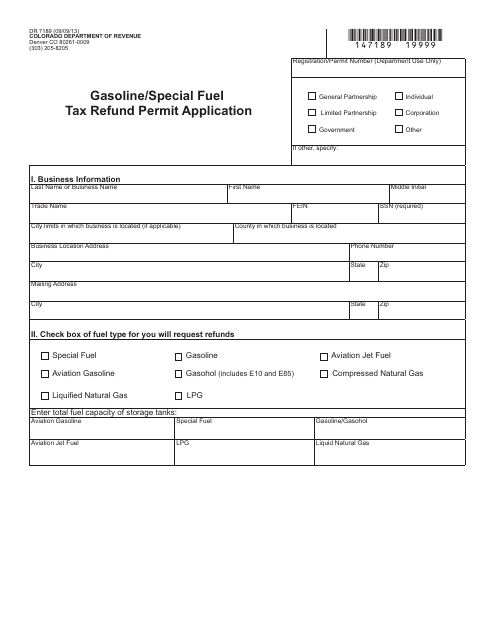

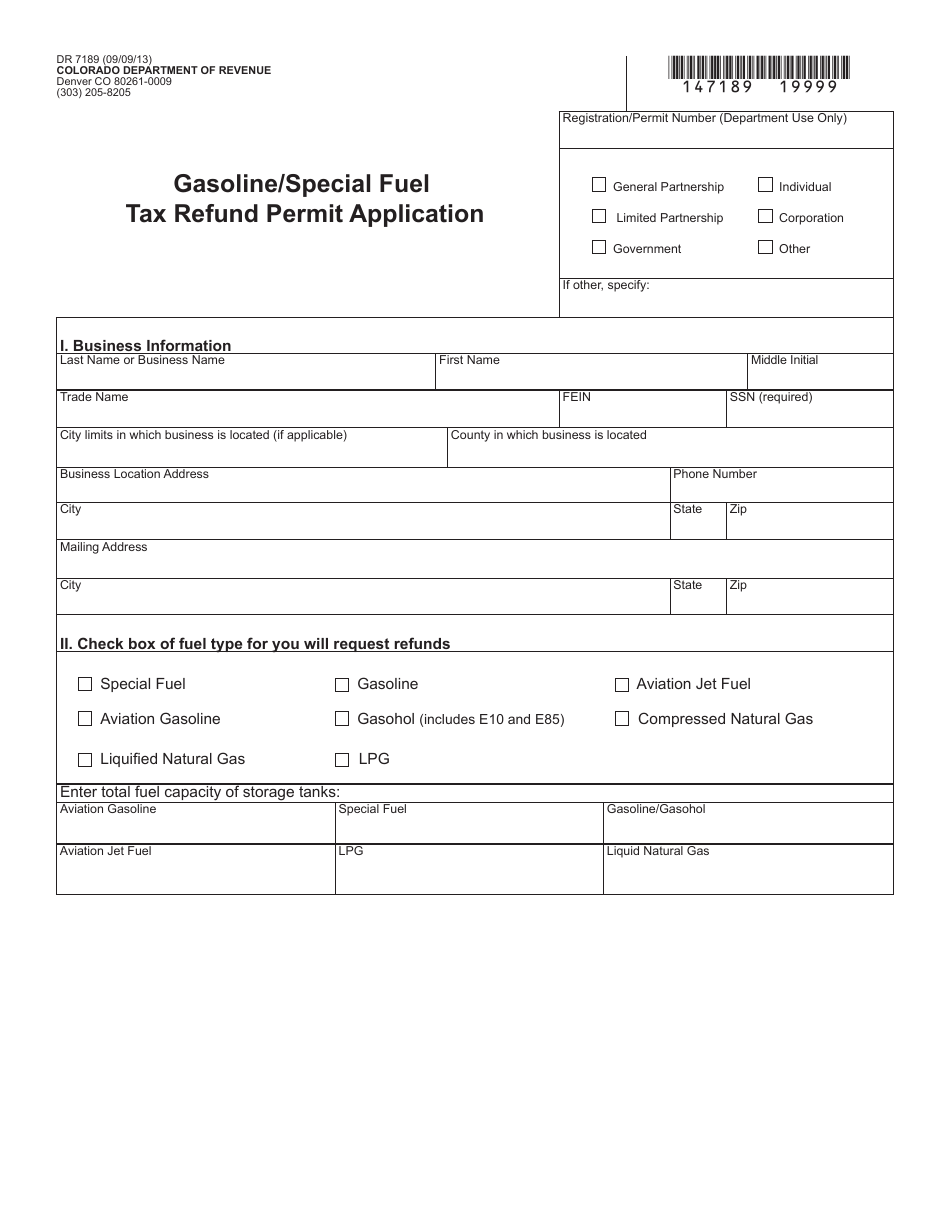

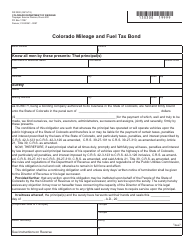

Form DR7189 Gasoline / Special Fuel Tax Refund Permit Application - Colorado

What Is Form DR7189?

This is a legal form that was released by the Colorado Department of Revenue - a government authority operating within Colorado. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form DR7189?

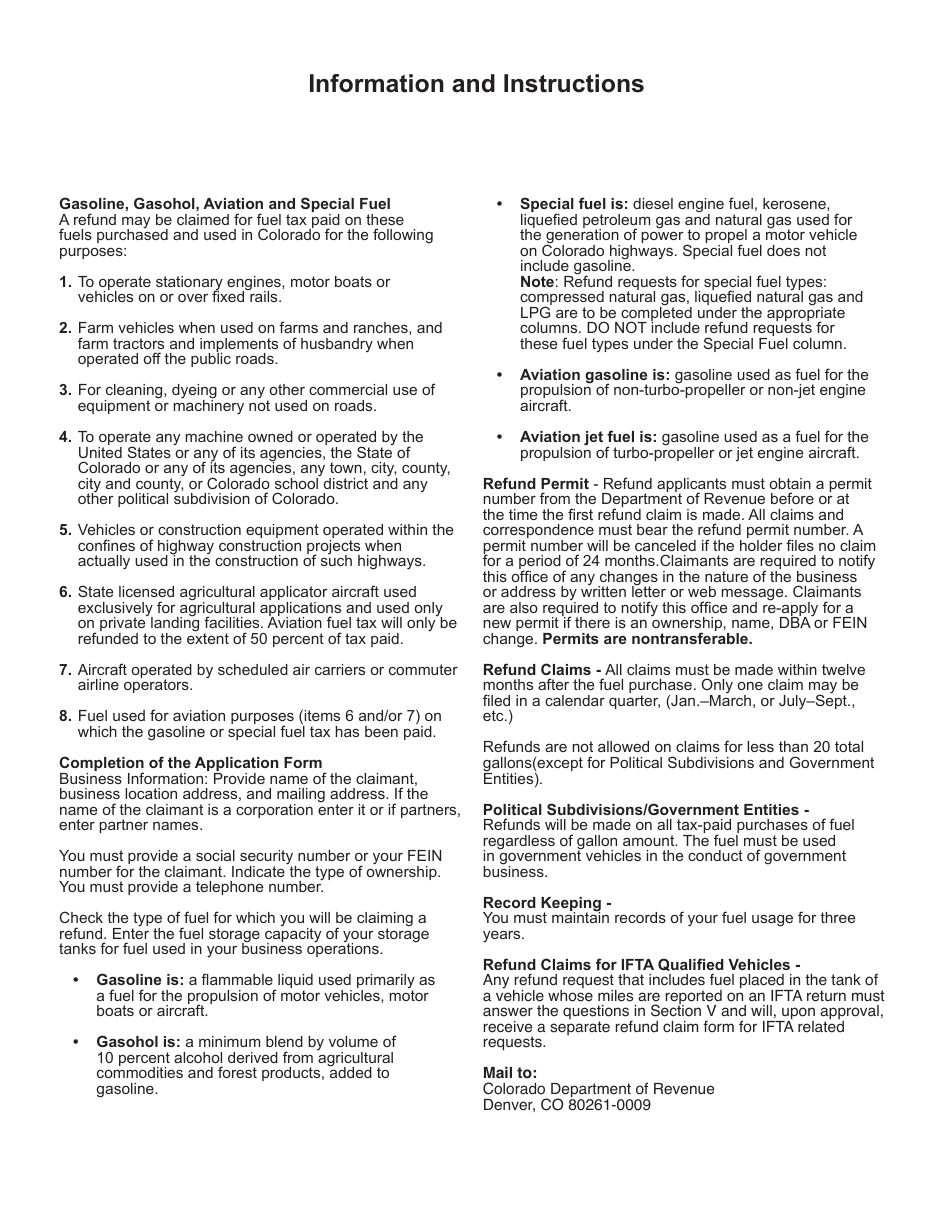

A: The Form DR7189 is a Gasoline/Special Fuel Tax Refund Permit Application used in Colorado.

Q: What is the purpose of Form DR7189?

A: The purpose of Form DR7189 is to apply for a refund permit for gasoline or special fuel tax in Colorado.

Q: Who needs to use Form DR7189?

A: Individuals or businesses who want to apply for a gasoline/special fuel tax refund permit in Colorado need to use Form DR7189.

Q: Is there a fee to submit Form DR7189?

A: There is no fee to submit Form DR7189. It is a free application.

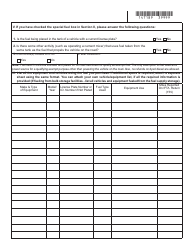

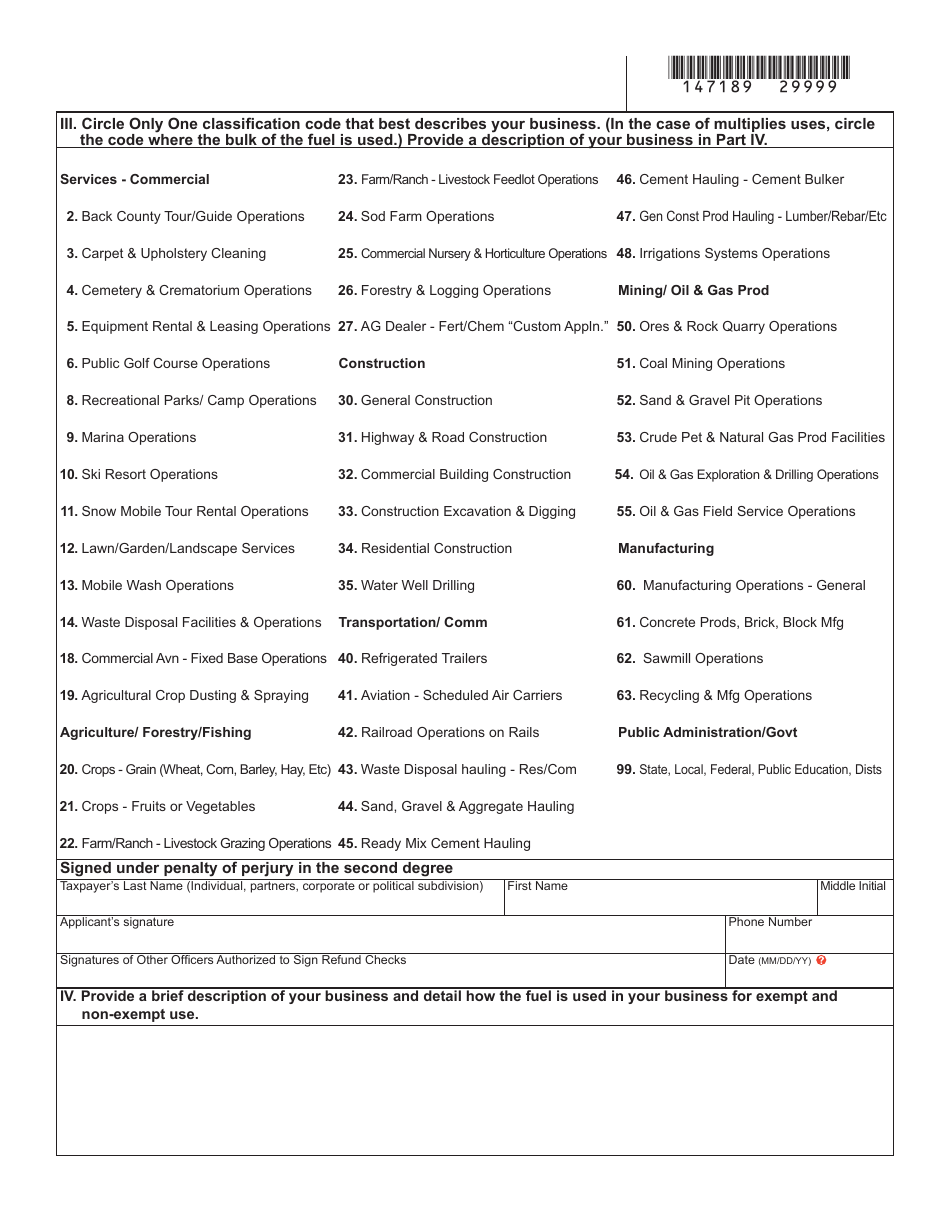

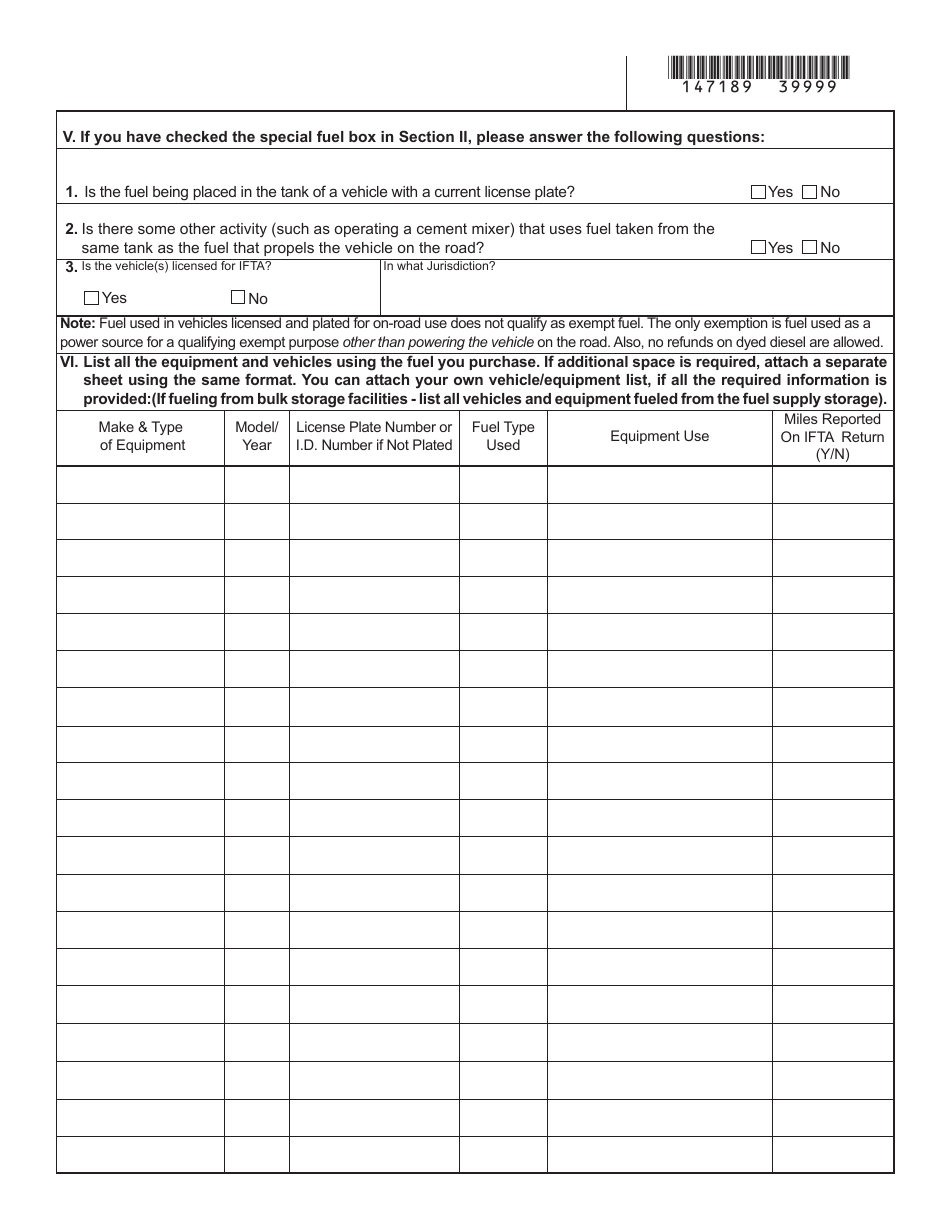

Q: What information is required in Form DR7189?

A: Form DR7189 requires information such as contact details, business information, fuel storage information, and estimated gallons of fuel to be claimed.

Q: When should Form DR7189 be submitted?

A: Form DR7189 should be submitted at least 30 days before the desired effective date of the refund permit.

Q: How long does it take to process Form DR7189?

A: The processing time for Form DR7189 can vary, but it typically takes a few weeks for the application to be reviewed and approved.

Q: What should I do if I have questions about Form DR7189 or the refund process?

A: If you have questions about Form DR7189 or the refund process, you can contact the Colorado Department of Revenue for assistance.

Form Details:

- Released on September 9, 2013;

- The latest edition provided by the Colorado Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DR7189 by clicking the link below or browse more documents and templates provided by the Colorado Department of Revenue.