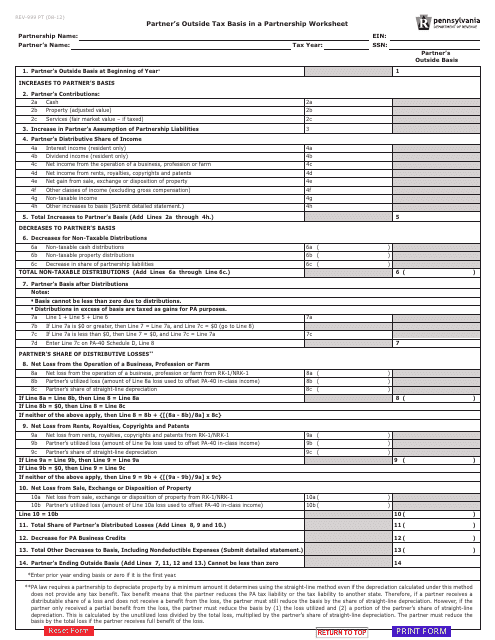

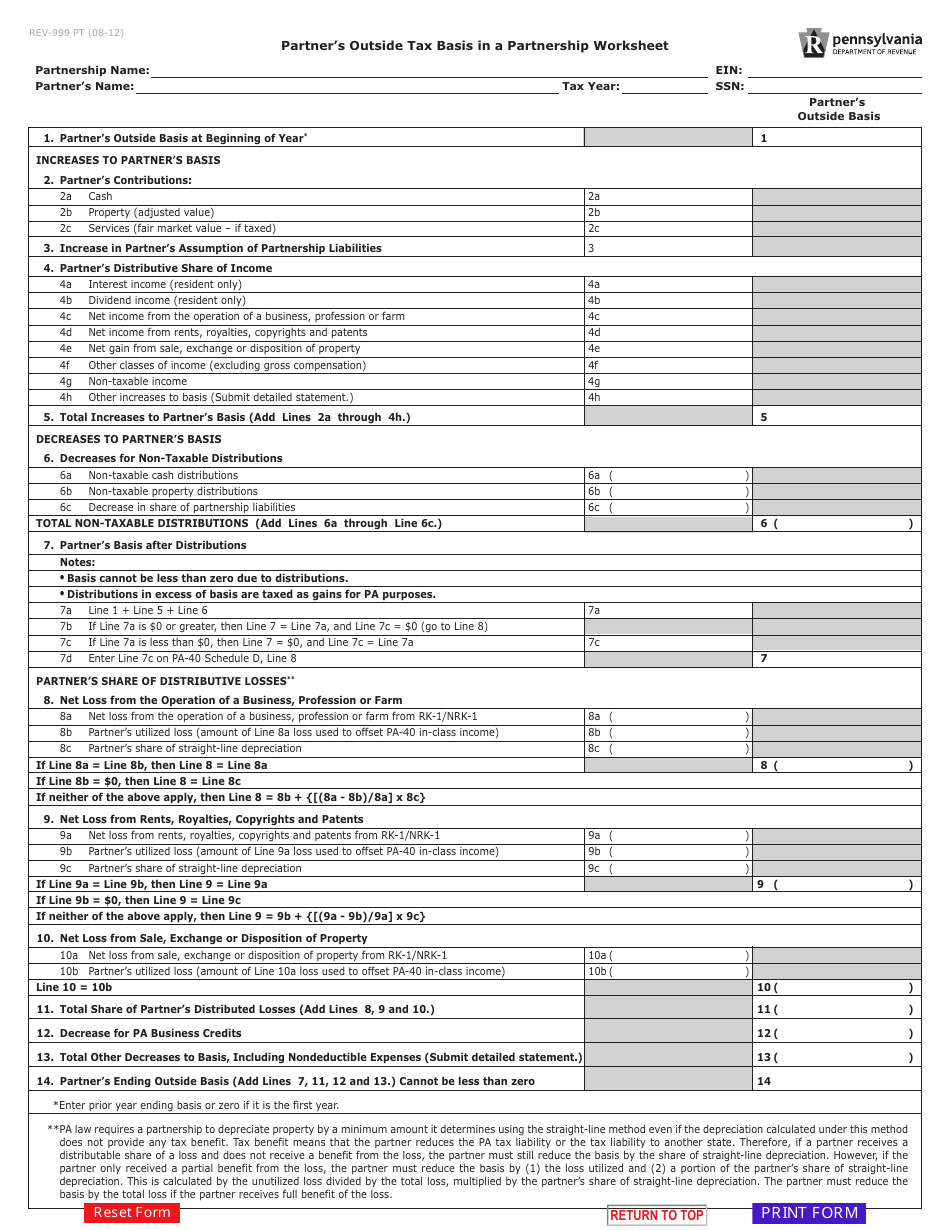

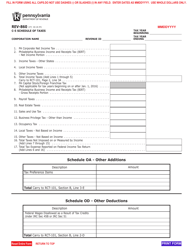

Form REV-999 Partner's Outside Tax Basis in a Partnership Worksheet - Pennsylvania

What Is Form REV-999?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form REV-999?

A: Form REV-999 is a worksheet used to calculate a partner's outside tax basis in a partnership in Pennsylvania.

Q: Who fills out Form REV-999?

A: The form is completed by a partner in a partnership in Pennsylvania.

Q: What is a partner's outside tax basis?

A: A partner's outside tax basis is the amount of money or property that a partner has invested in a partnership.

Q: Why is calculating a partner's outside tax basis important?

A: Calculating a partner's outside tax basis is important for determining the partner's share of the partnership's income, losses, and deductions.

Q: How is a partner's outside tax basis calculated?

A: A partner's outside tax basis is calculated by adding the partner's initial investment, any additional contributions, and their share of partnership income and deductions, while subtracting any withdrawals or distributions.

Q: Is Form REV-999 specific to Pennsylvania?

A: Yes, Form REV-999 is specific to the state of Pennsylvania.

Q: When is Form REV-999 due?

A: The due date for Form REV-999 may vary, so it is important to check the instructions or consult with a tax professional.

Form Details:

- Released on August 1, 2012;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-999 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.