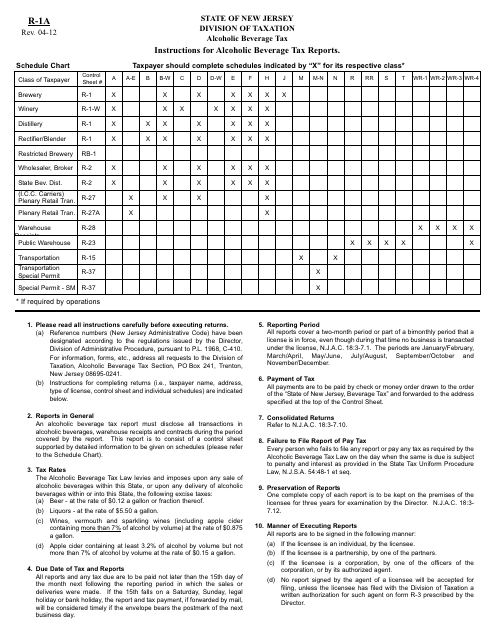

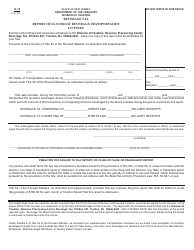

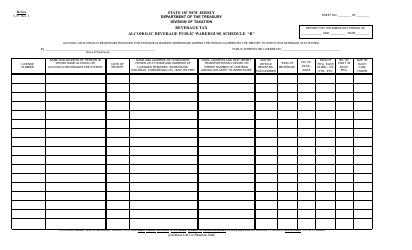

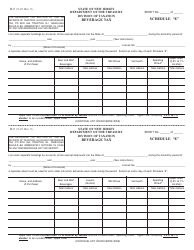

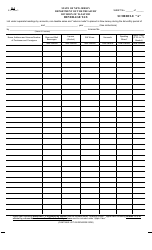

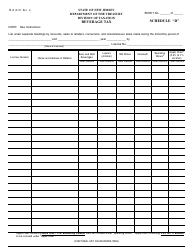

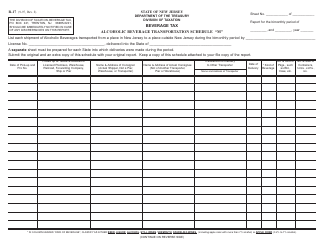

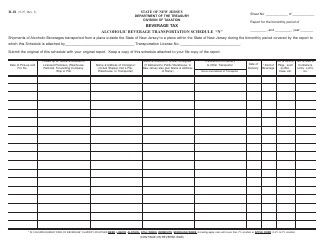

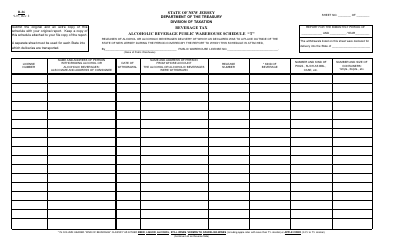

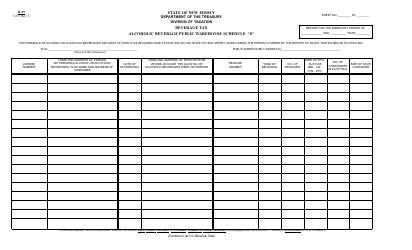

Form R-1A Instructions for Alcoholic Beverage Tax Reports - New Jersey

What Is Form R-1A?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-1A?

A: Form R-1A is a tax form used to report Alcoholic Beverage Tax in New Jersey.

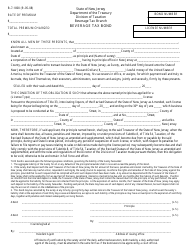

Q: Who needs to file Form R-1A?

A: Any person or entity engaged in the sale or distribution of alcoholic beverages in New Jersey needs to file Form R-1A.

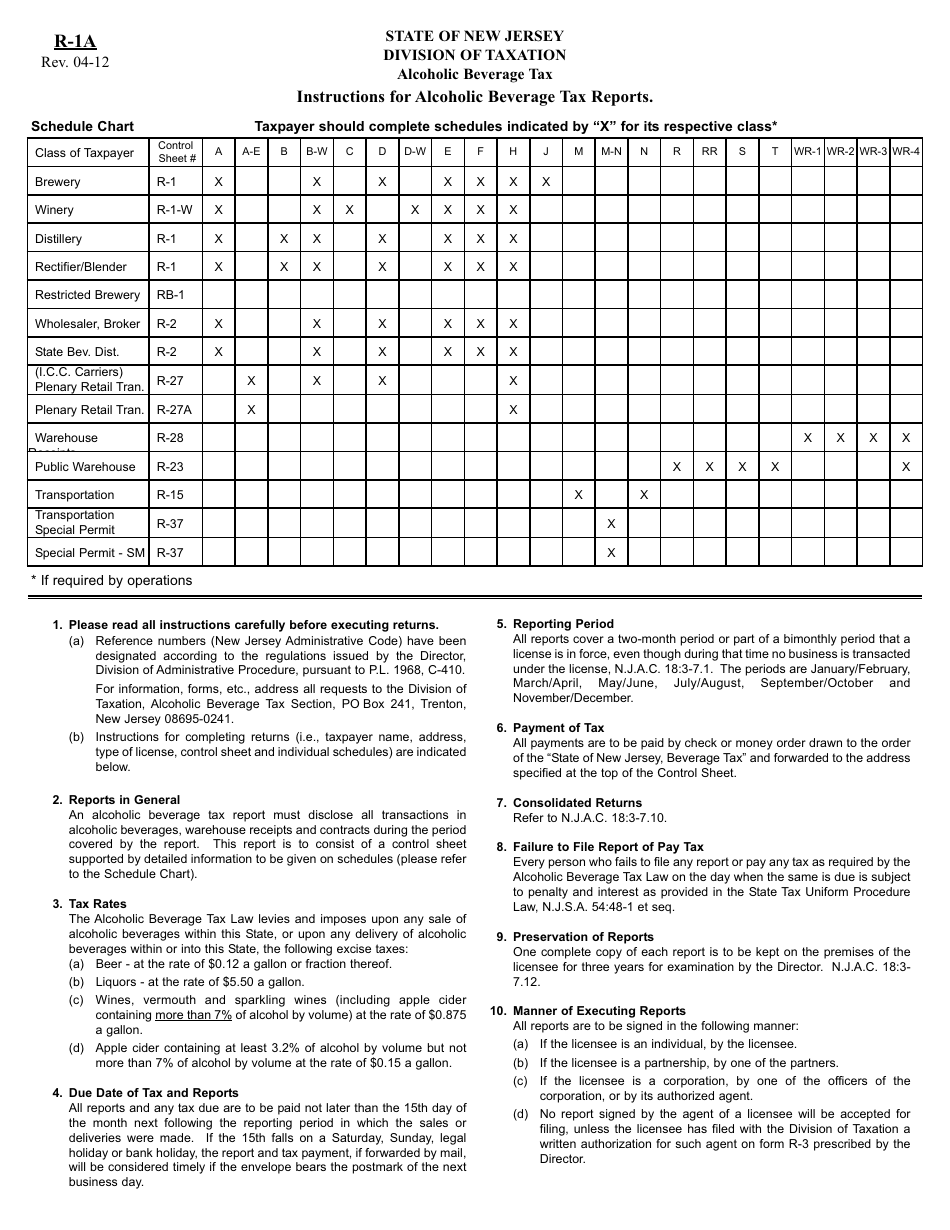

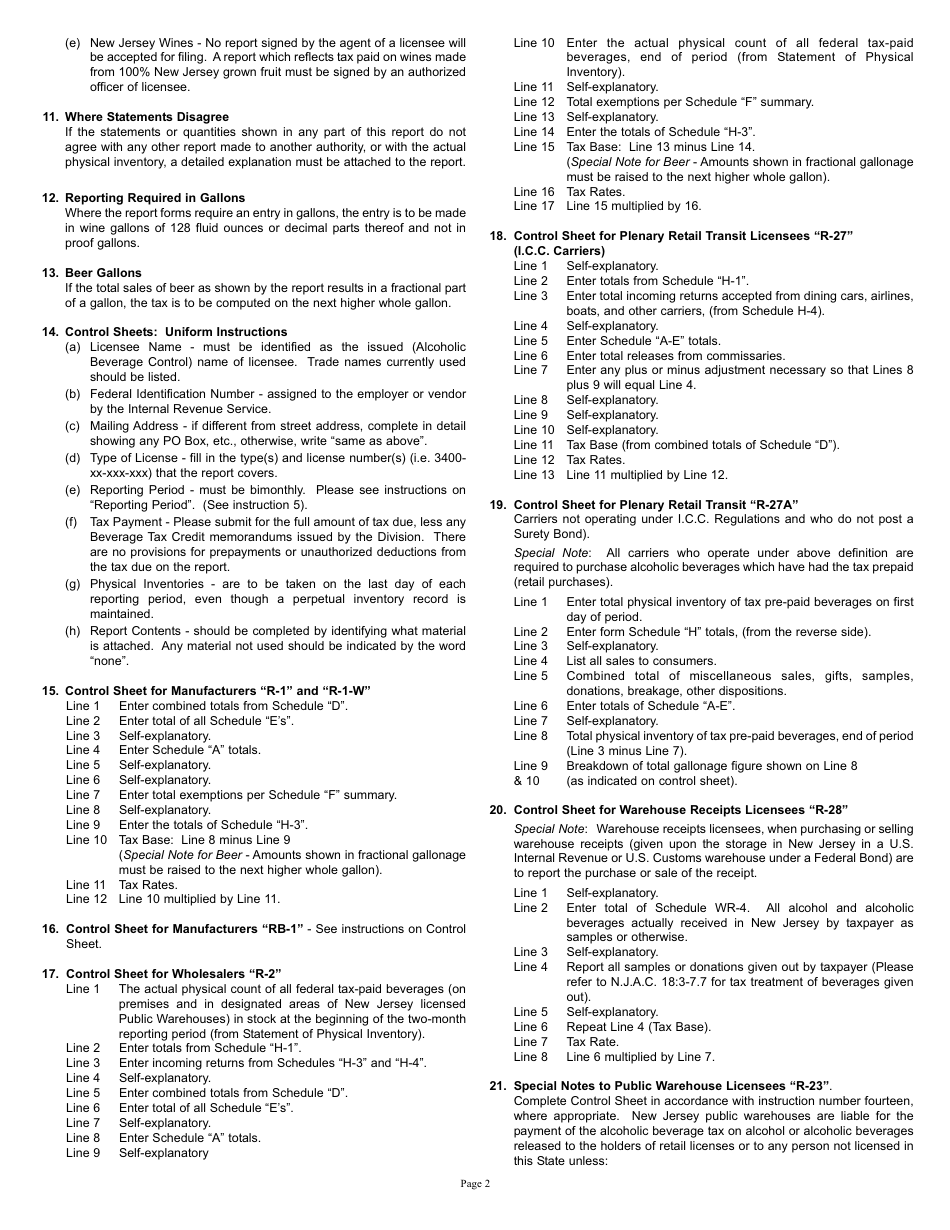

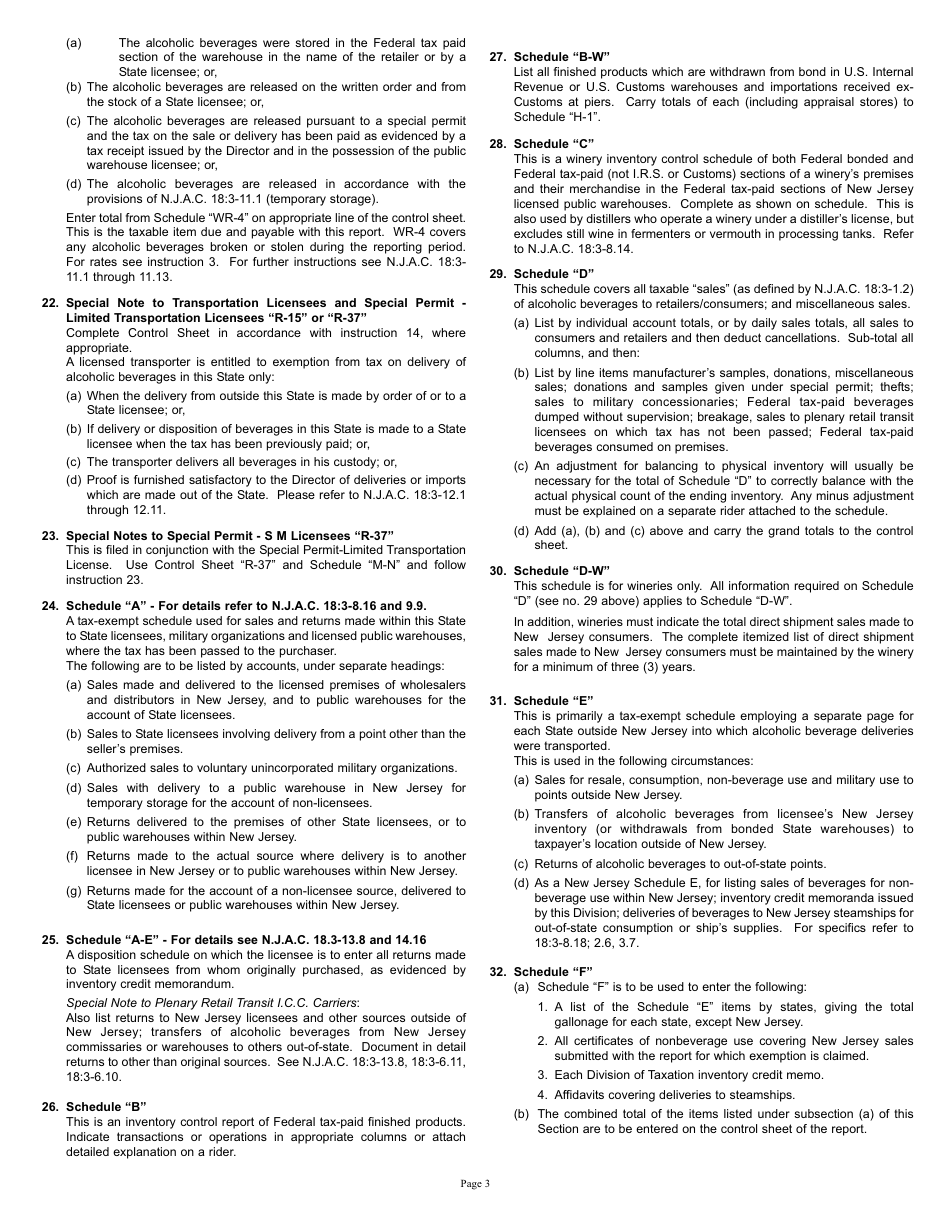

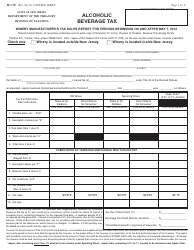

Q: What information is required on Form R-1A?

A: Form R-1A requires information such as the type and quantity of alcoholic beverages sold or distributed, the total cost of the beverages, and the amount of tax due.

Q: When is Form R-1A due?

A: Form R-1A is due on a monthly basis, and must be filed on or before the 15th day of the month following the end of the reporting period.

Q: Are there any consequences for not filing Form R-1A?

A: Failure to file Form R-1A or pay the Alcoholic Beverage Tax on time may result in penalties and interest charges.

Form Details:

- Released on April 1, 2012;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form R-1A by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.