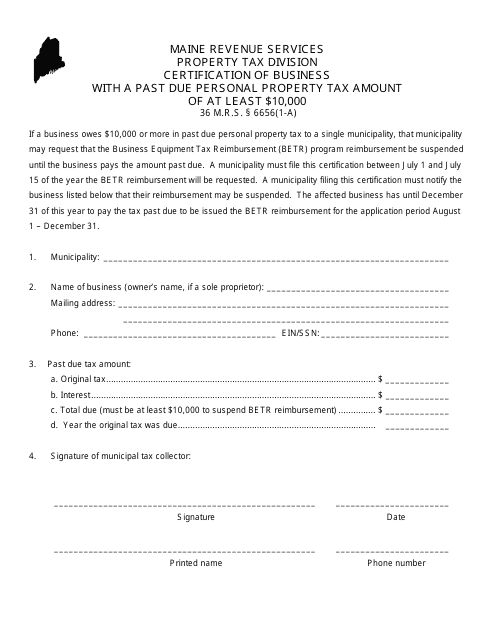

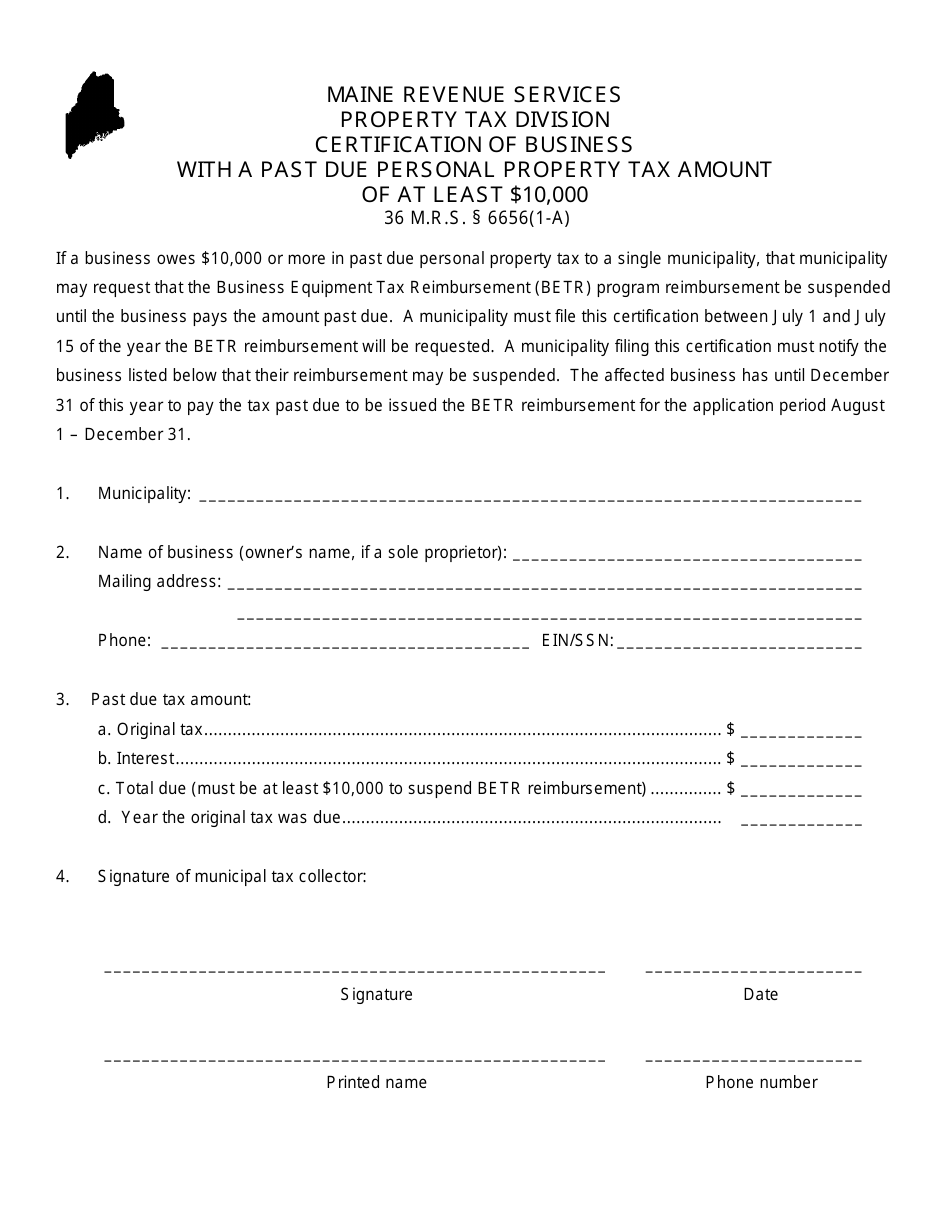

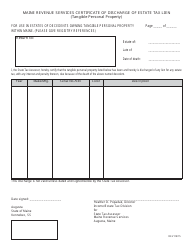

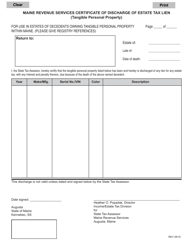

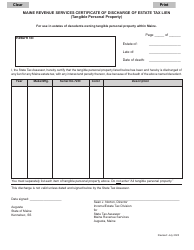

Certification of Business With a Past Due Personal Property Tax Amount of at Least $10,000 - Maine

Certification of Business With a Personal Property Tax Amount of at Least $10,000 is a legal document that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine.

FAQ

Q: What is the certification of business with a past due personal property tax amount?

A: It is a process of certifying a business that has a past due personal property tax amount.

Q: In which state does this certification apply?

A: This certification applies in Maine.

Q: What is considered a past due personal property tax amount?

A: A past due personal property tax amount of at least $10,000 is considered for this certification.

Q: What is the purpose of this certification?

A: The purpose of this certification is to address outstanding personal property tax liabilities of businesses.

Form Details:

- The latest edition currently provided by the Maine Department of Administrative and Financial Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.