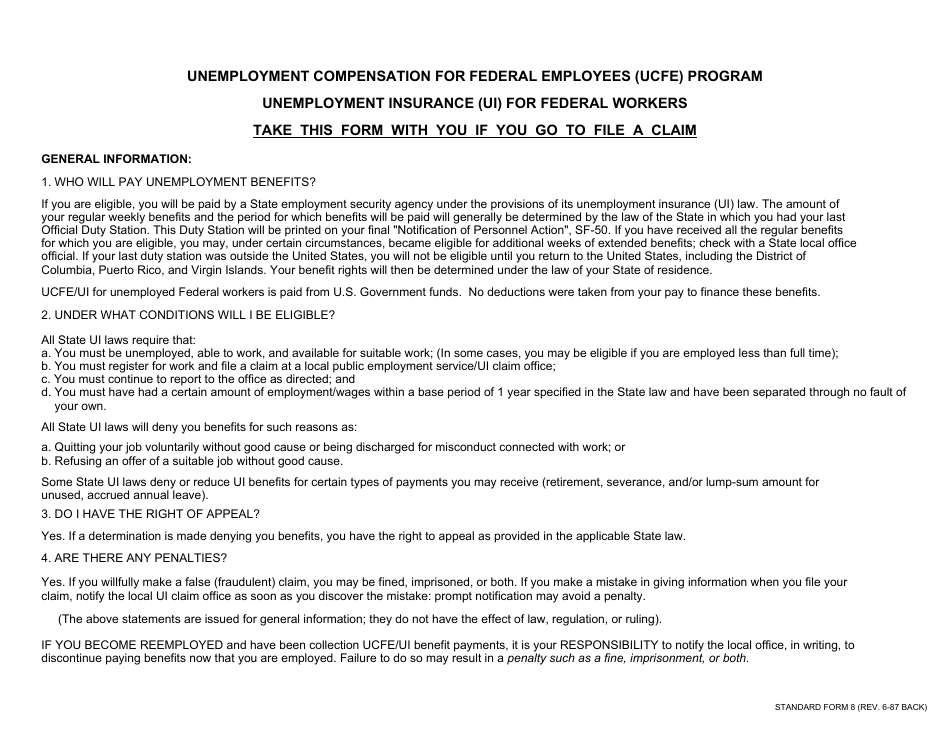

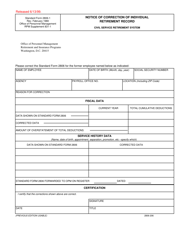

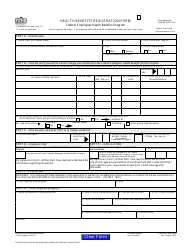

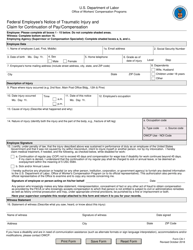

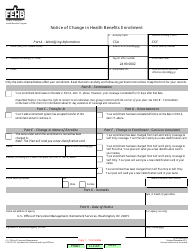

Form SF-8 Notice to Federal Employee About Unemployment Insurance - Unemployment Compensation for Federal Employees (Ucfe) Program

What Is Form SF-8?

This is a legal form that was released by the U.S. General Services Administration on June 1, 1987 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the SF-8 form?

A: The SF-8 form is a Notice to Federal Employee About Unemployment Insurance.

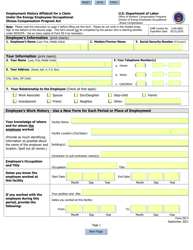

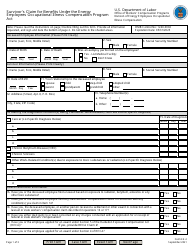

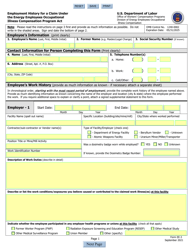

Q: What is the Unemployment Compensation for Federal Employees (UCFE) program?

A: The UCFE program provides unemployment benefits to federal employees who are laid off or experience a reduction in work hours.

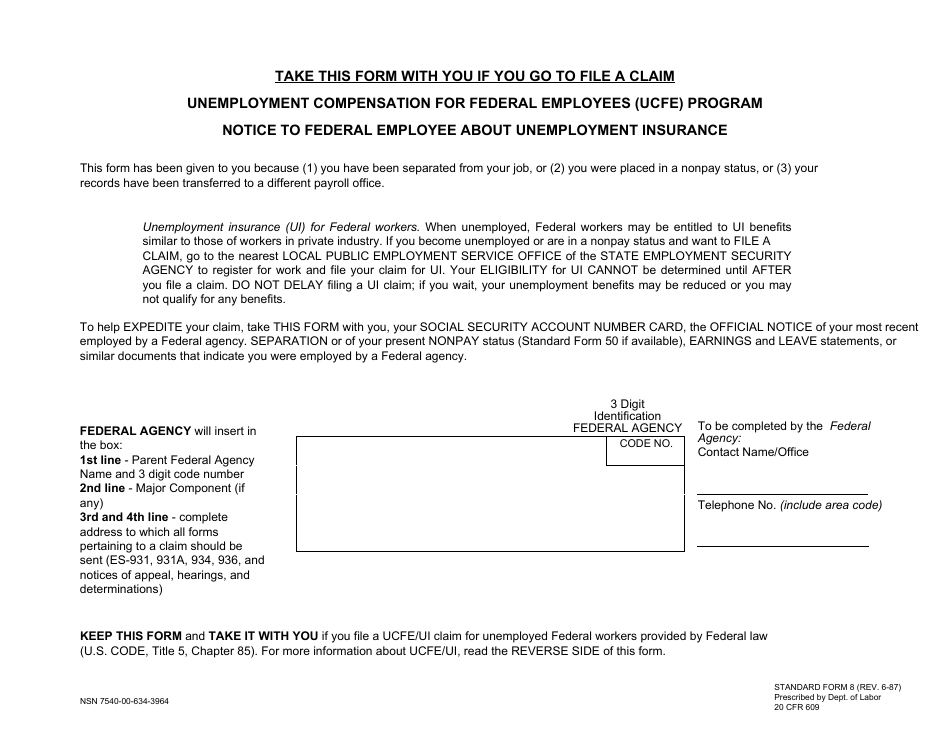

Q: What is the purpose of the SF-8 form?

A: The SF-8 form is used to notify federal employees about their potential eligibility for unemployment insurance benefits under the UCFE program.

Q: Who is eligible for the UCFE program?

A: Federal employees who are laid off or have their work hours reduced may be eligible for the UCFE program.

Q: How do I file a claim for UCFE benefits?

A: To file a claim for UCFE benefits, you need to contact your employing agency's personnel office or Human Resources department.

Q: What information is needed to complete the SF-8 form?

A: The SF-8 form requires the employee's personal information, including their name, Social Security number, agency name, and contact information.

Q: Are UCFE benefits taxable?

A: Yes, UCFE benefits are subject to federal income tax. They may also be subject to state income tax, depending on the state.

Q: How long can I receive UCFE benefits?

A: The duration of UCFE benefits varies depending on the individual's state of residence and the terms of the program.

Q: Can I receive UCFE benefits if I resign from my federal job?

A: No, to be eligible for UCFE benefits, you must be laid off or have your work hours reduced involuntarily.

Form Details:

- Released on June 1, 1987;

- The latest available edition released by the U.S. General Services Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SF-8 by clicking the link below or browse more documents and templates provided by the U.S. General Services Administration.