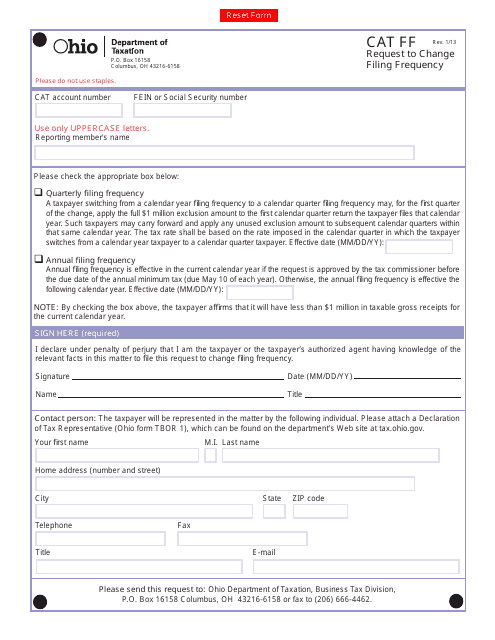

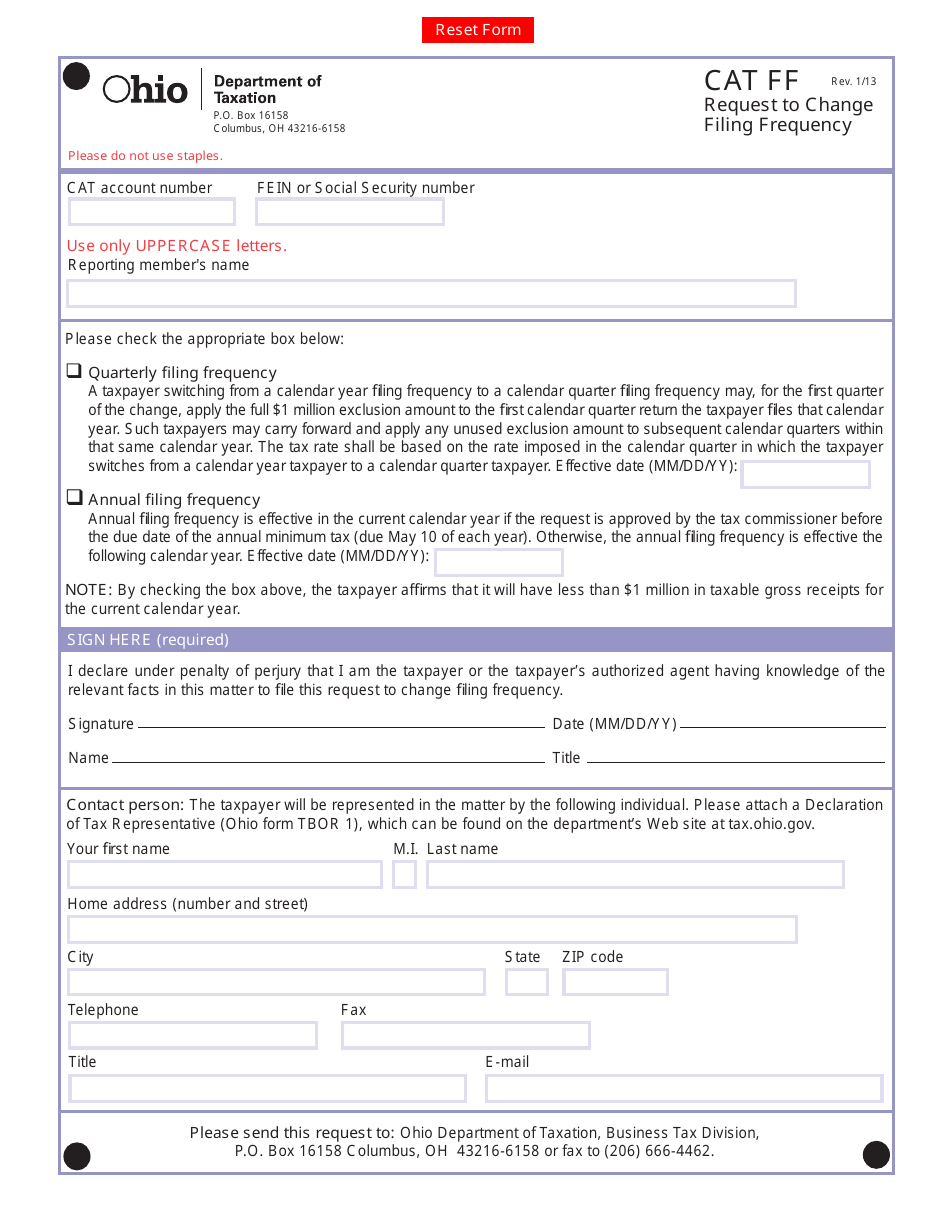

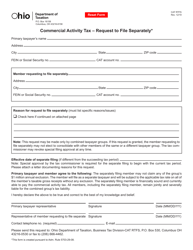

Form CAT FF Request to Change Filing Frequency - Ohio

What Is Form CAT FF?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a CAT FF Request?

A: A CAT FF Request is a form used to request a change in filing frequency for the Commercial Activity Tax (CAT) in Ohio.

Q: What is the Commercial Activity Tax (CAT)?

A: The Commercial Activity Tax (CAT) is a tax imposed on businesses with taxable gross receipts over a certain threshold in Ohio.

Q: Why would I need to change my filing frequency?

A: You may need to change your filing frequency if your business's gross receipts exceed or fall below the threshold for the current filing frequency.

Q: How do I request a change in filing frequency?

A: To request a change in filing frequency, you need to complete and submit a CAT FF Request form to the Ohio Department of Taxation.

Q: Are there any specific requirements for changing filing frequency?

A: Yes, there are specific requirements outlined in the instructions for the CAT FF Request form. Make sure to review and follow them carefully.

Q: Is there a fee for changing filing frequency?

A: No, there is no fee for changing filing frequency for the Commercial Activity Tax (CAT) in Ohio.

Q: How long does it take to process a CAT FF Request?

A: The processing time for a CAT FF Request may vary. It is recommended to submit the form well in advance of your next filing deadline.

Q: Who can I contact for more information about changing filing frequency?

A: You can contact the Ohio Department of Taxation for more information and assistance with changing your filing frequency for the Commercial Activity Tax (CAT).

Form Details:

- Released on January 1, 2013;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CAT FF by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.