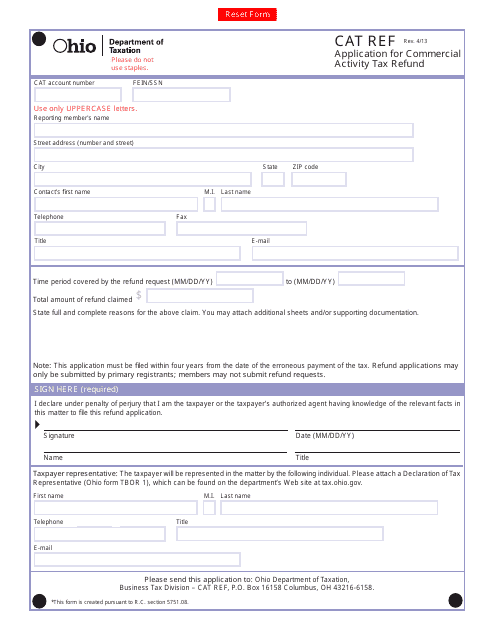

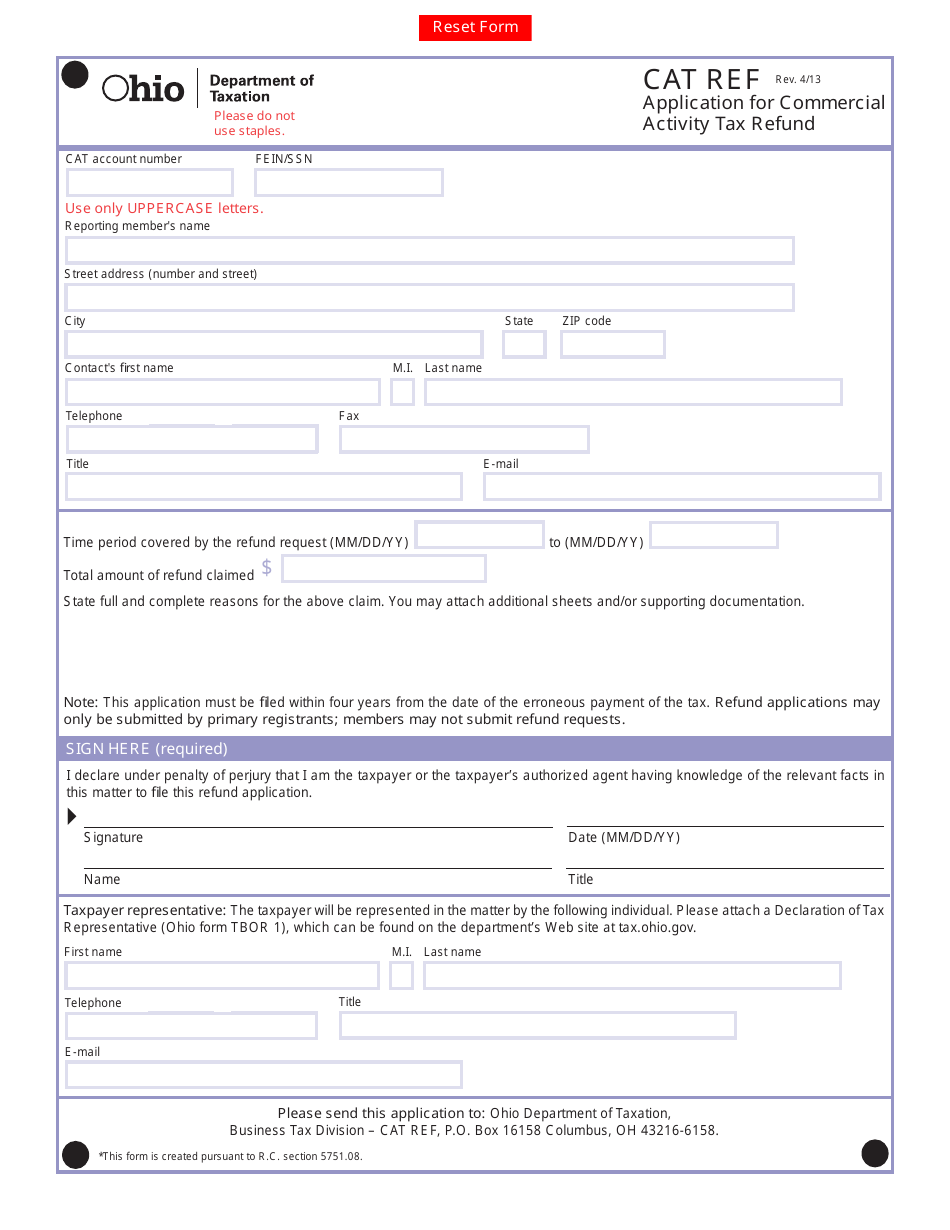

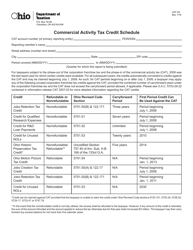

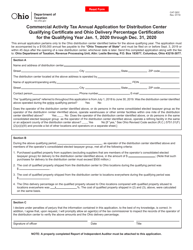

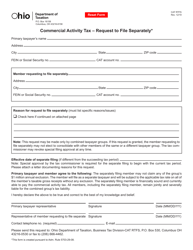

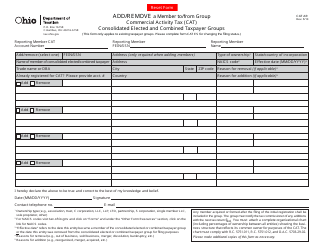

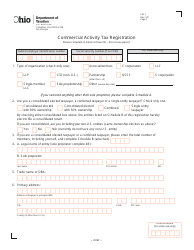

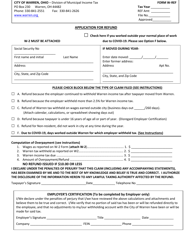

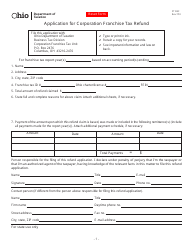

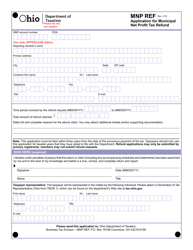

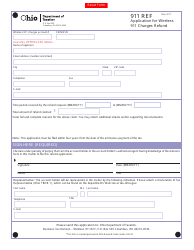

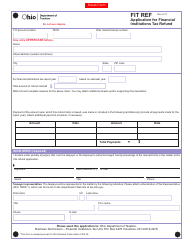

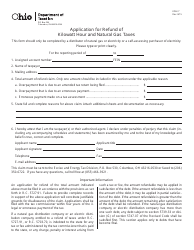

Form CAT REF Application for Commercial Activity Tax Refund - Ohio

What Is Form CAT REF?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the CAT REF application?

A: The CAT REF application is the application to request a refund for Commercial Activity Tax (CAT) paid in Ohio.

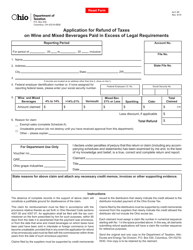

Q: What is the Commercial Activity Tax?

A: The Commercial Activity Tax (CAT) is a tax on certain business activities conducted in Ohio.

Q: Who can apply for the CAT REF?

A: Any business that has paid Commercial Activity Tax in Ohio and qualifies for a refund can apply for the CAT REF.

Q: What is the purpose of the CAT REF?

A: The purpose of the CAT REF is to allow businesses to request a refund for overpaid or wrongly assessed Commercial Activity Tax.

Q: How do I apply for the CAT REF?

A: To apply for the CAT REF, you need to complete the CAT REF Application and submit it to the Ohio Department of Taxation.

Q: What documents do I need to submit with the CAT REF application?

A: You may need to provide supporting documentation such as sales receipts, invoices, and business records to substantiate your refund claim.

Q: Is there a deadline to apply for the CAT REF?

A: Yes, the CAT REF application must be filed within the statute of limitations, which is generally three years from the original due date of the CAT.

Q: How long does it take to receive a refund after filing the CAT REF application?

A: The processing time for CAT REF refunds can vary, but it typically takes several weeks to several months.

Q: Can I check the status of my CAT REF application?

A: Yes, you can check the status of your CAT REF application by contacting the Ohio Department of Taxation.

Q: What should I do if my CAT REF application is denied?

A: If your CAT REF application is denied, you have the right to appeal the decision and provide additional information or documentation to support your claim.

Form Details:

- Released on April 1, 2013;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CAT REF by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.