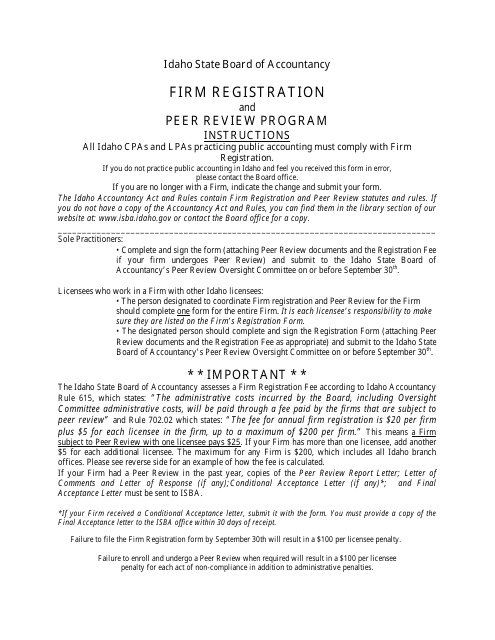

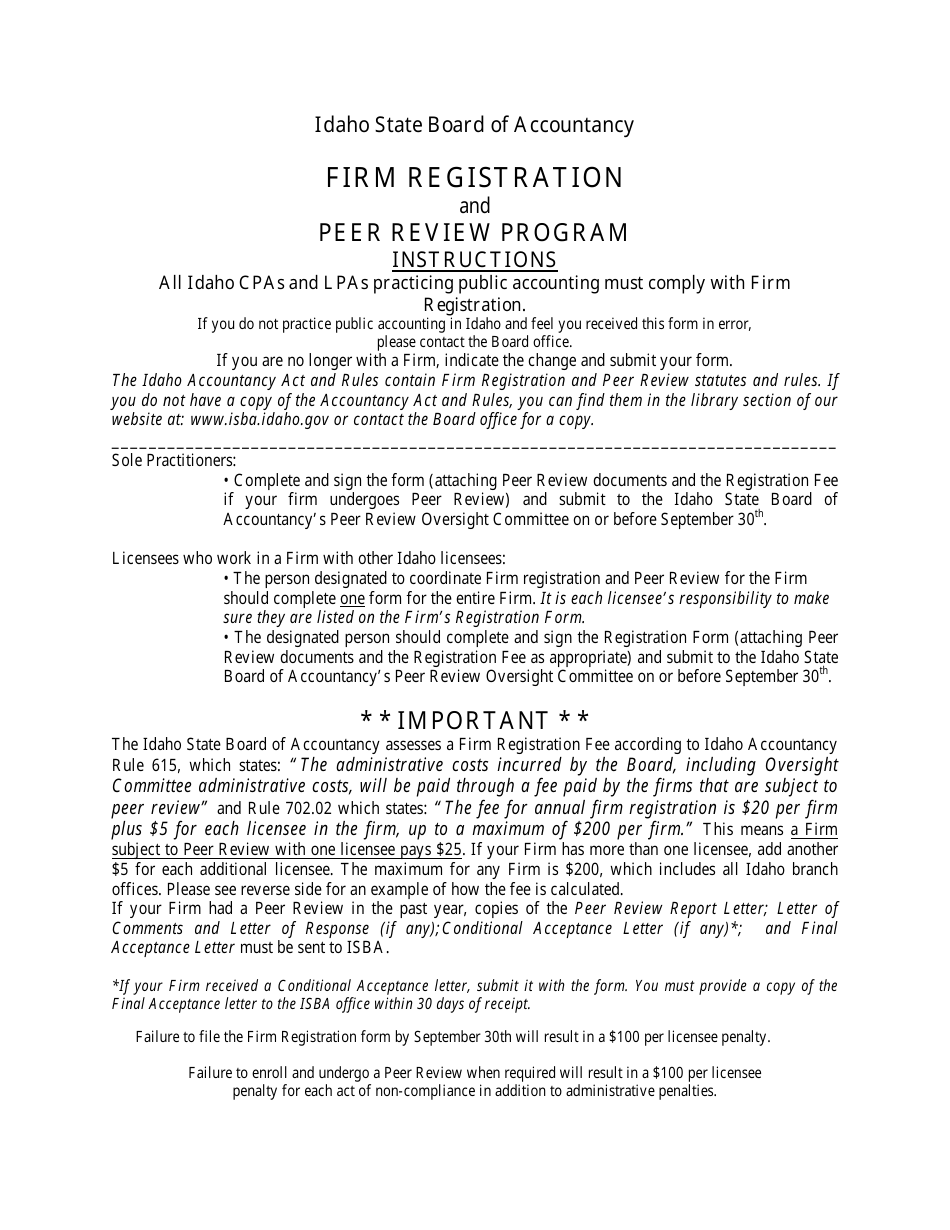

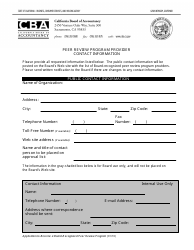

Instructions for Firm Registration and Peer Review Program - Idaho

This document was released by Idaho State Board of Accountancy and contains the most recent official instructions for Firm Registration and Peer Review Program .

FAQ

Q: What is the Firm Registration and Peer Review Program in Idaho?

A: The Firm Registration and Peer Review Program in Idaho is a program designed to ensure that accounting firms meet certain standards and undergo regular reviews to maintain their registration.

Q: What is the purpose of the program?

A: The purpose of the program is to protect the public interest by ensuring that accounting firms maintain high quality standards and provide reliable and competent services.

Q: Who needs to register under this program?

A: All accounting firms that offer services in Idaho, including those with offices outside the state, need to register under this program.

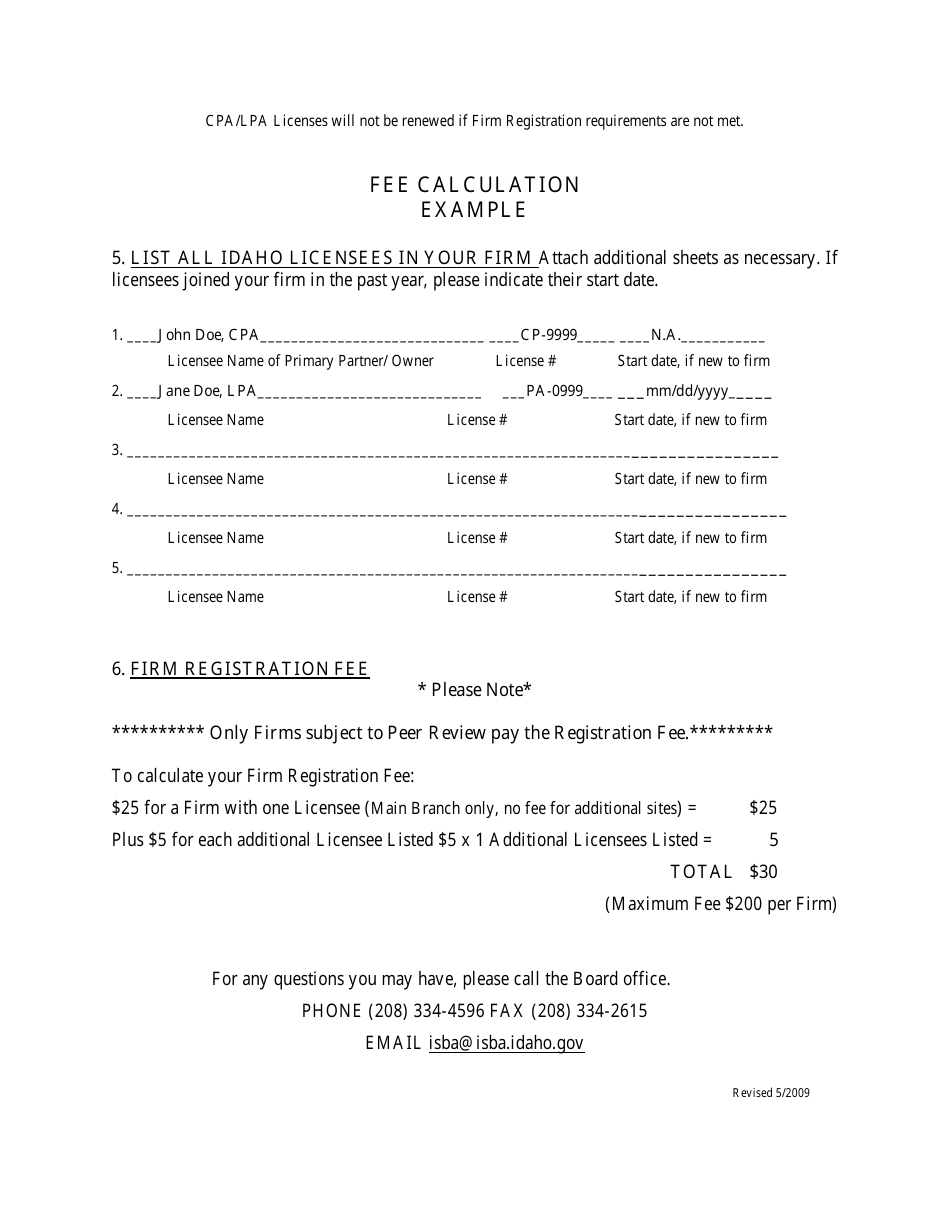

Q: How can an accounting firm register?

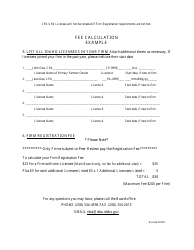

A: To register, an accounting firm needs to submit an application to the Idaho State Board of Accountancy along with the required fees and documentation.

Q: What are the requirements for registration?

A: The requirements for registration include having a CPA as the firm's owner or a designated responsible person, maintaining professional liability insurance, and complying with the peer review process.

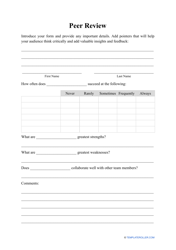

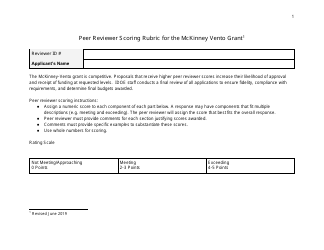

Q: What is a peer review?

A: A peer review is a process where an accounting firm's practices, procedures, and quality control systems are assessed by other qualified professionals to ensure compliance with professional standards.

Q: How often does an accounting firm need to undergo a peer review?

A: Accounting firms generally need to undergo a peer review at least once every three years.

Q: What happens if an accounting firm fails the peer review?

A: If an accounting firm fails the peer review, it must take corrective actions to address the deficiencies identified during the review.

Q: Are there any exemptions from the peer review requirement?

A: Yes, there are exemptions for certain types of accounting firms based on factors such as the size of the firm and the type of services provided.

Q: What are the consequences of not registering or complying with the program requirements?

A: Failure to register or comply with the program requirements may result in penalties, fines, or the suspension of an accounting firm's registration.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library legal documents released by the Idaho State Board of Accountancy.