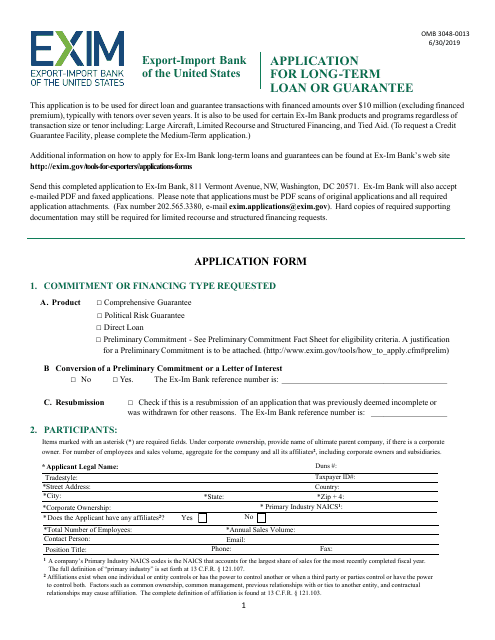

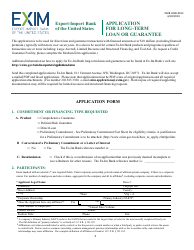

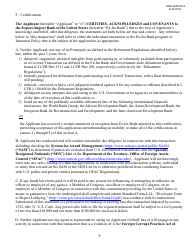

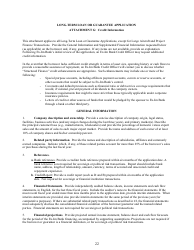

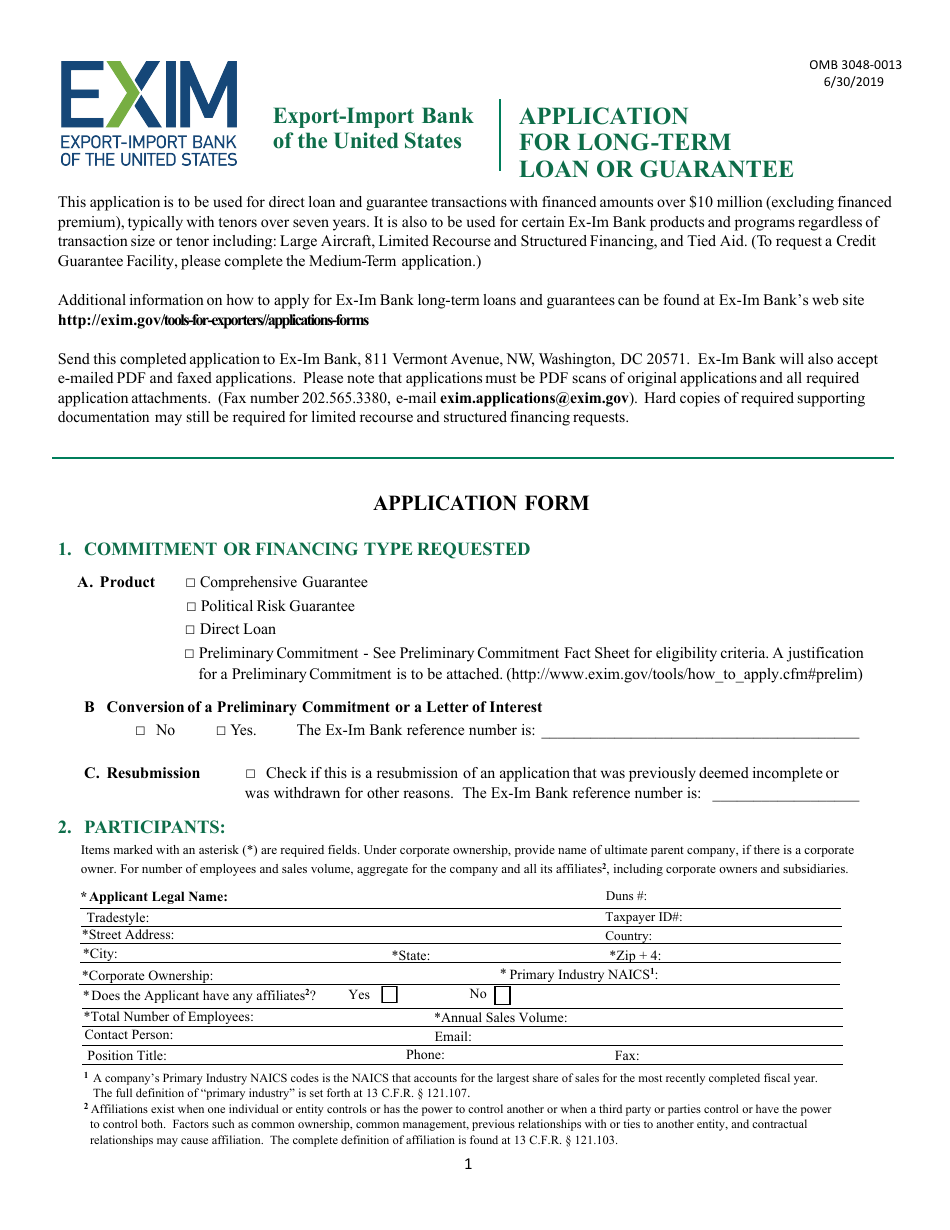

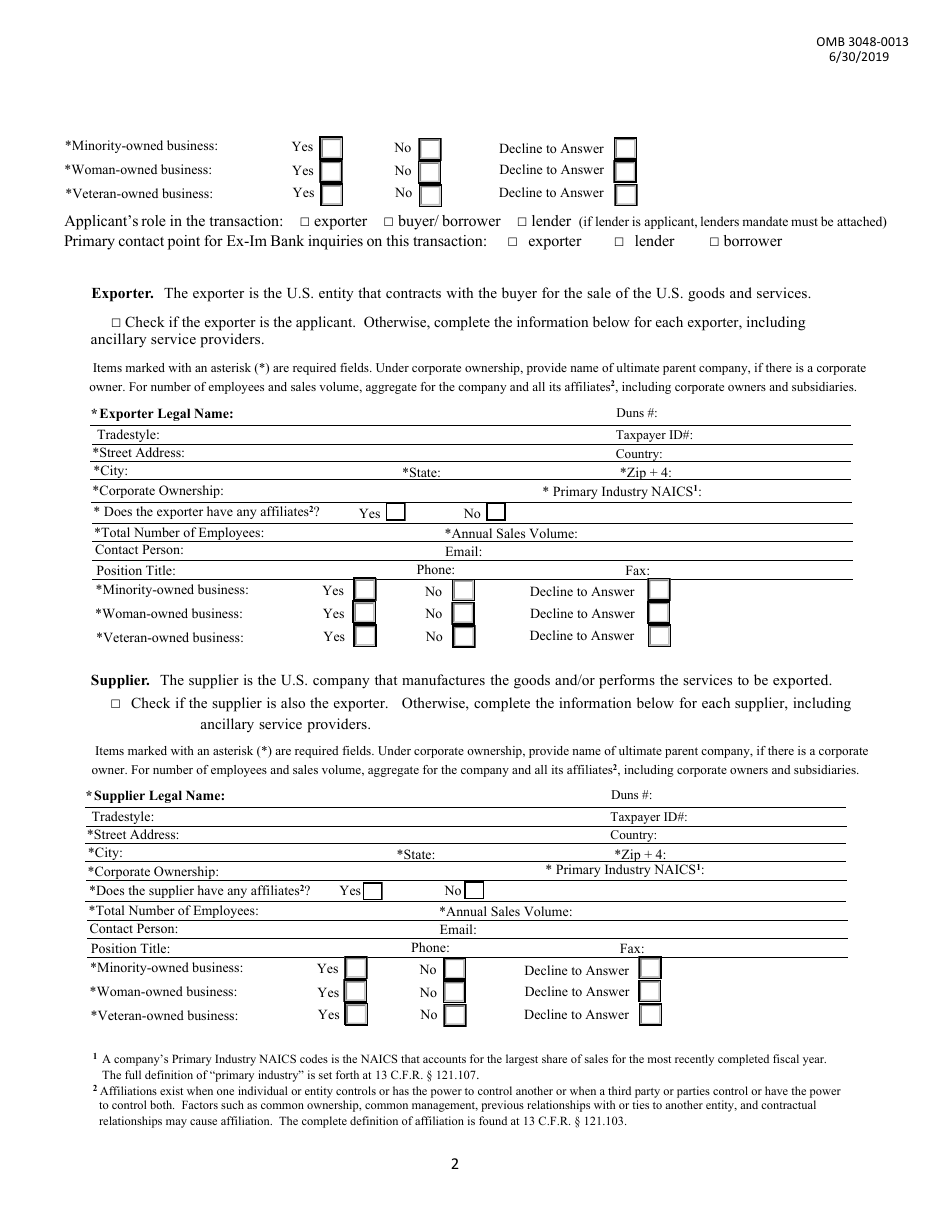

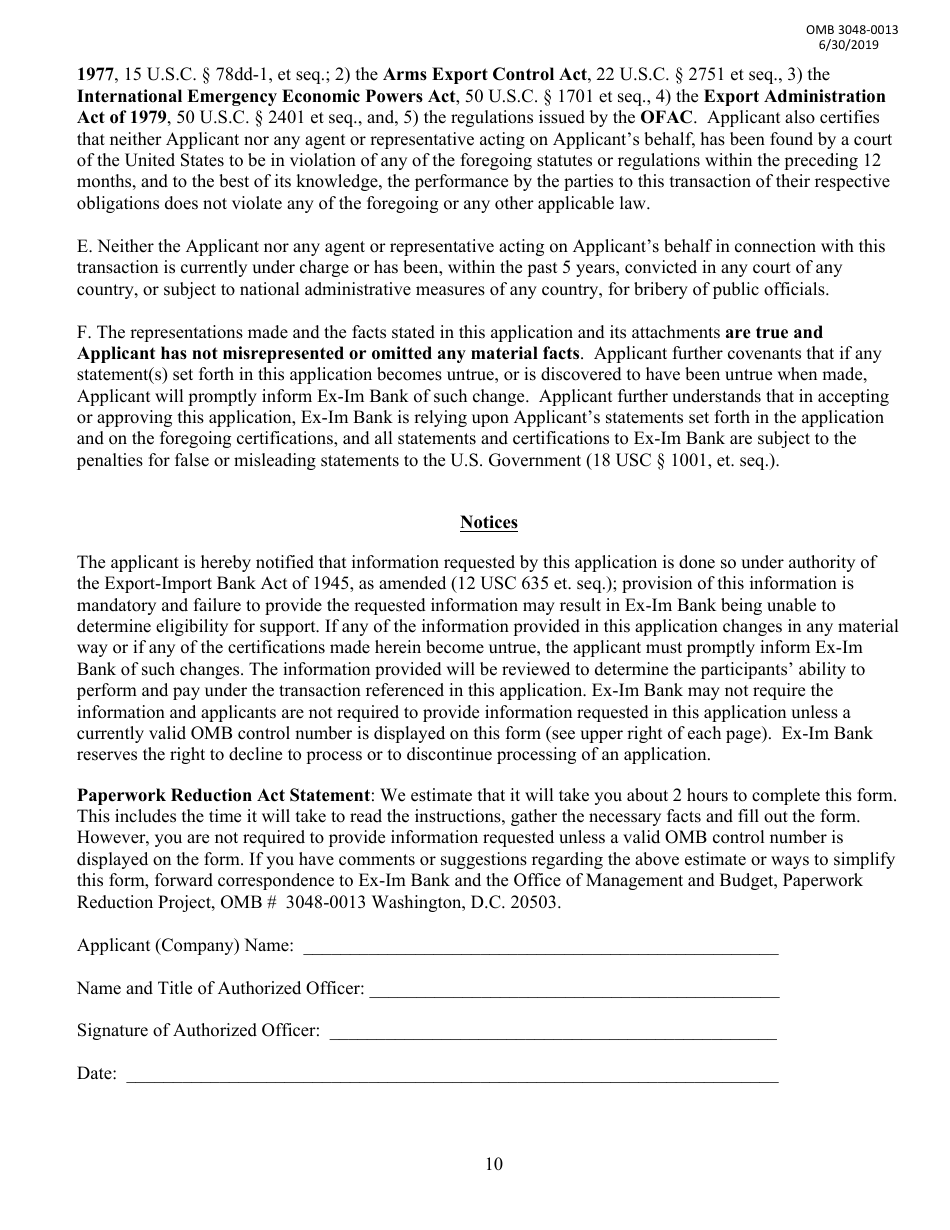

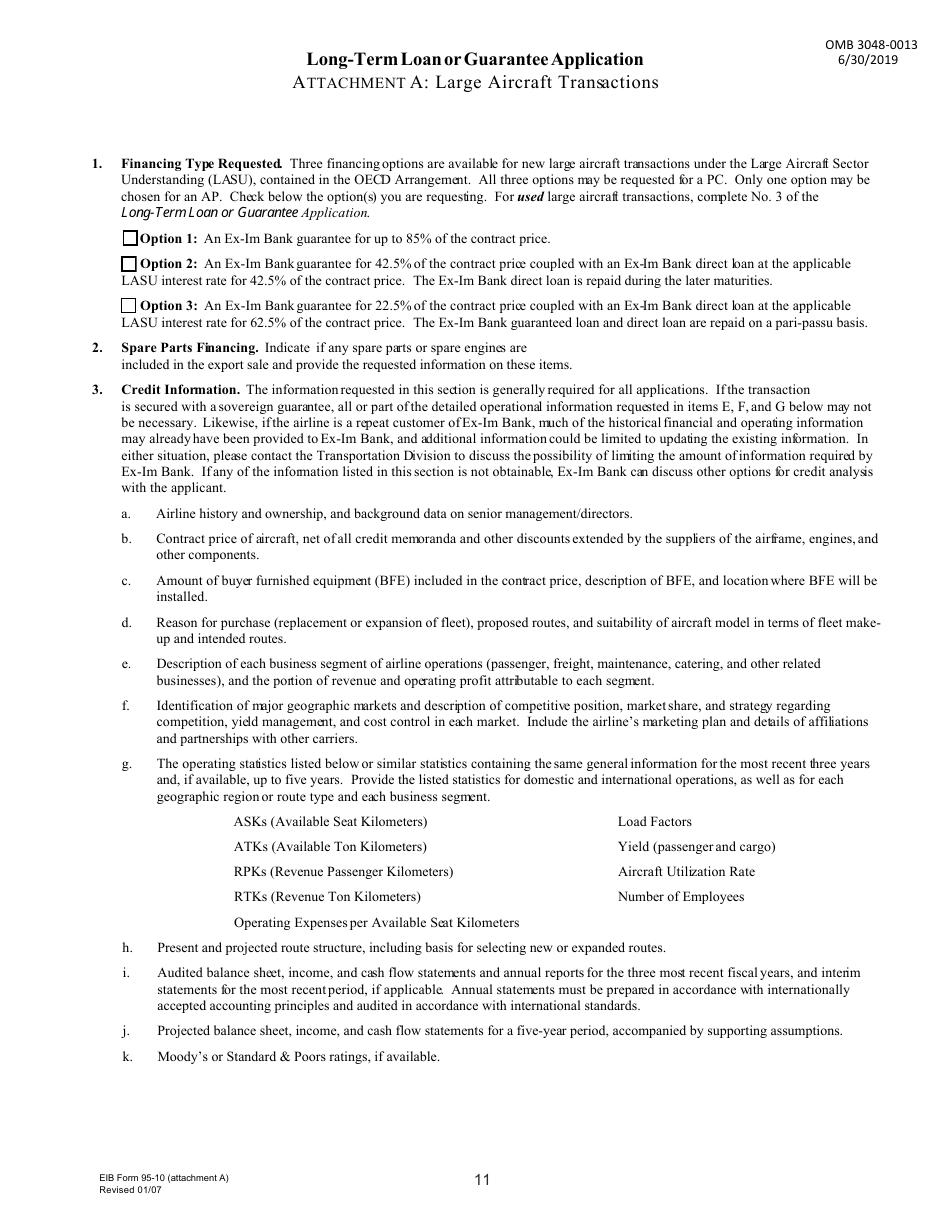

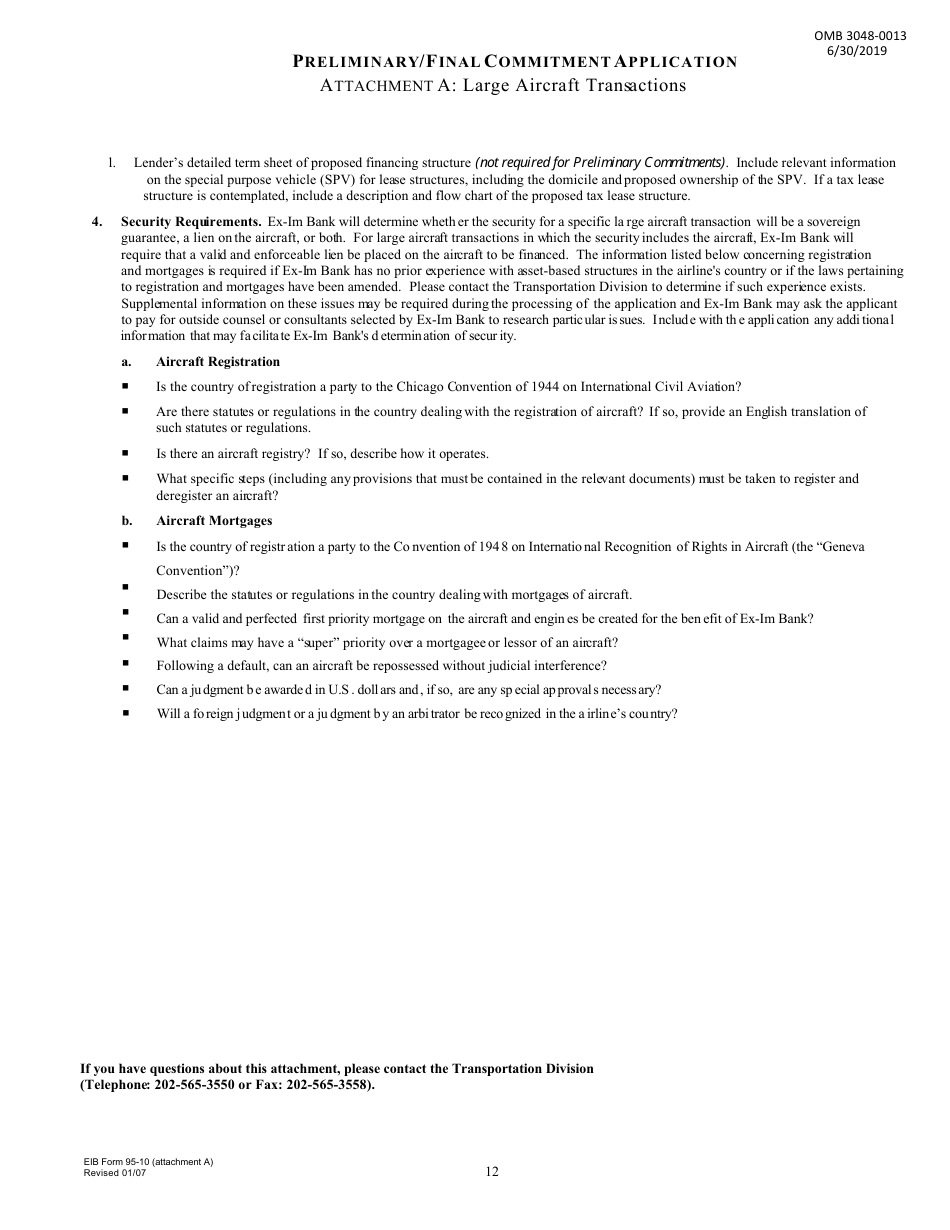

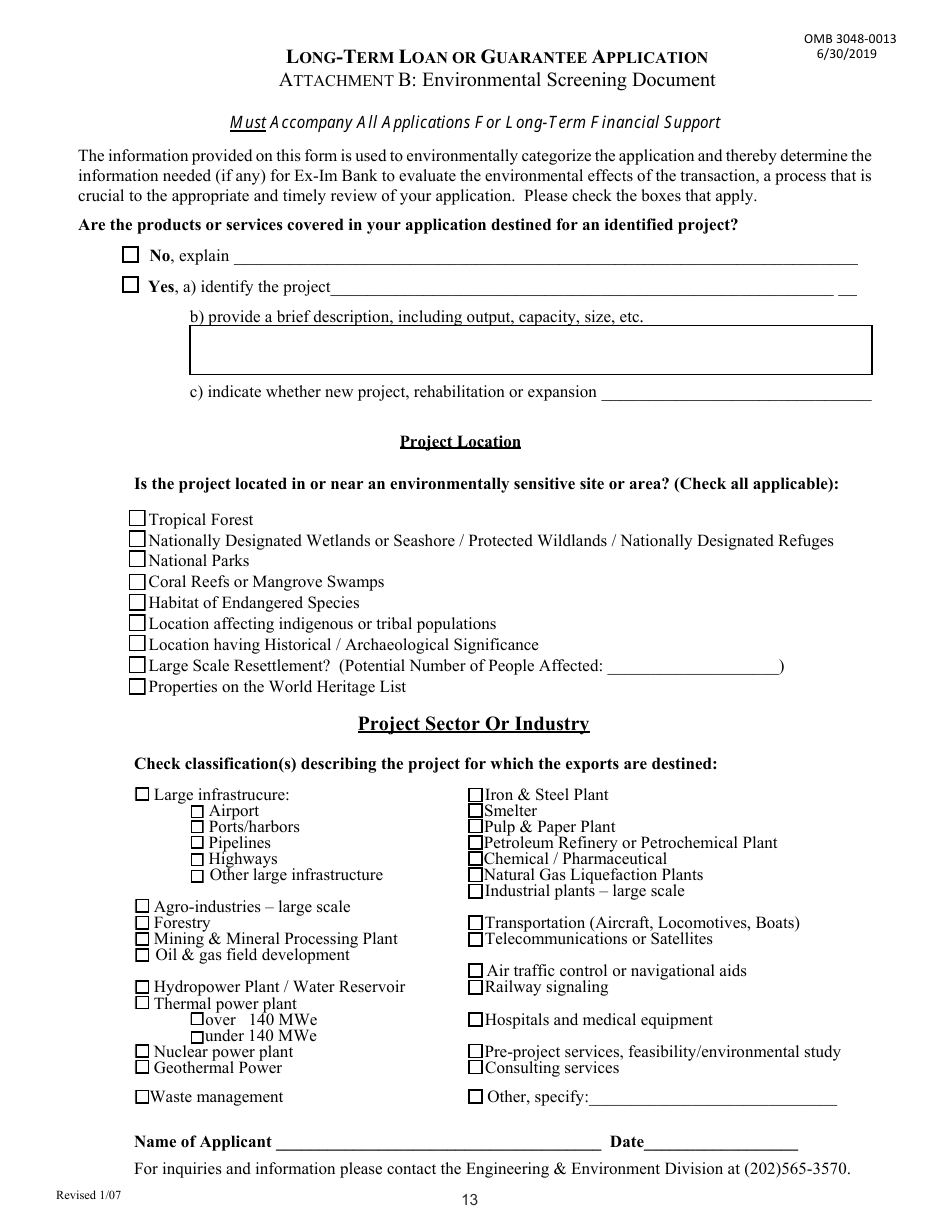

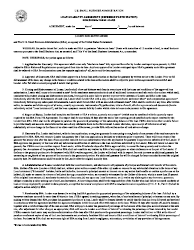

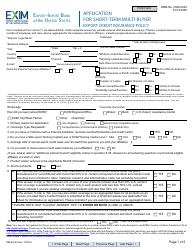

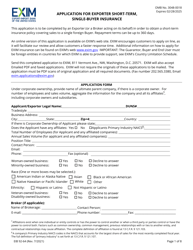

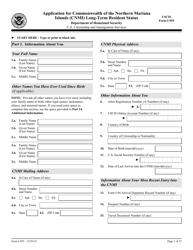

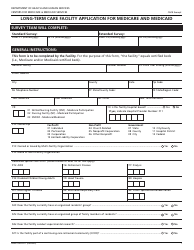

Application for Long-Term Loan or Guarantee

Application for Long-Term Loan or Guarantee is a 24-page legal document that was released by the Export-Import Bank of the United States and used nation-wide.

FAQ

Q: What is an application for a long-term loan or guarantee?

A: It is a request for a loan or guarantee that will be extended over a longer period of time.

Q: Why would someone apply for a long-term loan or guarantee?

A: People may apply for a long-term loan or guarantee to finance a large purchase or investment, such as buying a house or starting a business.

Q: What is the difference between a loan and a guarantee?

A: A loan is a sum of money borrowed that needs to be repaid with interest, while a guarantee is a promise to take responsibility for someone else's debt if they are unable to repay it.

Q: What are some common requirements for a long-term loan or guarantee?

A: Lenders typically require applicants to have a good credit history, stable income, and collateral to secure the loan or guarantee.

Q: How long does it take to process a long-term loan or guarantee application?

A: The processing time can vary depending on the lender and the complexity of the application, but it typically takes several weeks to complete the process.

Q: Can I apply for a long-term loan or guarantee if I have bad credit?

A: Having bad credit can make it more difficult to obtain a long-term loan or guarantee, but there may still be options available, such as applying with a co-signer or providing additional collateral.

Q: What are the risks of taking out a long-term loan or guarantee?

A: The main risk is the potential inability to repay the loan or fulfill the guarantee, which can lead to financial penalties, damage to credit history, and legal action.

Q: Are long-term loans and guarantees available to businesses as well?

A: Yes, businesses can also apply for long-term loans or guarantees to fund their operations, expand their facilities, or invest in new projects.

Q: Do I need to provide any supporting documents with my long-term loan or guarantee application?

A: Yes, lenders typically require applicants to provide documents such as proof of income, tax returns, bank statements, and a detailed business plan for commercial applications.

Q: What should I consider before applying for a long-term loan or guarantee?

A: It is important to carefully assess your financial situation, evaluate the terms and conditions of the loan or guarantee, and consider the impact on your long-term financial goals before applying.

Form Details:

- The latest edition currently provided by the Export-Import Bank of the United States;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more legal forms and templates provided by the issuing department.