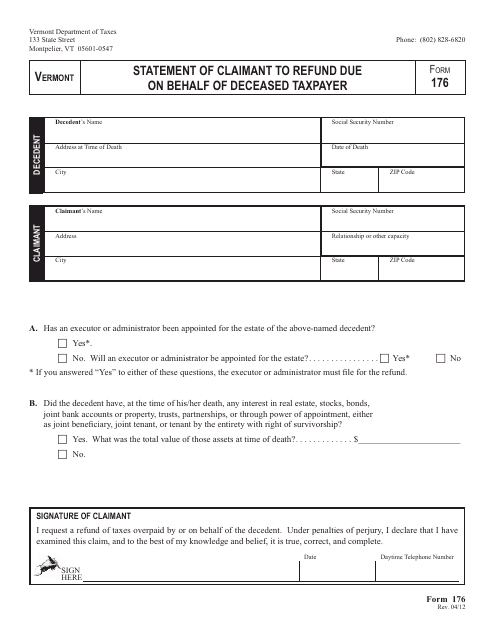

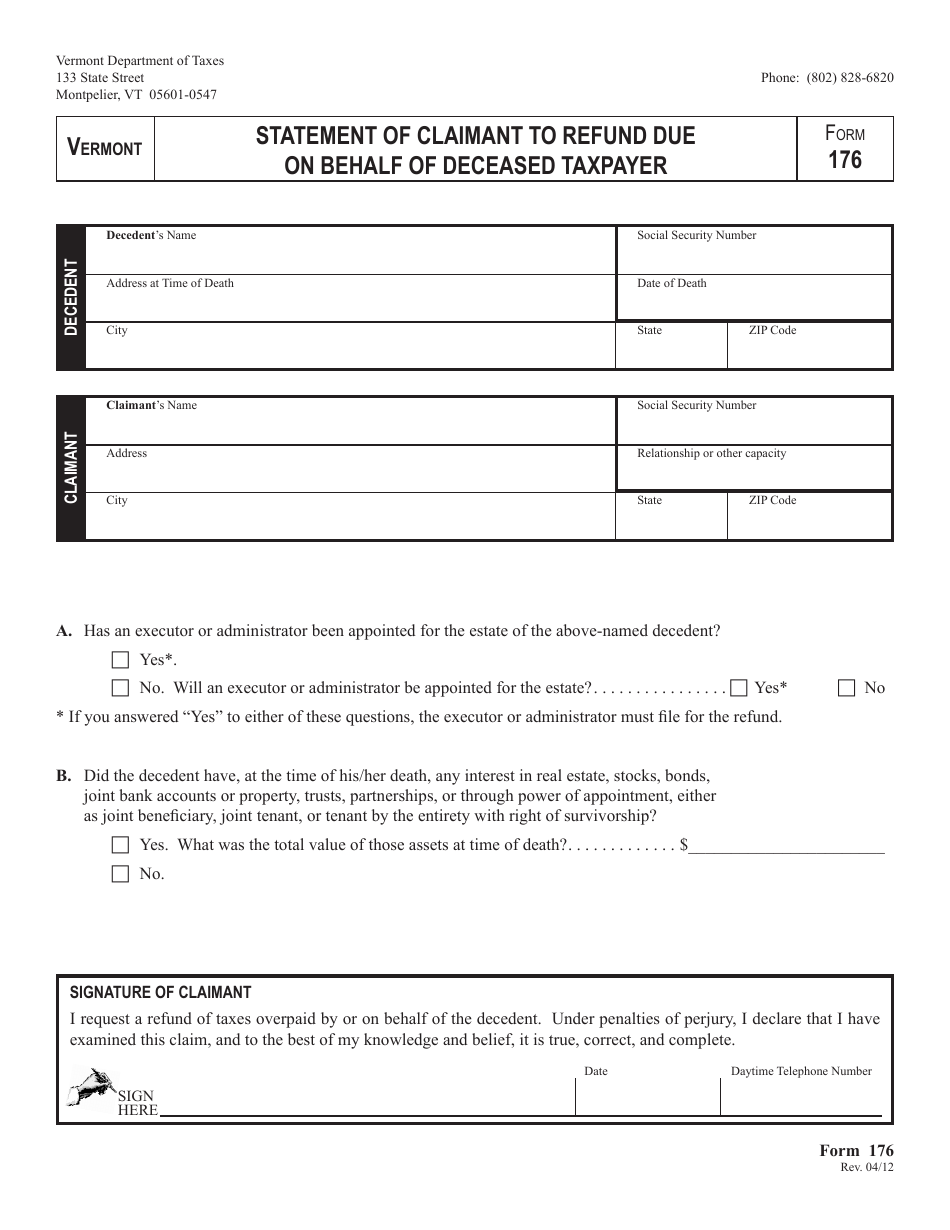

VT Form 176 Statement of Claimant to Refund Due on Behalf of Deceased Taxpayer - Vermont

What Is VT Form 176?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 176?

A: Form 176 is the Statement of Claimant to Refund Due on Behalf of Deceased Taxpayer for Vermont.

Q: Who should file Form 176?

A: Form 176 should be filed by a person who is claiming a refund on behalf of a deceased taxpayer in Vermont.

Q: What information is needed to complete Form 176?

A: You will need the deceased taxpayer's information, such as their name, social security number, and date of death, along with the claimant's information.

Q: Is there a deadline for filing Form 176?

A: Yes, Form 176 must be filed within three years from the due date of the original tax return or two years from the date the tax was paid, whichever is later.

Q: What happens after filing Form 176?

A: The Vermont Department of Taxes will review the claim and process the refund if it is determined that the claim is valid.

Q: Are there any fees associated with filing Form 176?

A: There are no fees associated with filing Form 176.

Form Details:

- Released on April 1, 2012;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of VT Form 176 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.