This version of the form is not currently in use and is provided for reference only. Download this version of

Form OTP-1

for the current year.

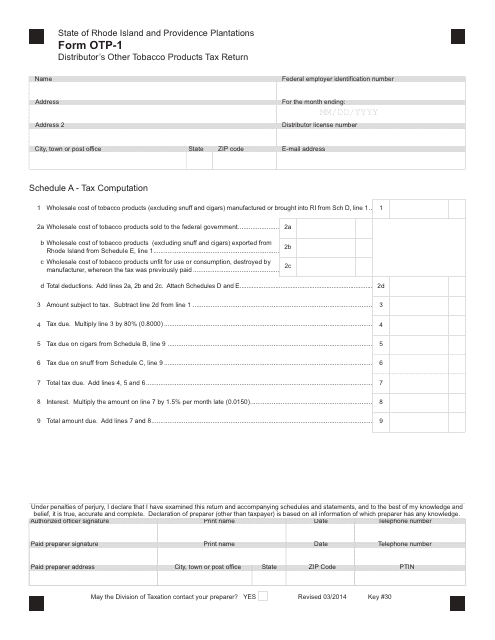

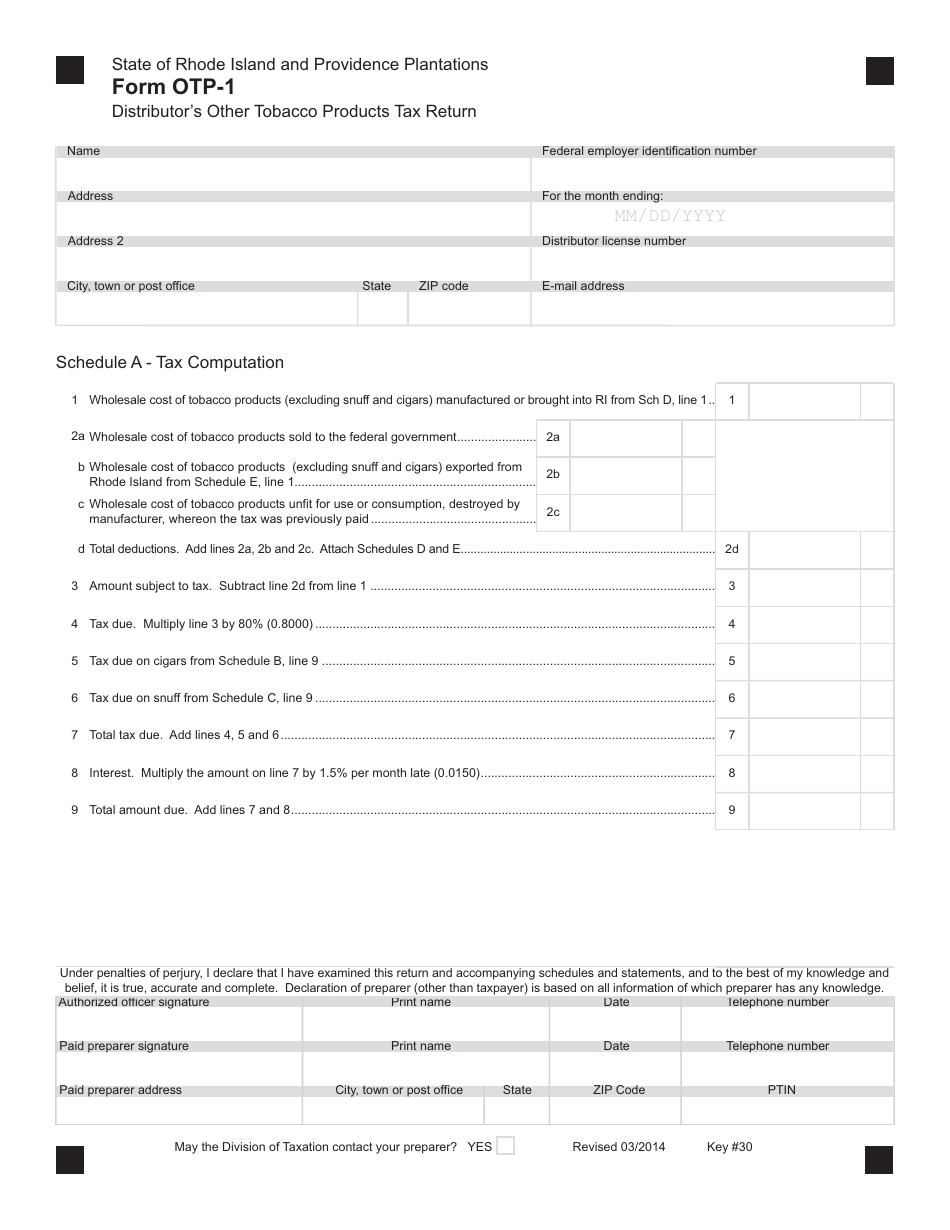

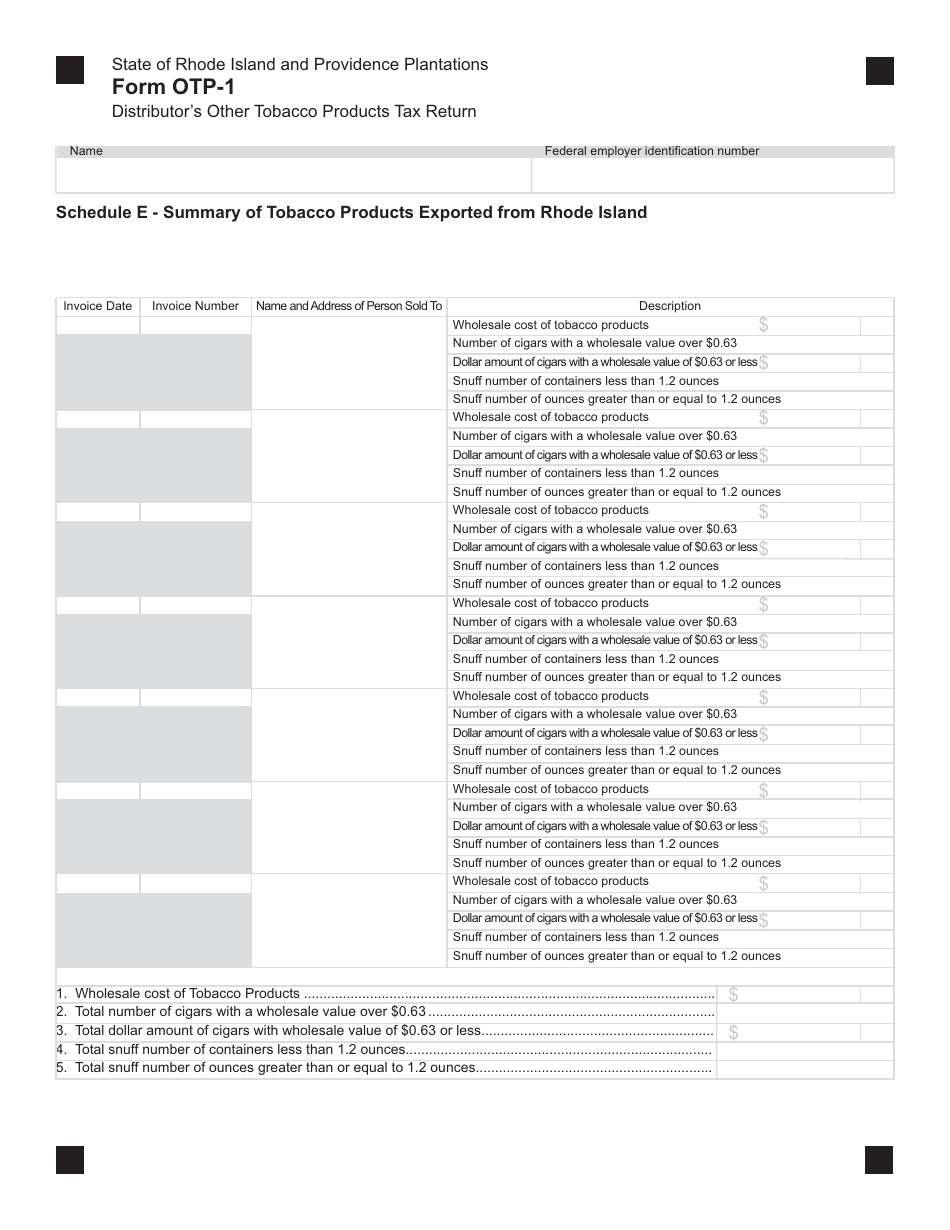

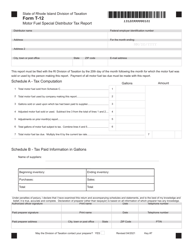

Form OTP-1 Distributor's Other Tobacco Products Tax Return - Rhode Island

What Is Form OTP-1?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTP-1?

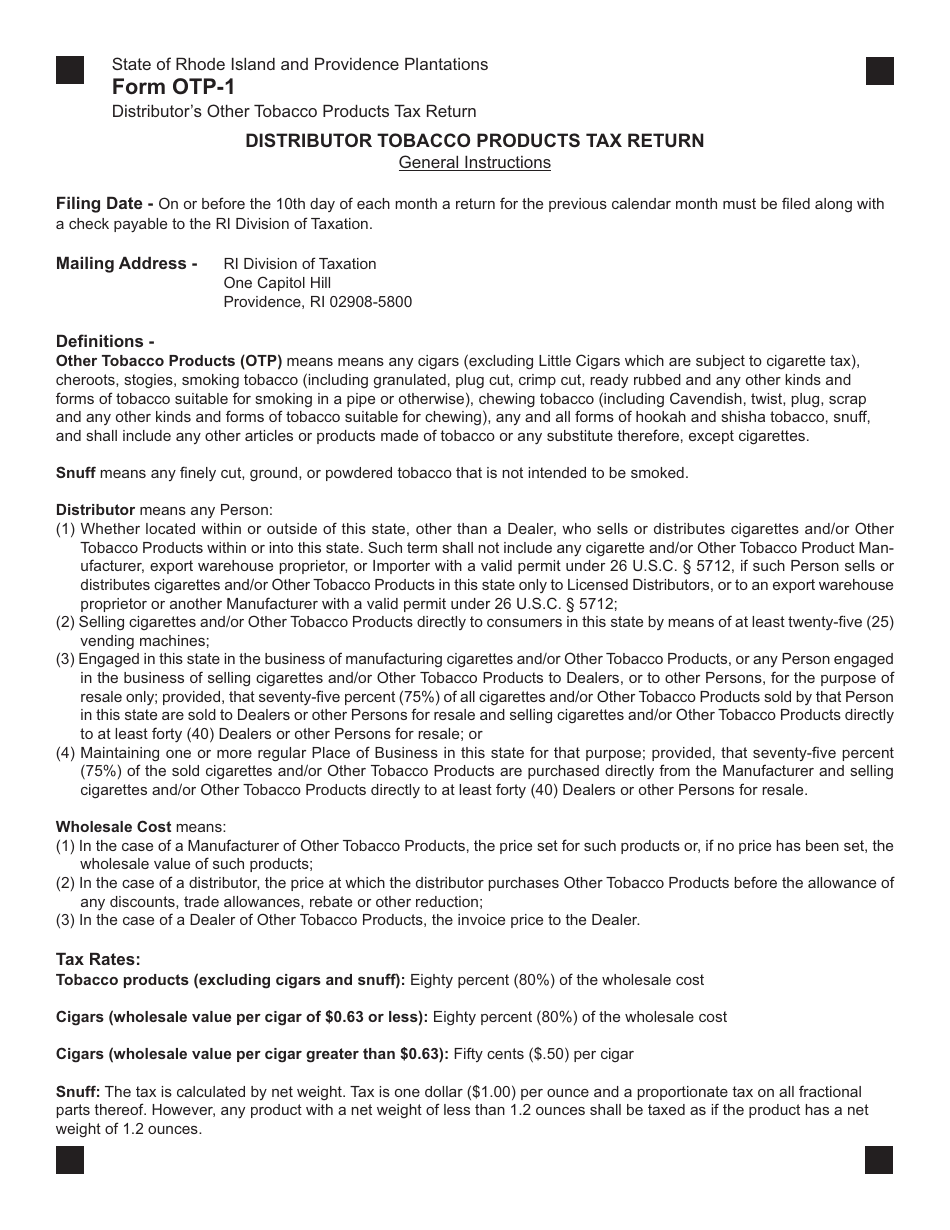

A: OTP-1 is the Distributor's Other Tobacco Products Tax Return form in Rhode Island.

Q: Who needs to file the OTP-1 form?

A: Distributors of other tobacco products in Rhode Island need to file the OTP-1 form.

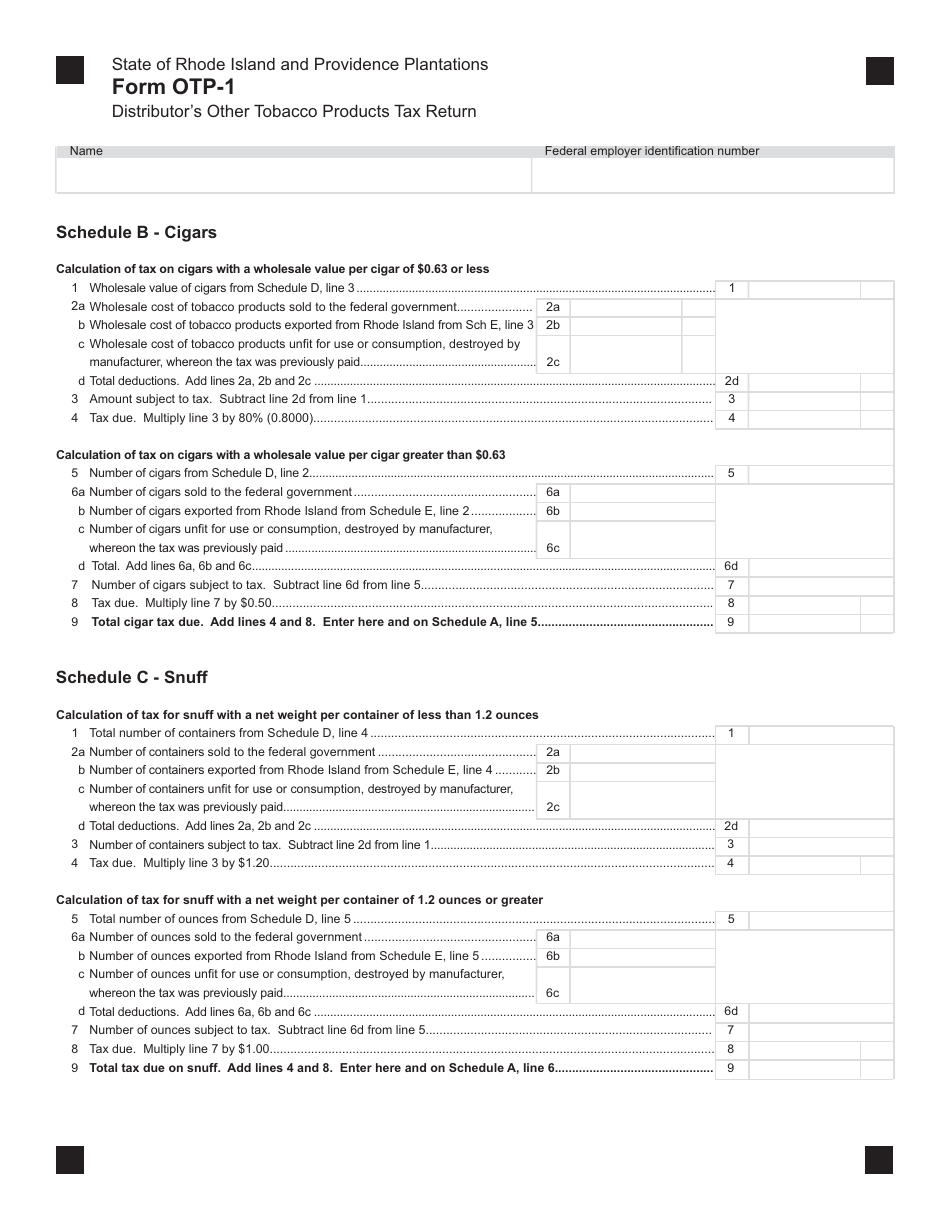

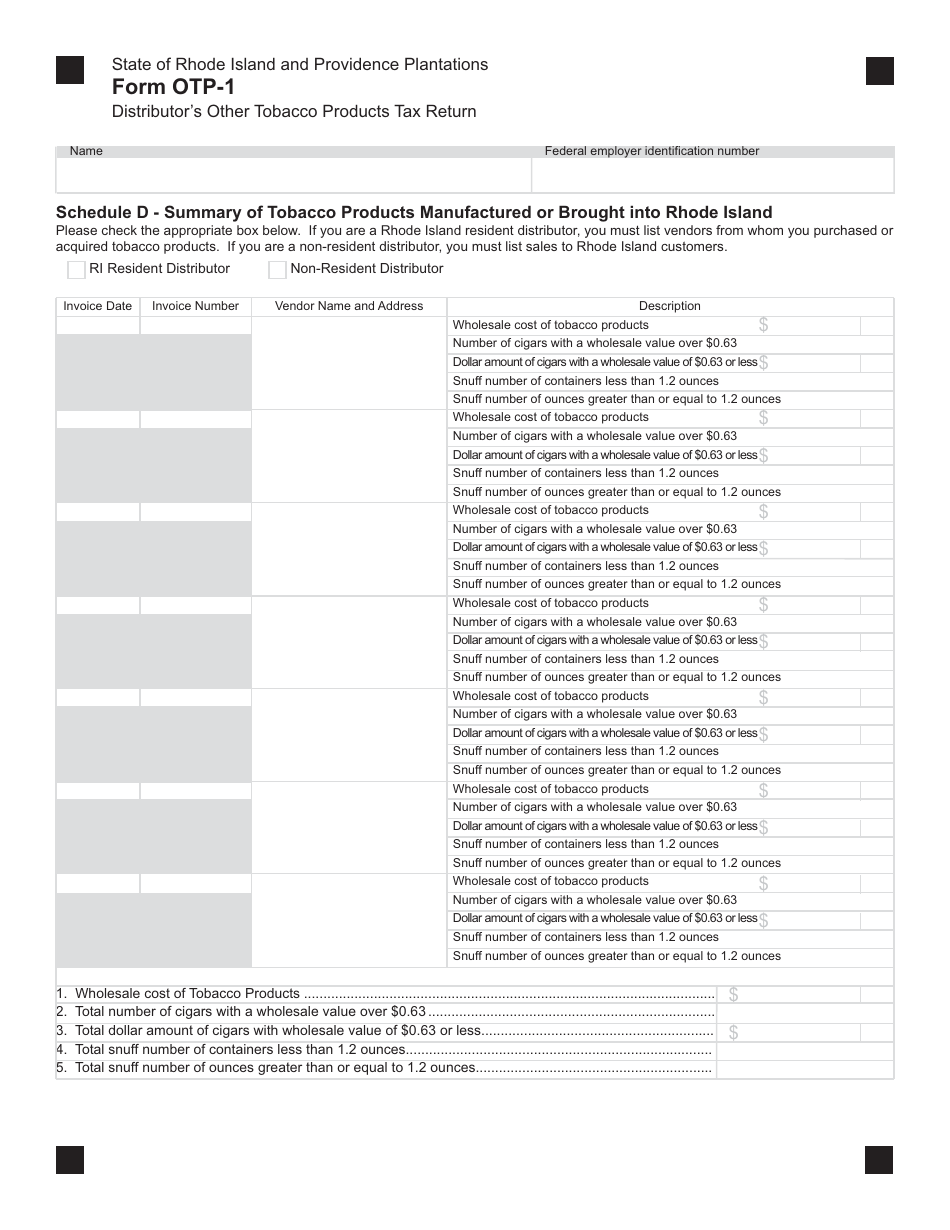

Q: What is considered 'other tobacco products'?

A: Other tobacco products include cigars, smoking tobacco, snuff, chewing tobacco, and any other product made of, or containing, tobacco.

Q: How often do I need to file the OTP-1 form?

A: The OTP-1 form needs to be filed monthly by the 20th day of the following month.

Q: What information do I need to provide on the OTP-1 form?

A: You need to provide information about the total quantity and wholesale cost of other tobacco products sold in Rhode Island.

Q: Is there a minimum threshold for filing the OTP-1 form?

A: Yes, if you sold less than 1,000 other tobacco products during the reporting period, you do not need to file the OTP-1 form.

Q: Are there any penalties for late or non-filing of the OTP-1 form?

A: Yes, there are penalties for late or non-filing of the OTP-1 form, including fines and possible license suspension.

Q: Is there a separate tax rate for other tobacco products?

A: Yes, other tobacco products are subject to a different tax rate compared to cigarettes in Rhode Island.

Form Details:

- Released on March 1, 2014;

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OTP-1 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.