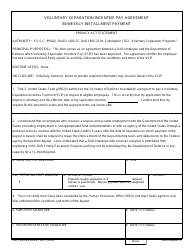

This version of the form is not currently in use and is provided for reference only. Download this version of

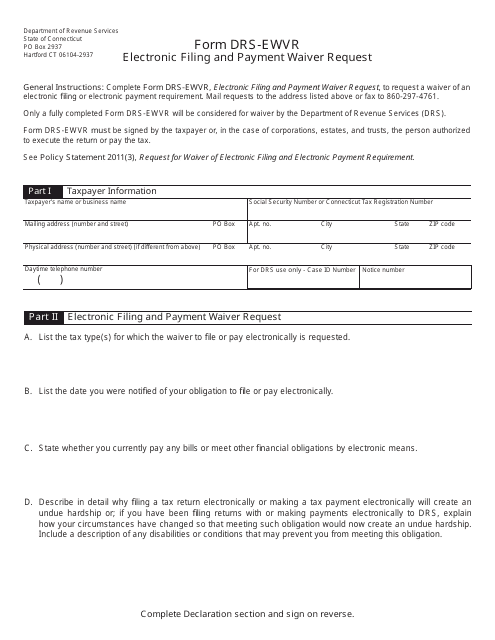

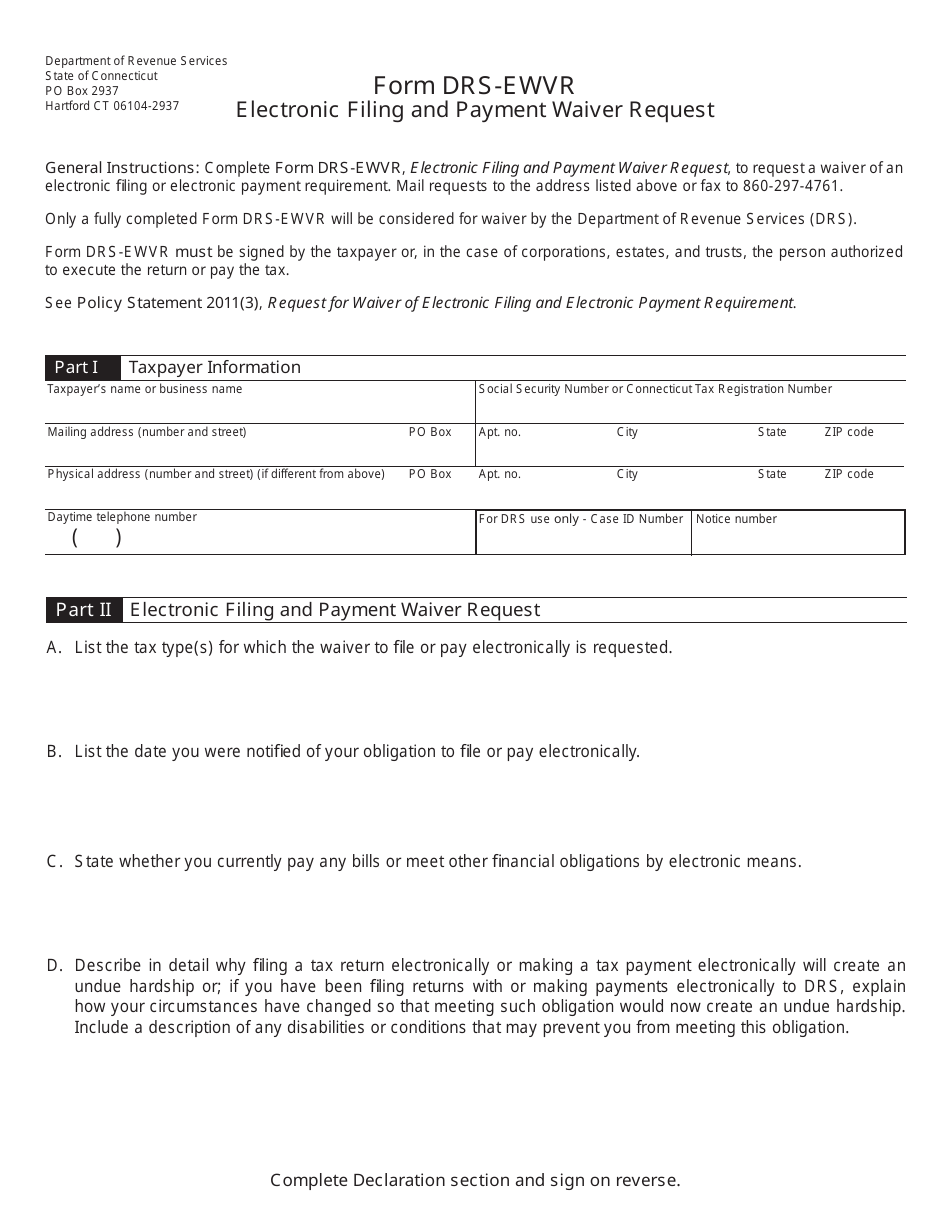

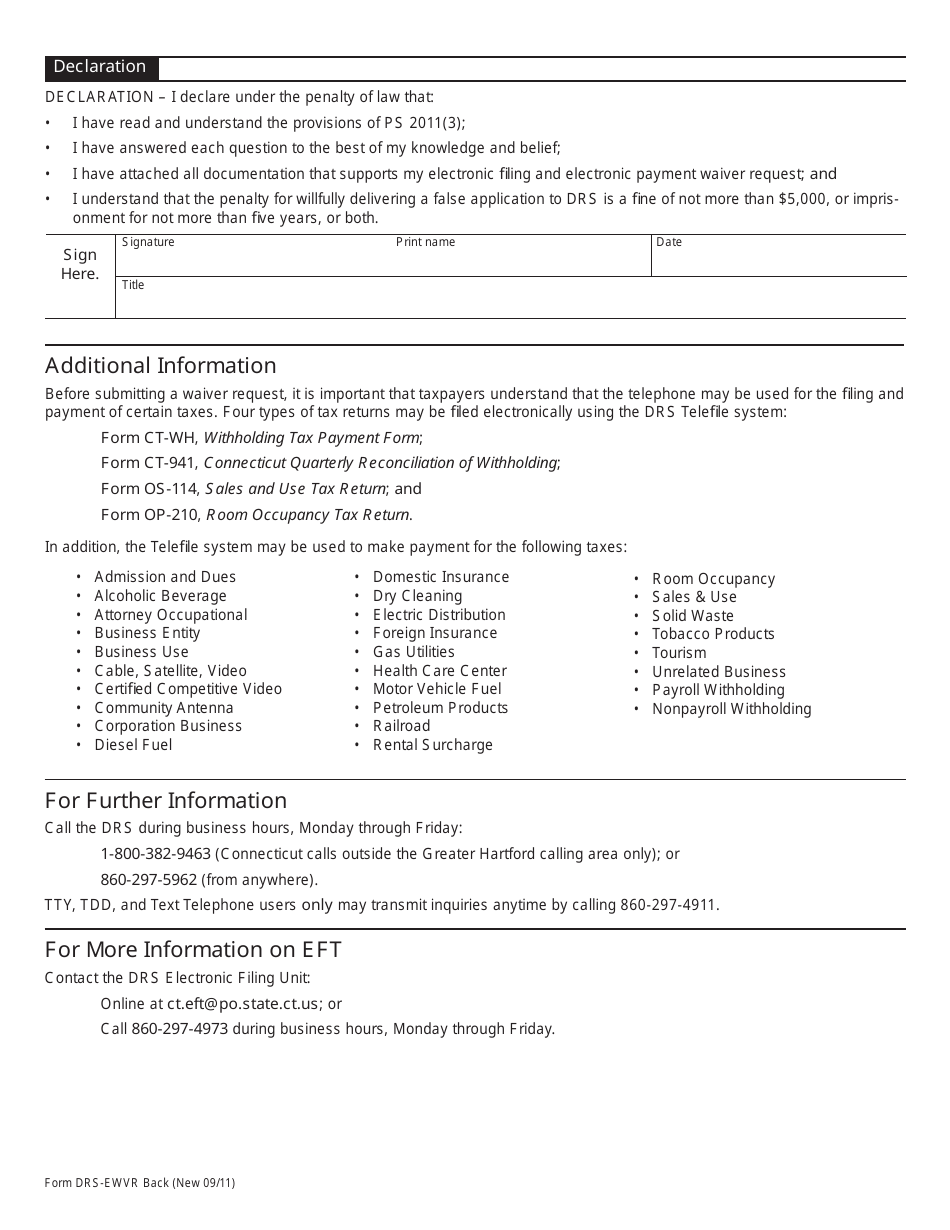

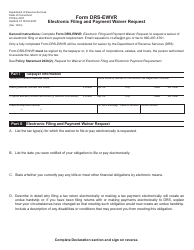

Form DRS-EWVR

for the current year.

Form DRS-EWVR Electronic Filing and Payment Waiver Request - Connecticut

What Is Form DRS-EWVR?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form DRS-EWVR?

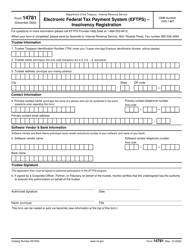

A: The Form DRS-EWVR is an Electronic Filing and Payment Waiver Request.

Q: What is the purpose of the Form DRS-EWVR?

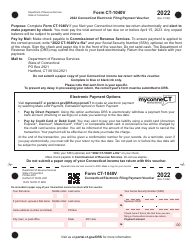

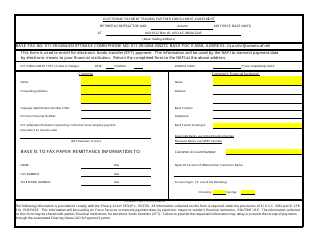

A: The purpose of the Form DRS-EWVR is to request a waiver from the electronic filing and payment requirements for certain Connecticut tax forms.

Q: Who should use the Form DRS-EWVR?

A: Taxpayers who are unable to file and pay their taxes electronically may use the Form DRS-EWVR to request a waiver from the electronic filing and payment requirements.

Q: What type of taxes can be included in the Form DRS-EWVR?

A: The Form DRS-EWVR can be used for various taxes, including income tax, business tax, sales and use tax, and more.

Q: Is there a deadline for submitting the Form DRS-EWVR?

A: Yes, there is a deadline for submitting the Form DRS-EWVR. It must be filed on or before the due date of the tax return or payment.

Q: Is there a fee for using the Form DRS-EWVR?

A: No, there is no fee for using the Form DRS-EWVR.

Q: How long does it take for a waiver request to be processed?

A: The processing time for a waiver request varies, but it typically takes a few weeks.

Q: Can I request a waiver for multiple tax years using one Form DRS-EWVR?

A: No, you need to submit a separate Form DRS-EWVR for each tax year you are requesting a waiver for.

Q: What should I do if my Form DRS-EWVR request is denied?

A: If your Form DRS-EWVR request is denied, you will need to file and pay your taxes electronically as required by the Connecticut Department of Revenue Services (DRS).

Form Details:

- Released on September 1, 2011;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DRS-EWVR by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.