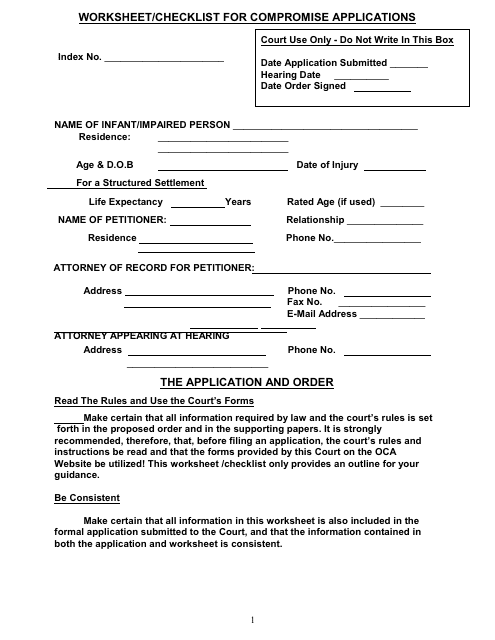

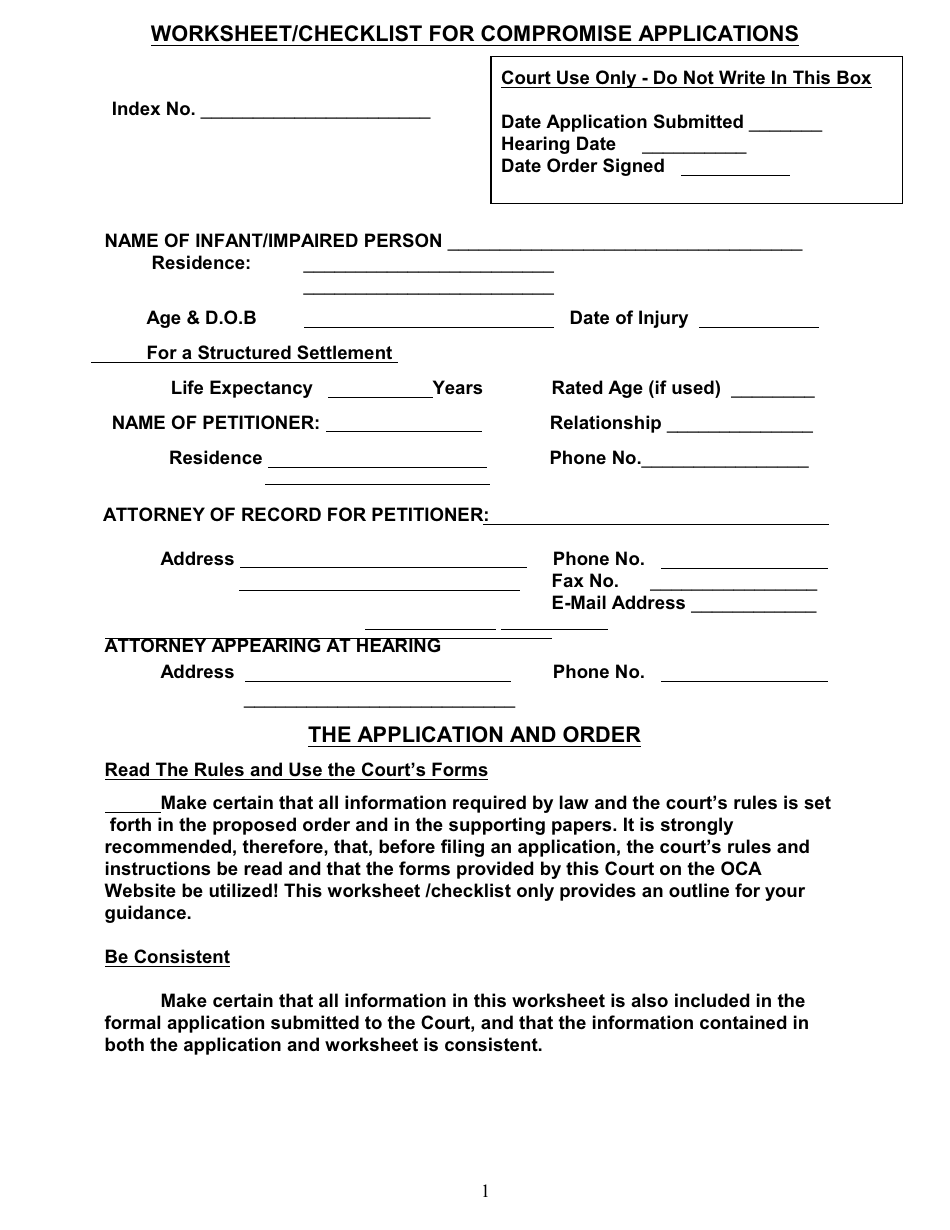

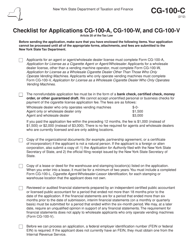

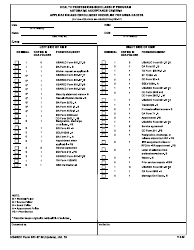

Worksheet / Checklist for Compromise Applications Template - New York

Worksheet/Checklist for Compromise Applications Template is a legal document that was released by the New York State Unified Court System - a government authority operating within New York.

FAQ

Q: What is a compromise application?

A: A compromise application refers to a request made to settle a debt with a creditor for less than the full amount owed.

Q: Why would someone submit a compromise application?

A: Someone may submit a compromise application to resolve their debt if they are unable to pay the full amount owed and want to negotiate a lower settlement.

Q: Who can submit a compromise application?

A: Anyone who owes a debt to a creditor and is unable to pay the full amount can submit a compromise application.

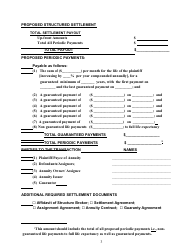

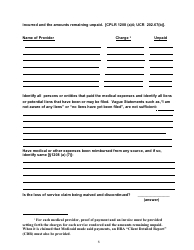

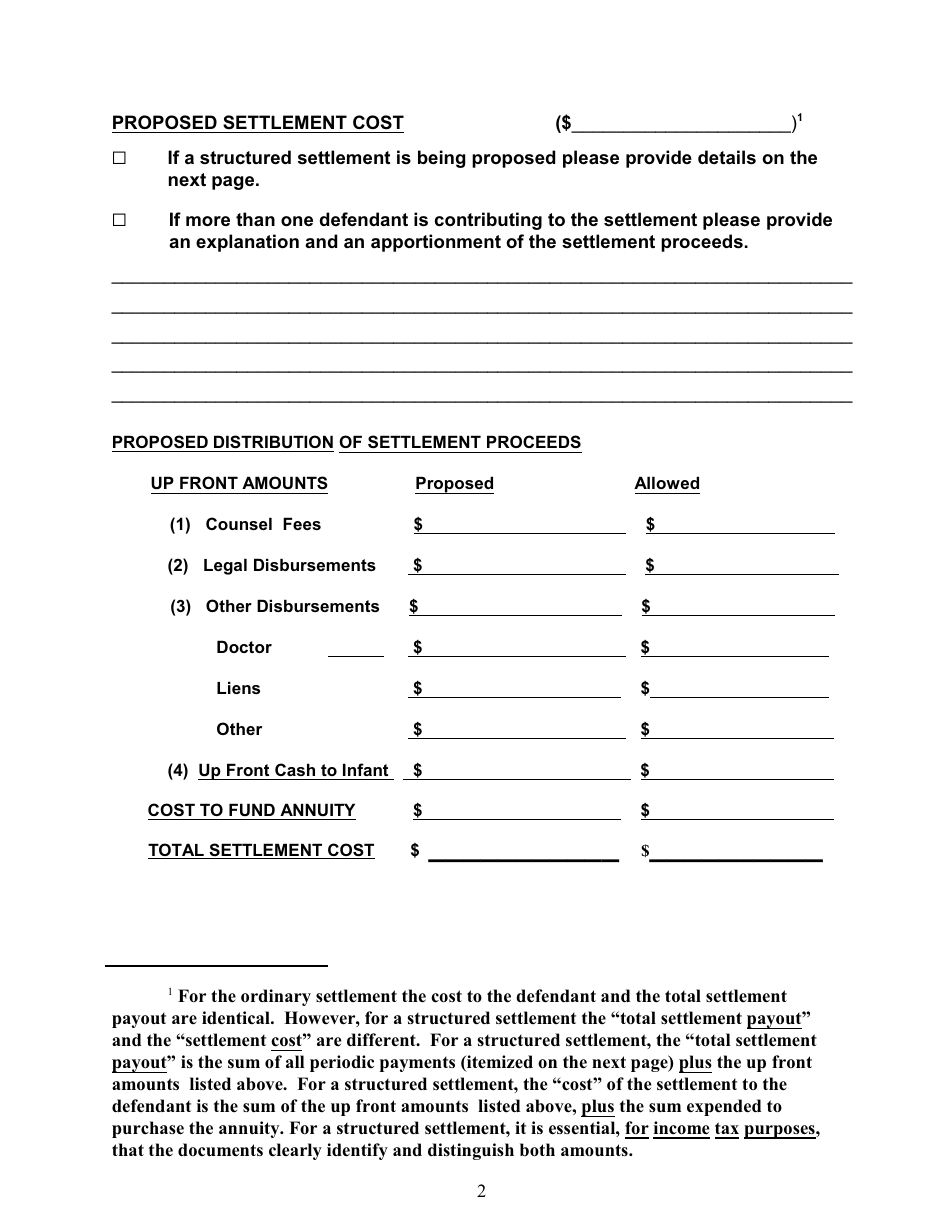

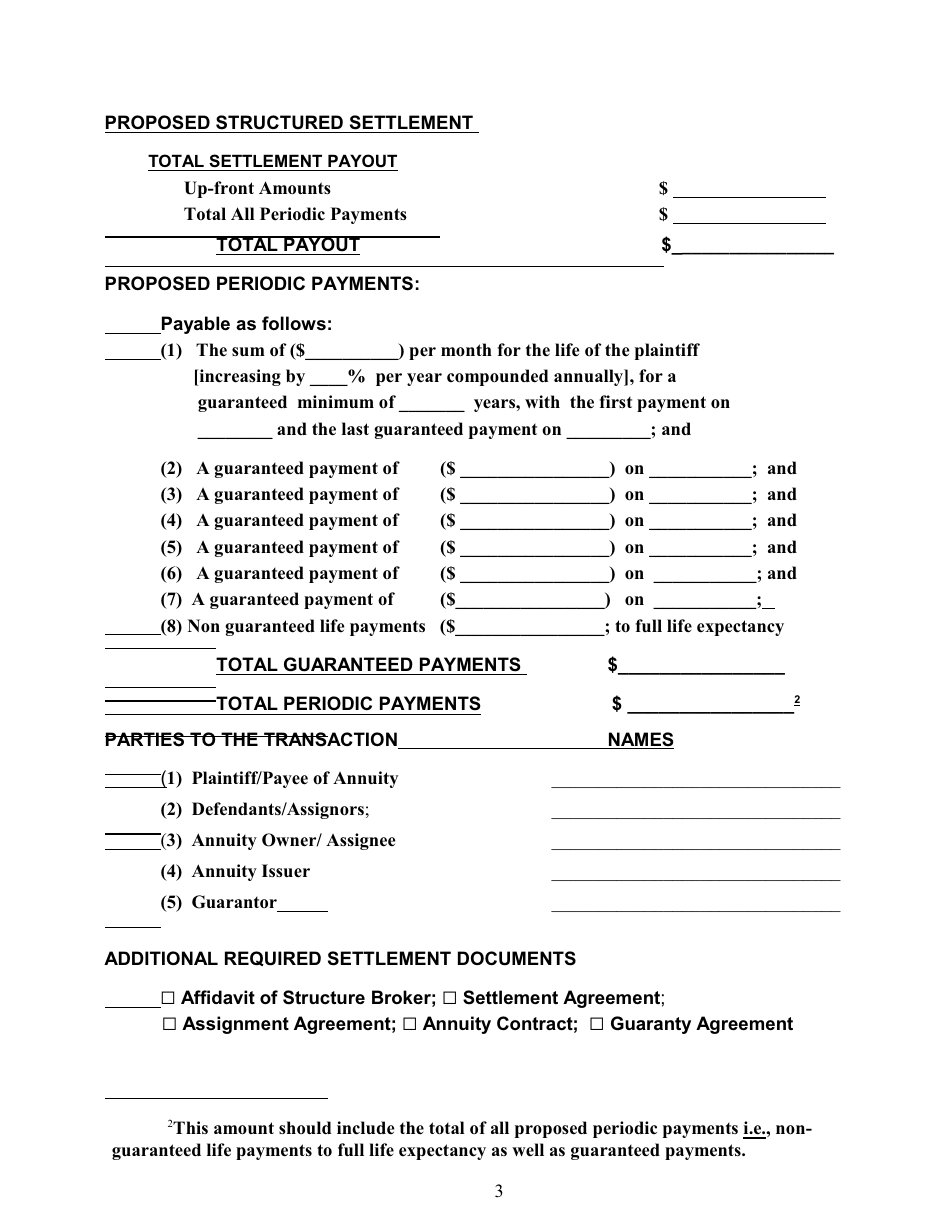

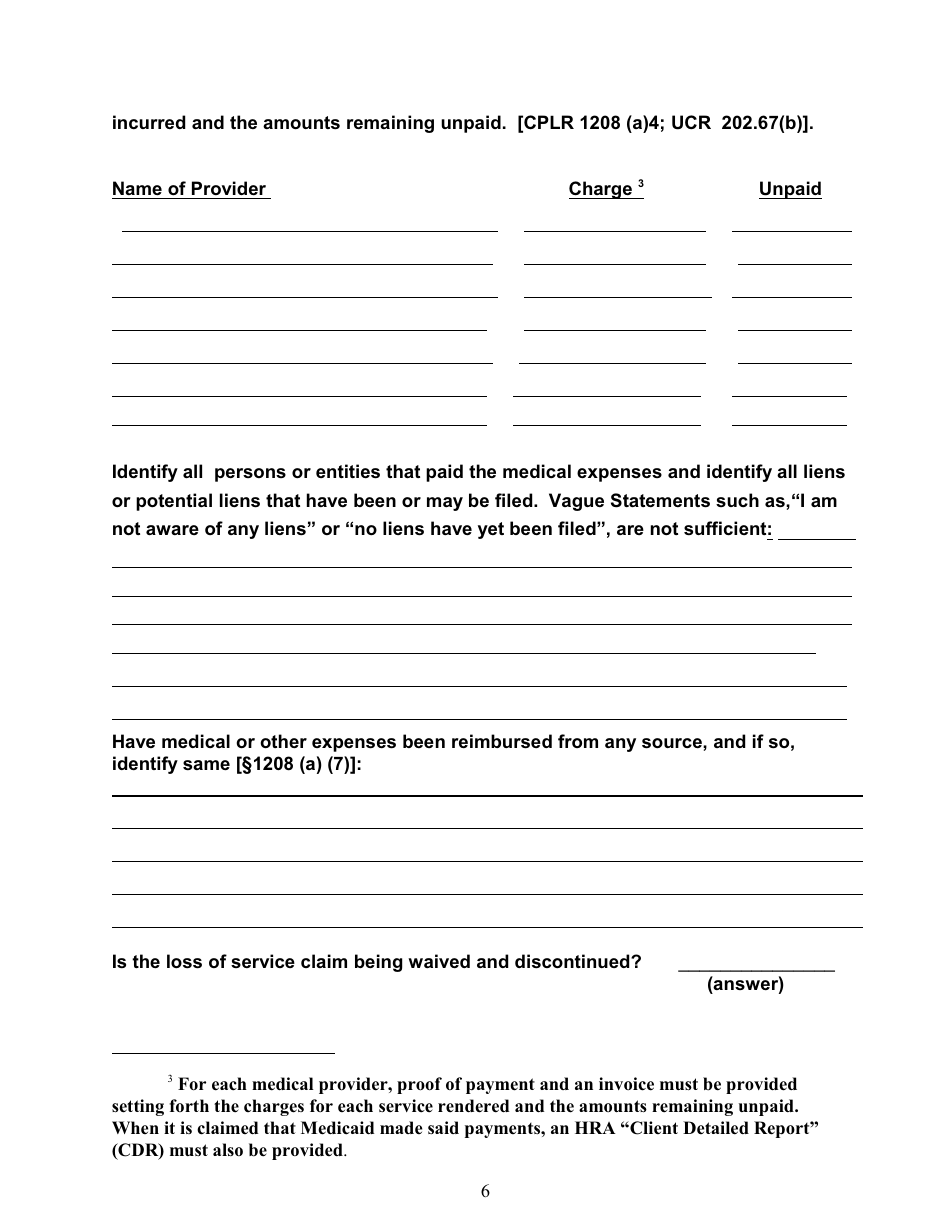

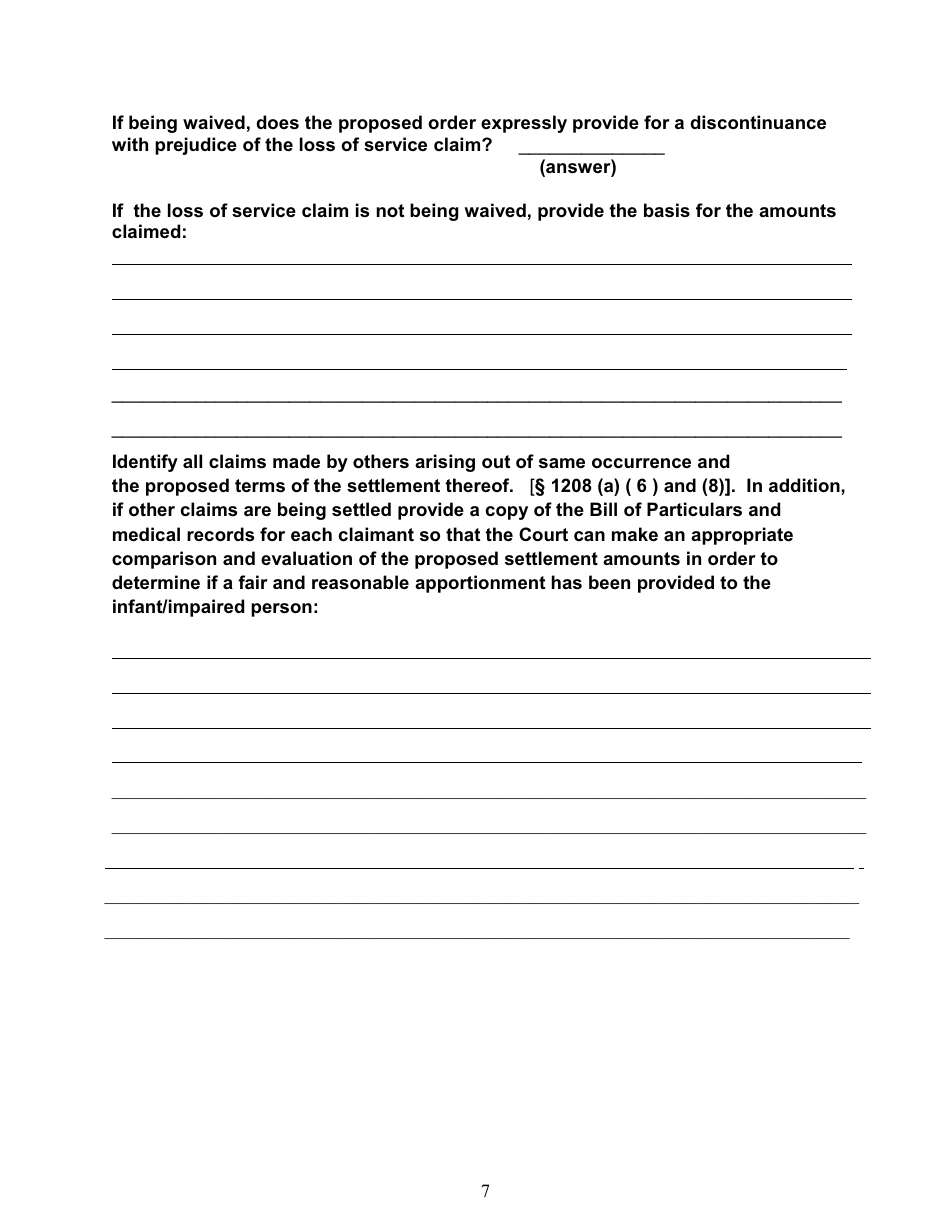

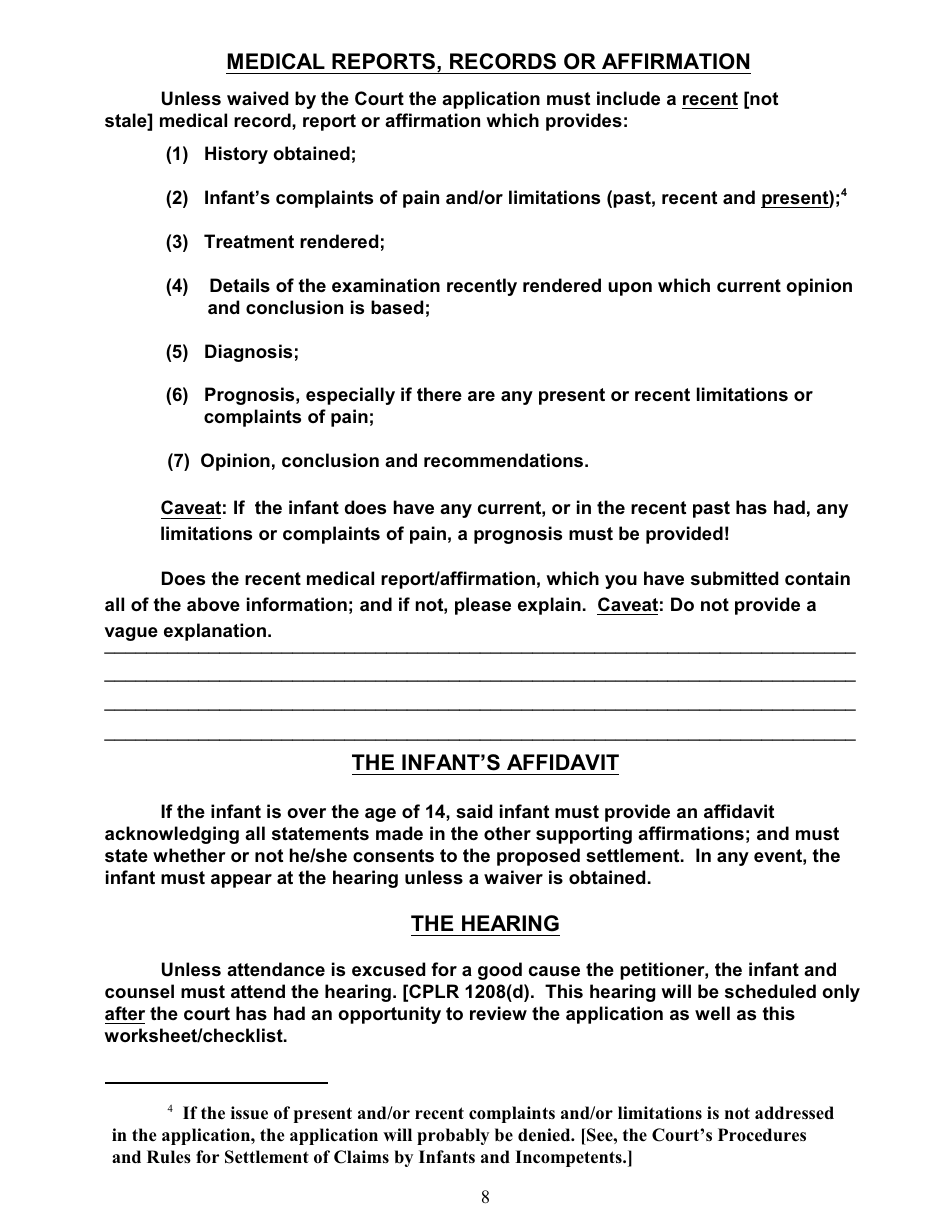

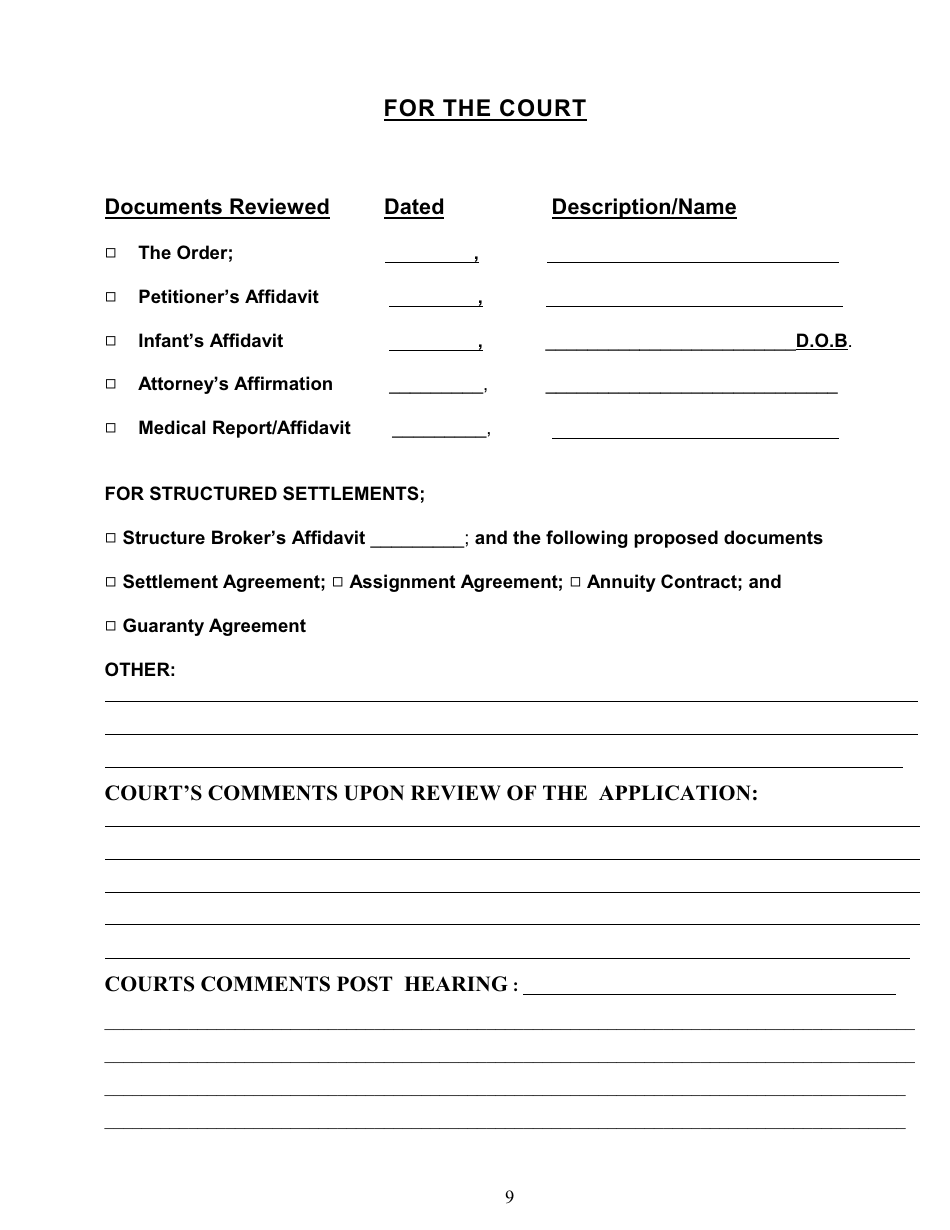

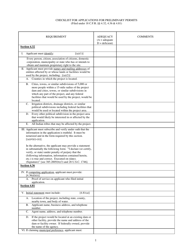

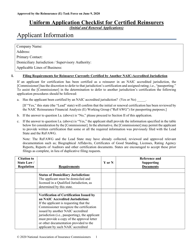

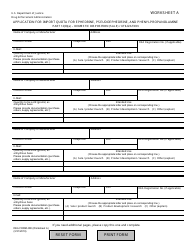

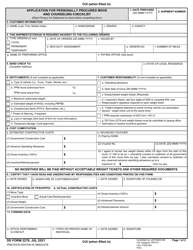

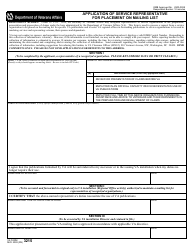

Q: What is included in a compromise application?

A: A compromise application typically includes information about the debtor, details of the debt, reasons for seeking a compromise, and a proposed settlement amount.

Q: Is there a fee to submit a compromise application?

A: Yes, there is usually a fee associated with submitting a compromise application, which varies depending on the jurisdiction and specific circumstances.

Q: How long does it take for a compromise application to be reviewed?

A: The time it takes for a compromise application to be reviewed can vary, but it may take several weeks to several months for a decision to be made.

Q: What happens if a compromise application is approved?

A: If a compromise application is approved, the debtor and creditor agree on a reduced settlement amount, and the debtor is typically required to make payment in a lump sum or installments.

Q: What happens if a compromise application is denied?

A: If a compromise application is denied, the debtor is still obligated to pay the full amount owed, and other options such as negotiating a different repayment plan or seeking legal advice should be considered.

Q: Are compromise applications legally binding?

A: Yes, if a compromise application is approved and the parties agree on a settlement, it becomes a legally binding agreement.

Q: Can a compromise application affect a person's credit score?

A: Yes, a compromise application can potentially have a negative impact on a person's credit score as it indicates a failure to repay the debt in full.

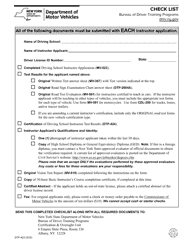

Form Details:

- The latest edition currently provided by the New York State Unified Court System;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the New York State Unified Court System.