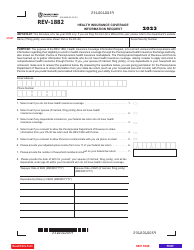

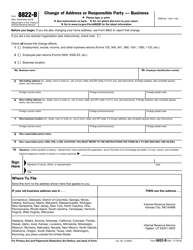

This version of the form is not currently in use and is provided for reference only. Download this version of

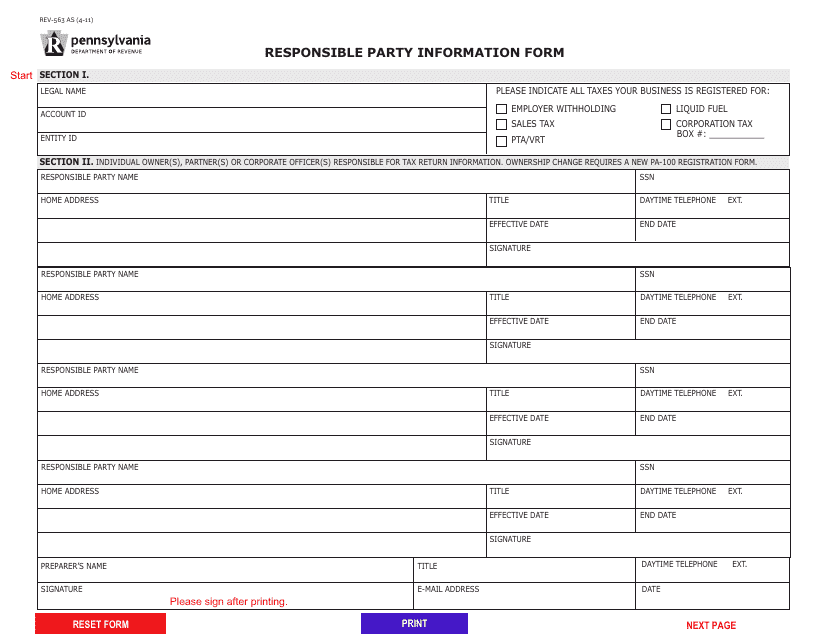

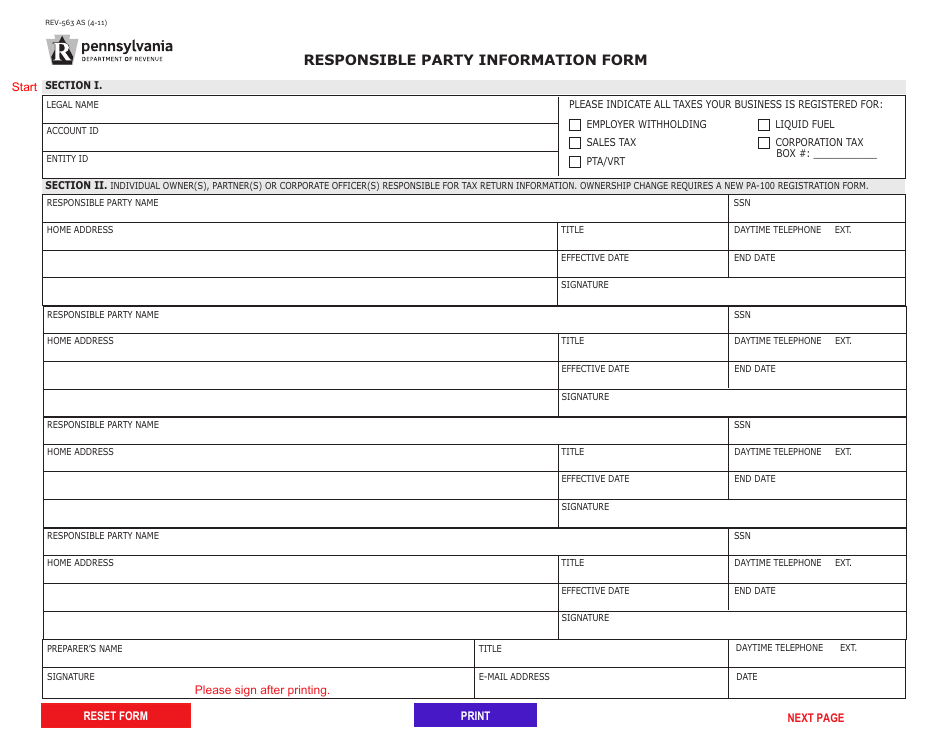

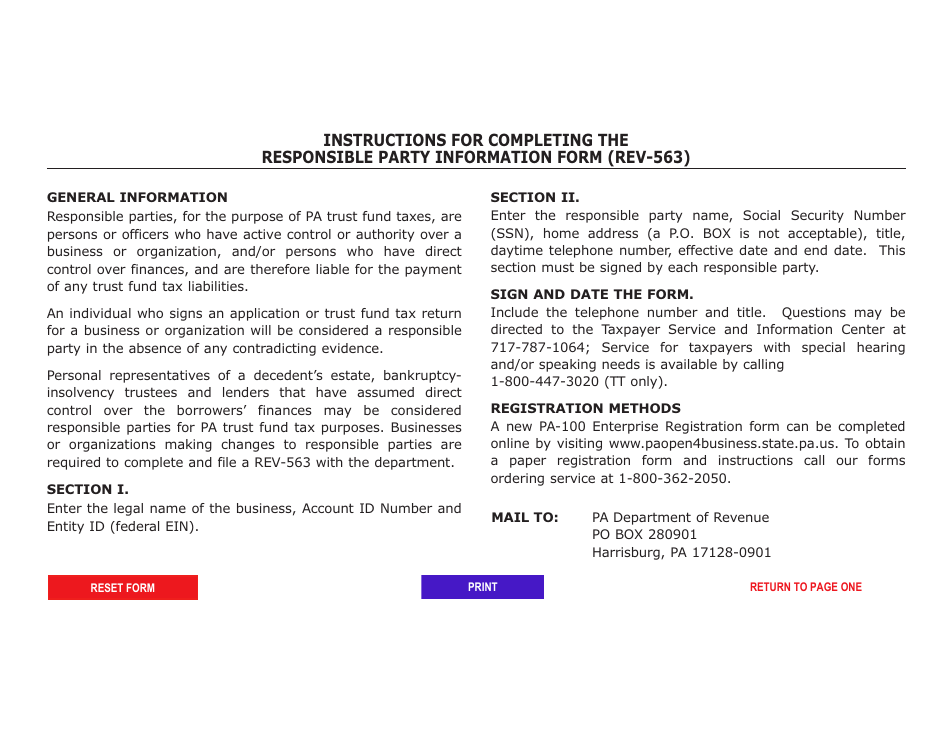

Form REV-563

for the current year.

Form REV-563 Responsible Party Information Form - Pennsylvania

What Is Form REV-563?

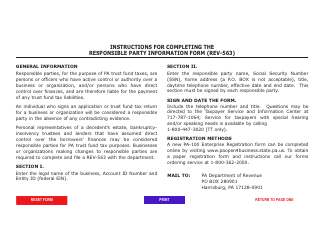

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

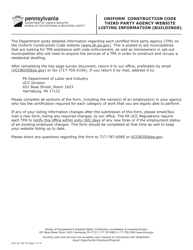

Q: What is Form REV-563?

A: Form REV-563 is the Responsible Party Information Form in Pennsylvania.

Q: What is the purpose of Form REV-563?

A: The purpose of Form REV-563 is to provide information about the responsible party for certain entities in Pennsylvania.

Q: Who needs to fill out Form REV-563?

A: Certain entities in Pennsylvania are required to fill out Form REV-563 to provide information about their responsible party.

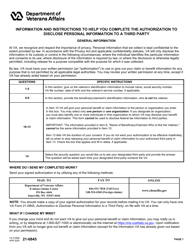

Q: What information is required on Form REV-563?

A: Form REV-563 requires information about the responsible party's name, title, address, phone number, social security number, and relationship to the entity.

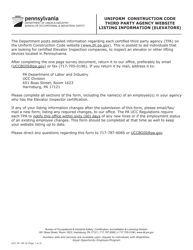

Q: Is Form REV-563 mandatory?

A: Yes, Form REV-563 is mandatory for certain entities in Pennsylvania.

Q: Are there any penalties for not filing Form REV-563?

A: Yes, there are penalties for not filing Form REV-563, including potential revocation of the entity's corporate charters or non-profit status.

Q: Can Form REV-563 be filed electronically?

A: No, Form REV-563 must be filed by mail or in person.

Q: What should I do if there are changes to the responsible party information after filing Form REV-563?

A: If there are changes to the responsible party information after filing Form REV-563, a new form should be filed with the updated information.

Form Details:

- Released on April 1, 2011;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-563 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.