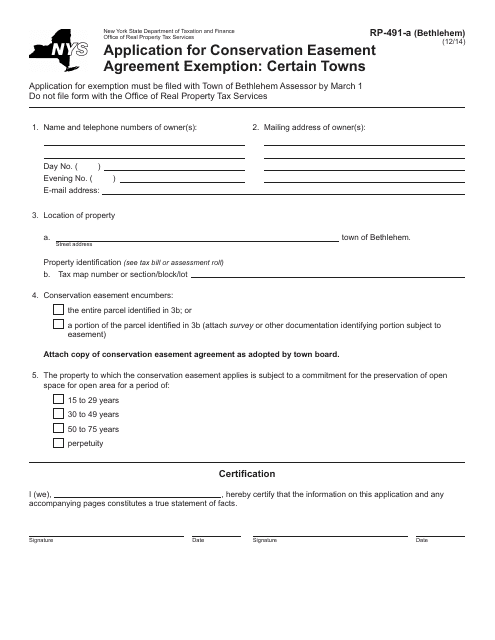

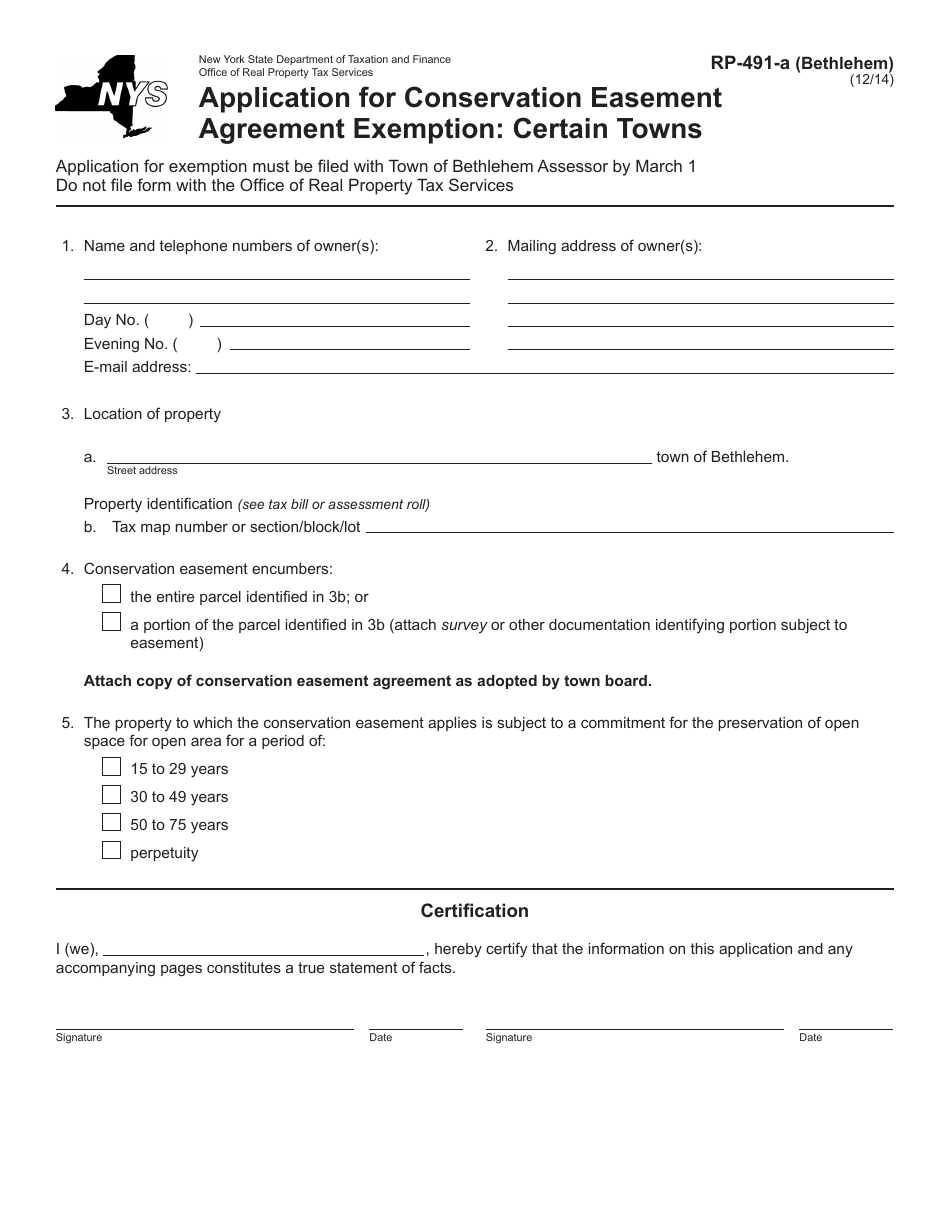

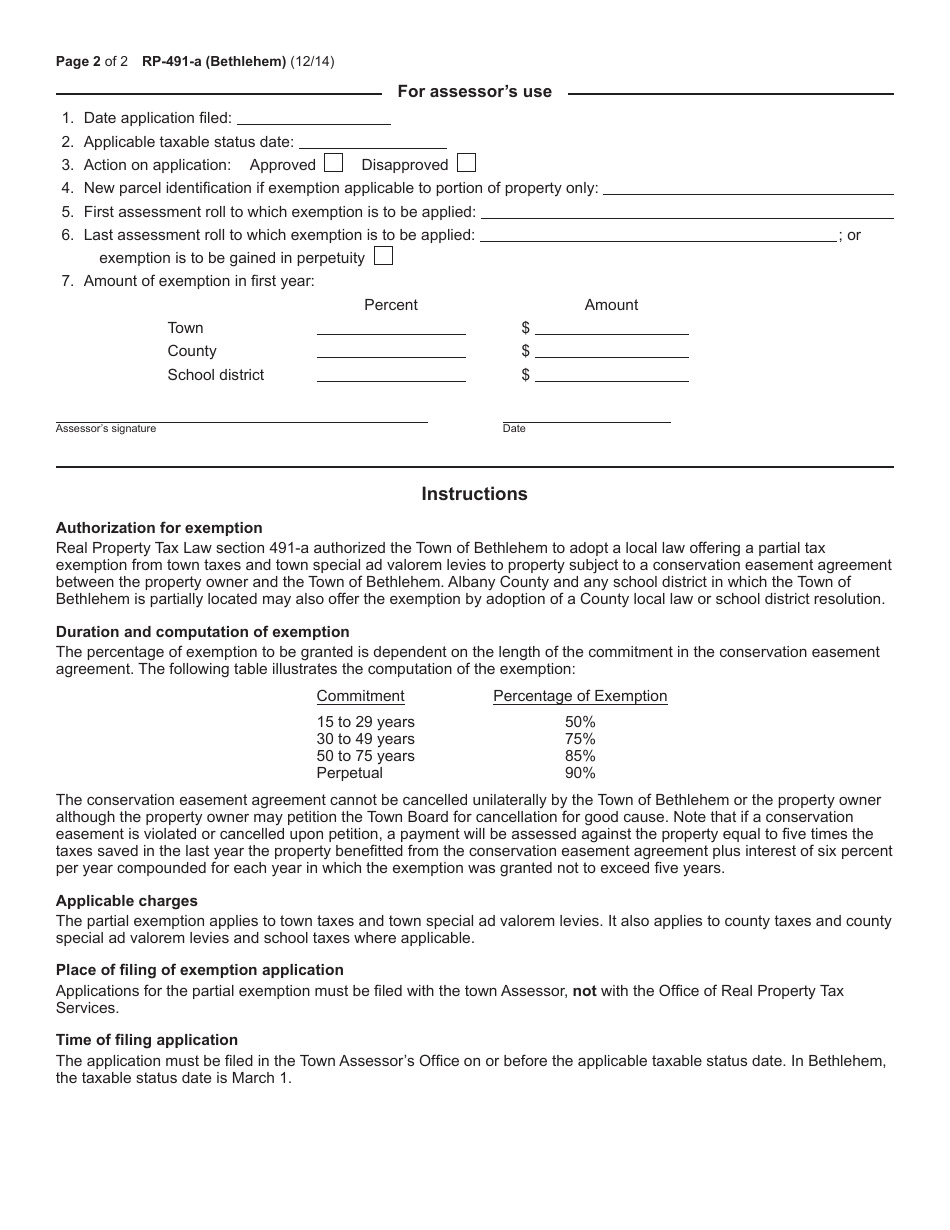

Form RP-491-A (BETHLEHEM) Application for Conservation Easement Agreement Exemption: Certain Towns - New York

What Is Form RP-491-A (BETHLEHEM)?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RP-491-A?

A: Form RP-491-A is an application for Conservation Easement Agreement Exemption in certain towns in New York.

Q: What is a Conservation Easement Agreement?

A: A Conservation Easement Agreement is a legal agreement between a property owner and a government or non-profit organization to protect and preserve the natural resources or historical significance of the property.

Q: Who needs to file Form RP-491-A?

A: Property owners in certain towns in New York who want to apply for an exemption from property taxes for their conservation easement agreement.

Q: Which towns in New York are eligible for this exemption?

A: The specific towns eligible for this exemption are listed on the form. Generally, they are towns located near the Bethlehem area.

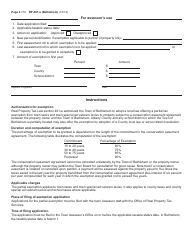

Q: How does the exemption work?

A: If approved, the property owner will be exempt from paying property taxes on the value of the conservation easement.

Q: Are there any deadlines for filing this form?

A: The specific deadlines for filing Form RP-491-A vary depending on the town and year. It is important to check with the local tax assessor's office for the correct deadline.

Q: Is there a fee for filing this form?

A: There is no fee for filing Form RP-491-A.

Q: Who can I contact for more information?

A: For more information and assistance with Form RP-491-A, you can contact the local tax assessor's office or the New York State Department of Taxation and Finance.

Form Details:

- Released on December 1, 2014;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-491-A (BETHLEHEM) by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.

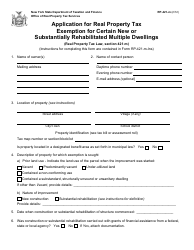

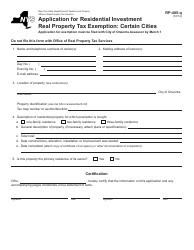

![Document preview: Form RP-491 [ELMA] Application for Conservation Easement Agreement Exemption. Certain Towns - New York](https://data.templateroller.com/pdf_docs_html/1733/17339/1733932/form-rp-491-elma-application-conservation-easement-agreement-exemption-certain-towns-new-york.png)

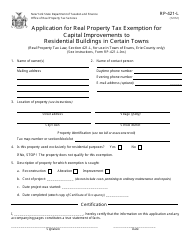

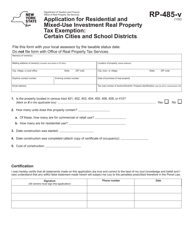

![Document preview: Form RP-485-I [ROME] Application for Residential Investment Real Property Tax Exemption; Certain Cities - New York](https://data.templateroller.com/pdf_docs_html/1733/17334/1733439/form-rp-485-i-rome-application-residential-investment-real-property-tax-exemption-certain-cities-new-york.png)

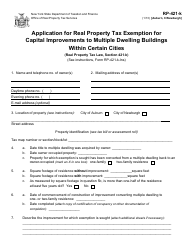

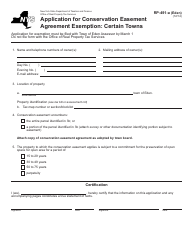

![Document preview: Form RP-485-M [ROME SD] Application for Residential Investment Real Property Tax Exemption; Certain School Districts - New York](https://data.templateroller.com/pdf_docs_html/1733/17339/1733929/form-rp-485-m-rome-sd-application-residential-investment-real-property-tax-exemption-certain-school-districts-new-york.png)

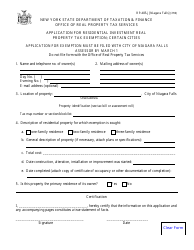

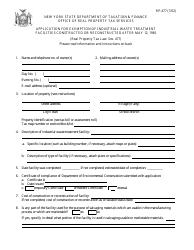

![Document preview: Form RP-485-K [UTICA SD] Application for Residential Investment Real Property Tax Exemption; Certain School Districts - City of Utica, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349829/form-rp-485-k-utica-sd-application-for-residential-investment-real-property-tax-exemption-certain-school-districts-city-of-utica-new-york.png)

![Document preview: Form RP-491 [ORCHARD PARK] Application for Conservation Easement Agreement Exemption. Certain Towns - New York](https://data.templateroller.com/pdf_docs_html/1733/17339/1733934/form-rp-491-orchard-park-application-conservation-easement-agreement-exemption-certain-towns-new-york.png)

![Document preview: Form RP-485-I [JAMESTOWN SD] Application for Residential Investment Real Property Tax Exemption; Certain School Districts - New York](https://data.templateroller.com/pdf_docs_html/578/5786/578655/form-rp-485-i-jamestown-sd-application-residential-investment-real-property-tax-exemption-certain-school-districts-new-york.png)