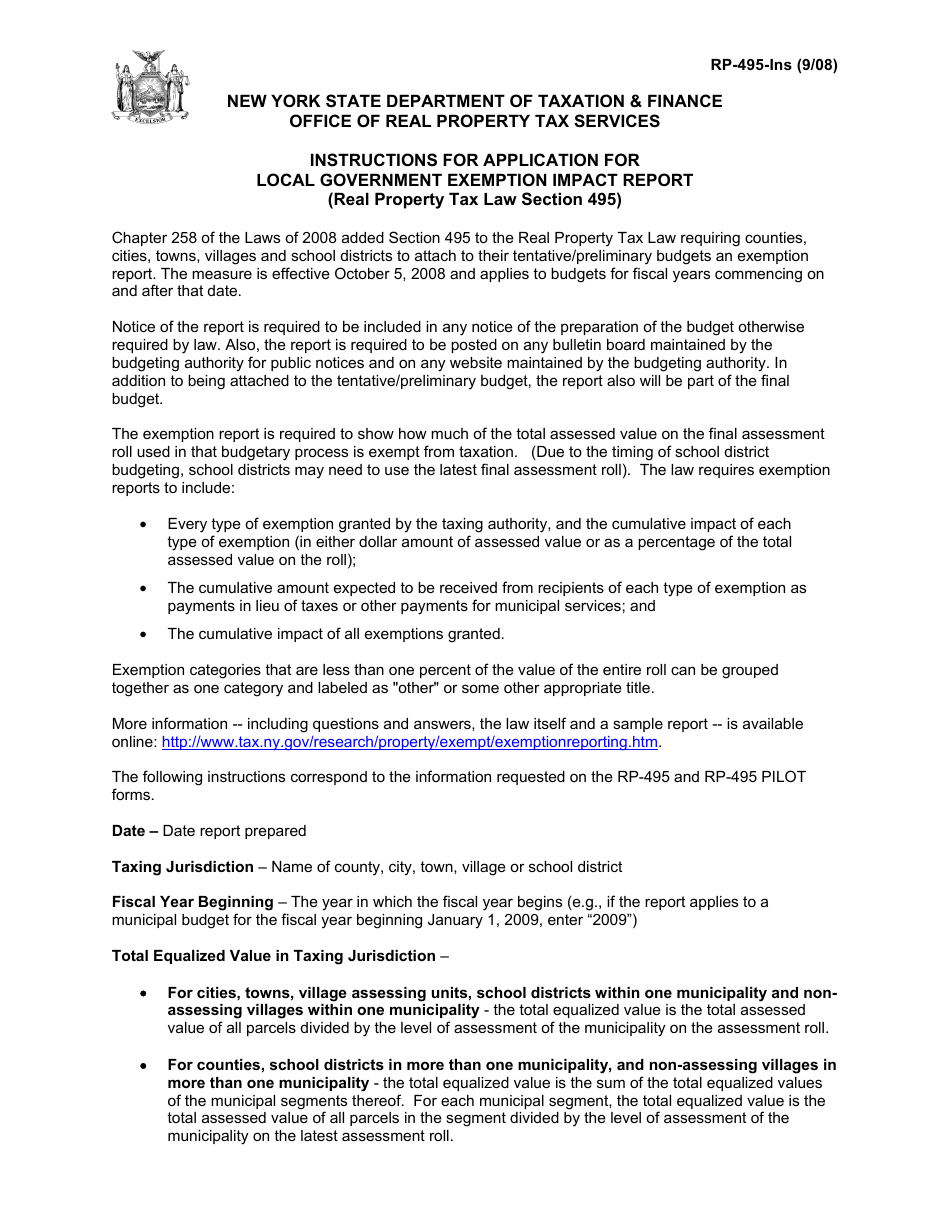

Instructions for Form RP-495 Application for Local Government Exemption Impact Report - New York

This document contains official instructions for Form RP-495 , Application for Local Government Exemption Impact Report - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form RP-495 is available for download through this link.

FAQ

Q: What is Form RP-495?

A: Form RP-495 is the application for the Local Government Exemption Impact Report in New York.

Q: What is the purpose of Form RP-495?

A: The purpose of Form RP-495 is to apply for an exemption from local governmentreporting requirements in New York.

Q: Who is eligible to use Form RP-495?

A: Tax-exempt organizations and government entities in New York are eligible to use Form RP-495.

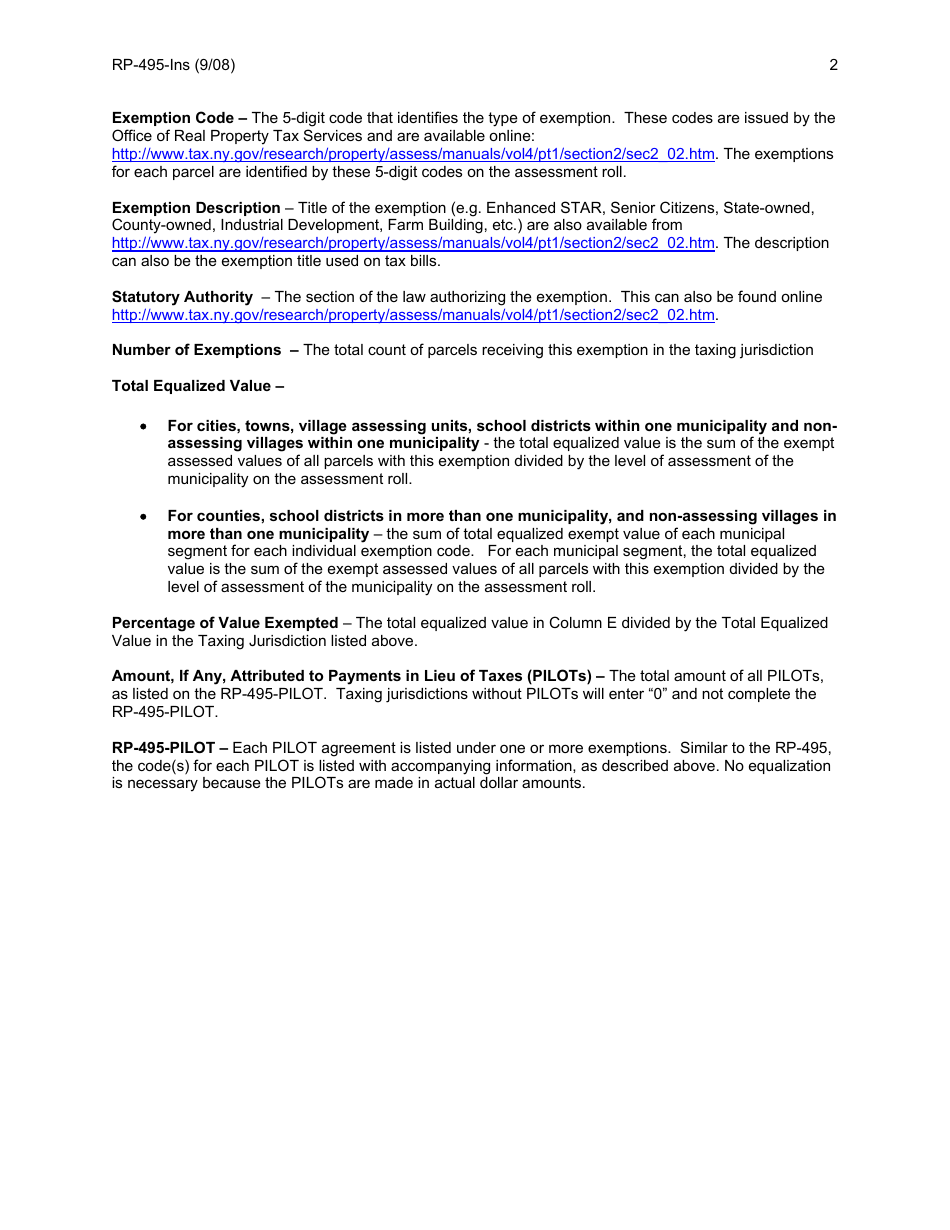

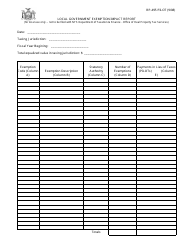

Q: What information is required on Form RP-495?

A: Form RP-495 requires information such as the organization's name, address, and employer identification number (EIN), as well as details about the exemption requested.

Q: Are there any filing fees for Form RP-495?

A: No, there are no filing fees for Form RP-495.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.