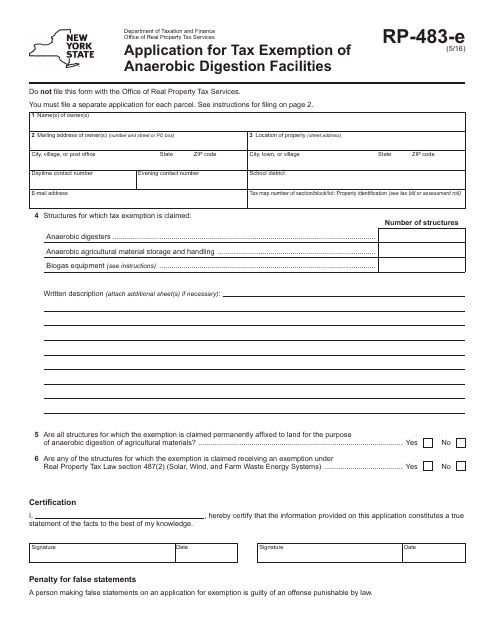

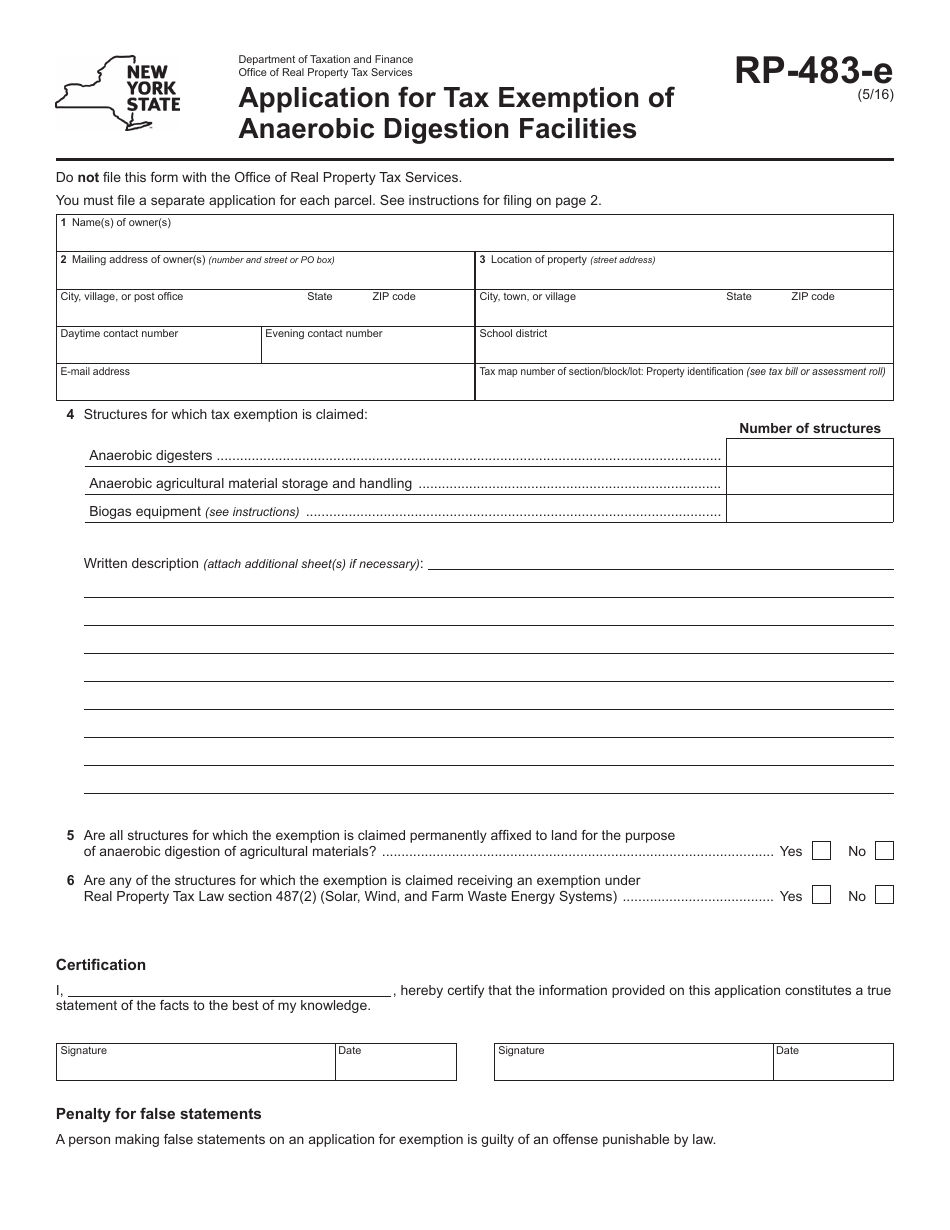

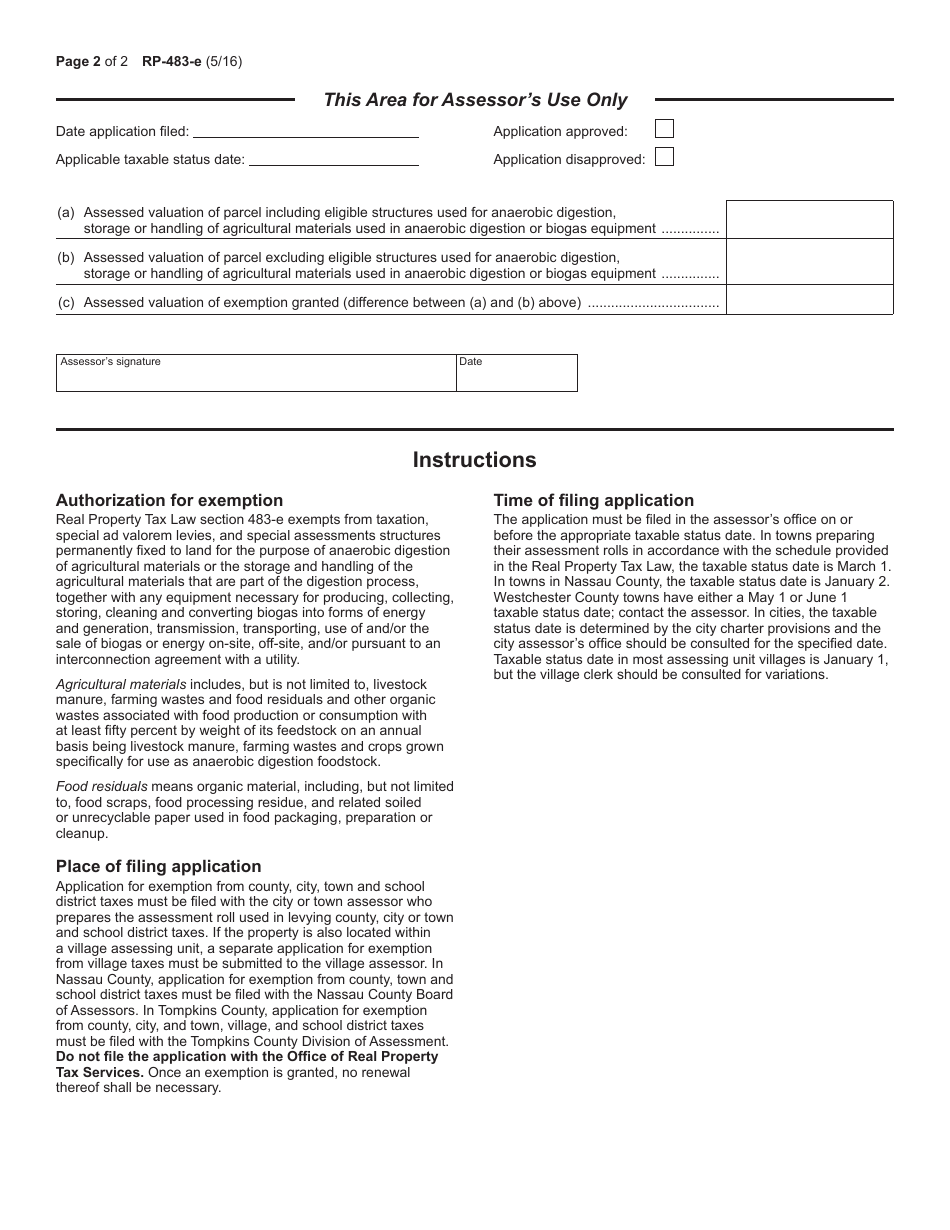

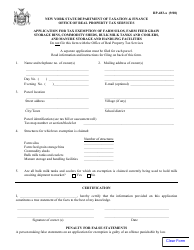

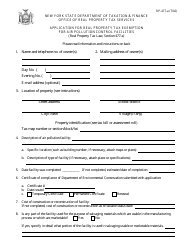

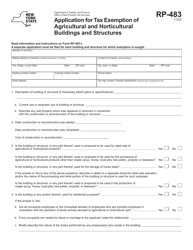

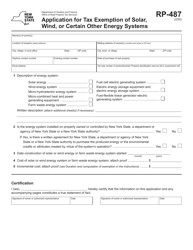

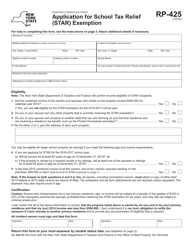

Form RP-483-E Application for Tax Exemption of Anaerobic Digestion Facilities - New York

What Is Form RP-483-E?

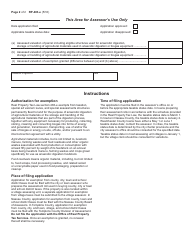

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RP-483-E?

A: Form RP-483-E is the Application for Tax Exemption of Anaerobic Digestion Facilities in New York.

Q: What is the purpose of Form RP-483-E?

A: The purpose of Form RP-483-E is to apply for tax exemption for anaerobic digestion facilities in New York.

Q: Who needs to fill out Form RP-483-E?

A: Owners or operators of anaerobic digestion facilities in New York who want to apply for tax exemption need to fill out Form RP-483-E.

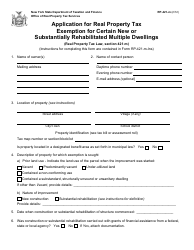

Q: Is Form RP-483-E specific to a certain region?

A: Yes, Form RP-483-E is specific to New York.

Q: Is there a fee to file Form RP-483-E?

A: There is no fee to file Form RP-483-E.

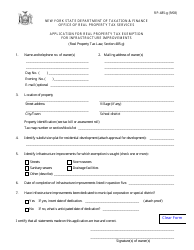

Q: What supporting documentation is required with Form RP-483-E?

A: Supporting documentation such as project plans, financial information, and any other relevant information will need to be submitted with Form RP-483-E.

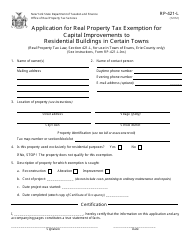

Q: Is there a deadline to submit Form RP-483-E?

A: Form RP-483-E should be submitted at least 60 days before the anaerobic digestion facility is expected to begin operations.

Q: Who can I contact for more information about Form RP-483-E?

A: For more information about Form RP-483-E, you can contact the New York State Department of Taxation and Finance.

Form Details:

- Released on May 1, 2016;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-483-E by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.