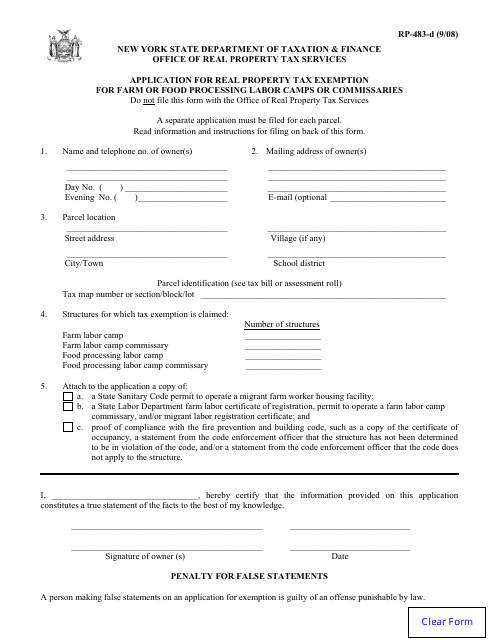

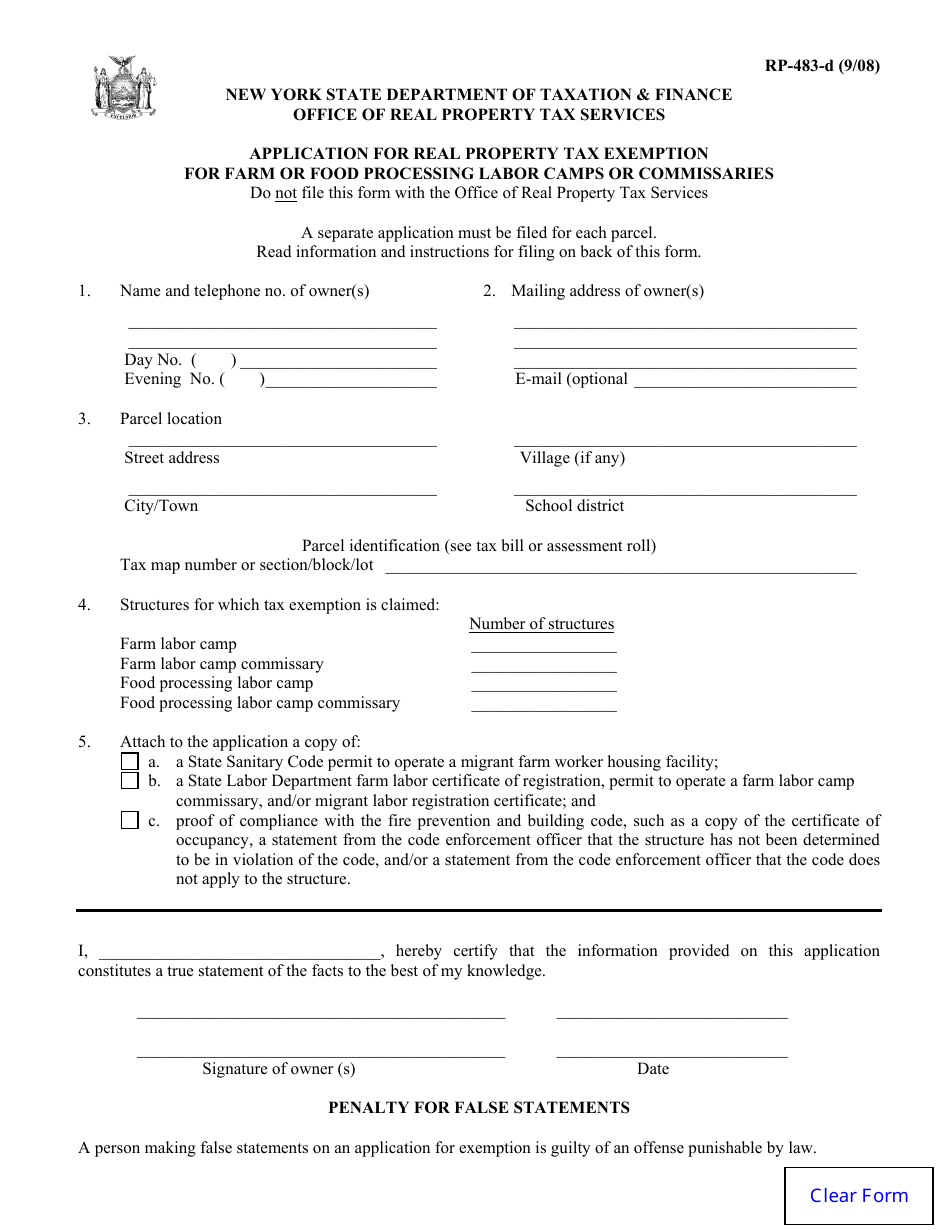

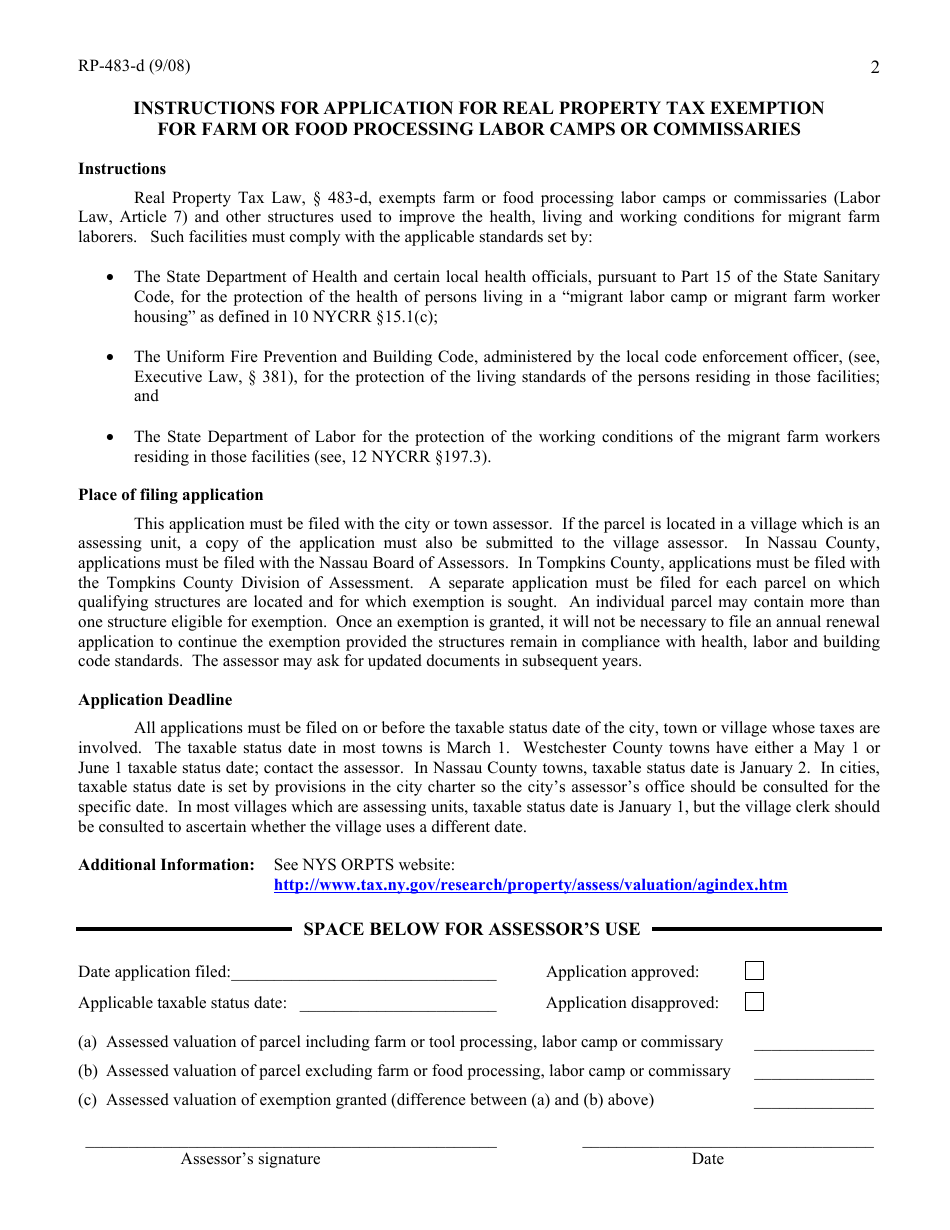

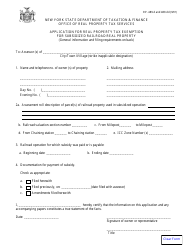

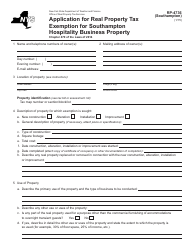

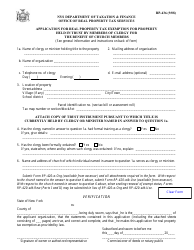

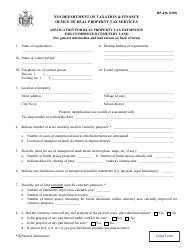

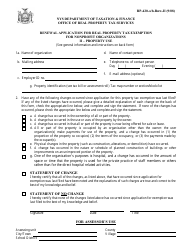

Form RP-483-d Application for Real Property Tax Exemption for Farm or Food Processing Labor Camps or Commissaries - New York

What Is Form RP-483-d?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is RP-483-d?

A: RP-483-d is the application form used in New York to apply for real property tax exemption for farm or food processing labor camps or commissaries.

Q: Who can use RP-483-d?

A: Any individual or organization in New York that operates a farm or food processing labor camp or commissary and meets the eligibility criteria can use RP-483-d.

Q: What is the purpose of the exemption?

A: The purpose of the exemption is to provide tax relief to individuals or organizations that provide housing or related services to farm workers or seasonal agricultural employees.

Q: What information is required in RP-483-d?

A: RP-483-d requires information such as the applicant's name, contact information, property location, and details about the farm or food processing labor camp or commissary.

Q: Is there a deadline for submitting the application?

A: Yes, the application must be filed with the assessor of the municipality where the property is located on or before the taxable status date, which is usually March 1st.

Q: What documents should be included with the application?

A: Along with RP-483-d, you may need to include supporting documents such as ownership proof, site plans, and any other relevant documentation to support your application.

Q: How long does it take to process the application?

A: The processing time may vary, but generally, you can expect a decision on your application within a few months.

Q: Is there any fee associated with the application?

A: There is no fee required to file an application for real property tax exemption for farm or food processing labor camps or commissaries in New York.

Form Details:

- Released on September 1, 2008;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-483-d by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.