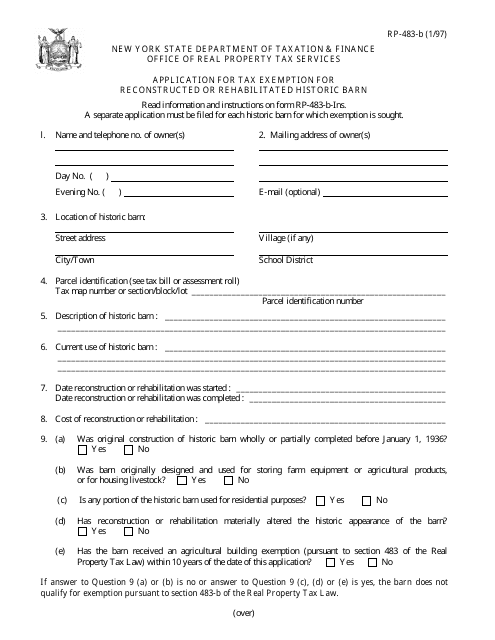

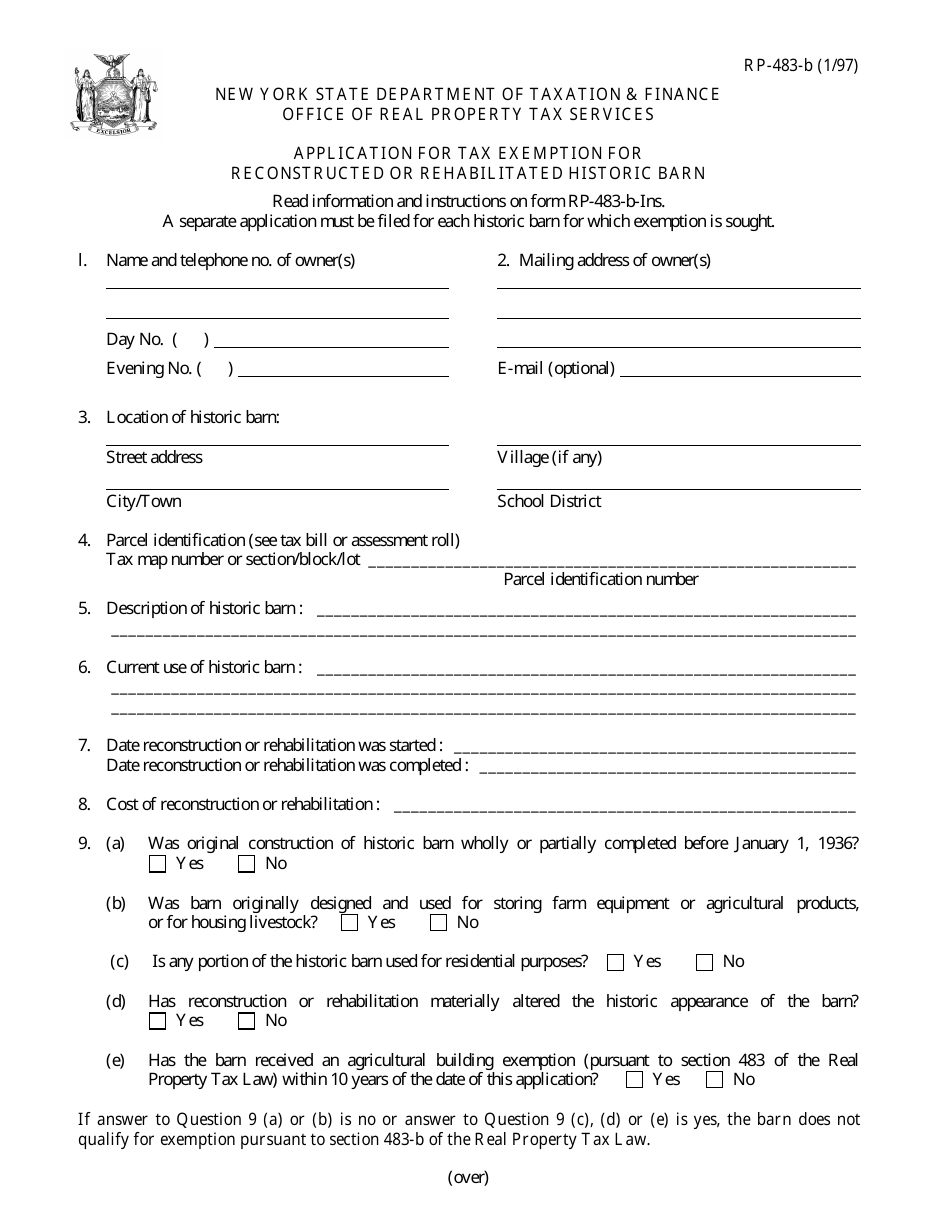

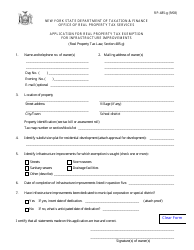

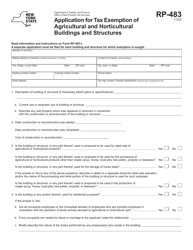

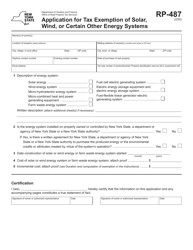

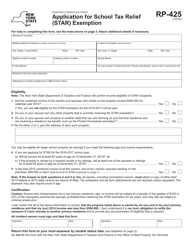

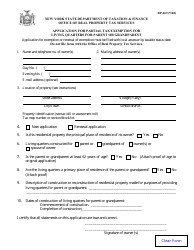

Form RP-483-b Application for Tax Exemption for Reconstructed or Rehabilitated Historic Barn - New York

What Is Form RP-483-b?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form RP-483-b?

A: Form RP-483-b is an application for tax exemption for reconstructed or rehabilitated historic barn in New York.

Q: Who can use Form RP-483-b?

A: Property owners in New York who have reconstructed or rehabilitated a historic barn may use Form RP-483-b.

Q: What is the purpose of Form RP-483-b?

A: The purpose of Form RP-483-b is to apply for tax exemption for reconstructed or rehabilitated historic barns in New York.

Q: What is required to be eligible for tax exemption?

A: To be eligible for tax exemption, the reconstructed or rehabilitated barn must be a certified historic barn and meet other guidelines determined by the local assessing unit.

Q: What supporting documentation is required?

A: The application must be accompanied by a detailed description of the reconstruction or rehabilitation project, photographs of the barn before and after the project, and any other documentation required by the local assessing unit.

Form Details:

- Released on January 1, 1997;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-483-b by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.