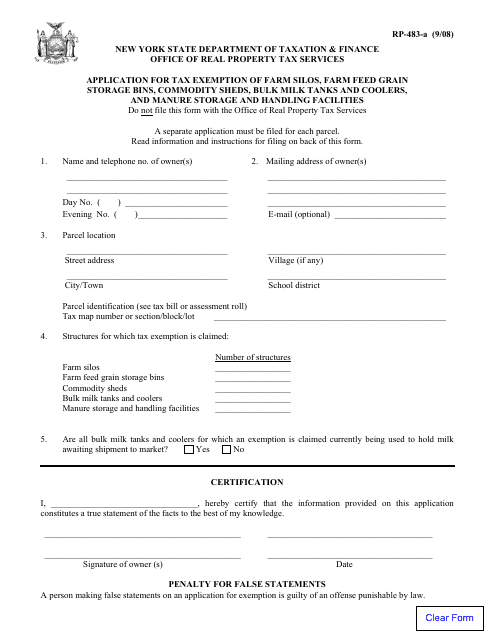

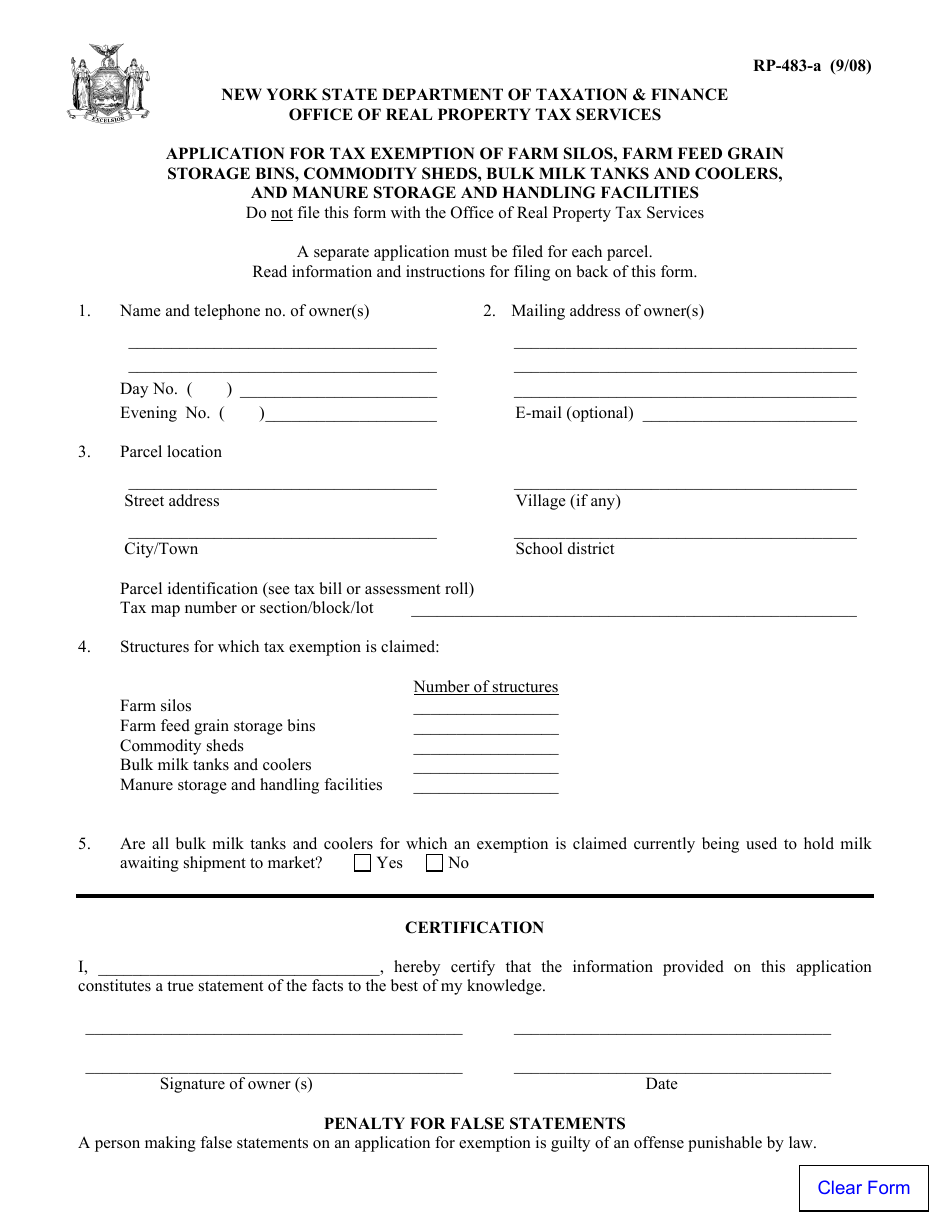

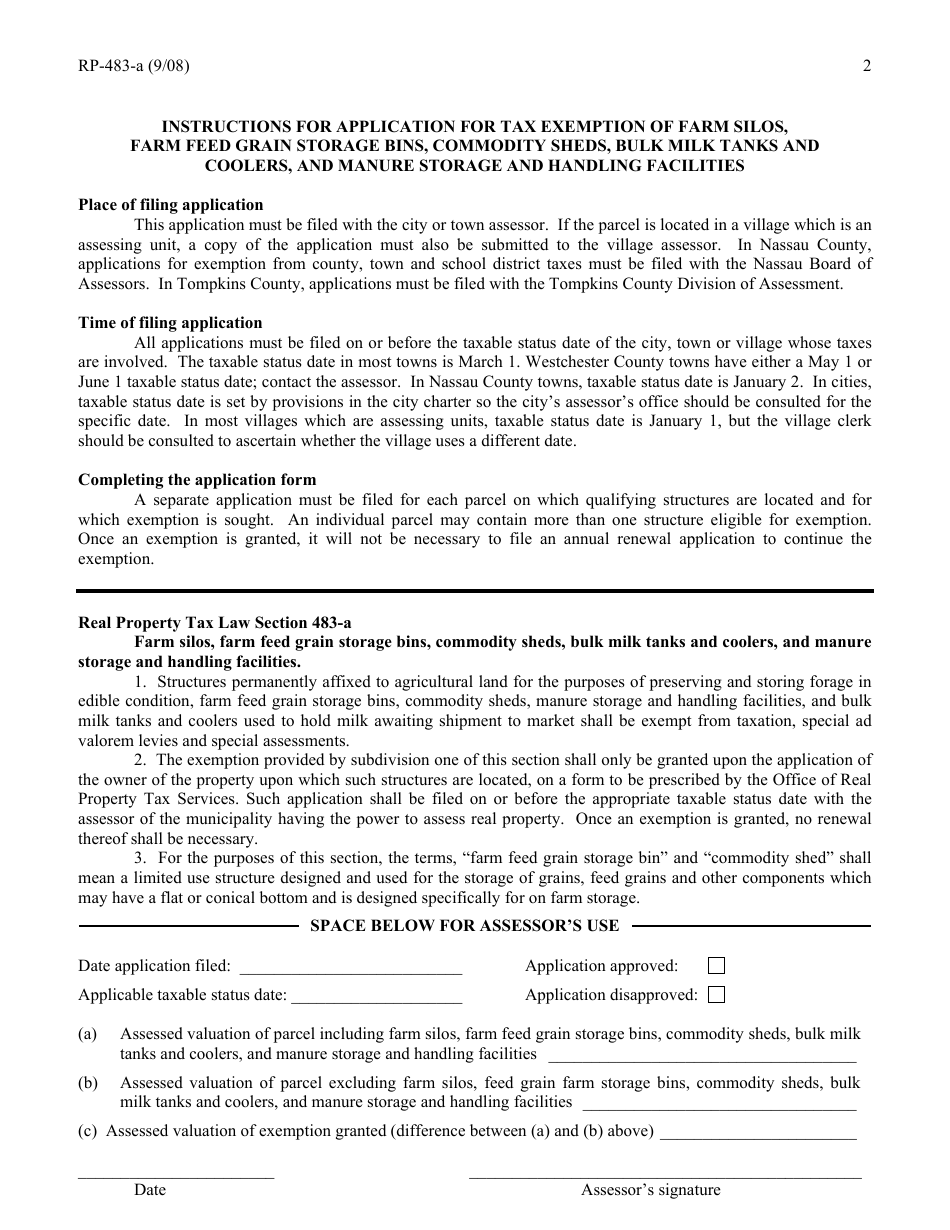

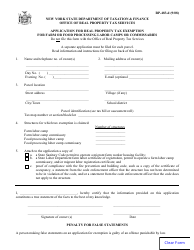

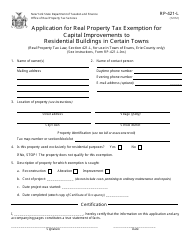

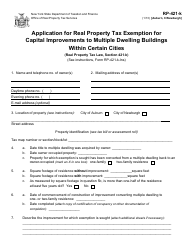

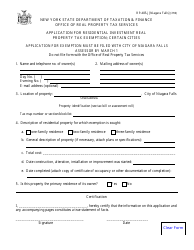

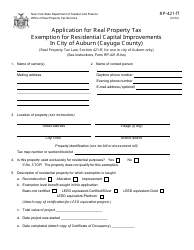

Form RP-483-a Application for Tax Exemption of Farm Silos, Farm Feed Grain Storage Bins Commodity Sheds, Bulk Milk Tanks and Coolers, and Manure Storage and Handling Facilities - New York

What Is Form RP-483-a?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is RP-483-a?

A: RP-483-a is an application for tax exemption of certain farm structures in New York.

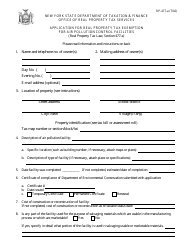

Q: What structures can be exempt from taxes with this application?

A: Farm silos, farm feed grain storage bins, commodity sheds, bulk milk tanks and coolers, and manure storage and handling facilities.

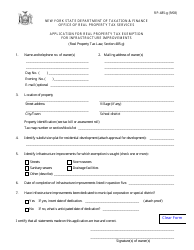

Q: Who can apply for tax exemption with RP-483-a?

A: Farm owners or operators in New York.

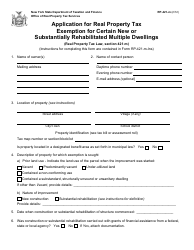

Q: What is the purpose of this tax exemption?

A: The tax exemption is intended to support the agricultural industry by reducing the tax burden on certain farm structures.

Q: Is there a fee for submitting this application?

A: No, there is no fee for submitting RP-483-a.

Q: Is there a deadline for submitting the application?

A: Yes, the application must be submitted by March 1st of the year in which the exemption is sought.

Q: Can the tax exemption be granted retroactively?

A: No, the exemption can only be granted for structures that were completed and put into use after the date of application.

Q: What documents should be submitted along with the application?

A: You should provide support documentation, such as building permits, receipts, and construction contracts, to demonstrate the completion and use of the eligible structures.

Q: Who should I contact for more information about RP-483-a?

A: For more information and assistance with RP-483-a, you can contact the New York State Department of Taxation and Finance.

Form Details:

- Released on September 1, 2008;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-483-a by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.