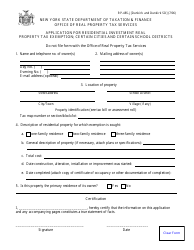

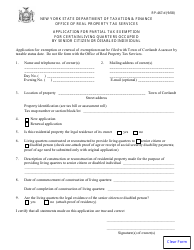

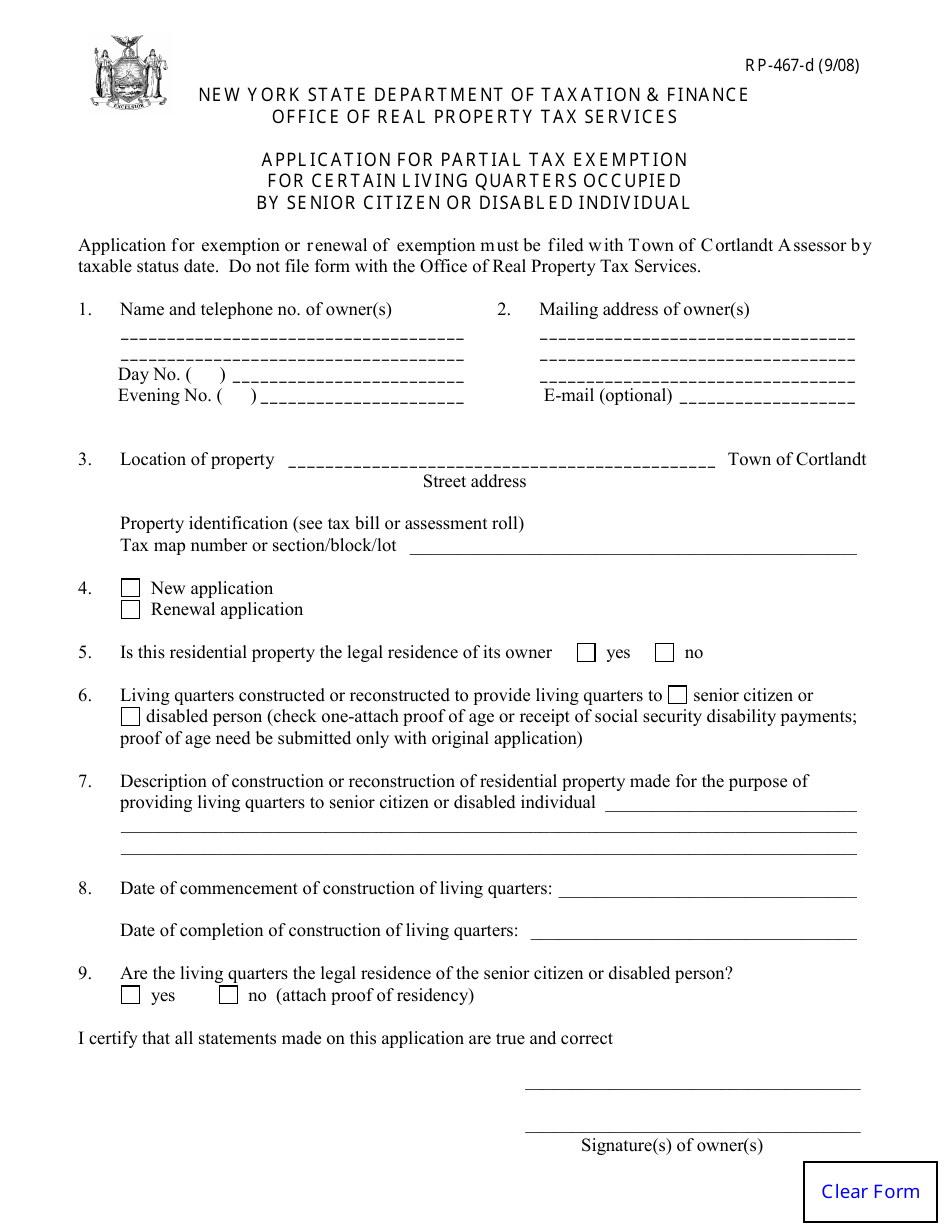

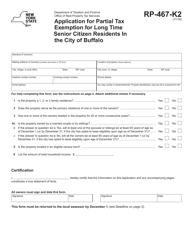

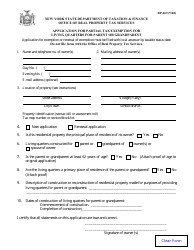

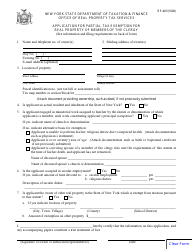

Form RP-467-d Application for Partial Tax Exemption for Certain Living Quarters Occupied by Senior Citizen or Disabled Individual - New York

What Is Form RP-467-d?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

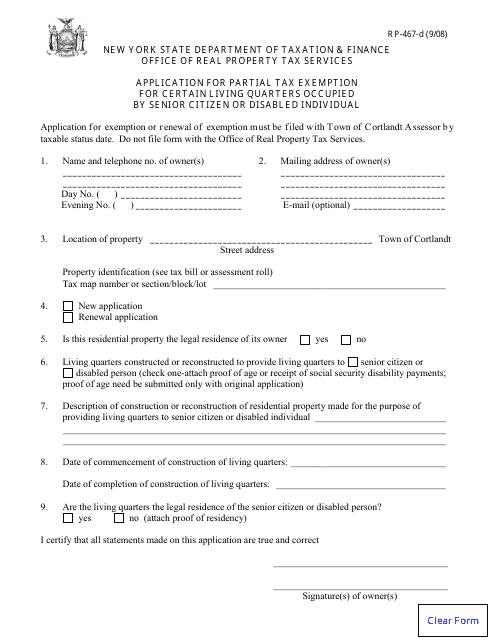

Q: What is form RP-467-d?

A: Form RP-467-d is an application for partial tax exemption for certain living quarters occupied by senior citizen or disabled individual in New York.

Q: Who can apply for the partial tax exemption?

A: Senior citizens or disabled individuals who occupy the living quarters can apply for the partial tax exemption.

Q: What is the purpose of the partial tax exemption?

A: The partial tax exemption is intended to provide financial relief for eligible senior citizens or disabled individuals.

Q: What are the eligibility criteria?

A: To be eligible, the applicant must be a senior citizen or disabled individual and occupy the living quarters as their primary residence.

Q: What documents are required to apply for the exemption?

A: The applicant needs to provide proof of age or disability, proof of occupancy, and other relevant documentation as specified in the application form.

Q: Is there a deadline for submitting the application?

A: Yes, the application must be submitted by the taxable status date, which varies by locality. It is recommended to contact the local tax assessor's office for the specific deadline.

Q: What happens after submitting the application?

A: After submitting the application, the local tax assessor's office will review the application and determine eligibility. If approved, the partial tax exemption will be applied to the property taxes.

Q: Can the exemption be transferred if the homeowner moves?

A: No, the partial tax exemption is tied to the specific property and cannot be transferred if the homeowner moves.

Q: Are there any income limits for eligibility?

A: No, there are no income limits for eligibility. However, other criteria such as age, disability, and occupancy must be met.

Form Details:

- Released on September 1, 2008;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-467-d by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.

![Document preview: Form RP-485-K [UTICA SD] Application for Residential Investment Real Property Tax Exemption; Certain School Districts - City of Utica, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349829/form-rp-485-k-utica-sd-application-for-residential-investment-real-property-tax-exemption-certain-school-districts-city-of-utica-new-york.png)

![Document preview: Form RP-485-I [JAMESTOWN SD] Application for Residential Investment Real Property Tax Exemption; Certain School Districts - New York](https://data.templateroller.com/pdf_docs_html/578/5786/578655/form-rp-485-i-jamestown-sd-application-residential-investment-real-property-tax-exemption-certain-school-districts-new-york.png)

![Document preview: Form RP-421-J [NIAGARA FALLS] Application for Capital Investment in Multiple Dwellings Real Property Tax Exemption; Certain Cities - City of Niagara Falls, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349861/form-rp-421-j-niagara-falls-application-for-capital-investment-in-multiple-dwellings-real-property-tax-exemption-certain-cities-city-of-niagara-falls-new-york.png)