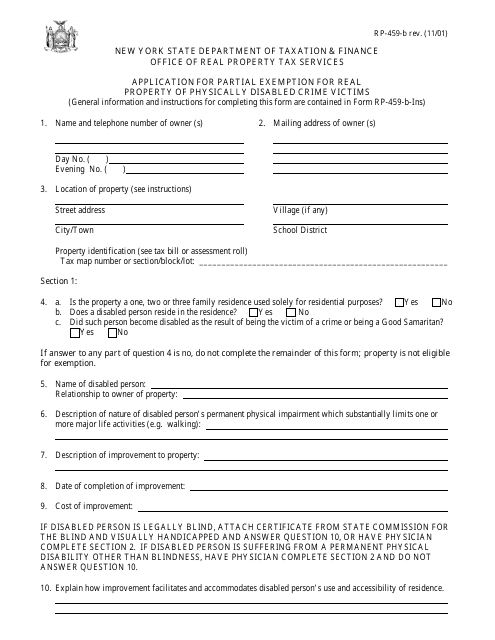

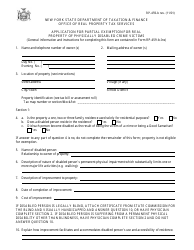

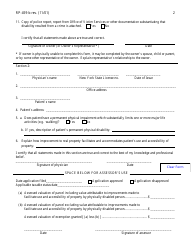

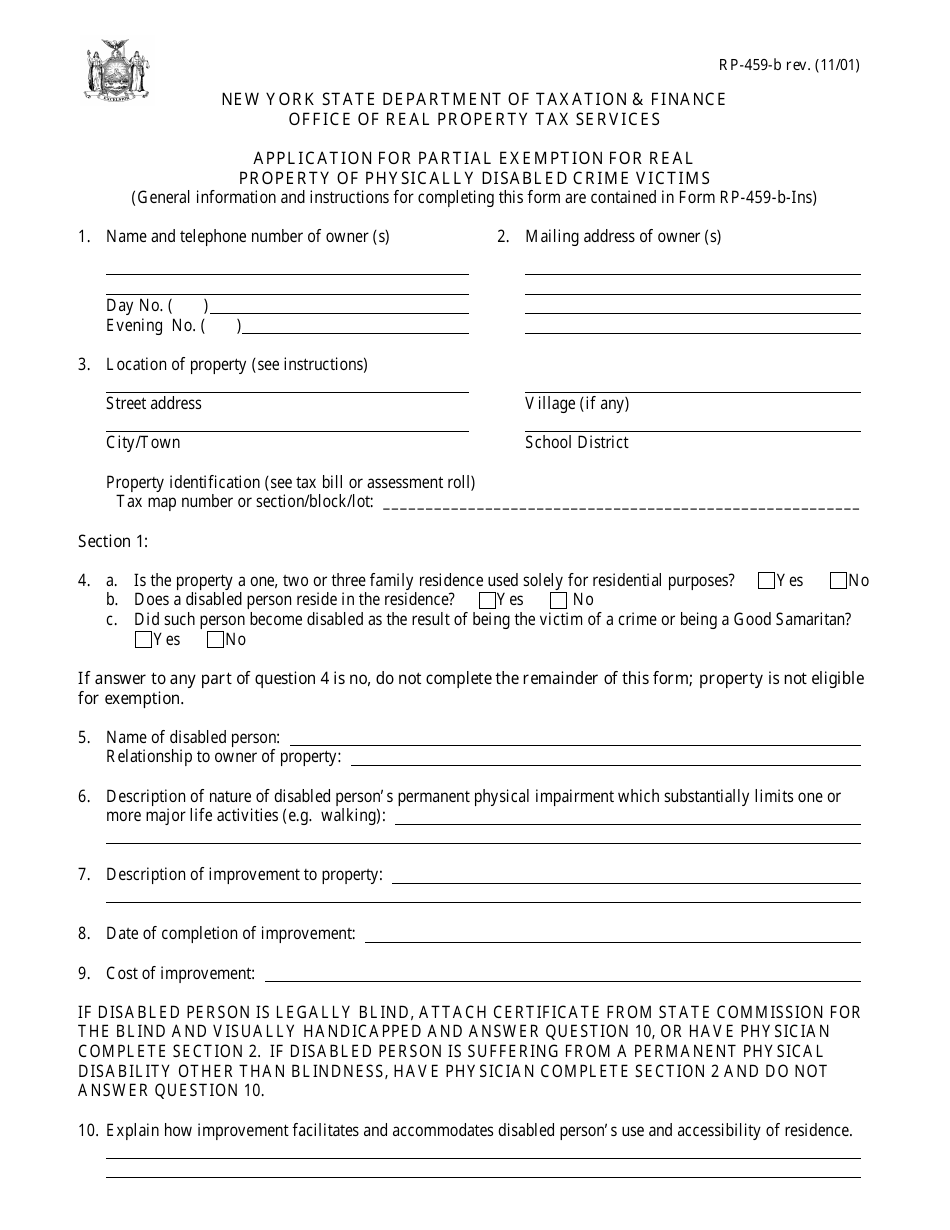

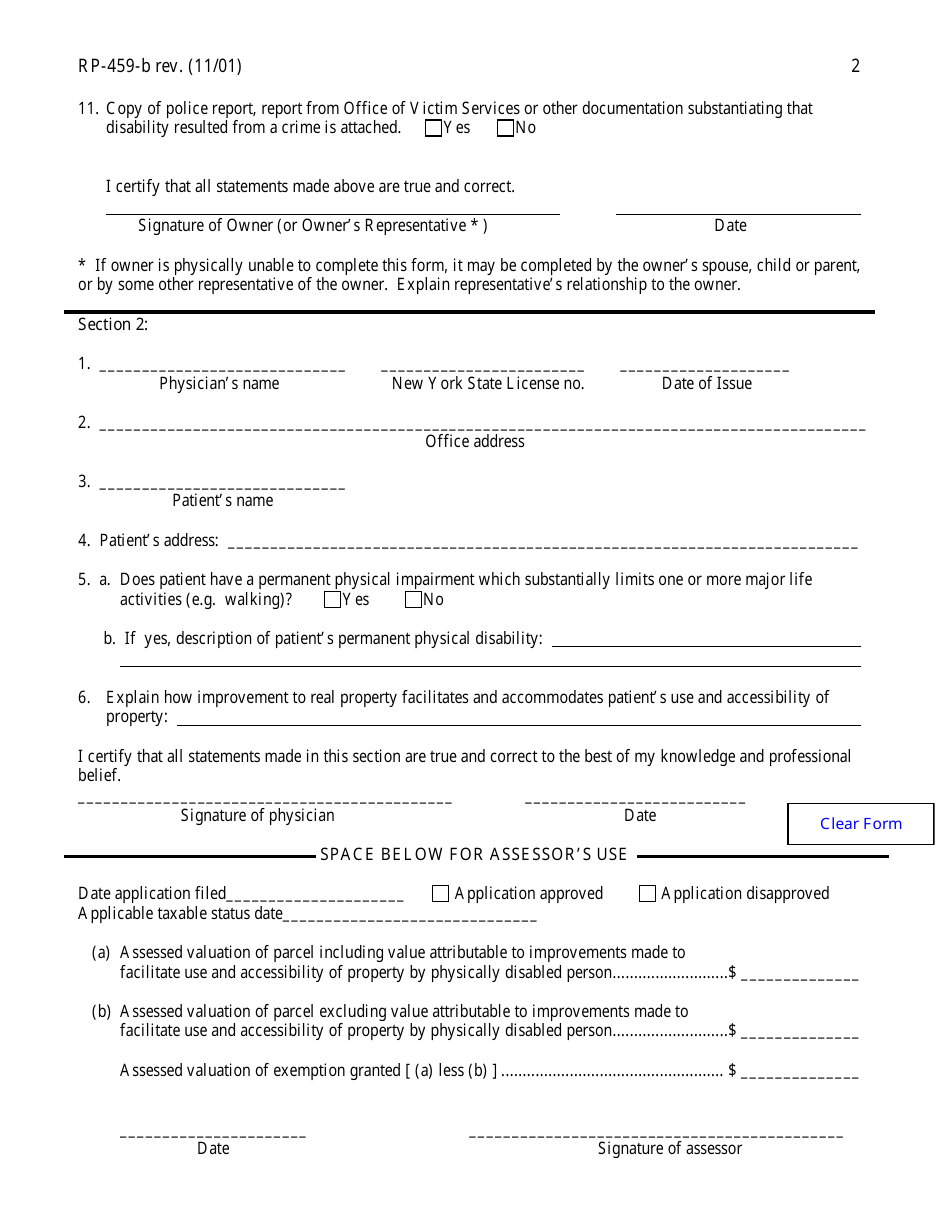

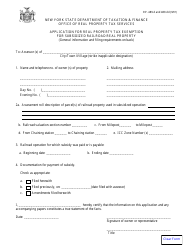

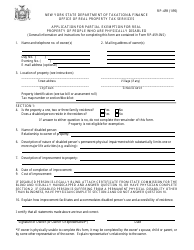

Form RP-459-B Application for Partial Exemption for Real Property of Physically Disabled Crime Victims - New York

What Is Form RP-459-B?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

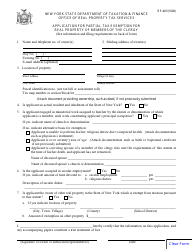

Q: What is RP-459-B?

A: RP-459-B is an application for partial exemption for real property of physically disabled crime victims in New York.

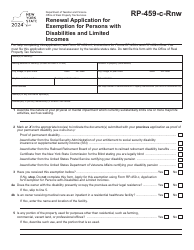

Q: Who is eligible to apply for RP-459-B?

A: Physically disabled crime victims in New York are eligible to apply for RP-459-B.

Q: What does the exemption provide?

A: The exemption provides a partial exemption from property taxes for qualifying disabled crime victims.

Q: What documents are required to apply for RP-459-B?

A: To apply for RP-459-B, you need to submit proof of disability, proof of crime victimization, and any other supporting documentation.

Q: Is there a deadline to submit the RP-459-B application?

A: Yes, the RP-459-B application must be filed on or before the taxable status date of the assessing unit in which the property is located.

Q: What happens after I submit the RP-459-B application?

A: After submitting the RP-459-B application, the assessor's office will review your application and determine your eligibility for the exemption.

Q: Can I appeal if my RP-459-B application is denied?

A: Yes, if your RP-459-B application is denied, you have the right to appeal the decision to the Board of Assessment Review or to a small claims assessment review.

Q: Can I receive other property tax exemptions in addition to RP-459-B?

A: Yes, you may be eligible for other property tax exemptions in addition to RP-459-B. Contact your local assessor's office for more information.

Form Details:

- Released on November 1, 2001;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-459-B by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.