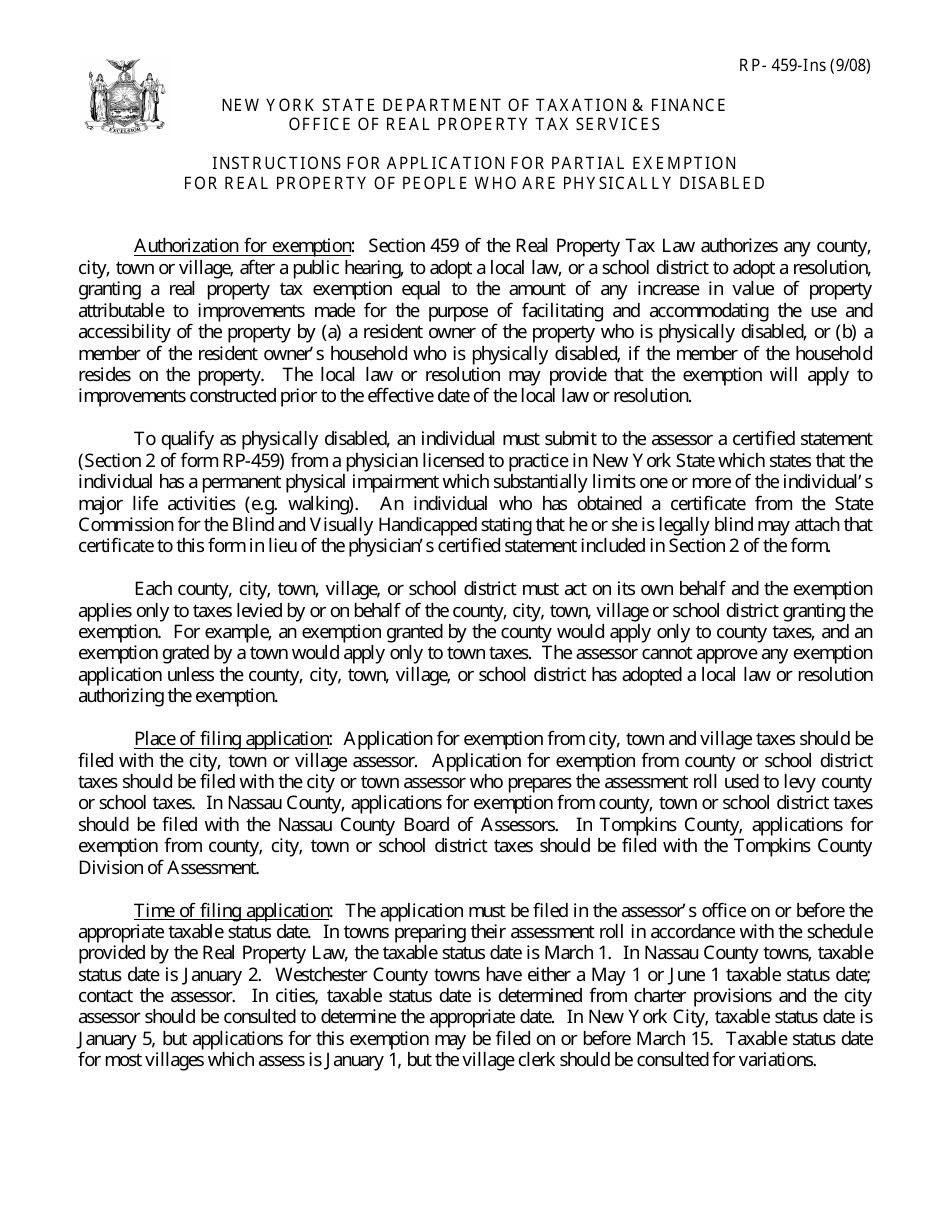

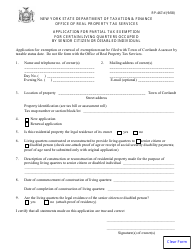

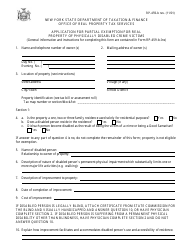

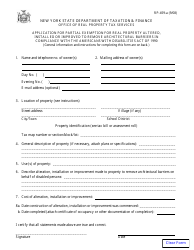

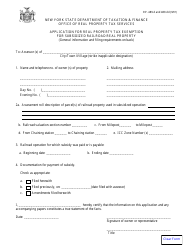

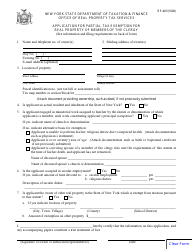

Instructions for Form RP-459 Application for Partial Exemption for Real Property of People Who Are Physically Disabled - New York

This document contains official instructions for Form RP-459 , Application for Real Property of People Who Are Physically Disabled - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form RP-459 is available for download through this link.

FAQ

Q: What is Form RP-459?

A: Form RP-459 is an application for a partial exemption for real property of people who are physically disabled in New York.

Q: Who can apply for this exemption?

A: People who are physically disabled can apply for this exemption.

Q: What is the purpose of this exemption?

A: The purpose of this exemption is to provide a partial exemption on real property taxes for people who are physically disabled in New York.

Q: How can I obtain Form RP-459?

A: You can obtain Form RP-459 from the New York State Department of Taxation and Finance.

Q: Is there a deadline for submitting the application?

A: Yes, the application must be filed with the assessor by taxable status date, which is generally March 1st.

Q: What documents do I need to include with the application?

A: You may need to include supporting documentation, such as medical evidence or disability determination, with your application.

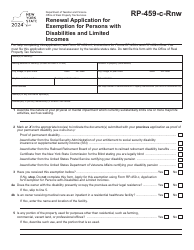

Q: Will I need to reapply for this exemption every year?

A: No, once you are approved for the exemption, you generally do not need to reapply unless there is a change in your eligibility or circumstances.

Q: How long does the exemption last?

A: The exemption generally lasts for a period of one year, but you may need to reapply if your eligibility or circumstances change.

Q: Are there any income limits for this exemption?

A: No, there are no income limits for this exemption. It is based solely on disability status and property ownership.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.