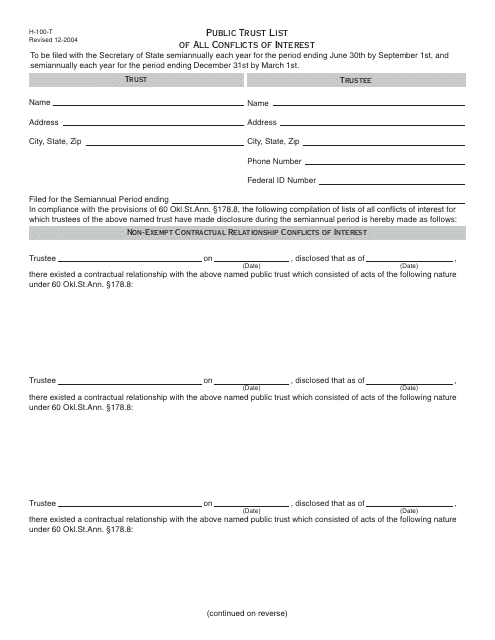

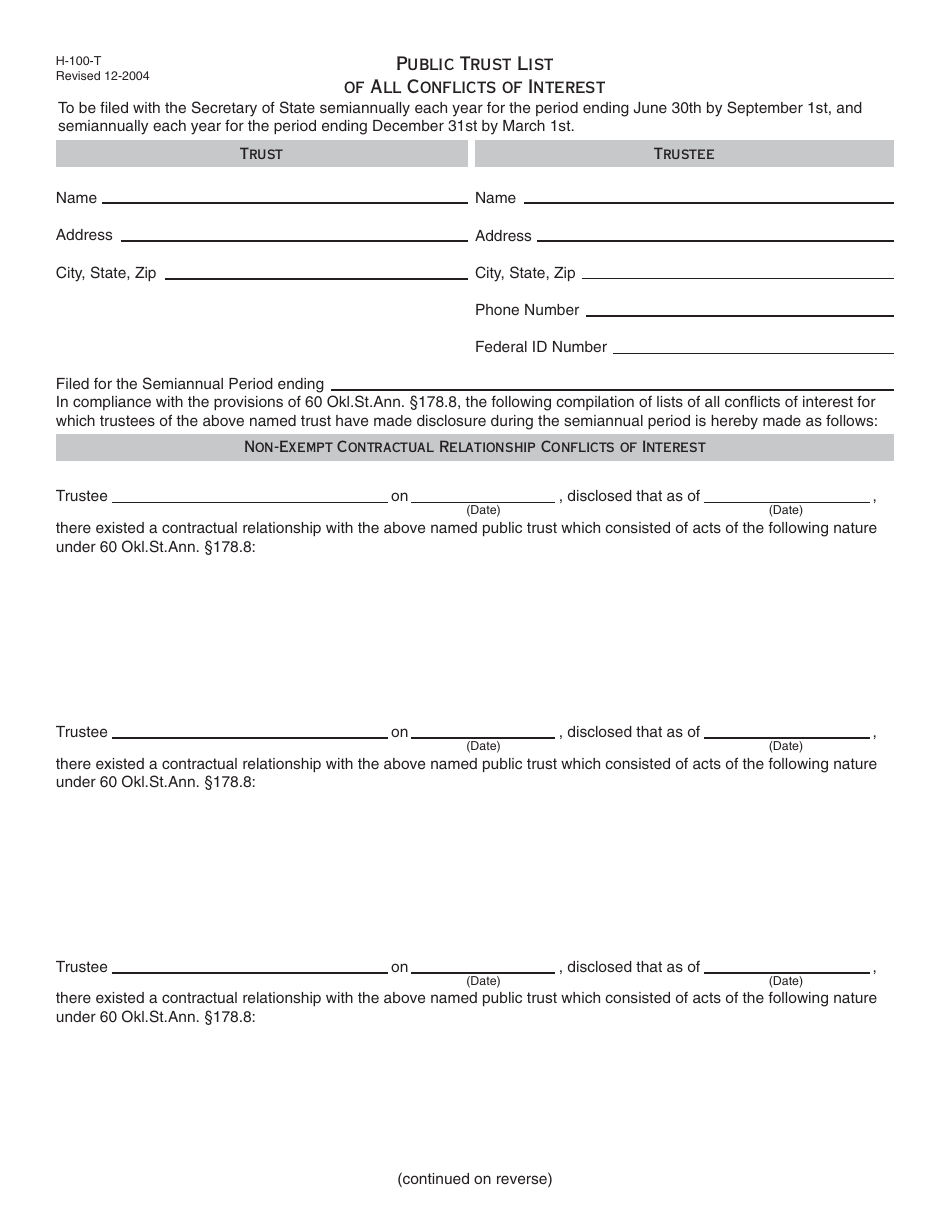

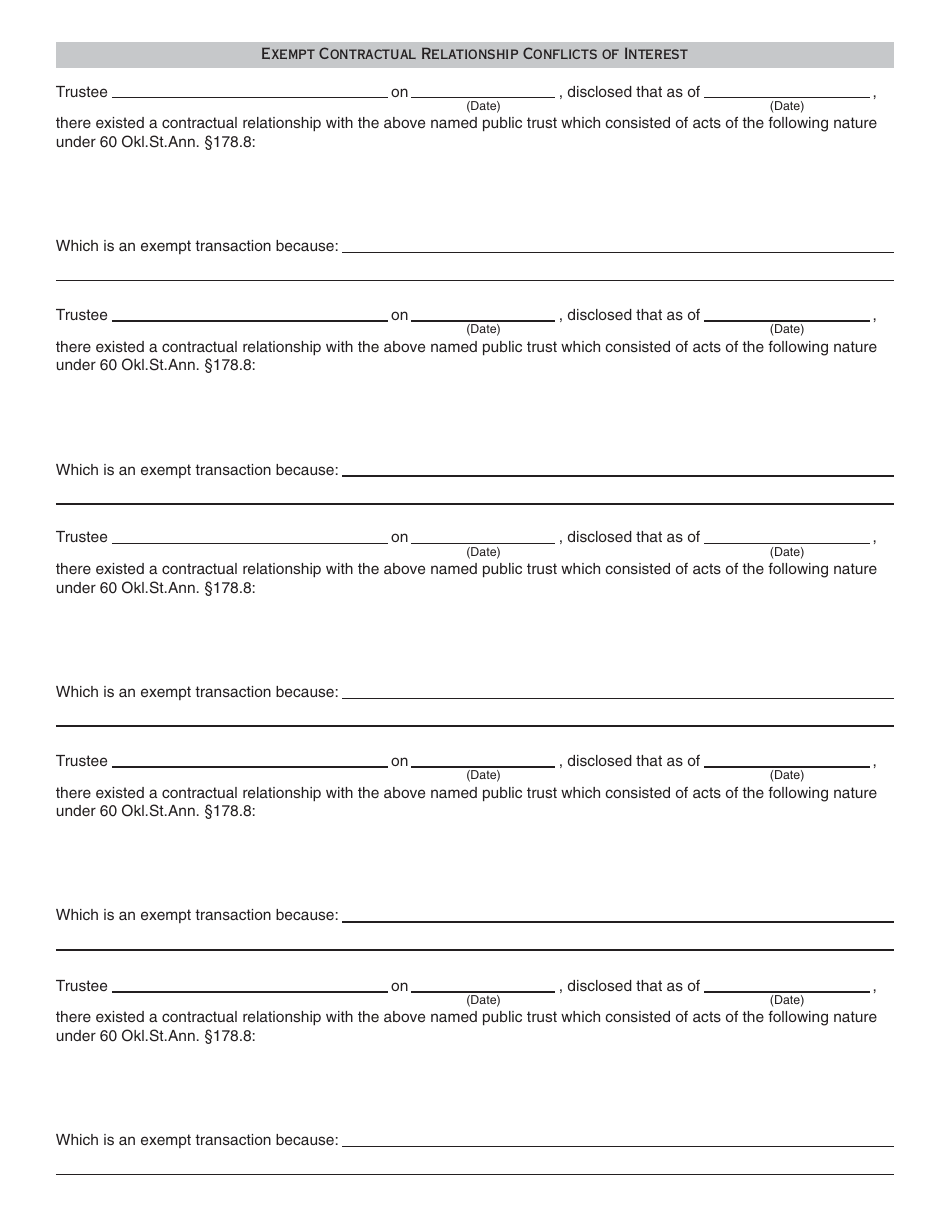

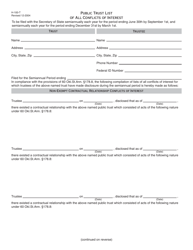

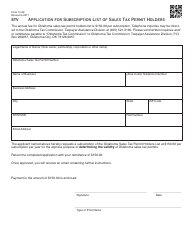

OTC Form H-100-T Public Trust List of All Conflicts of Interest - Oklahoma

What Is OTC Form H-100-T?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form H-100-T?

A: OTC Form H-100-T is a document used in Oklahoma to disclose conflicts of interest in a public trust.

Q: What is the purpose of OTC Form H-100-T?

A: The purpose of OTC Form H-100-T is to provide transparency by listing all conflicts of interest related to a public trust.

Q: Who is required to complete OTC Form H-100-T?

A: Anyone involved in a public trust in Oklahoma is required to complete OTC Form H-100-T if they have any conflicts of interest.

Q: What is a conflict of interest in the context of OTC Form H-100-T?

A: A conflict of interest refers to any situation where an individual's personal or financial interests may influence their decision-making in the public trust.

Q: Is OTC Form H-100-T mandatory?

A: Yes, completing OTC Form H-100-T is mandatory for individuals involved in public trusts in Oklahoma with conflicts of interest.

Form Details:

- Released on December 1, 2004;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form H-100-T by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.