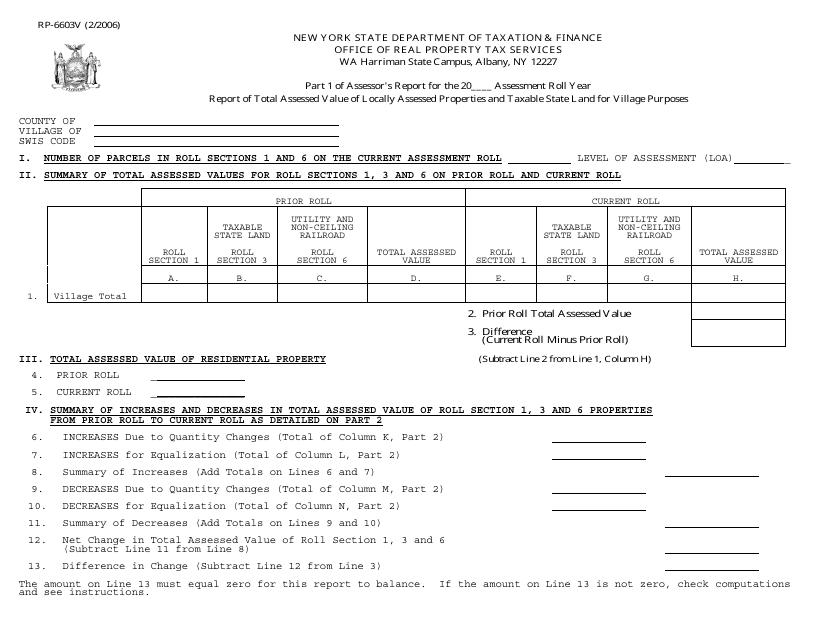

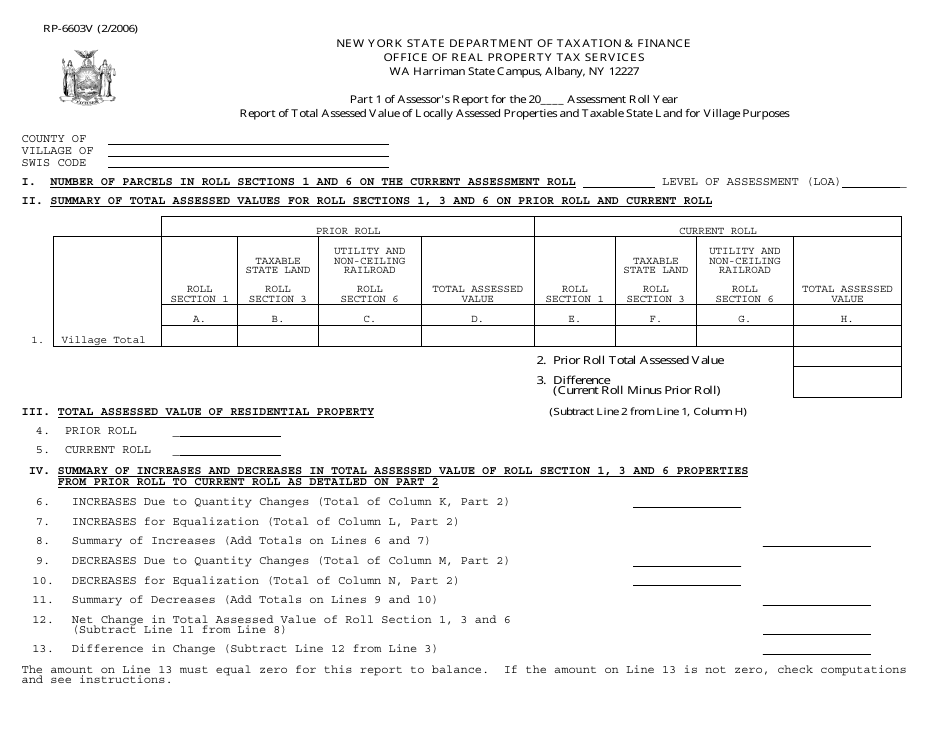

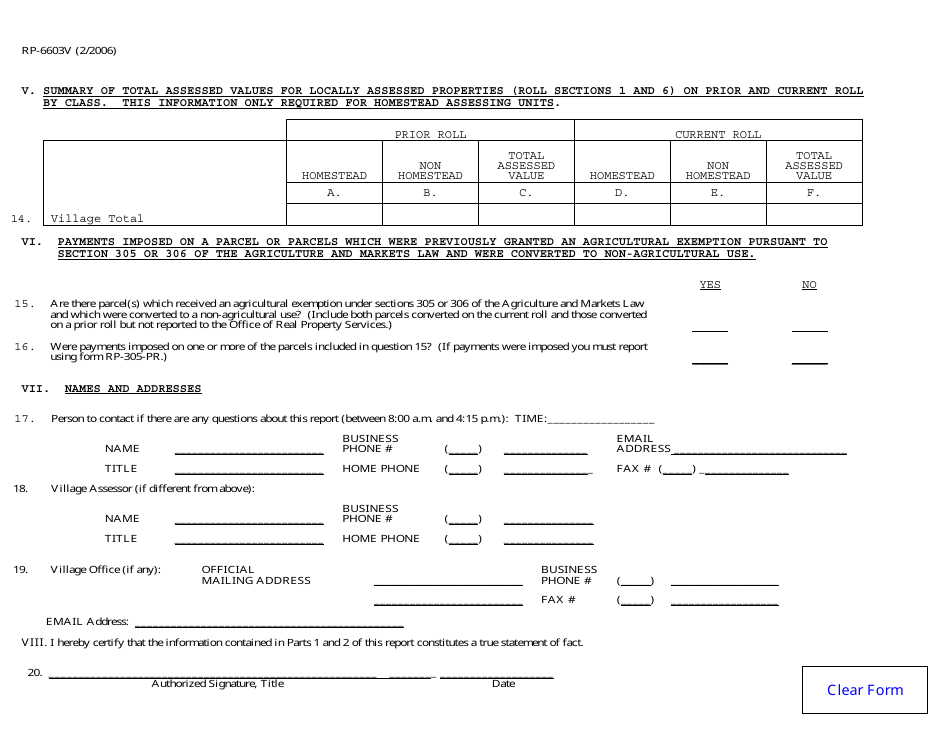

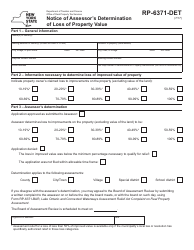

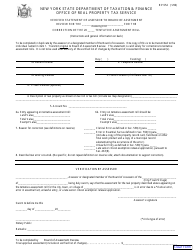

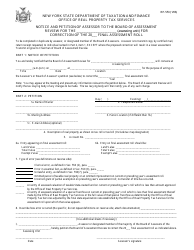

Form RP-6603V Part 1 of Assessor's Report - Report of Total Assessed Value of Locally Assessed Properties and Taxable State Land for Village Purposes - New York

What Is Form RP-6603V?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RP-6603V?

A: Form RP-6603V is the Assessor's Report for the total assessed value of locally assessed properties and taxable state land for village purposes.

Q: What is the purpose of Form RP-6603V?

A: The purpose of Form RP-6603V is to report the total assessed value of properties and taxable state land for village purposes in New York.

Q: Who completes Form RP-6603V?

A: The Assessor completes Form RP-6603V.

Q: What information is included in Form RP-6603V?

A: Form RP-6603V includes the total assessed value of locally assessed properties and taxable state land for village purposes.

Q: Why is Form RP-6603V important?

A: Form RP-6603V is important for assessing the value of properties and determining taxes for village purposes in New York.

Form Details:

- Released on February 1, 2006;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-6603V by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.