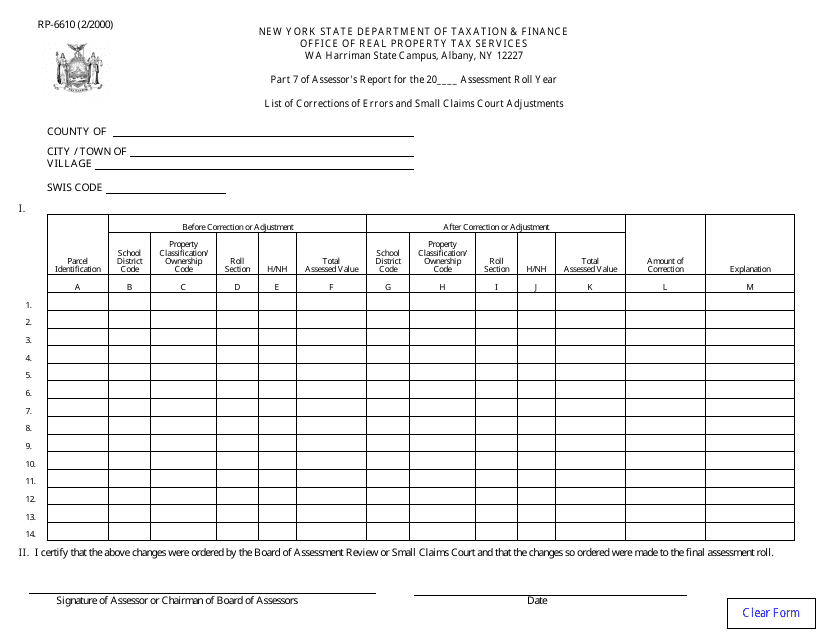

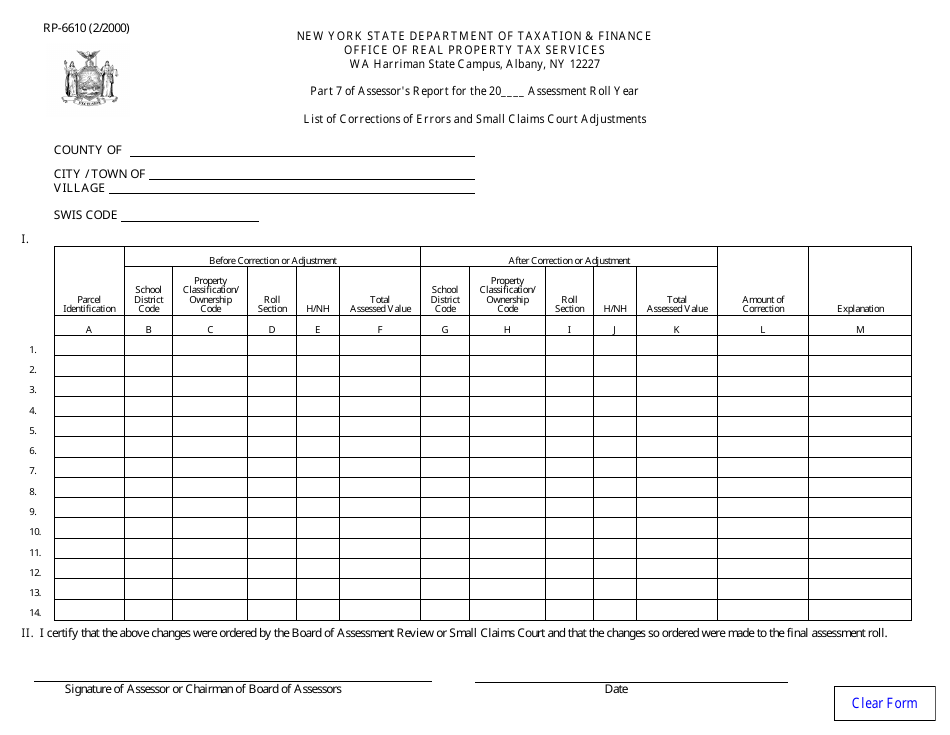

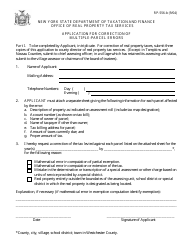

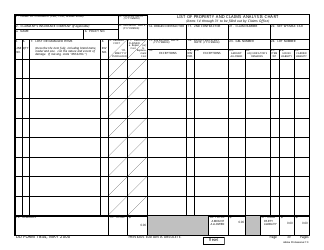

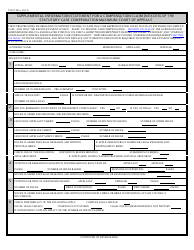

Form RP-6610 List of Corrections of Errors and Small Claims Court Adjustments - New York

What Is Form RP-6610?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RP-6610?

A: Form RP-6610 is a document used in New York to list corrections of errors and small claims court adjustments related to property tax assessments.

Q: When should I use Form RP-6610?

A: You should use Form RP-6610 when you need to make corrections to errors or adjustments to your property tax assessment in New York.

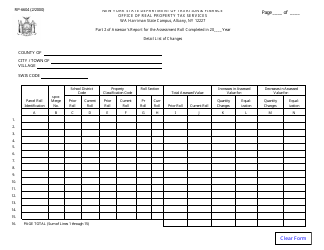

Q: What information is required on Form RP-6610?

A: Form RP-6610 requires you to provide details about the property, the specific errors or adjustments to be made, and any supporting documentation.

Q: How do I submit Form RP-6610?

A: You can submit Form RP-6610 to the local assessor's office by mail or in person. Make sure to keep a copy for your records.

Q: What is the purpose of Form RP-6610?

A: The purpose of Form RP-6610 is to notify the assessor of errors in property tax assessments and request adjustments to correct them.

Q: Can I use Form RP-6610 for any property tax adjustments in New York?

A: Form RP-6610 is specifically for corrections of errors and small claims court adjustments. Other types of adjustments may require different forms.

Q: Are there any fees associated with submitting Form RP-6610?

A: There are generally no fees for submitting Form RP-6610, but it's advisable to check with the local assessor's office for any specific requirements.

Q: What should I do if I need assistance with completing Form RP-6610?

A: If you need help with completing Form RP-6610, you can contact the local assessor's office or consult with a property tax professional for guidance.

Q: Is Form RP-6610 applicable in both residential and commercial properties?

A: Yes, Form RP-6610 can be used for corrections and adjustments for both residential and commercial properties in New York.

Q: Can I appeal a decision made based on Form RP-6610?

A: If you disagree with the assessor's decision regarding your corrections or adjustments, you may have the option to further appeal the decision.

Form Details:

- Released on February 1, 2000;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-6610 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.