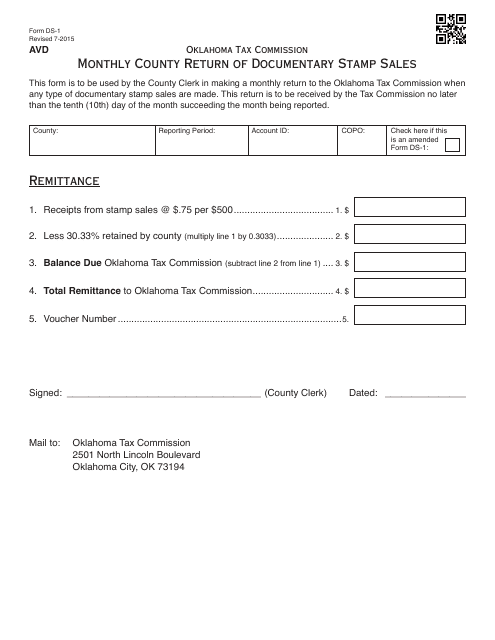

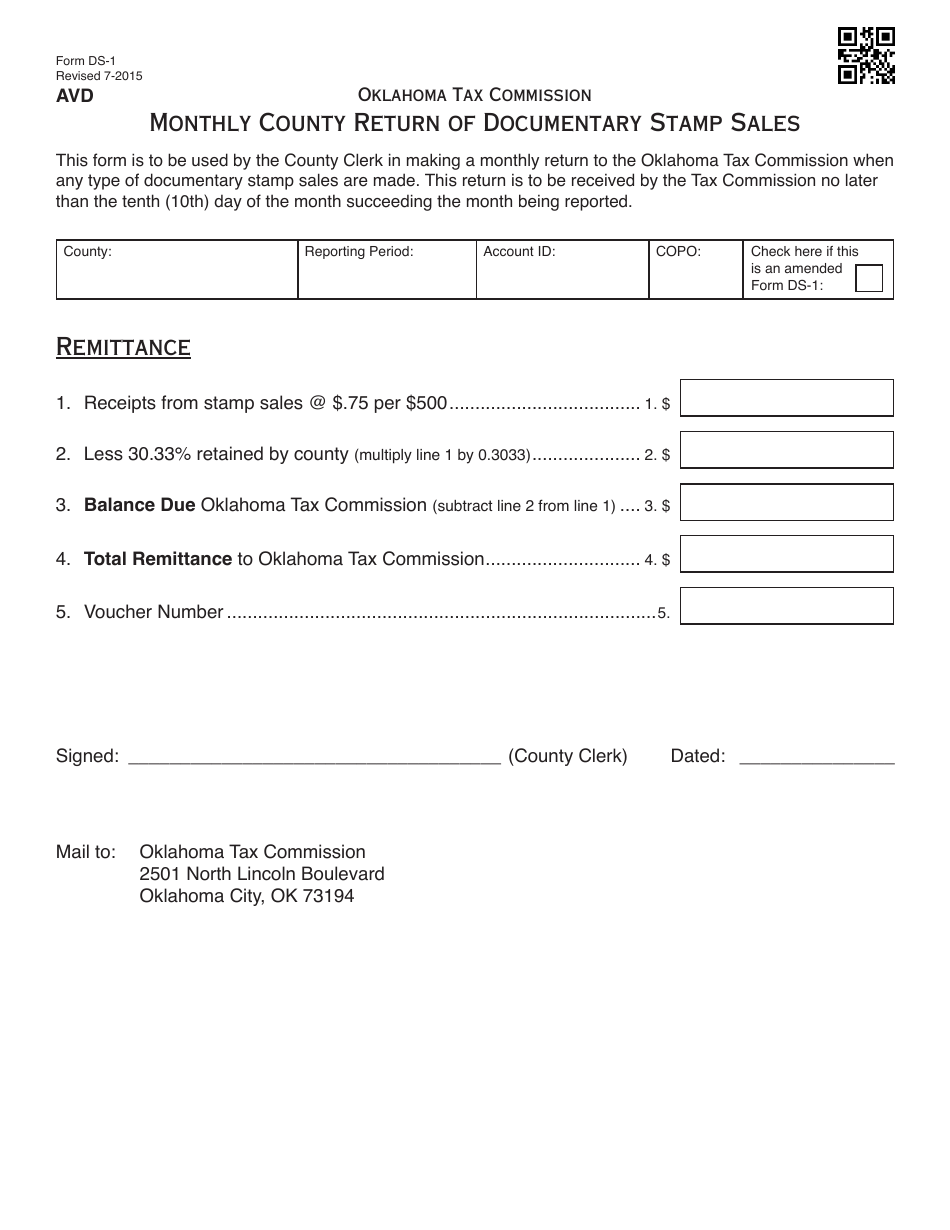

OTC Form DS-1 Monthly County Return of Documentary Stamp Sales - Oklahoma

What Is OTC Form DS-1?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form DS-1?

A: OTC Form DS-1 is a monthly county return used to report documentary stamp sales in Oklahoma.

Q: Who needs to file OTC Form DS-1?

A: Anyone engaged in the business of selling or issuing taxable stamps, including wholesalers, retailers, and other entities, needs to file OTC Form DS-1.

Q: What is the purpose of OTC Form DS-1?

A: The purpose of OTC Form DS-1 is to report documentary stamp sales and remit the corresponding taxes to the Oklahoma Tax Commission.

Q: When is OTC Form DS-1 due?

A: OTC Form DS-1 is due on the 20th day of the month following the reporting month.

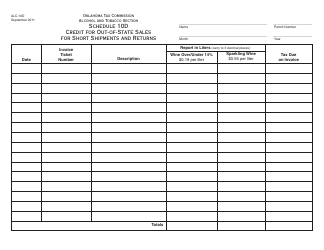

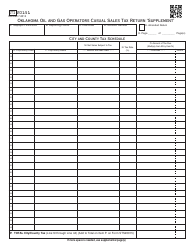

Q: What information needs to be provided on OTC Form DS-1?

A: OTC Form DS-1 requires information about the seller, the total taxable sales, the amount of tax due, and any refunds or adjustments.

Q: Are there any penalties for late filing or non-compliance?

A: Yes, there are penalties for late filing or non-compliance, including interest charges and possible legal consequences.

Q: Is OTC Form DS-1 required for all counties in Oklahoma?

A: Yes, OTC Form DS-1 must be filed for all counties in Oklahoma.

Form Details:

- Released on July 1, 2015;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form DS-1 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.