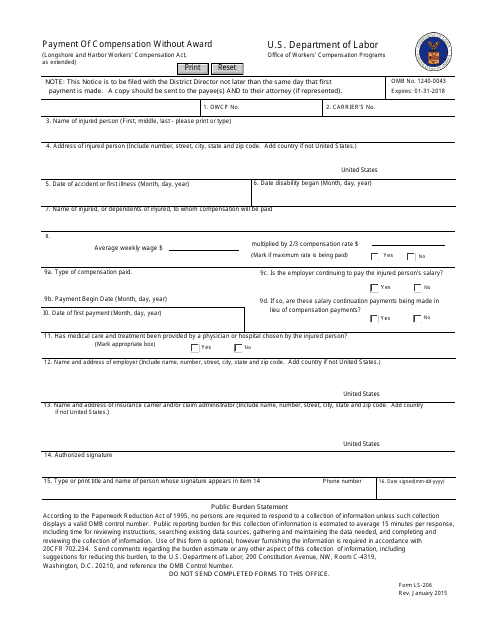

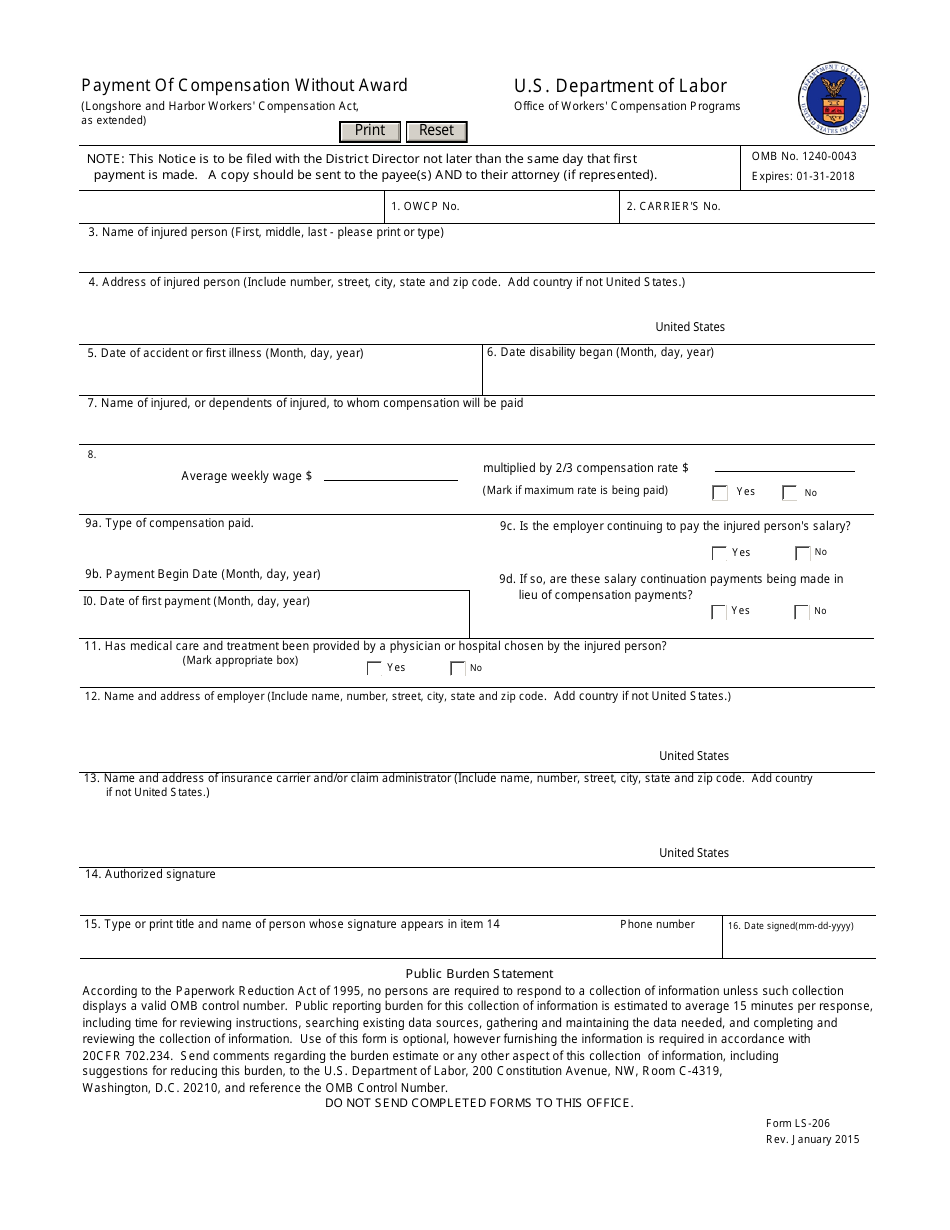

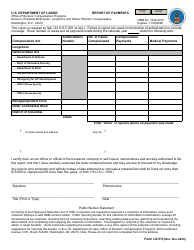

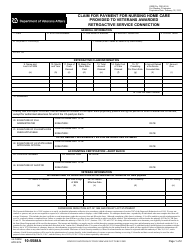

Form LS-206 Payment of Compensation Without Award

What Is Form LS-206?

This is a legal form that was released by the U.S. Department of Labor on January 1, 2015 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form LS-206?

A: Form LS-206 is a form used to report the payment of compensation without an award.

Q: When is Form LS-206 used?

A: Form LS-206 is used when an employer or its insurance company voluntarily makes a payment of compensation to an employee without a formal award being made by the Department of Labor.

Q: Who should complete Form LS-206?

A: The employer or its insurance company should complete Form LS-206.

Q: Do I need to file Form LS-206?

A: Yes, Form LS-206 must be filed with the Office of Workers' Compensation Programs (OWCP) within 30 days of the voluntary payment of compensation.

Q: Are there any fees associated with filing Form LS-206?

A: No, there are no fees associated with filing Form LS-206.

Form Details:

- Released on January 1, 2015;

- The latest available edition released by the U.S. Department of Labor;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form LS-206 by clicking the link below or browse more documents and templates provided by the U.S. Department of Labor.