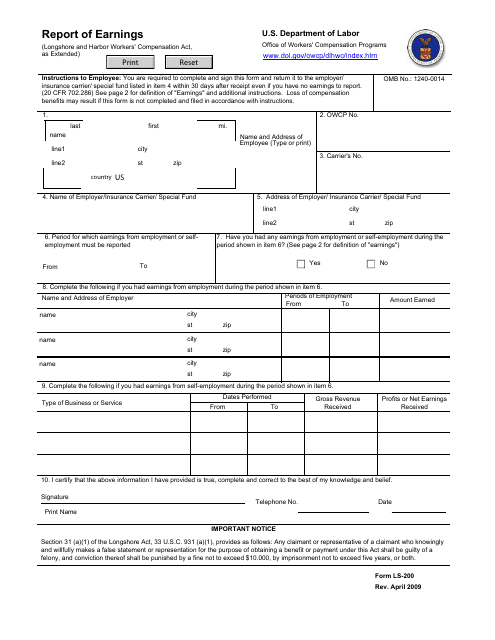

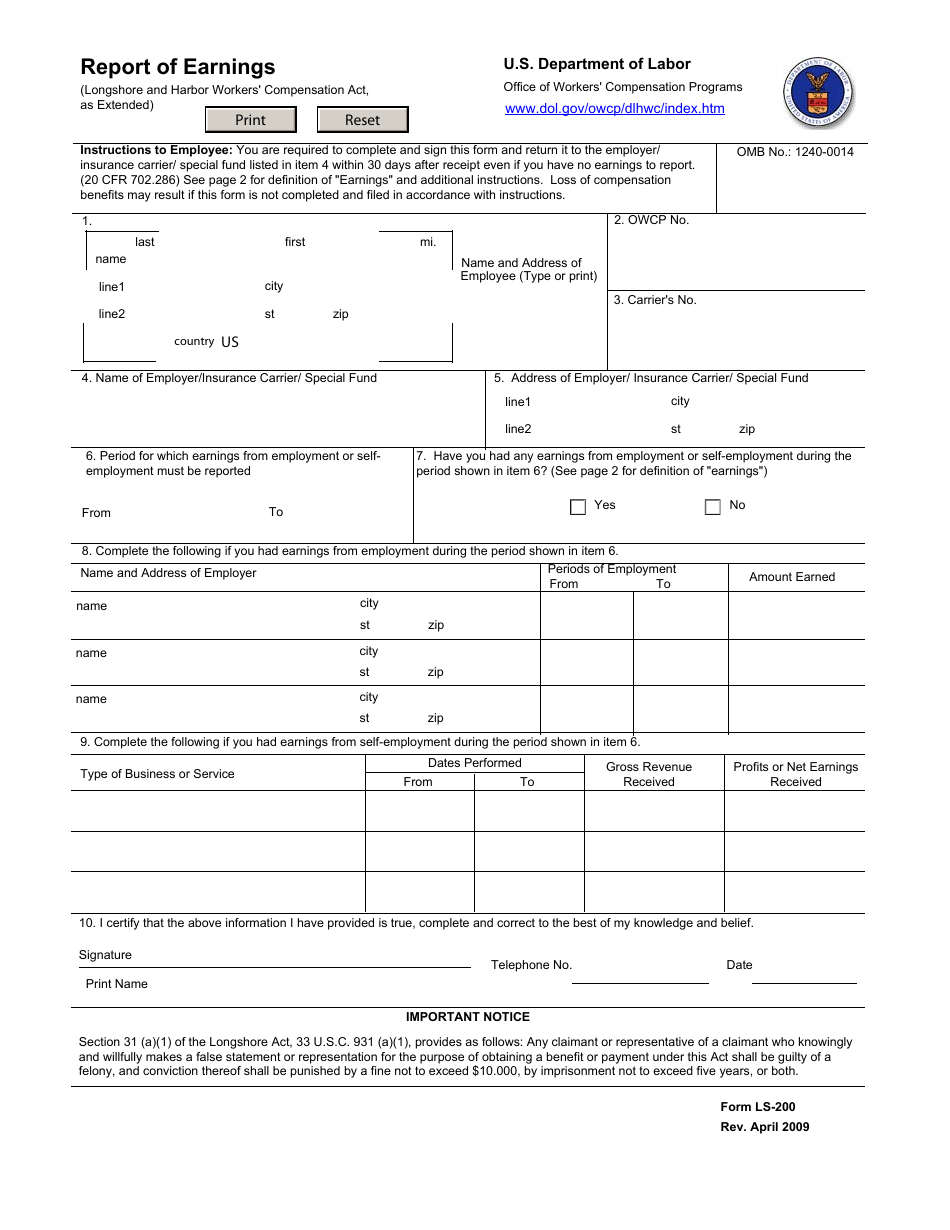

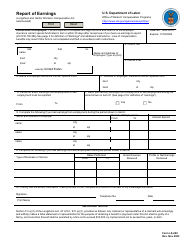

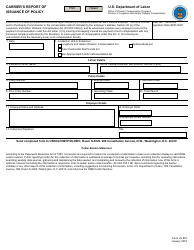

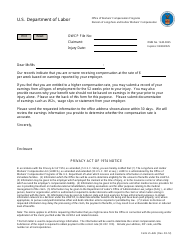

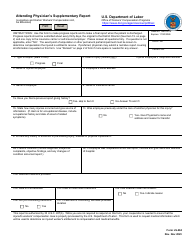

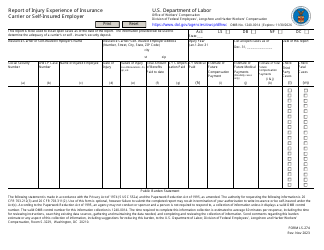

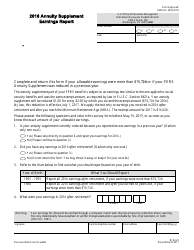

Form LS-200 Report of Earnings

What Is Form LS-200?

This is a legal form that was released by the U.S. Department of Labor on April 1, 2009 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form LS-200?

A: Form LS-200 is the Report of Earnings form.

Q: Who needs to file Form LS-200?

A: Form LS-200 needs to be filed by employers who have employees in the United States and Canada.

Q: What is the purpose of Form LS-200?

A: The purpose of Form LS-200 is to report employee earnings for tax and wage purposes.

Q: What information is required on Form LS-200?

A: Form LS-200 requires information such as employee details, earnings, and withholding taxes.

Q: When is Form LS-200 due?

A: The due date for Form LS-200 varies, so it is important to check with the relevant tax authorities.

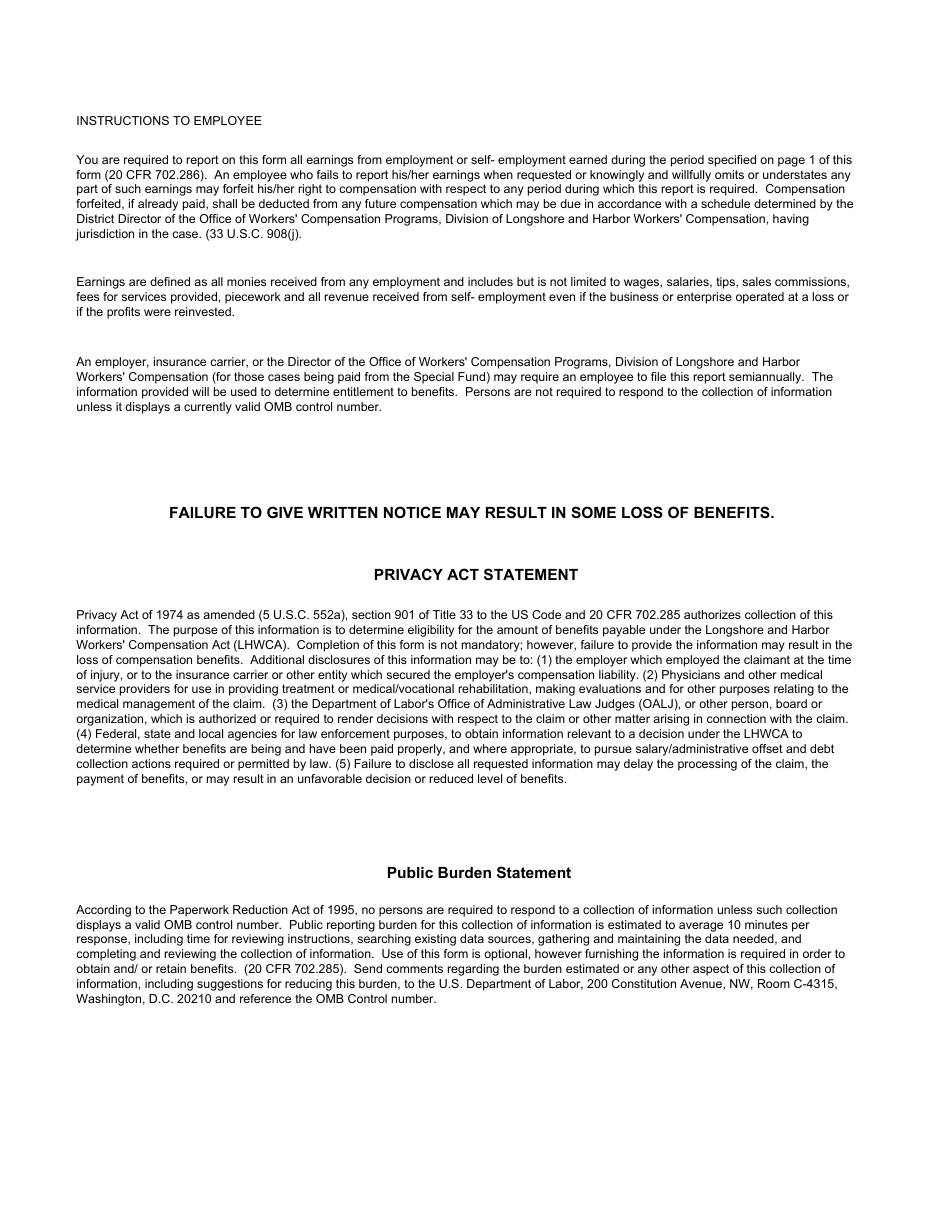

Q: Are there any penalties for not filing Form LS-200?

A: Yes, there may be penalties for not filing Form LS-200 or not filing it on time. It is important to comply with the reporting requirements.

Q: Can Form LS-200 be filed electronically?

A: Yes, Form LS-200 can be filed electronically in some cases. Check with the tax authorities for specific instructions.

Q: Is Form LS-200 only for employers in the United States?

A: No, Form LS-200 is for employers who have employees in both the United States and Canada.

Q: What should I do if I have questions about Form LS-200?

A: If you have questions about Form LS-200, you should contact the relevant tax agency for guidance and assistance.

Form Details:

- Released on April 1, 2009;

- The latest available edition released by the U.S. Department of Labor;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form LS-200 by clicking the link below or browse more documents and templates provided by the U.S. Department of Labor.