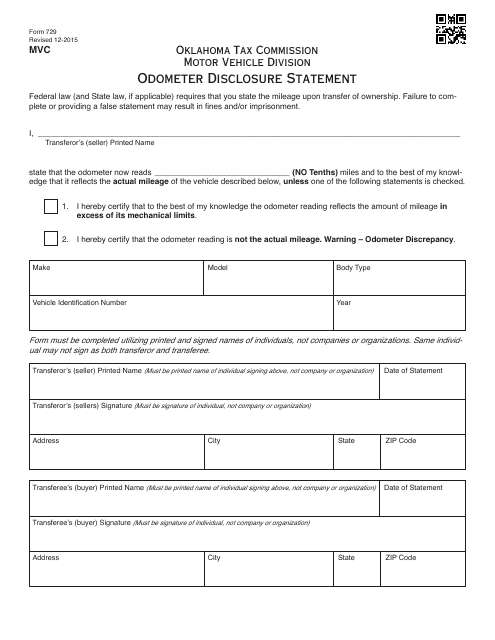

OTC Form 729 Odometer Disclosure Statement - Oklahoma

What Is OTC Form 729?

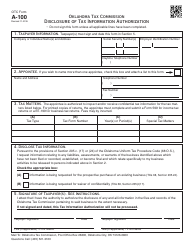

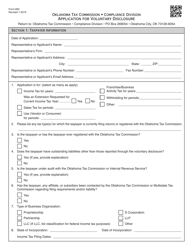

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form 729?

A: OTC Form 729 is the Odometer Disclosure Statement used in Oklahoma.

Q: What is the purpose of OTC Form 729?

A: The purpose of OTC Form 729 is to disclose the accurate mileage or odometer reading of a motor vehicle when transferring ownership.

Q: Who needs to fill out OTC Form 729?

A: Both the buyer and seller of a motor vehicle in Oklahoma need to fill out OTC Form 729.

Q: What information is required on OTC Form 729?

A: OTC Form 729 requires information such as the vehicle identification number (VIN), the buyer and seller's names and addresses, the date of sale, and the accurate odometer reading.

Q: Are there any fees associated with OTC Form 729?

A: There is no fee associated with OTC Form 729 itself, but there may be fees for other services related to vehicle registration or title transfer.

Q: What happens if the odometer reading on OTC Form 729 is incorrect?

A: Providing false or inaccurate information on OTC Form 729 is a violation of the law and may result in penalties or legal consequences.

Form Details:

- Released on December 1, 2015;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form 729 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.