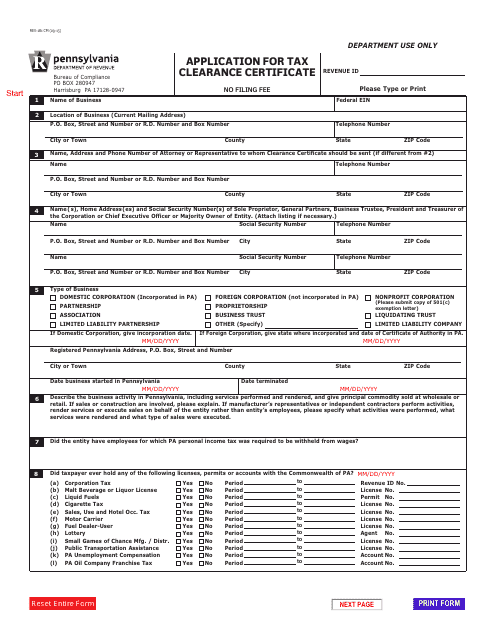

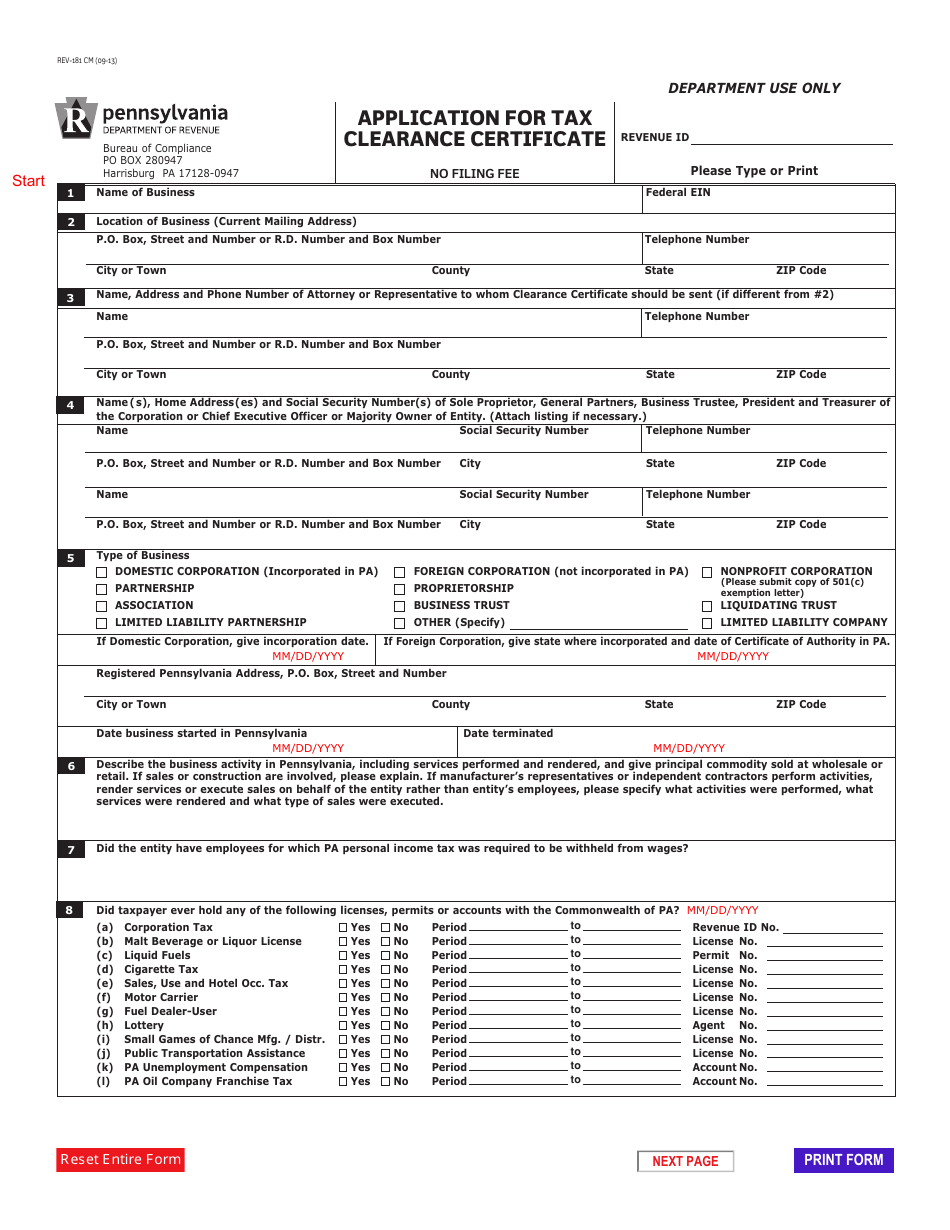

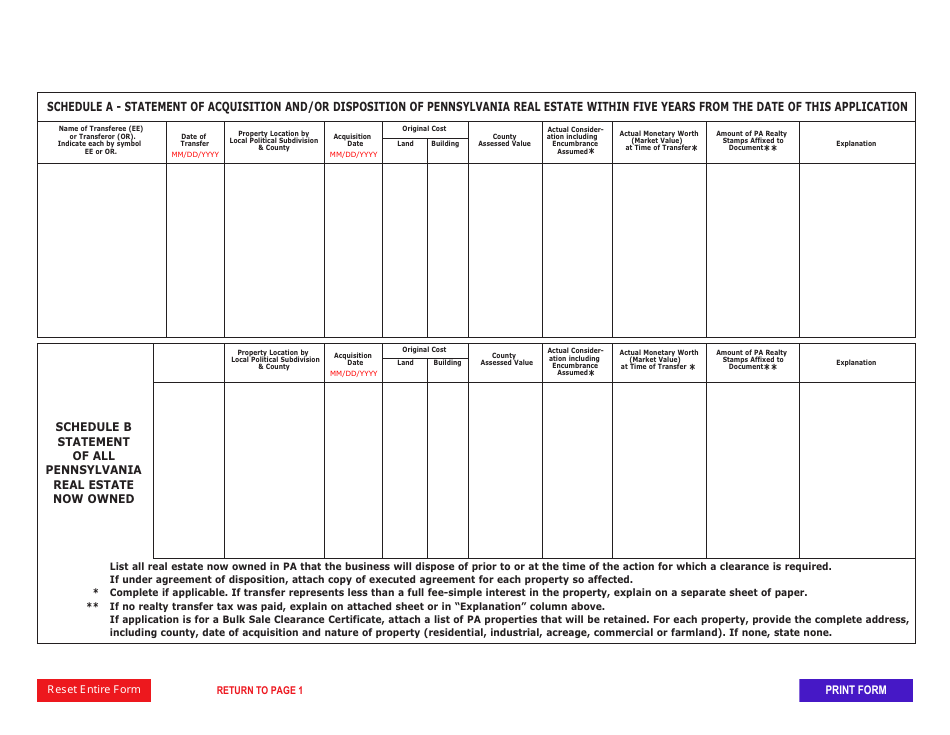

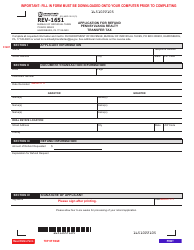

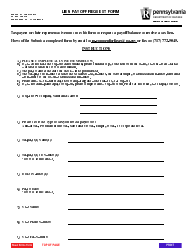

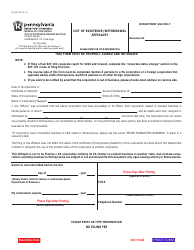

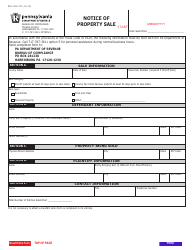

Form REV-181 CM Application for Tax Clearance Certificate - Pennsylvania

What Is Form REV-181 CM?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form REV-181 CM?

A: Form REV-181 CM is the application form for a Tax Clearance Certificate in Pennsylvania.

Q: What is a Tax Clearance Certificate?

A: A Tax Clearance Certificate is a document that verifies that an individual or business has satisfied their Pennsylvania tax obligations.

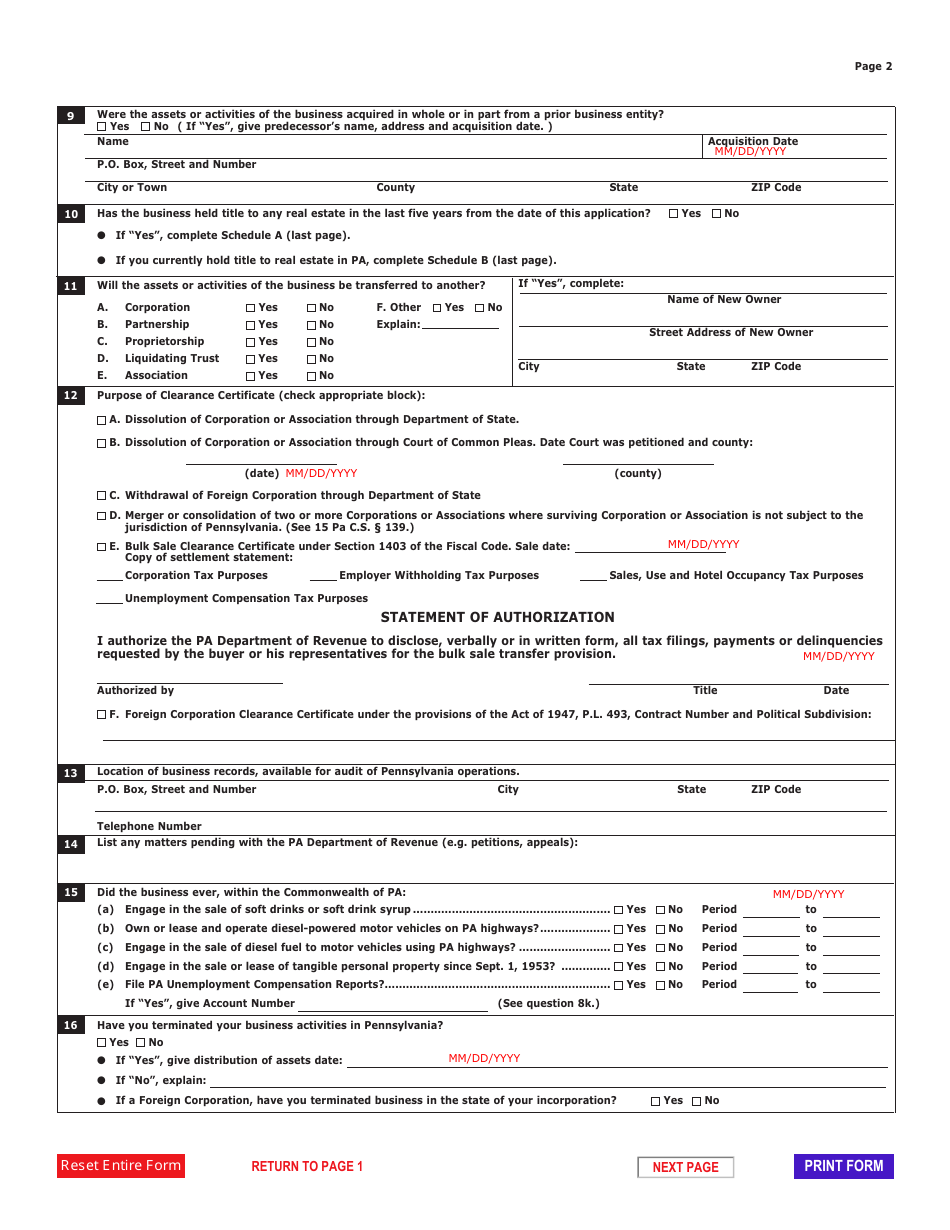

Q: Why would I need a Tax Clearance Certificate?

A: You may need a Tax Clearance Certificate for various reasons, such as obtaining a business license, selling real estate, or entering into contracts with the state.

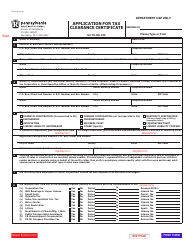

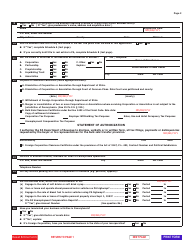

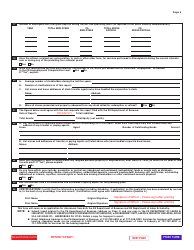

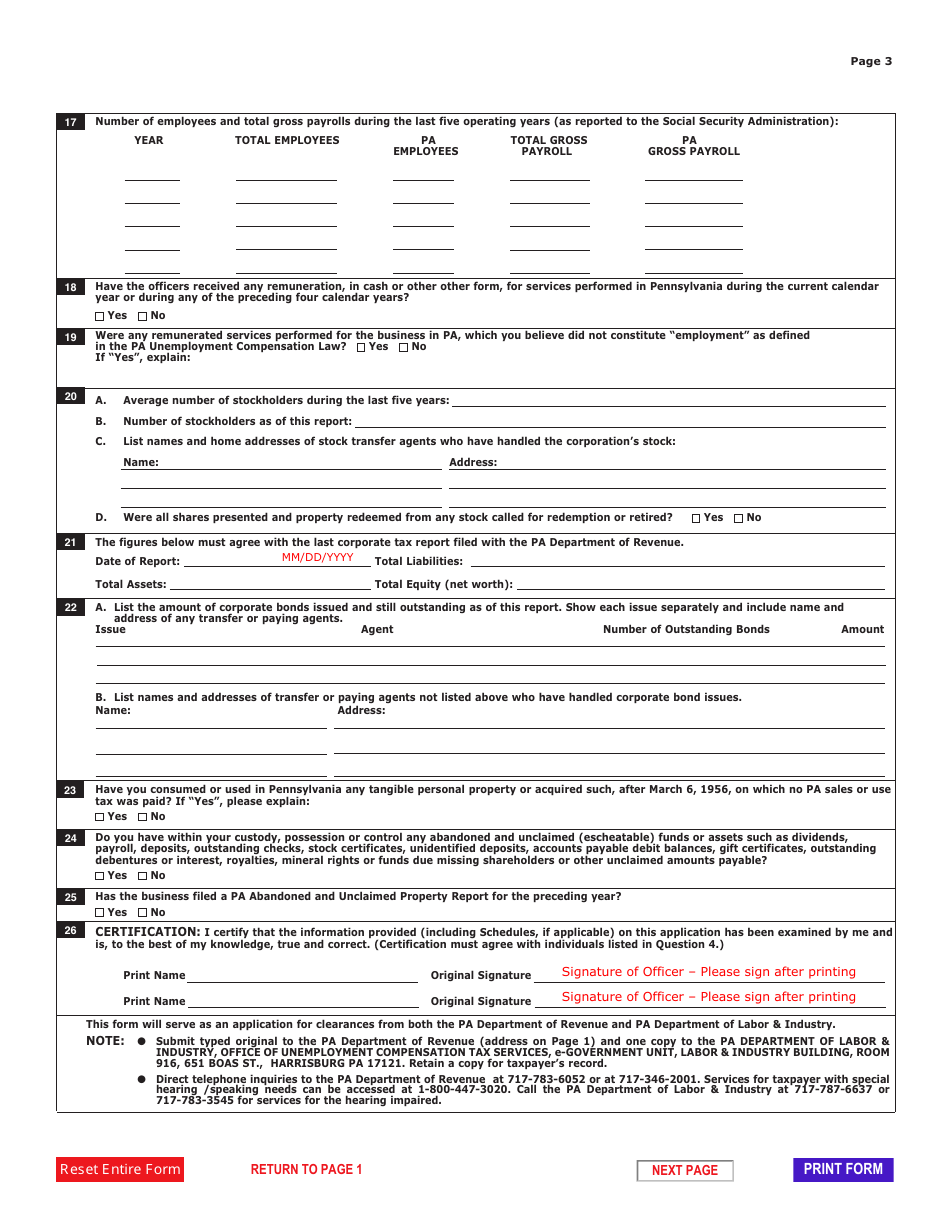

Q: What information is required on form REV-181 CM?

A: Form REV-181 CM requires information about the applicant, including their name, address, and taxpayer identification number.

Q: Is there a fee for applying for a Tax Clearance Certificate?

A: Yes, there is a non-refundable fee for applying for a Tax Clearance Certificate in Pennsylvania.

Q: How long does it take to process a Tax Clearance Certificate application?

A: The processing time for a Tax Clearance Certificate application can vary, but it typically takes several weeks.

Q: Who can I contact for more information about form REV-181 CM and the Tax Clearance Certificate?

A: You can contact the Pennsylvania Department of Revenue for more information about form REV-181 CM and the Tax Clearance Certificate.

Form Details:

- Released on September 1, 2013;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-181 CM by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.