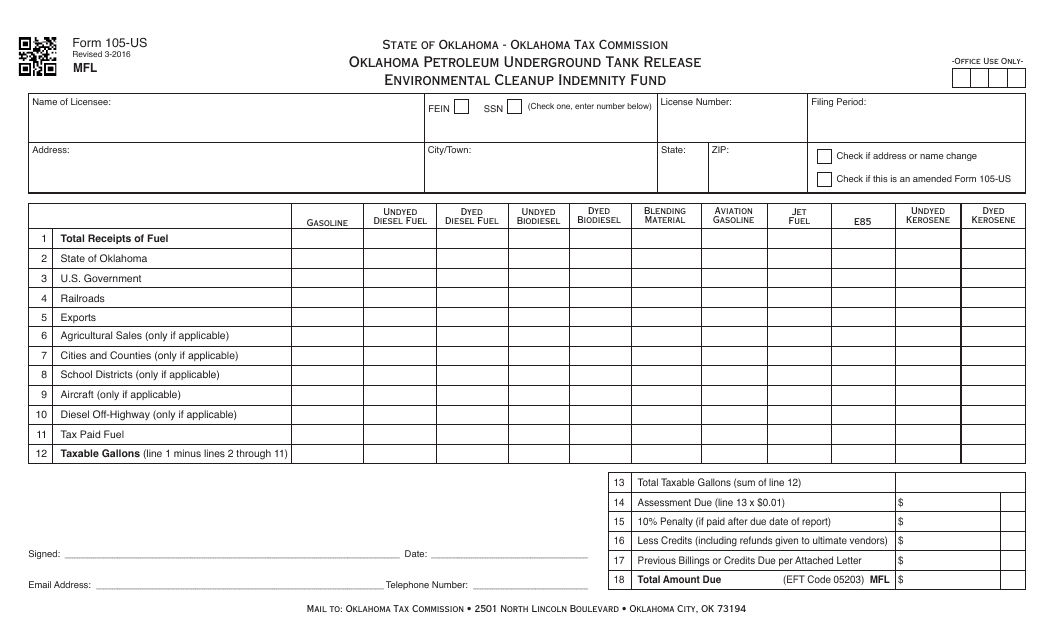

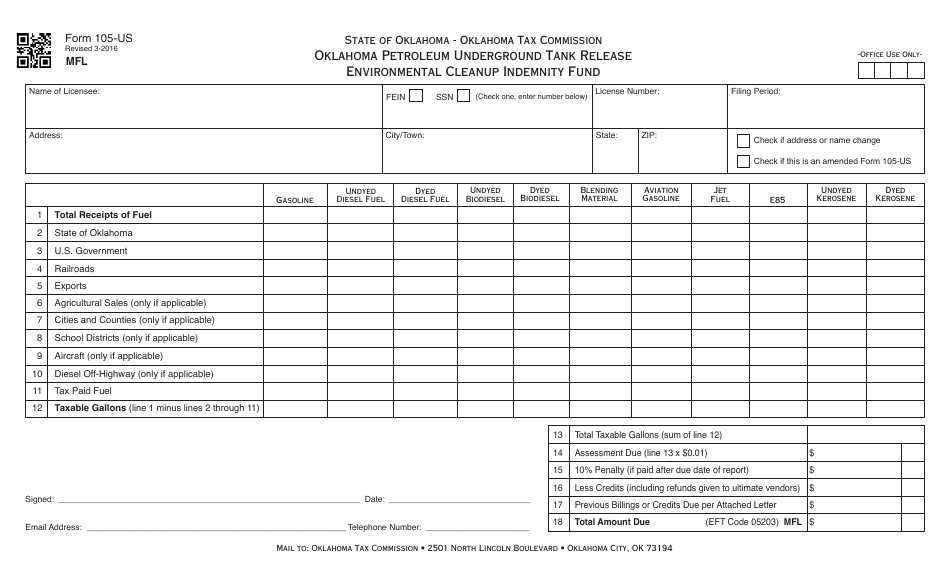

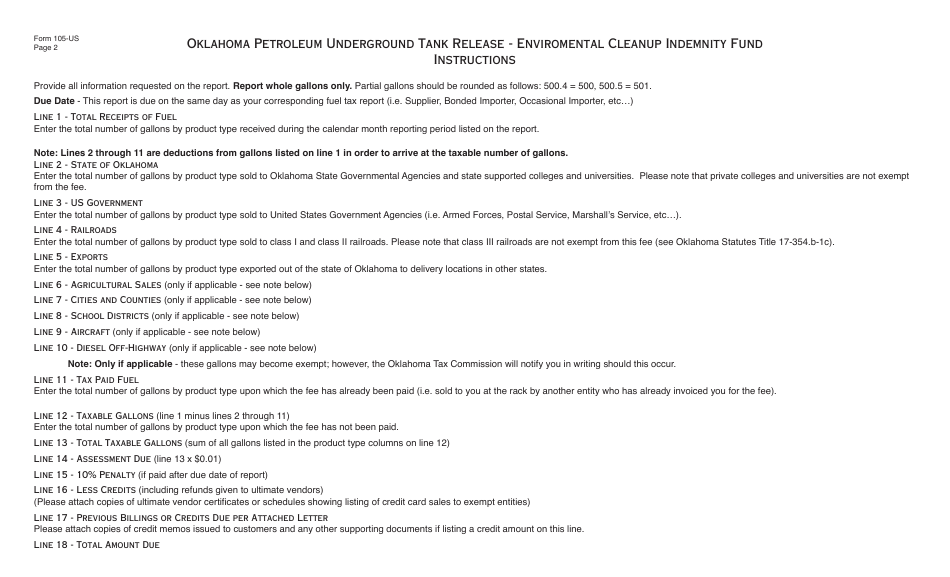

OTC Form 105-US Oklahoma Petroleum Underground Tank Release Environmental Cleanup Indemnity Fund - Oklahoma

What Is OTC Form 105-US?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form 105?

A: OTC Form 105 refers to the Oklahoma Petroleum Underground Tank Release Environmental Cleanup Indemnity Fund.

Q: What is the purpose of OTC Form 105?

A: The purpose of OTC Form 105 is to provide indemnity for environmental cleanup costs related to underground tank releases in Oklahoma.

Q: Who is eligible to utilize OTC Form 105?

A: Owners and operators of underground petroleum storage tanks in Oklahoma are eligible to utilize OTC Form 105.

Q: What does the OTC Form 105 cover?

A: OTC Form 105 covers the costs of environmental cleanup and remediation due to releases from underground petroleum storage tanks.

Q: How can I apply for OTC Form 105?

A: To apply for OTC Form 105, you need to complete the application form and submit it to the Oklahoma Tax Commission.

Q: Is there a fee for submitting OTC Form 105?

A: Yes, there is a fee associated with submitting OTC Form 105. The fee amount is specified in the application form.

Q: Are there any deadlines for submitting OTC Form 105?

A: Yes, there are specific deadlines for submitting OTC Form 105. The deadlines are stated in the application form and may vary depending on the circumstances.

Q: What happens after I submit OTC Form 105?

A: After you submit OTC Form 105, the Oklahoma Tax Commission will review your application and determine if you are eligible for indemnity.

Form Details:

- Released on February 1, 2016;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form 105-US by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.