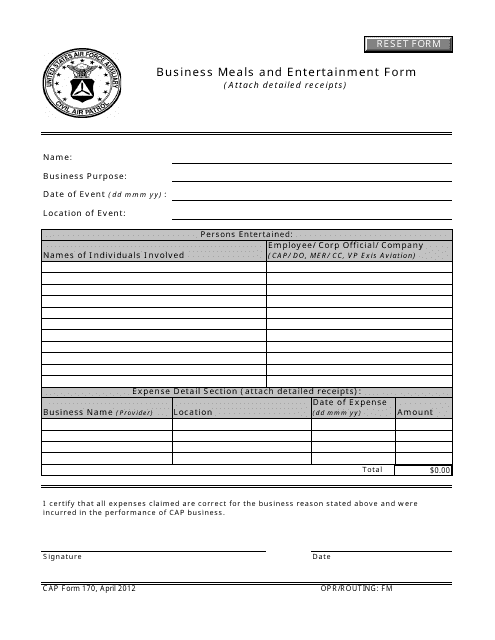

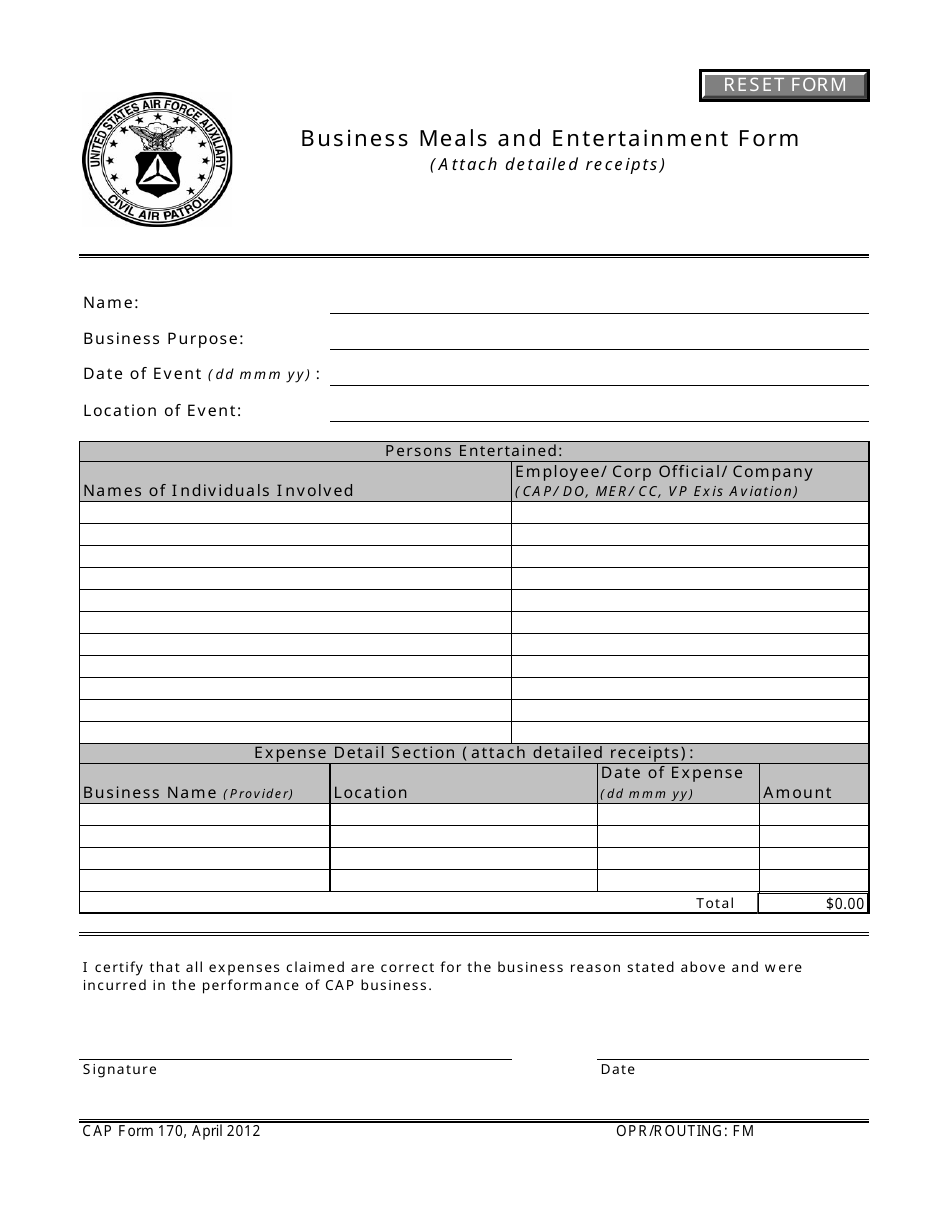

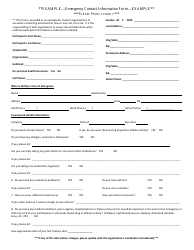

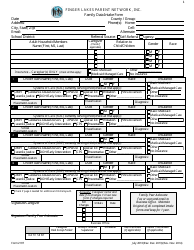

CAP Form 170 Business Meals and Entertainment Form

What Is CAP Form 170?

This is a legal form that was released by the U.S. Air Force - Civil Air Patrol on April 1, 2012 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is CAP Form 170?

A: CAP Form 170 is a form used for reporting business meals and entertainment expenses.

Q: What does CAP Form 170 cover?

A: CAP Form 170 covers expenses related to business meals and entertainment.

Q: Who needs to use CAP Form 170?

A: Businesses and individuals who incur business meals and entertainment expenses need to use CAP Form 170.

Q: What information is required in CAP Form 170?

A: CAP Form 170 requires information about the date, location, amount, and purpose of the business meals and entertainment expenses.

Q: Is CAP Form 170 specific to the United States or Canada?

A: CAP Form 170 is specific to the United States.

Q: What is the purpose of CAP Form 170?

A: The purpose of CAP Form 170 is to accurately report and document business meals and entertainment expenses for tax purposes.

Q: Are there any specific rules or guidelines for filling out CAP Form 170?

A: Yes, there are specific rules and guidelines provided with CAP Form 170 that need to be followed while filling out the form.

Q: Can CAP Form 170 be used for personal meals and entertainment expenses?

A: No, CAP Form 170 is specifically for reporting business meals and entertainment expenses and cannot be used for personal expenses.

Q: Do I need to keep records of the expenses reported on CAP Form 170?

A: Yes, it is important to keep proper records and receipts of the expenses reported on CAP Form 170 for documentation and audit purposes.

Form Details:

- Released on April 1, 2012;

- The latest available edition released by the U.S. Air Force - Civil Air Patrol;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of CAP Form 170 by clicking the link below or browse more documents and templates provided by the U.S. Air Force - Civil Air Patrol.