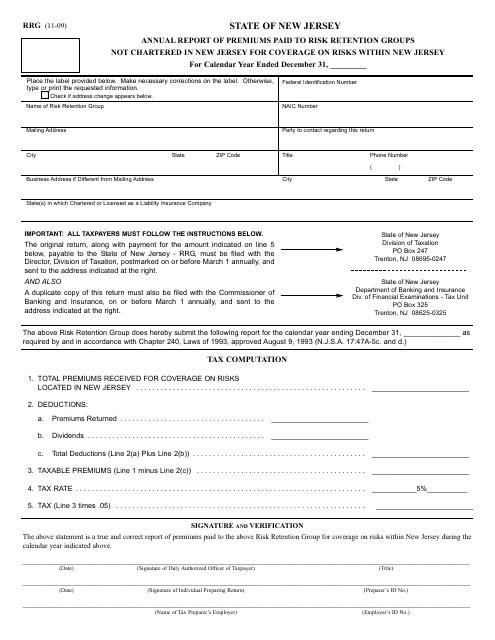

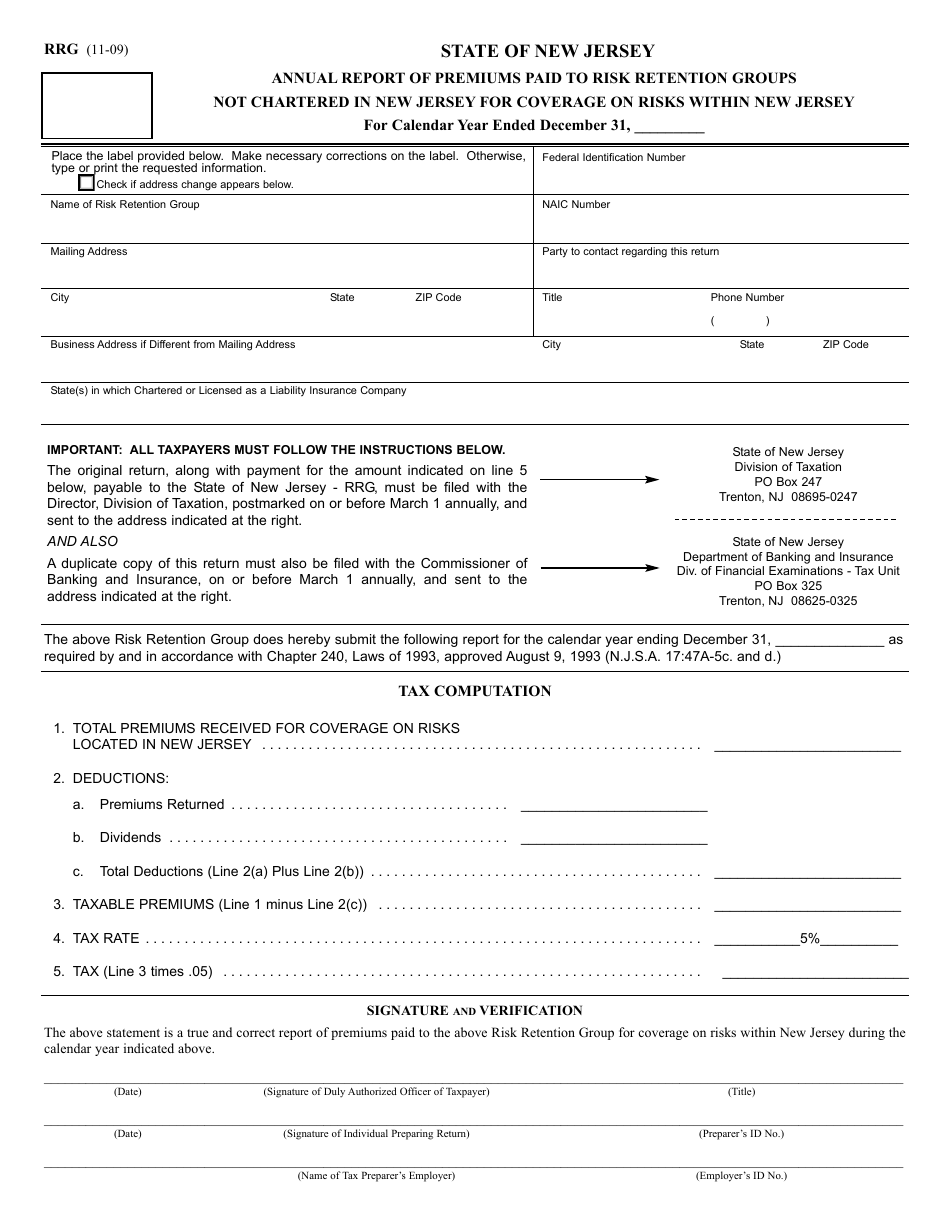

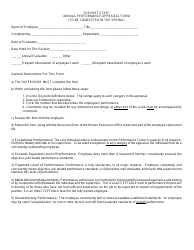

Form RRG Annual Report of Premiums Paid to Risk Retention Groups - New Jersey

What Is Form RRG?

This is a legal form that was released by the New Jersey Department of Banking and Insurance - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form RRG Annual Report?

A: The Form RRG Annual Report is a report that documents the premiums paid to Risk Retention Groups (RRGs) in the state of New Jersey.

Q: What are Risk Retention Groups?

A: Risk Retention Groups (RRGs) are insurance entities that are formed by members of similar businesses or activities to provide liability coverage for their group members.

Q: Who is required to file the Form RRG Annual Report?

A: Insurance companies and Risk Retention Groups (RRGs) operating in New Jersey are required to file the Form RRG Annual Report.

Q: What information is included in the Form RRG Annual Report?

A: The Form RRG Annual Report includes information about the premiums paid by Risk Retention Groups (RRGs), such as the amount of premiums and the number of policyholders.

Q: When is the deadline to file the Form RRG Annual Report?

A: The deadline to file the Form RRG Annual Report is typically on or before March 1st of each year.

Q: Are there any penalties for non-compliance with filing the Form RRG Annual Report?

A: Yes, there may be penalties for non-compliance with filing the Form RRG Annual Report, such as fines or other sanctions imposed by the New Jersey Department of Banking and Insurance.

Form Details:

- Released on November 1, 2009;

- The latest edition provided by the New Jersey Department of Banking and Insurance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RRG by clicking the link below or browse more documents and templates provided by the New Jersey Department of Banking and Insurance.