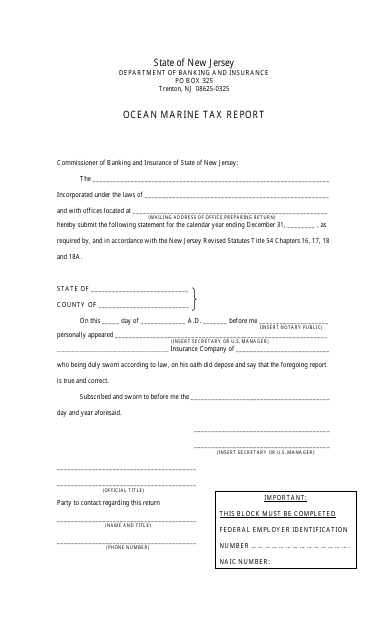

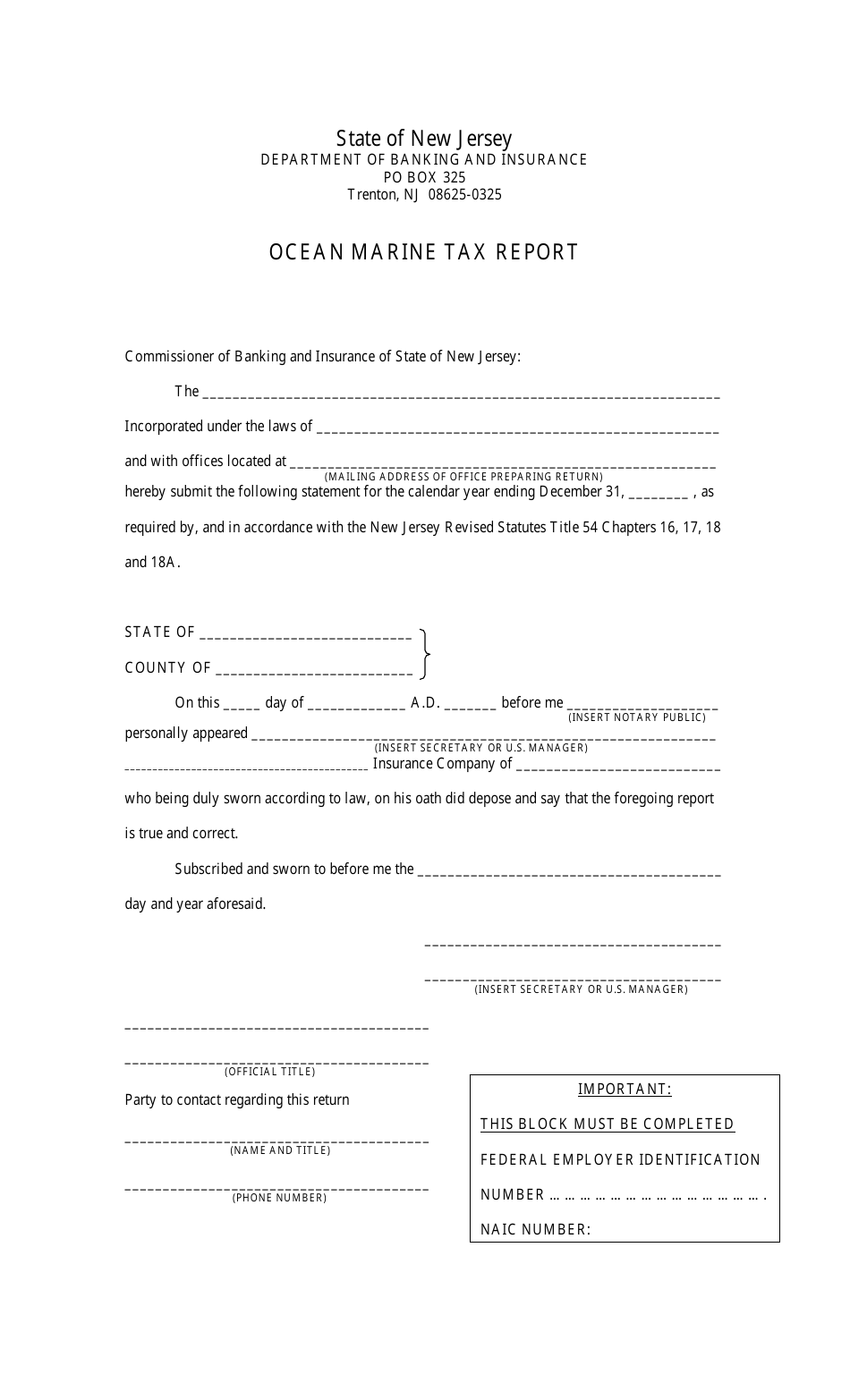

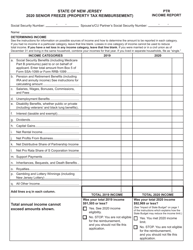

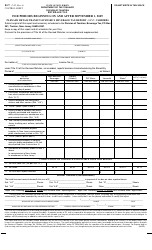

Ocean Marine Tax Report - New Jersey

Ocean Marine Tax Report is a legal document that was released by the New Jersey Department of Banking and Insurance - a government authority operating within New Jersey.

FAQ

Q: What is the Ocean Marine Tax Report?

A: The Ocean Marine Tax Report is a tax form that needs to be filed in New Jersey if you own or operate a vessel.

Q: Who needs to file the Ocean Marine Tax Report?

A: Anyone who owns or operates a vessel in New Jersey needs to file the Ocean Marine Tax Report.

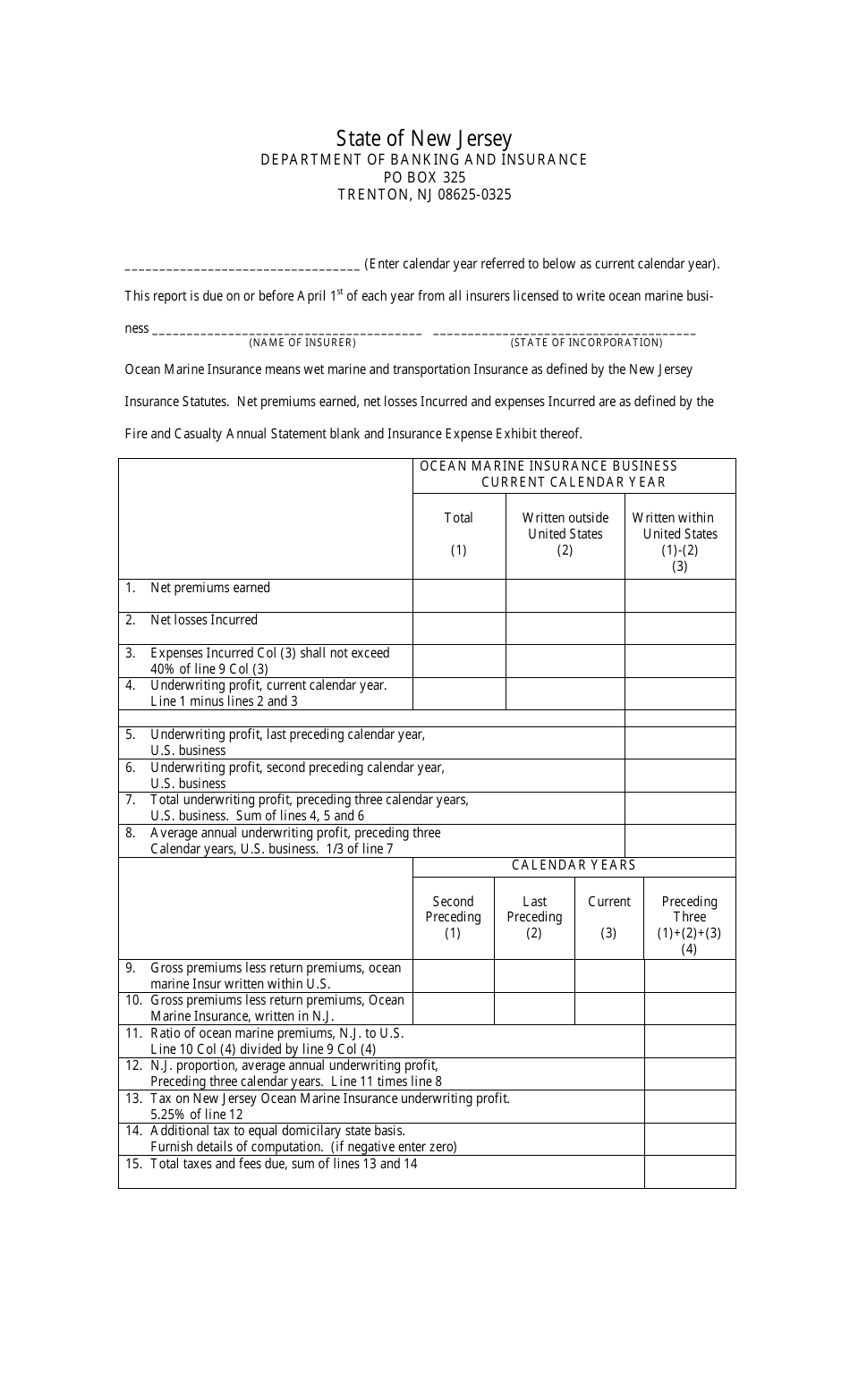

Q: When is the deadline to file the Ocean Marine Tax Report?

A: The deadline to file the Ocean Marine Tax Report in New Jersey is usually April 1st of each year.

Q: How can I obtain the Ocean Marine Tax Report form?

A: You can obtain the Ocean Marine Tax Report form from the New Jersey Department of Revenue and Finance.

Q: Is there a penalty for not filing the Ocean Marine Tax Report?

A: Yes, there may be penalties for not filing the Ocean Marine Tax Report, so it is important to file it on time.

Q: What information do I need to include in the Ocean Marine Tax Report?

A: You will need to provide information about your vessel, such as its identification number, value, and the dates it was operated in New Jersey.

Q: Are there any exemptions or deductions available for the Ocean Marine Tax?

A: There may be exemptions or deductions available for the Ocean Marine Tax in New Jersey. It is best to consult with a tax professional for specific details.

Q: What happens if I sell my vessel during the year?

A: If you sell your vessel during the year, you will still need to file the Ocean Marine Tax Report for the period of time you owned and operated the vessel.

Q: Can I e-file the Ocean Marine Tax Report?

A: At the time of this document, e-filing for Ocean Marine Tax Report is not available. Check with the New Jersey Department of Revenue and Finance for the most current information.

Form Details:

- The latest edition currently provided by the New Jersey Department of Banking and Insurance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the New Jersey Department of Banking and Insurance.