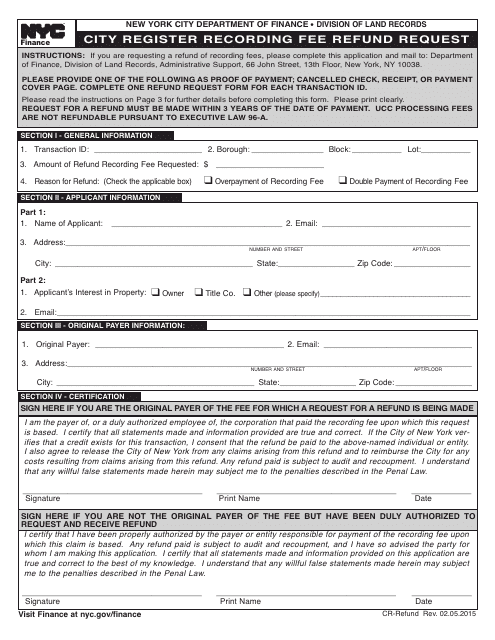

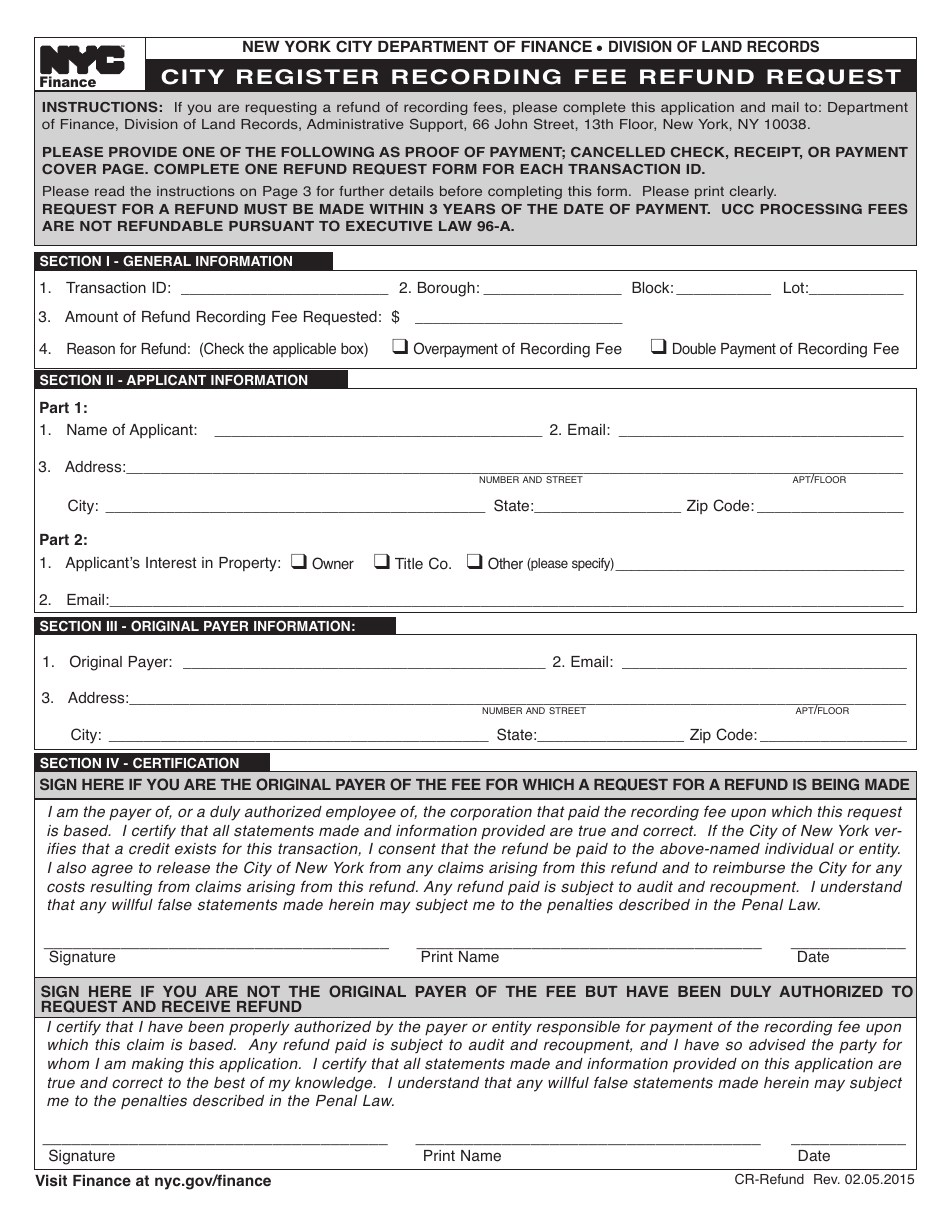

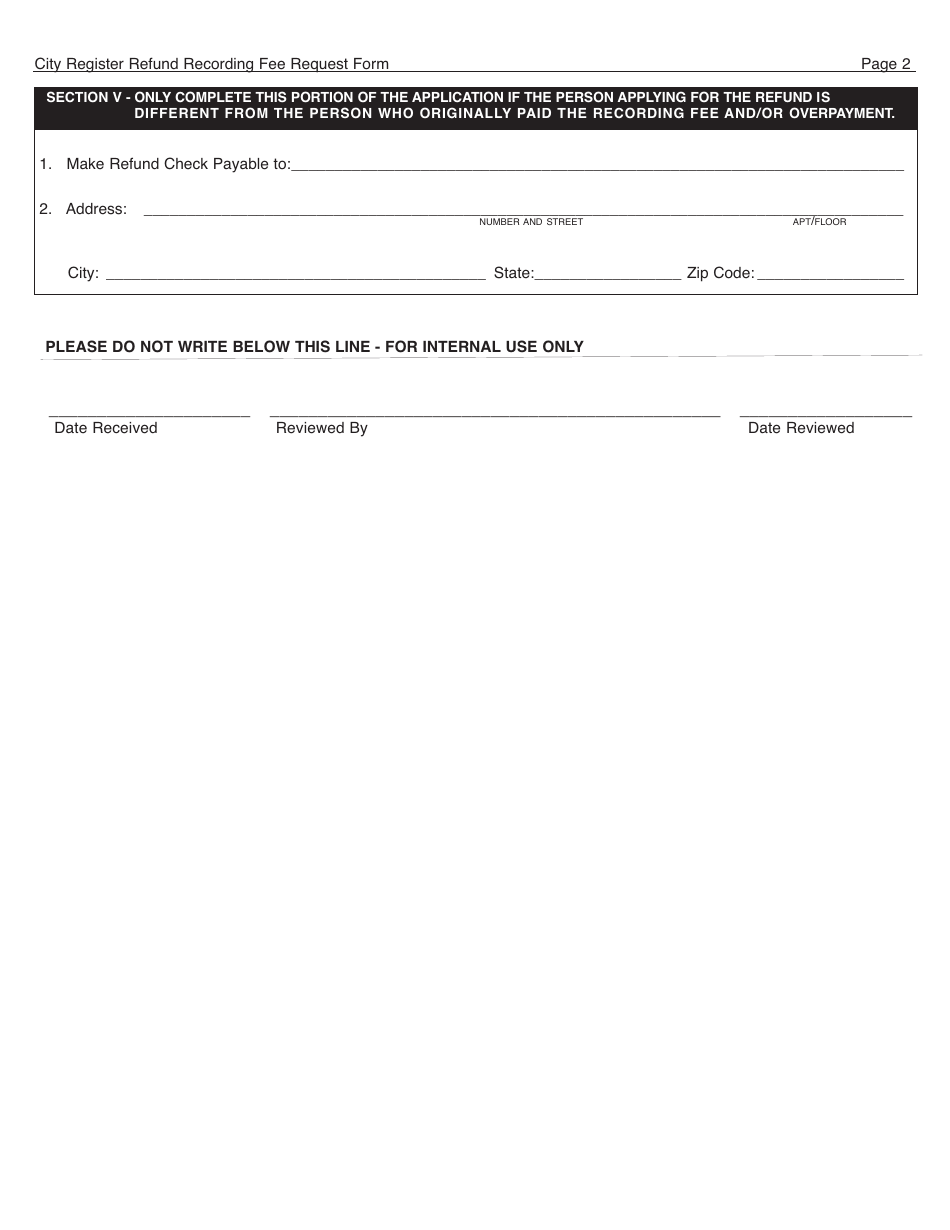

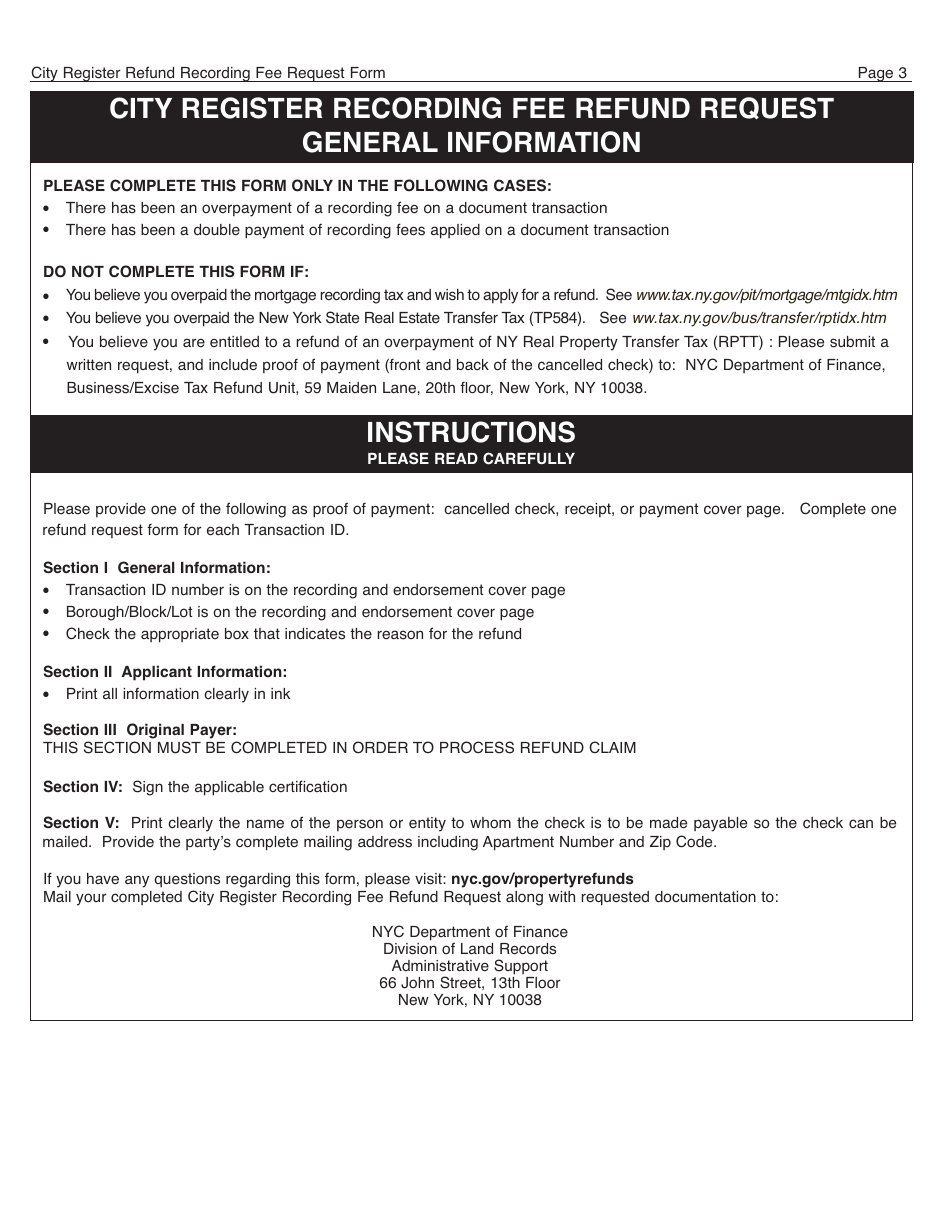

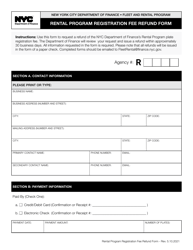

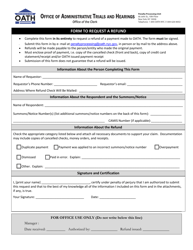

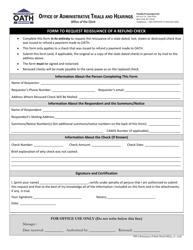

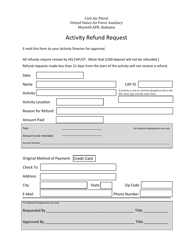

Form CR-REFUND City Register Recording Fee Refund Request - New York City

What Is Form CR-REFUND?

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

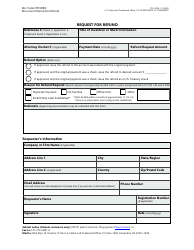

Q: What is CR-REFUND?

A: CR-REFUND is the form used to request a refund for the City Register Recording Fee in New York City.

Q: What is the City Register Recording Fee?

A: The City Register Recording Fee is a fee charged for recording certain documents with the City Register in New York City.

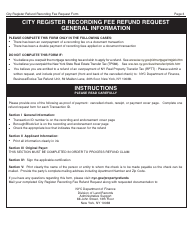

Q: How can I request a refund for the City Register Recording Fee?

A: You can request a refund by completing the CR-REFUND form and submitting it to the appropriate department.

Q: Are there any eligibility requirements for the refund?

A: Yes, there may be eligibility requirements depending on the specific circumstances. You should review the instructions on the CR-REFUND form.

Q: How long does it take to receive a refund?

A: The processing time for a refund can vary depending on the department and the circumstances. It is best to contact the department for an estimated timeline.

Q: Is there a fee for requesting a refund?

A: There is typically no fee for requesting a refund, but you should review the instructions on the CR-REFUND form to confirm.

Q: What other documents do I need to submit along with the CR-REFUND form?

A: The specific requirements may vary depending on the circumstances. You should review the instructions on the CR-REFUND form for a list of required documents.

Q: Who should I contact for more information or assistance?

A: You should contact the appropriate department or agency responsible for processing the CR-REFUND form for more information or assistance.

Form Details:

- Released on February 5, 2015;

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CR-REFUND by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.