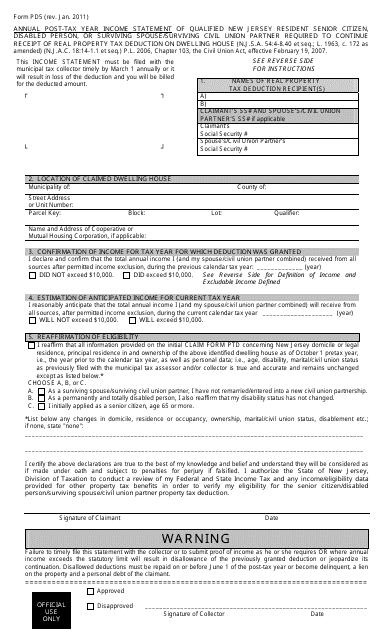

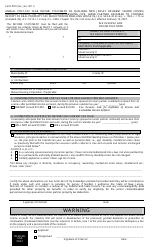

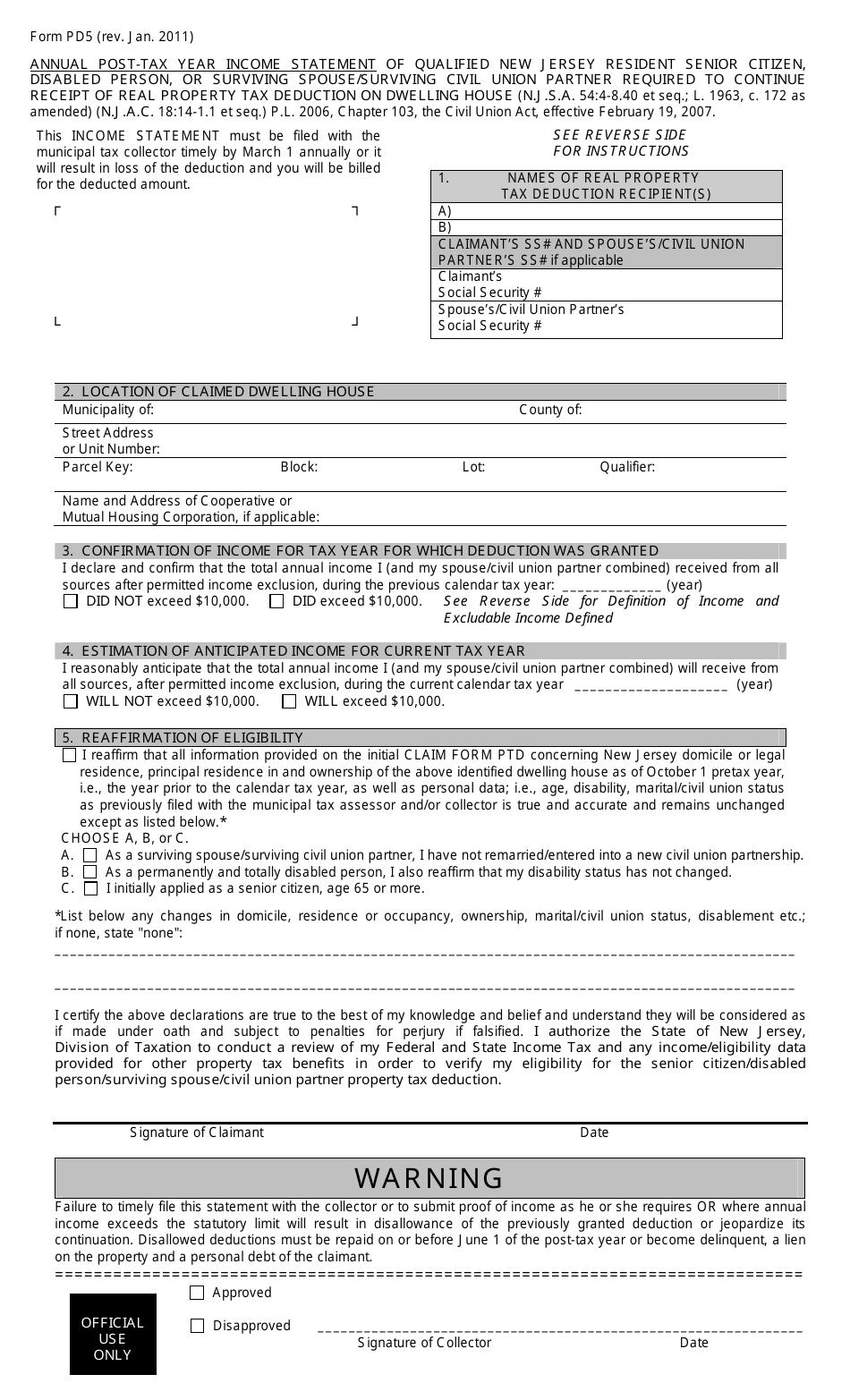

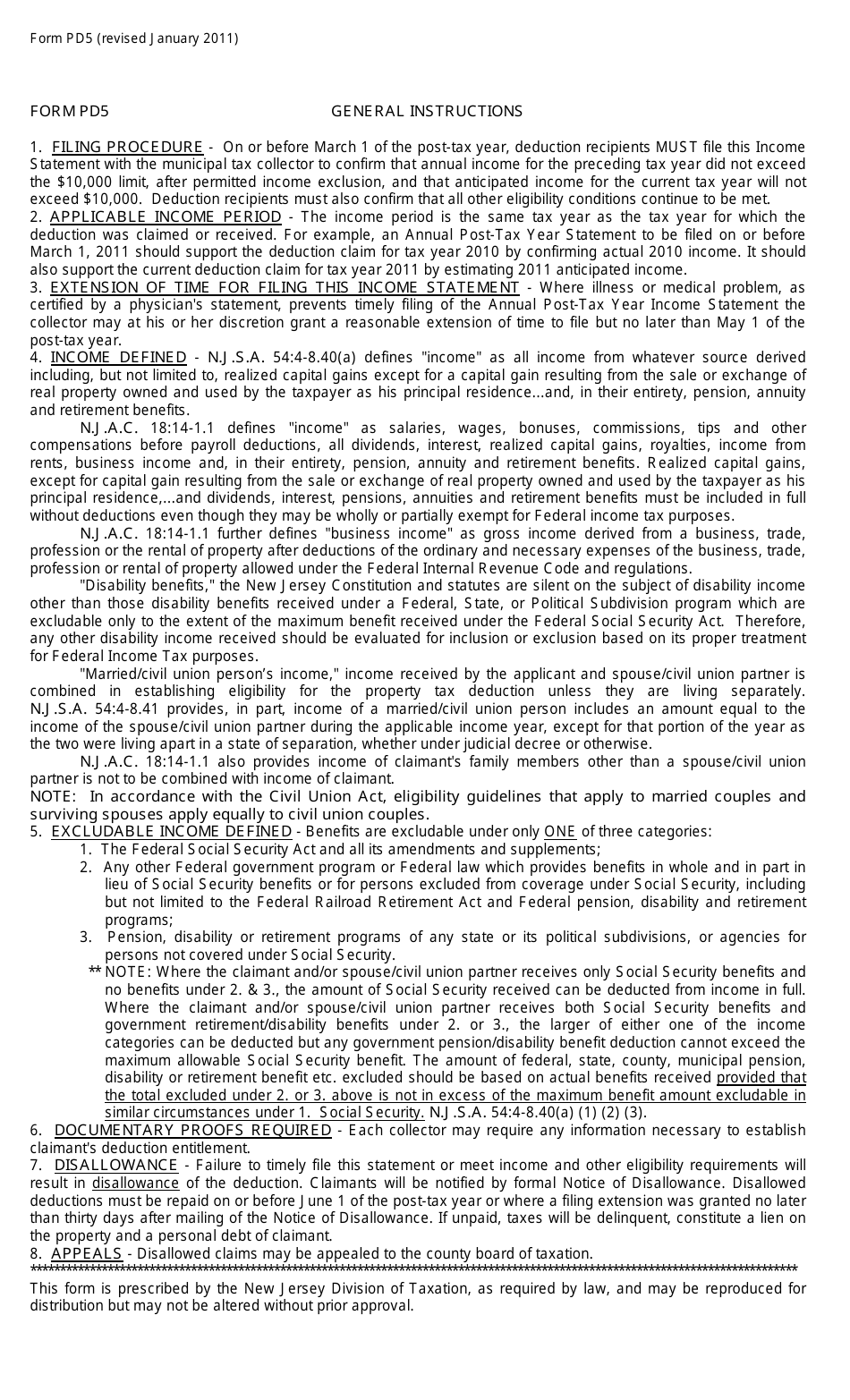

Form PD5 Annual Post-tax Year Income Statement - New Jersey

What Is Form PD5?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PD5?

A: Form PD5 is the Annual Post-tax Year Income Statement for New Jersey.

Q: Who is required to file Form PD5?

A: All taxpayers who are residents of New Jersey and have a gross income of $10,000 or more during the tax year are required to file Form PD5.

Q: What is the purpose of Form PD5?

A: The purpose of Form PD5 is to report your annual post-tax year income to the State of New Jersey.

Q: What information is needed to complete Form PD5?

A: To complete Form PD5, you will need your personal information, including your name, Social Security Number, and address, as well as details about your income sources and deductions.

Q: When is the deadline to file Form PD5?

A: Form PD5 must be filed by April 15th of the year following the tax year.

Form Details:

- Released on January 1, 2011;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PD5 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.