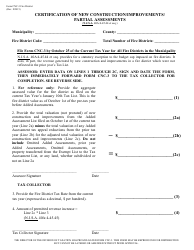

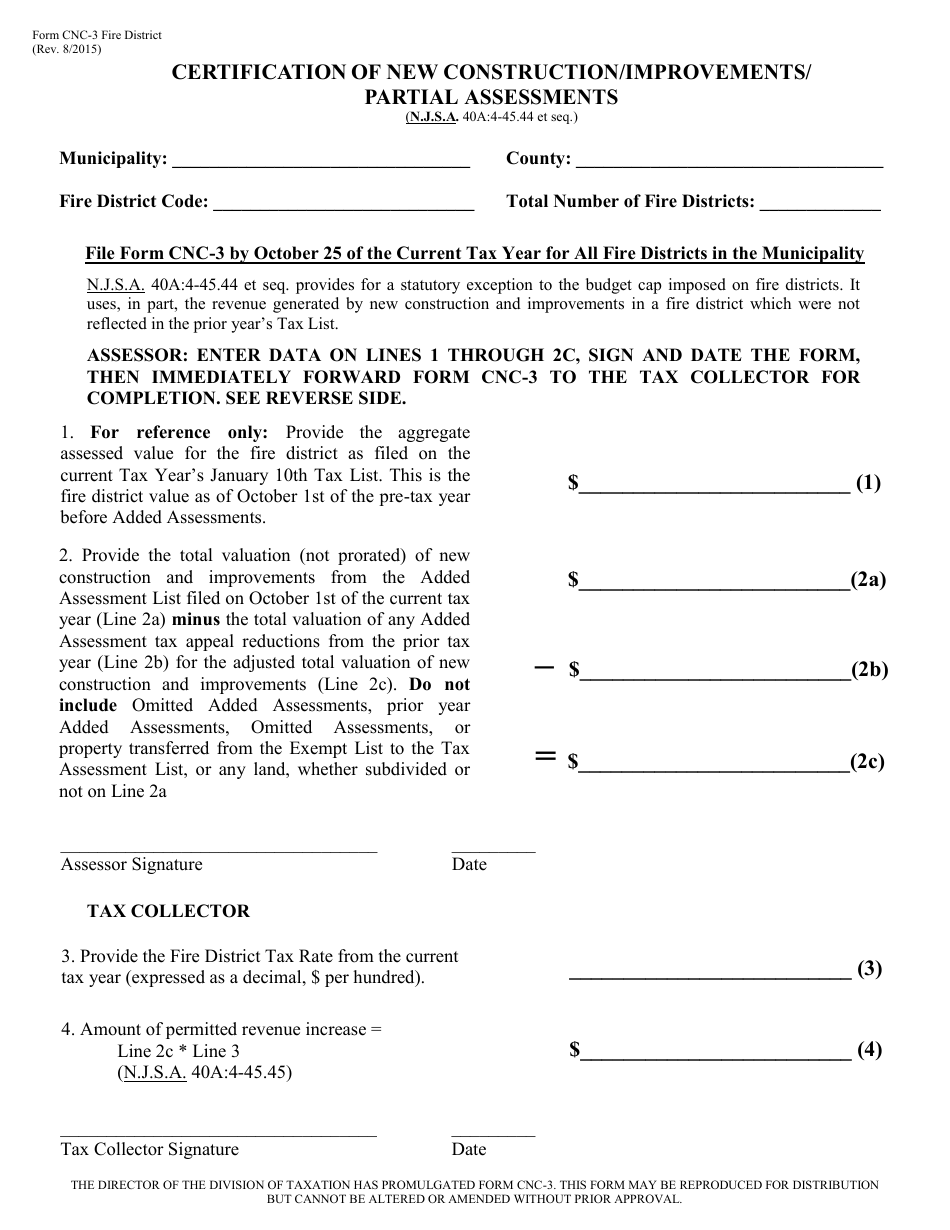

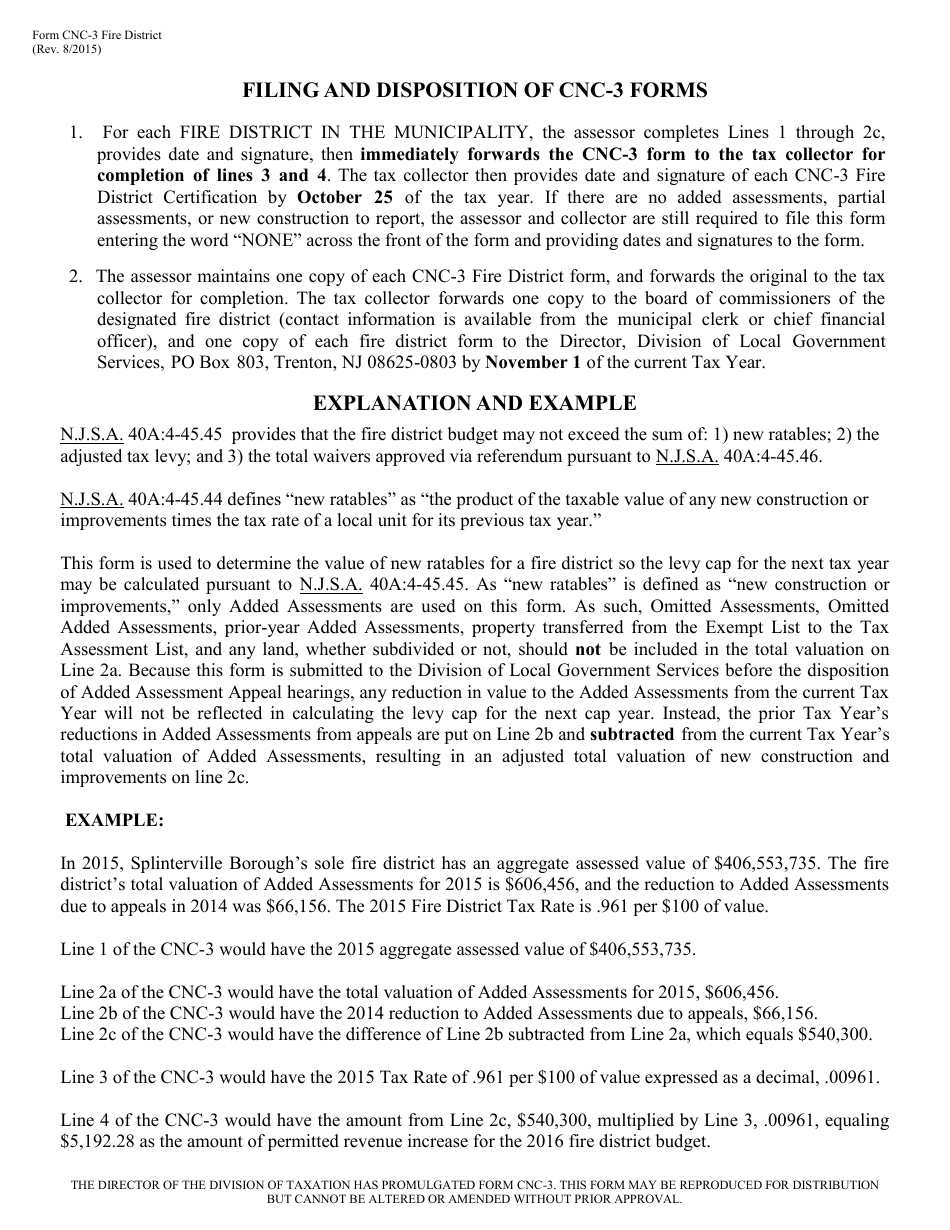

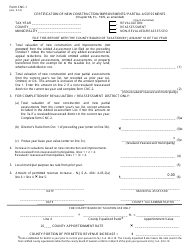

Form CNC-3 Certification of New Construction / Improvements / Partial Assessments - New Jersey

What Is Form CNC-3?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CNC-3 for?

A: Form CNC-3 is used for the Certification of New Construction/Improvements/Partial Assessments in New Jersey.

Q: Who needs to fill out Form CNC-3?

A: The Form CNC-3 needs to be filled out by property owners or their agents who have made improvements or constructed new buildings.

Q: What information is required on Form CNC-3?

A: Form CNC-3 requires information about the property, the type of construction or improvement made, and the cost of the construction or improvement.

Q: When do I need to submit Form CNC-3?

A: Form CNC-3 needs to be submitted to the Tax Assessor's office within 30 days after completion of the construction or improvement.

Q: What happens after I submit Form CNC-3?

A: After submitting Form CNC-3, the Tax Assessor will review the information provided and evaluate the impact on the property tax assessment.

Q: What if I don't submit Form CNC-3?

A: Failure to submit Form CNC-3 may result in inaccurate property tax assessments and potential penalties.

Q: Can I appeal the property tax assessment based on the information provided in Form CNC-3?

A: Yes, property owners have the right to appeal the property tax assessment if they believe it is incorrect based on the information provided in Form CNC-3.

Q: Are there any fees associated with filing Form CNC-3?

A: There may be filing fees associated with submitting Form CNC-3, which vary by municipality.

Q: Is Form CNC-3 specific to New Jersey?

A: Yes, Form CNC-3 is specific to New Jersey and is not used for property tax assessments in other states.

Form Details:

- Released on August 1, 2015;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CNC-3 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.