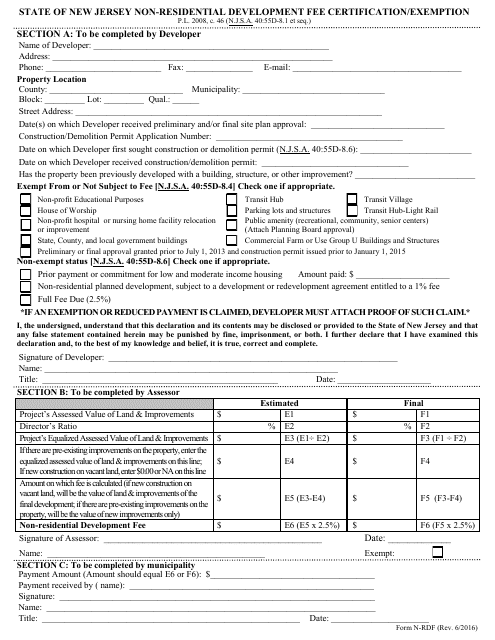

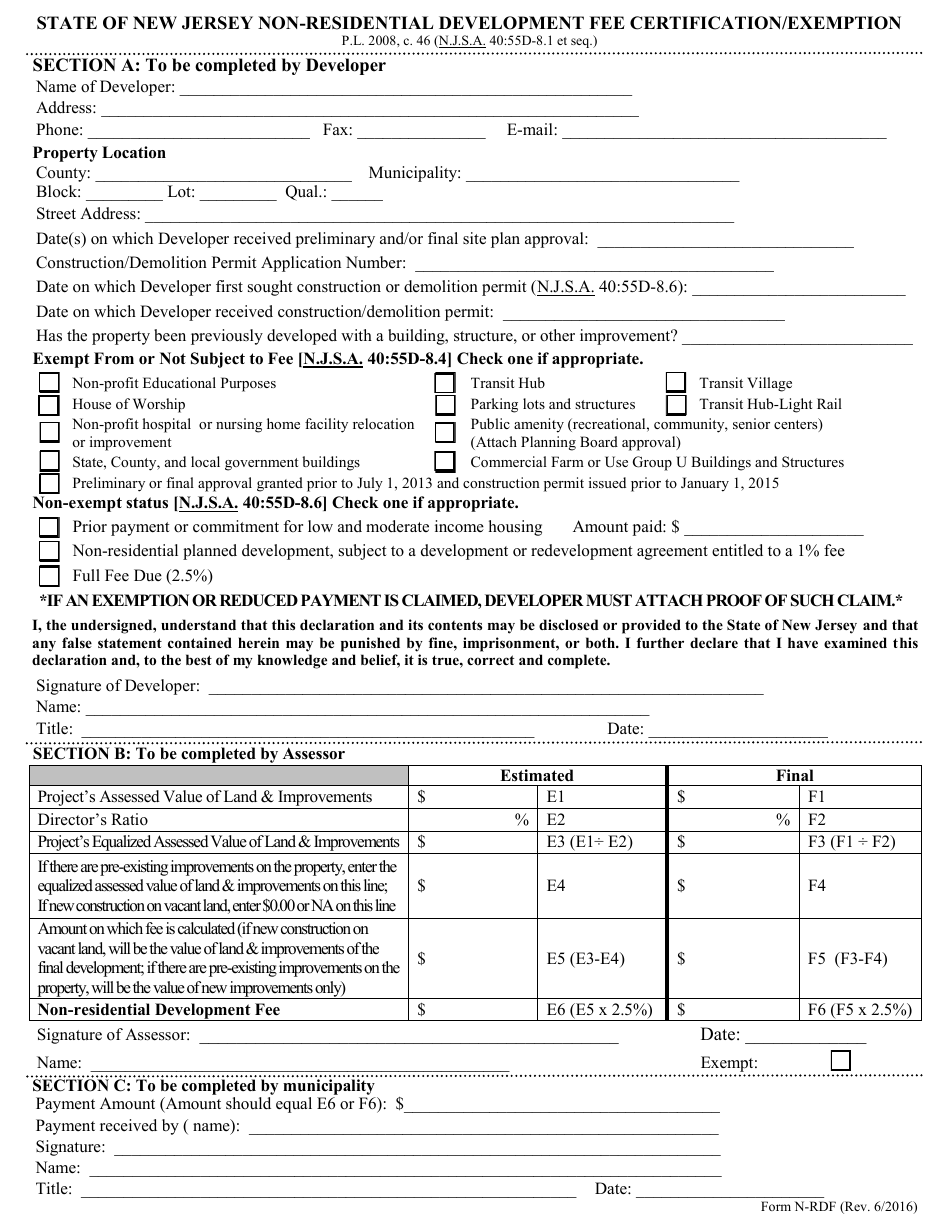

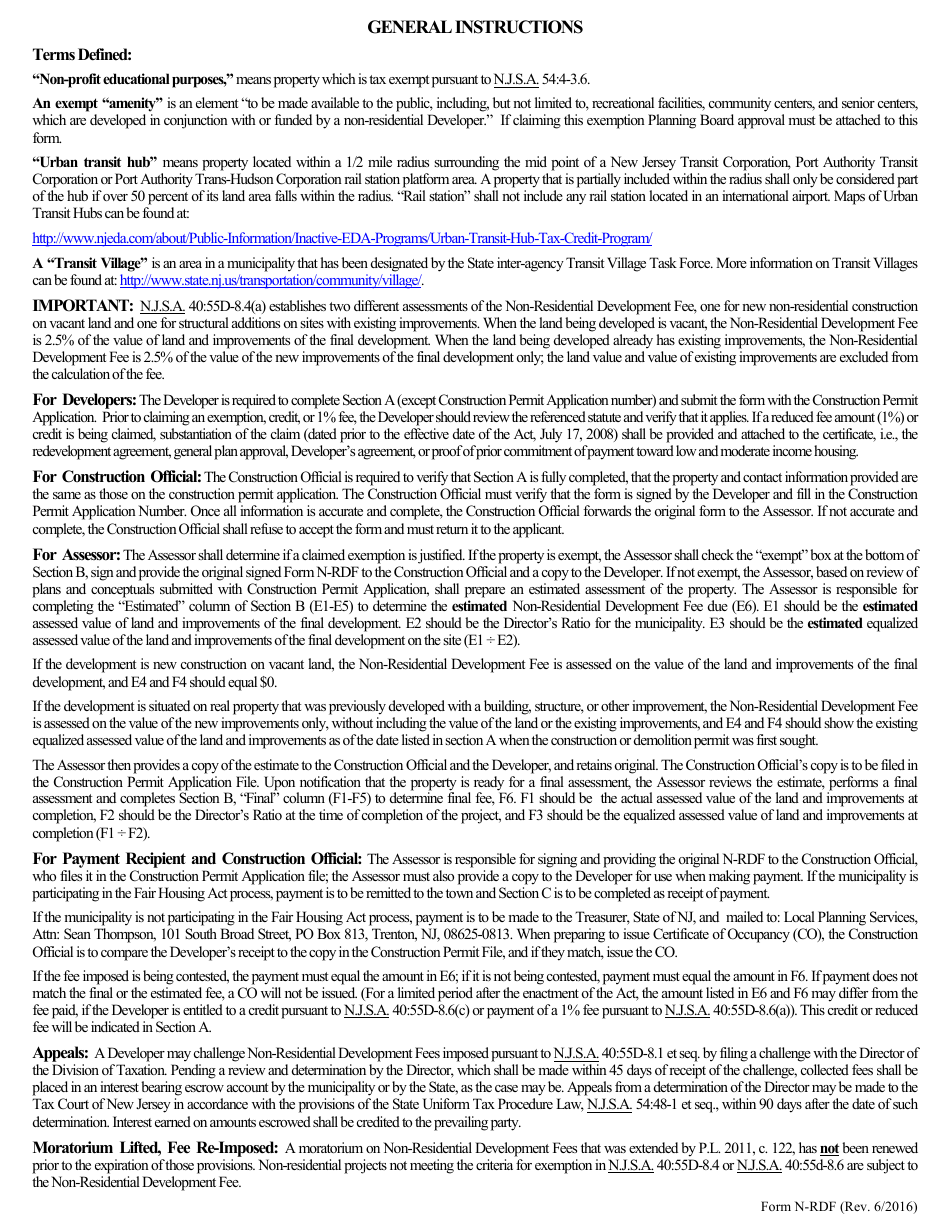

Form N-RDF Non-residential Development Fee Certification / Exemption - New Jersey

What Is Form N-RDF?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-RDF?

A: Form N-RDF is the abbreviation for Non-residential Development Fee Certification/Exemption form.

Q: What is the purpose of Form N-RDF?

A: The purpose of Form N-RDF is to certify or claim an exemption from the Non-residential Development Fee in the state of New Jersey.

Q: Who needs to fill out Form N-RDF?

A: Anyone who is undertaking a non-residential development project in New Jersey may need to fill out Form N-RDF.

Q: What is the Non-residential Development Fee?

A: The Non-residential Development Fee is a fee imposed on non-residential development projects in New Jersey to support affordable housing.

Q: How do I certify or claim an exemption from the Non-residential Development Fee?

A: You can certify or claim an exemption from the Non-residential Development Fee by filling out Form N-RDF and submitting it to the appropriate agency in New Jersey.

Q: What information do I need to provide on Form N-RDF?

A: You will need to provide information about the non-residential development project, such as the address and purpose of the development, as well as information about the developer.

Q: Are there any exemptions from the Non-residential Development Fee?

A: Yes, there are certain exemptions from the Non-residential Development Fee. These exemptions are listed on Form N-RDF, and you must meet the eligibility criteria to claim an exemption.

Q: What happens after I submit Form N-RDF?

A: After you submit Form N-RDF, the appropriate agency will review your form and determine whether you are eligible for certification or exemption from the Non-residential Development Fee.

Q: What should I do if I have more questions about Form N-RDF?

A: If you have more questions about Form N-RDF, you should contact the New Jersey Department of Community Affairs or the local agency responsible for non-residential development in your area.

Form Details:

- Released on June 1, 2016;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-RDF by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.