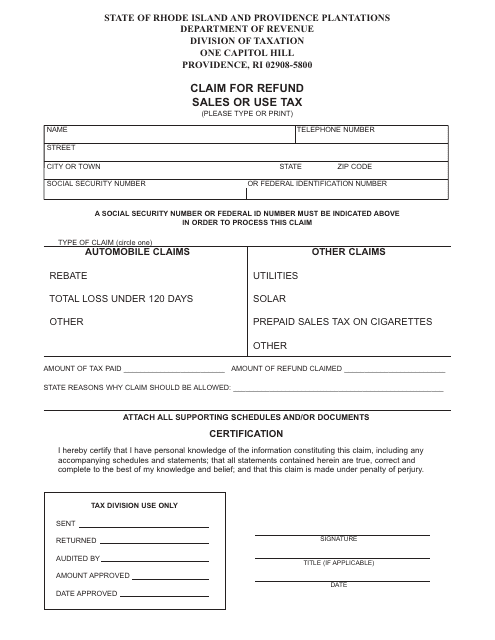

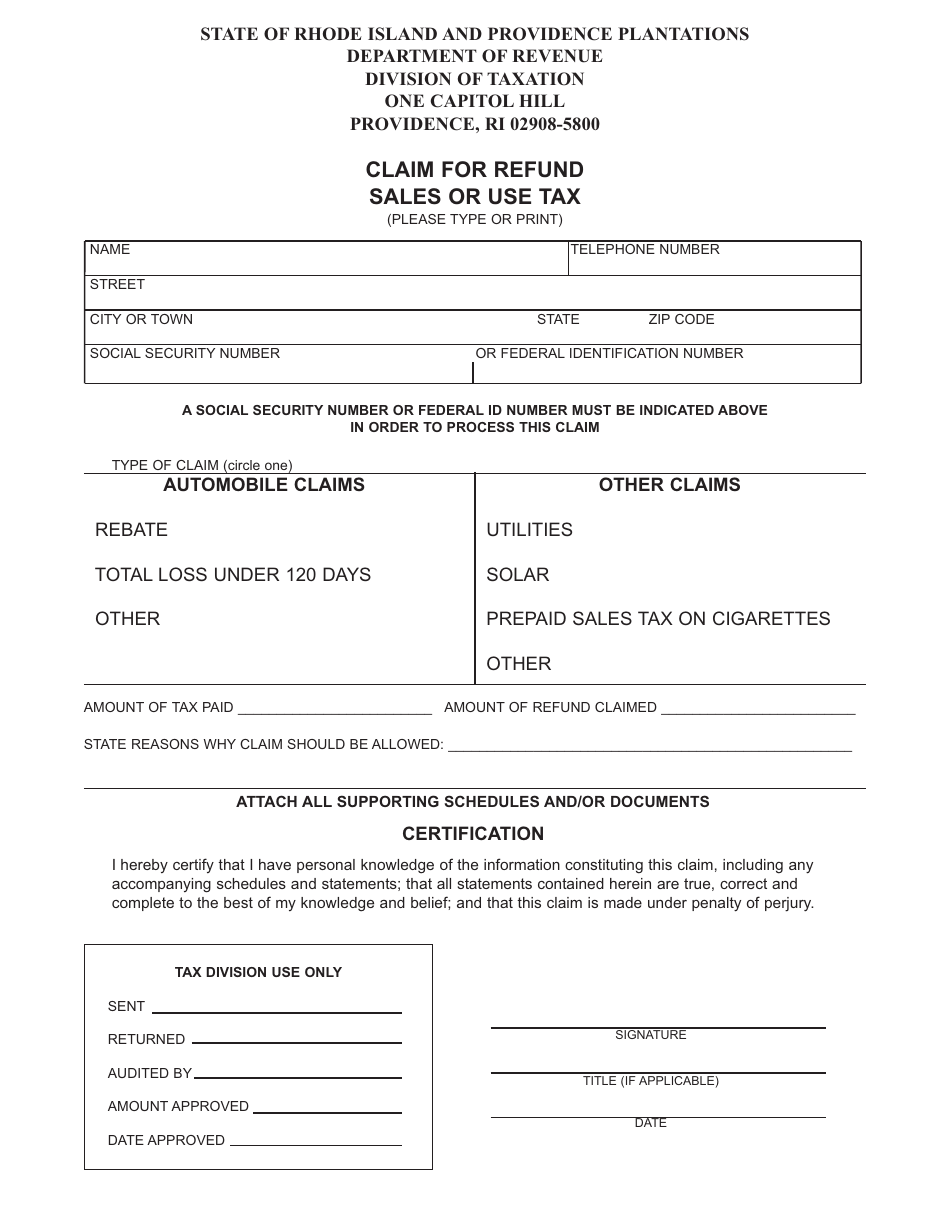

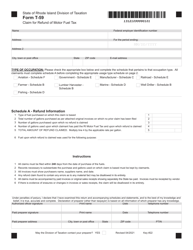

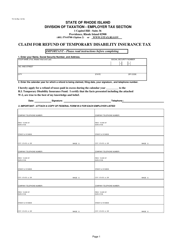

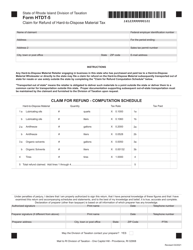

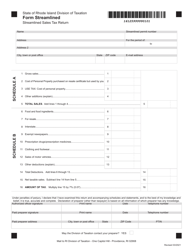

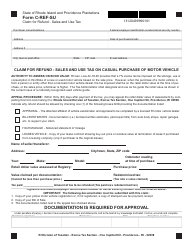

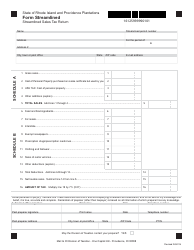

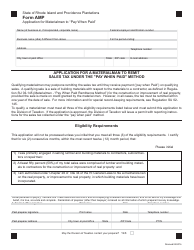

Claim for Refund - Sales or Use Tax - Rhode Island

Claim for Refund - Sales or Use Tax is a legal document that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island.

FAQ

Q: What is a Sales or Use Tax Claim for Refund?

A: A Sales or Use Tax Claim for Refund is a request to the Rhode Island Division of Taxation to return the sales or use tax paid on a purchase.

Q: Who can file a Sales or Use Tax Claim for Refund?

A: Any individual or business entity that paid sales or use tax in Rhode Island and believes they are entitled to a refund can file a claim.

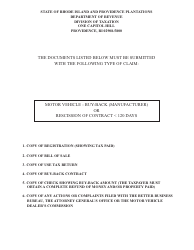

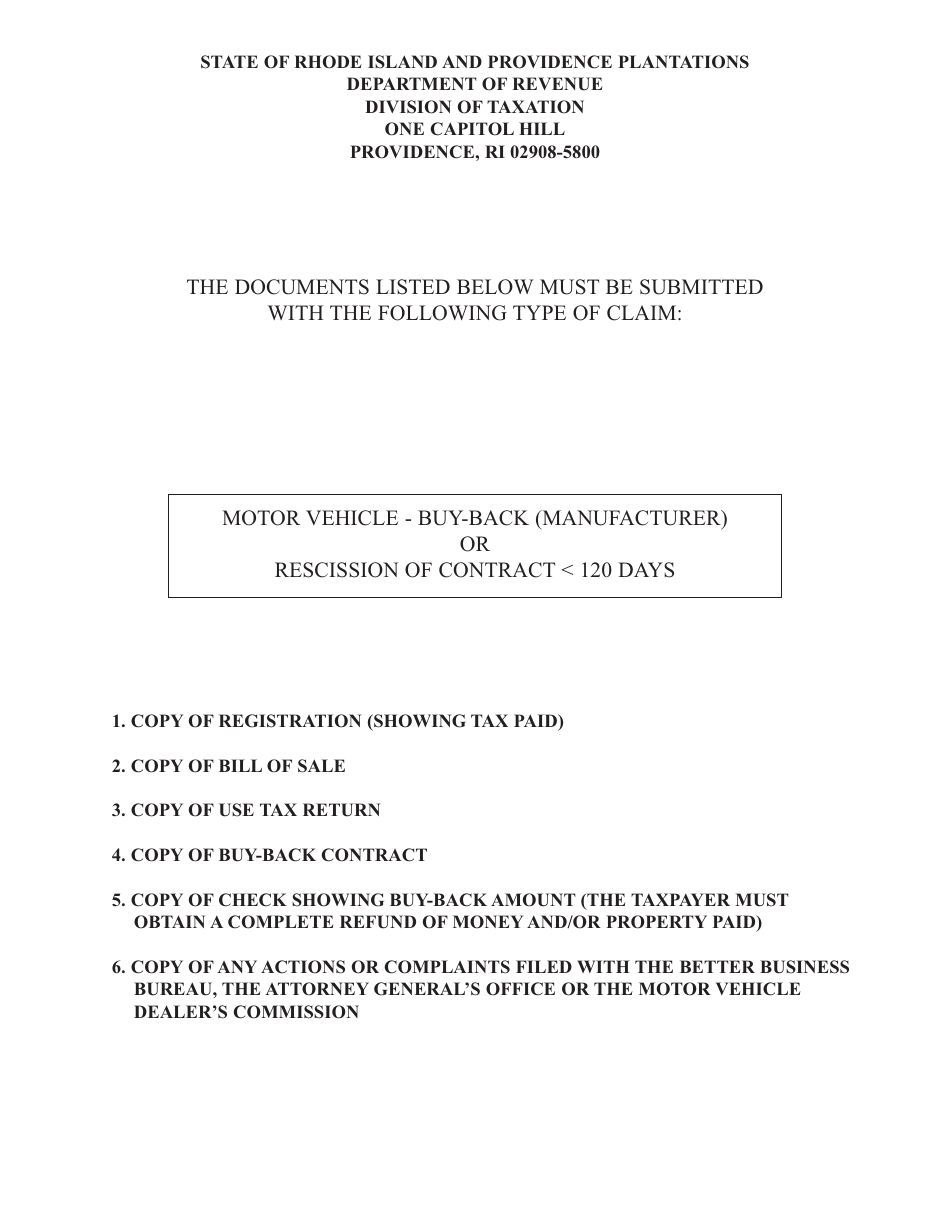

Q: What are the requirements for filing a Sales or Use Tax Claim for Refund?

A: The requirements for filing a claim include providing proof of payment, such as receipts or invoices, and submitting the claim within the applicable time period.

Q: What is the time period for filing a Sales or Use Tax Claim for Refund?

A: Generally, a claim must be filed within three years from the due date of the original return or within one year from the date of overpayment, whichever is later.

Form Details:

- The latest edition currently provided by the Rhode Island Department of Revenue - Division of Taxation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.