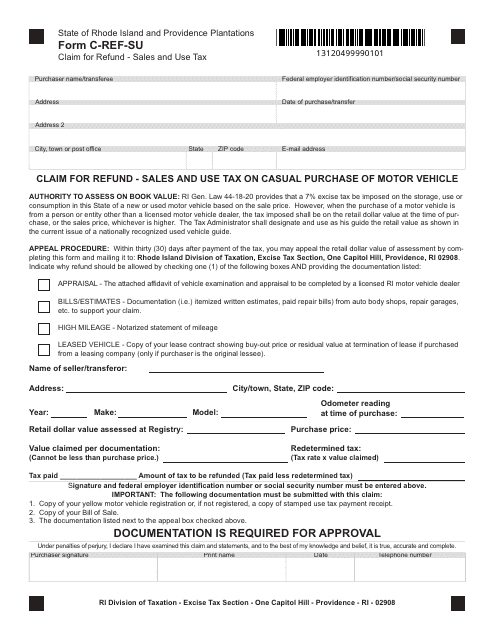

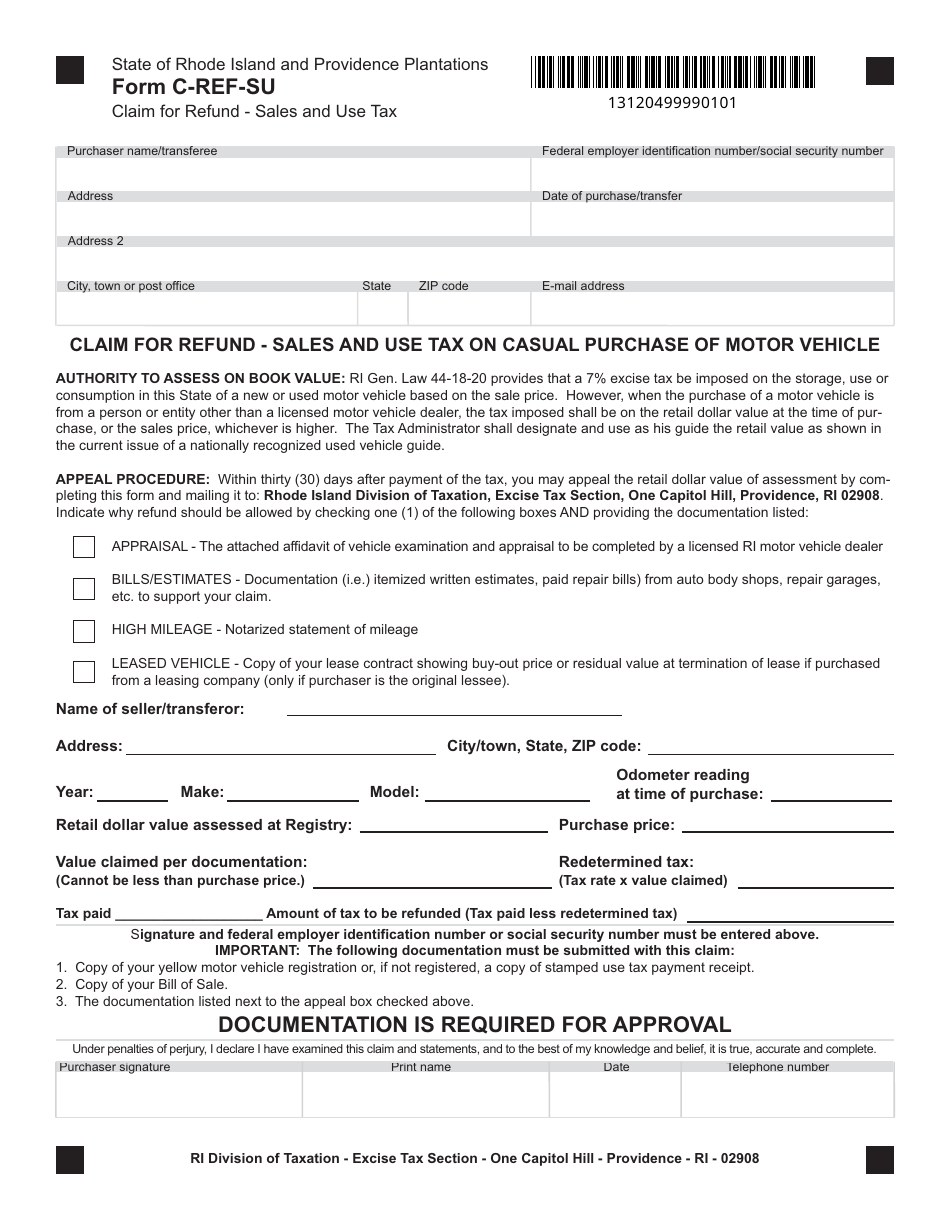

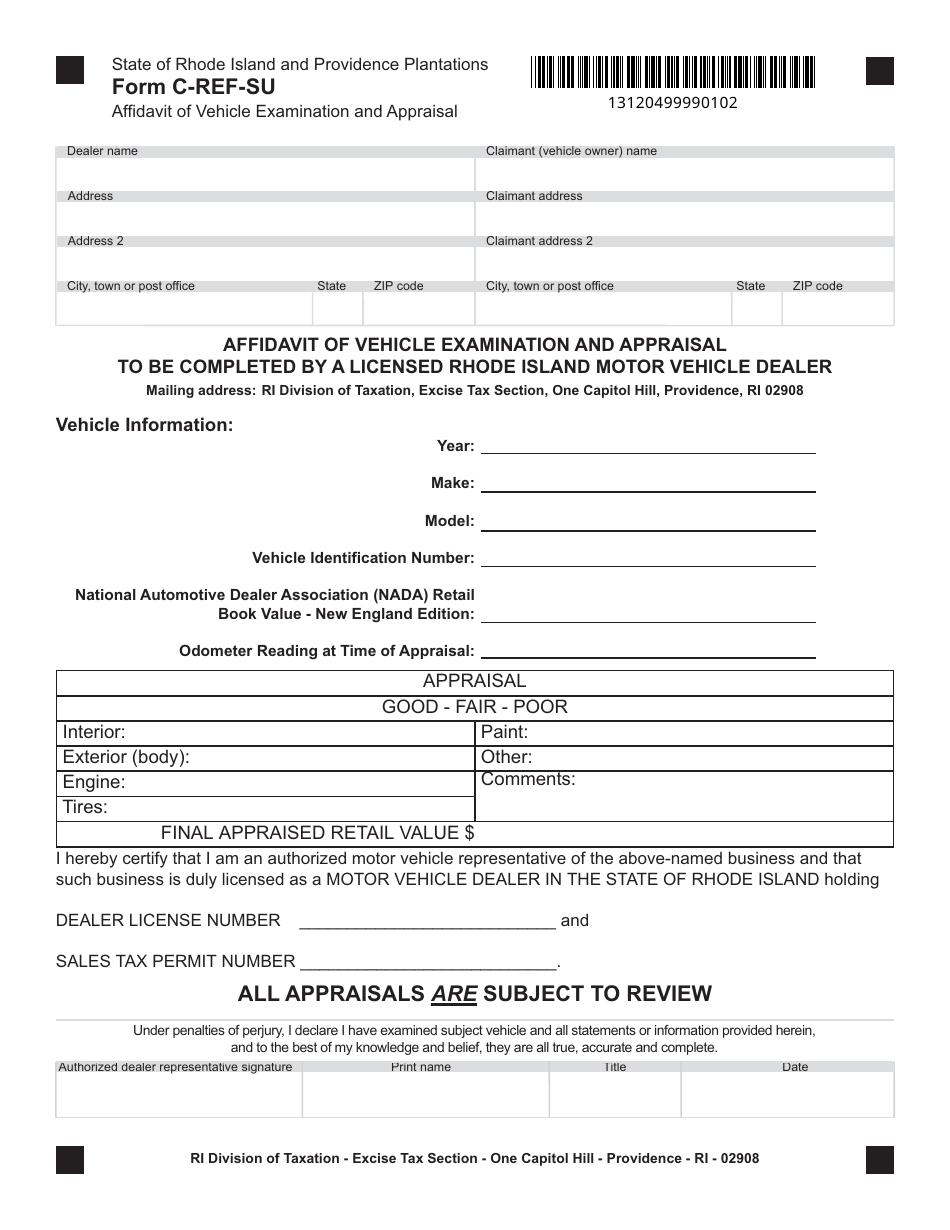

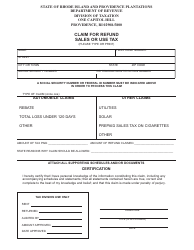

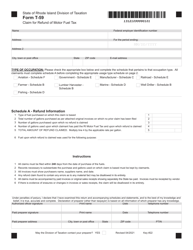

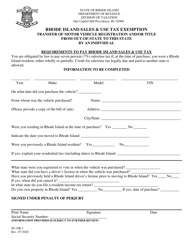

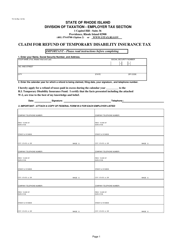

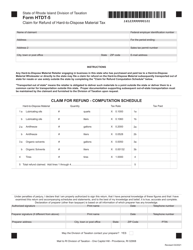

Form C-REF-SU Claim for Refund - Sales and Use Tax on Casual Purchase of Motor Vehicle - Rhode Island

What Is Form C-REF-SU?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form C-REF-SU?

A: Form C-REF-SU is a form used in Rhode Island to claim a refund for sales and use tax on a casual purchase of a motor vehicle.

Q: What is the purpose of Form C-REF-SU?

A: The purpose of Form C-REF-SU is to request a refund of sales and use tax that was paid on a casual purchase of a motor vehicle in Rhode Island.

Q: Who can use Form C-REF-SU?

A: Any individual who purchased a motor vehicle in Rhode Island and paid sales and use tax on the purchase can use Form C-REF-SU to claim a refund.

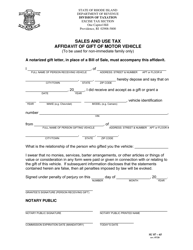

Q: What is a casual purchase of a motor vehicle?

A: A casual purchase of a motor vehicle refers to a one-time purchase from an individual, rather than a dealership or business.

Q: How long do I have to submit Form C-REF-SU?

A: Form C-REF-SU must be submitted within one year from the date of purchase of the motor vehicle.

Q: What supporting documents do I need to include with Form C-REF-SU?

A: You will need to include copies of the bill of sale, title, and a copy of the cancelled check or other proof of payment.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form C-REF-SU by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.