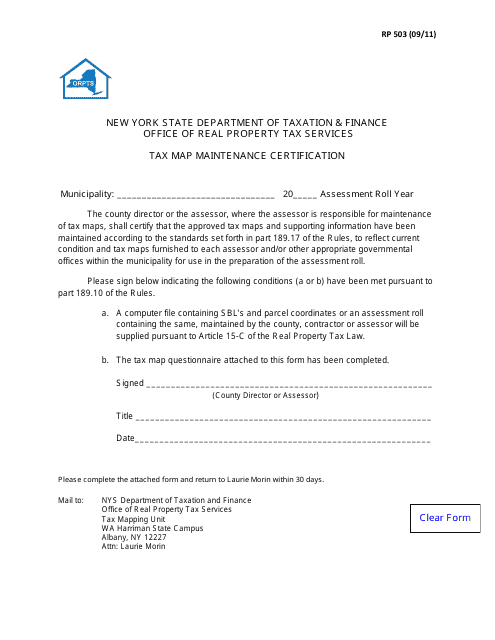

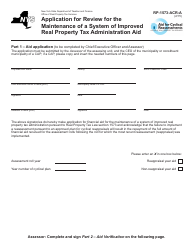

Form RP503 Tax Map Maintenance Certification - New York

What Is Form RP503?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is RP503 Tax Map Maintenance Certification?

A: RP503 Tax Map Maintenance Certification is a form used in New York to certify the accuracy and maintenance of tax maps.

Q: Who needs to file RP503 Tax Map Maintenance Certification?

A: Property owners or their designated agents who are responsible for maintaining tax maps need to file RP503 Tax Map Maintenance Certification.

Q: When is RP503 Tax Map Maintenance Certification due?

A: RP503 Tax Map Maintenance Certification is due on or before May 31st each year.

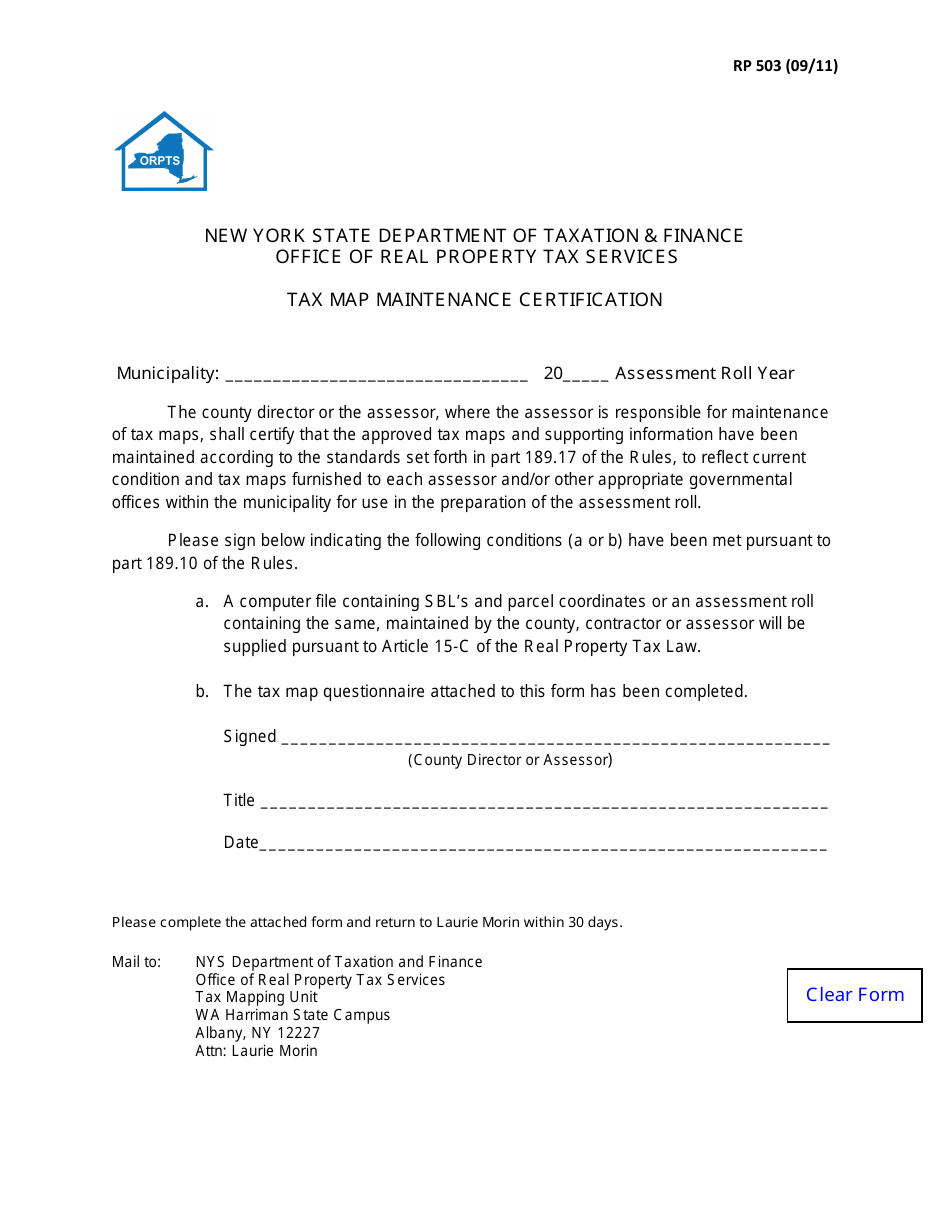

Q: What information is required in RP503 Tax Map Maintenance Certification?

A: RP503 Tax Map Maintenance Certification requires information such as the property identification number, owner's name, address, and a statement certifying the accuracy of the tax map.

Q: What are the consequences of not filing RP503 Tax Map Maintenance Certification?

A: Failure to file RP503 Tax Map Maintenance Certification may result in penalties and fines imposed by the local tax authorities.

Form Details:

- Released on September 1, 2011;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP503 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.