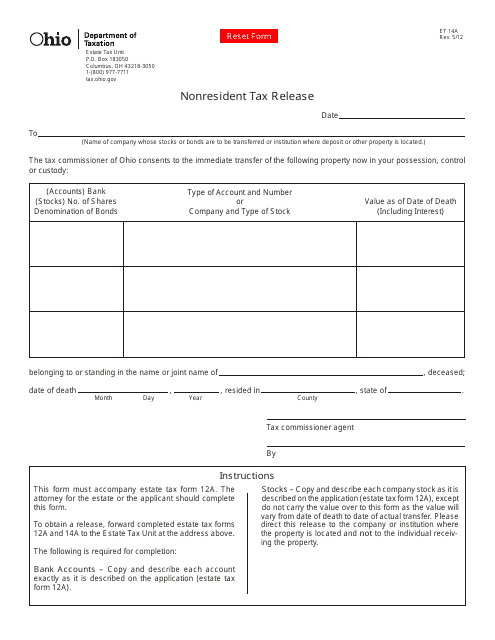

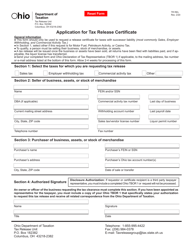

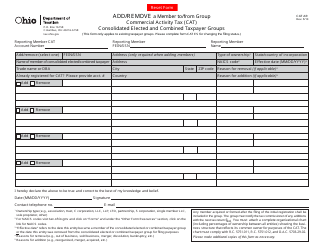

Form ET14A Nonresident Tax Release - Ohio

What Is Form ET14A?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ET14A?

A: Form ET14A is a Nonresident Tax Release form used in the state of Ohio.

Q: Who needs to file Form ET14A?

A: Nonresidents who have been subject to withholding tax in Ohio may need to file Form ET14A to release the withholding tax.

Q: What is the purpose of Form ET14A?

A: The purpose of Form ET14A is to release the withholding tax on income earned by nonresidents in Ohio.

Q: What information is required on Form ET14A?

A: Form ET14A requires information such as the taxpayer's name, address, social security number, and the amount of withholding tax being released.

Q: When is Form ET14A due?

A: Form ET14A must be filed within 12 months from the end of the tax year in which the withholding tax was paid.

Q: Are there any fees associated with filing Form ET14A?

A: No, there are no fees associated with filing Form ET14A.

Q: Can Form ET14A be filed electronically?

A: No, Form ET14A cannot be filed electronically. It must be filed by mail or in person.

Q: Is Form ET14A only for nonresidents?

A: Yes, Form ET14A is specifically for nonresidents who have been subject to withholding tax in Ohio.

Q: What should I do if I have questions about Form ET14A?

A: If you have questions about Form ET14A, you can contact the Ohio Department of Taxation for assistance.

Form Details:

- Released on May 1, 2012;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ET14A by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.