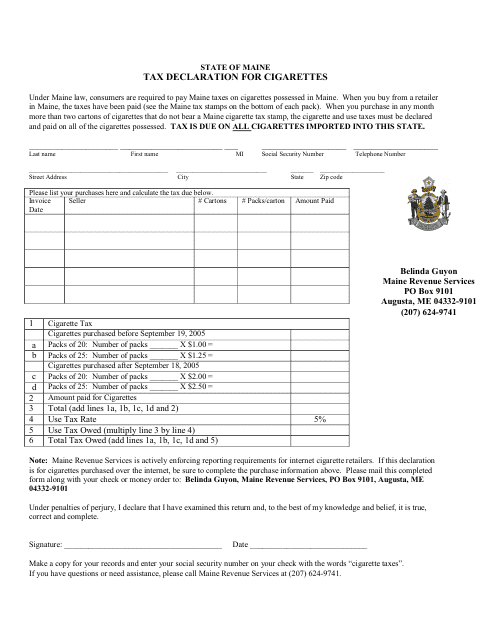

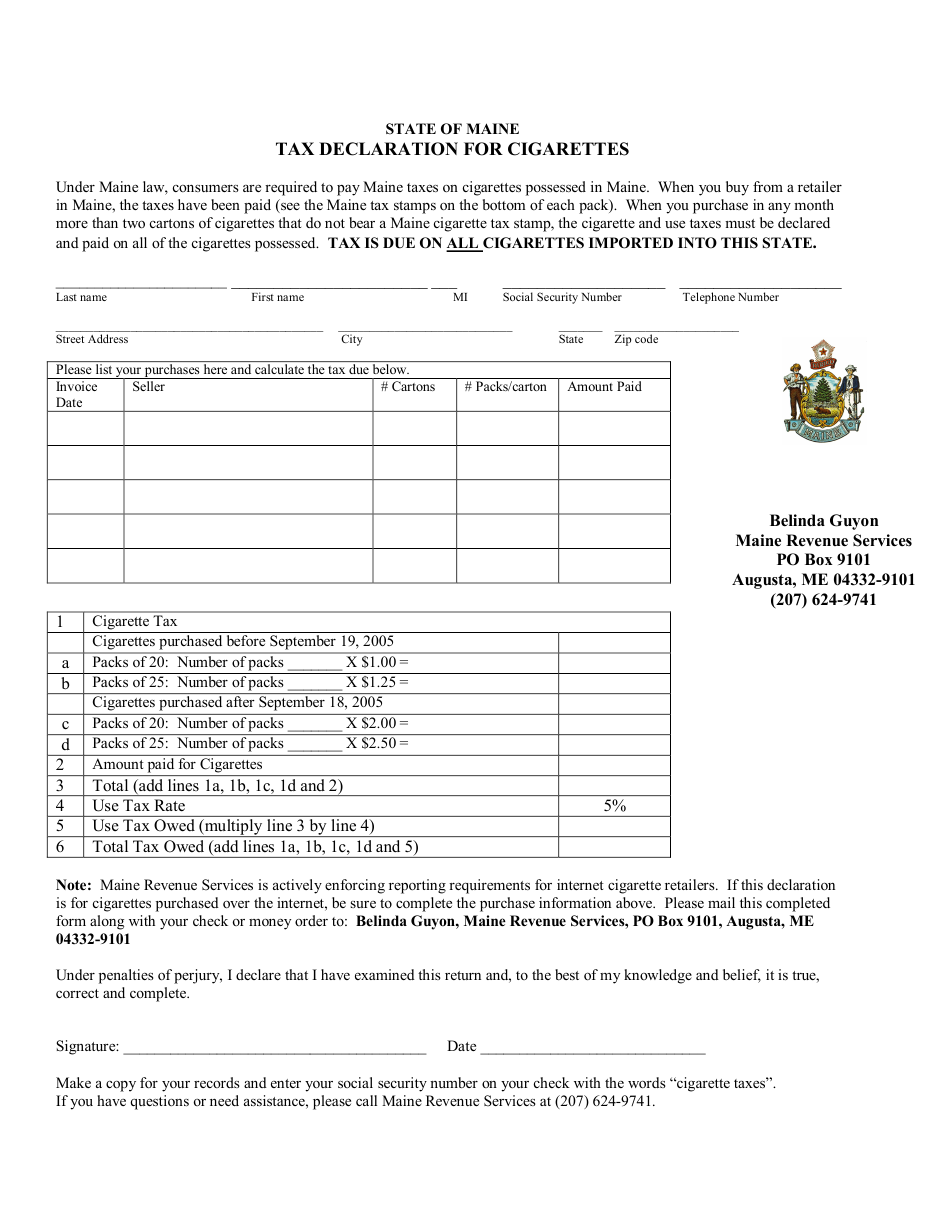

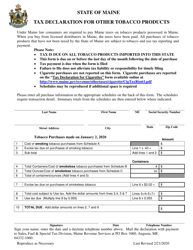

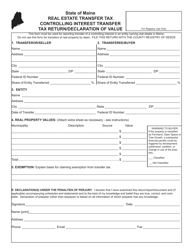

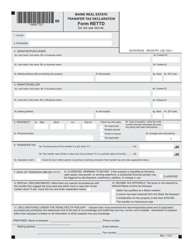

Tax Declaration Form for Cigarettes - Maine

Tax Declaration Form for Cigarettes is a legal document that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine.

FAQ

Q: What is a tax declaration form for cigarettes?

A: A tax declaration form for cigarettes is a document that must be completed by individuals or businesses selling cigarettes in Maine.

Q: Who needs to complete a tax declaration form for cigarettes in Maine?

A: Individuals or businesses selling cigarettes in Maine need to complete a tax declaration form for cigarettes.

Q: Why is a tax declaration form for cigarettes necessary in Maine?

A: The tax declaration form is necessary in order to report and pay the state taxes on cigarettes sold in Maine.

Q: When is the deadline for completing a tax declaration form for cigarettes in Maine?

A: The deadline for completing a tax declaration form for cigarettes in Maine is typically on a monthly or quarterly basis, depending on the specific requirements set by the Maine Revenue Services.

Q: What information is required on a tax declaration form for cigarettes in Maine?

A: The tax declaration form for cigarettes typically requires information such as the number of cigarettes sold, the brand name, the cigarette tax rate, and the total tax due.

Q: How do I pay the cigarette taxes in Maine?

A: Cigarette taxes can be paid by including a check or money order with the completed tax declaration form or by electronic funds transfer (EFT) if enrolled in the EFT program.

Q: Are there any penalties for not completing a tax declaration form for cigarettes in Maine?

A: Yes, there can be penalties for not completing a tax declaration form for cigarettes in Maine, including late payment fees and potential legal consequences.

Form Details:

- The latest edition currently provided by the Maine Department of Administrative and Financial Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.